Original Title: "Will Bitcoin Reach New Heights This Month? Market Experts Weigh in on Future Trends"

Original Author: 1912212.eth, Foresight News

On May 19, Bitcoin briefly surpassed $107,000, just $2,000 shy of its all-time high. Ethereum hovered around $2,400, while SOL lingered near $170, and various altcoins retreated after a brief surge. According to coinglass data, the total liquidations across the network in the last 24 hours reached $577 million, with long positions liquidated at $351 million and short positions at $227 million, resulting in a dual liquidation scenario amid market fluctuations.

With the China-U.S. tariff war temporarily paused, the altcoin market rebounded after hitting a bottom. How will the crypto market evolve in the future?

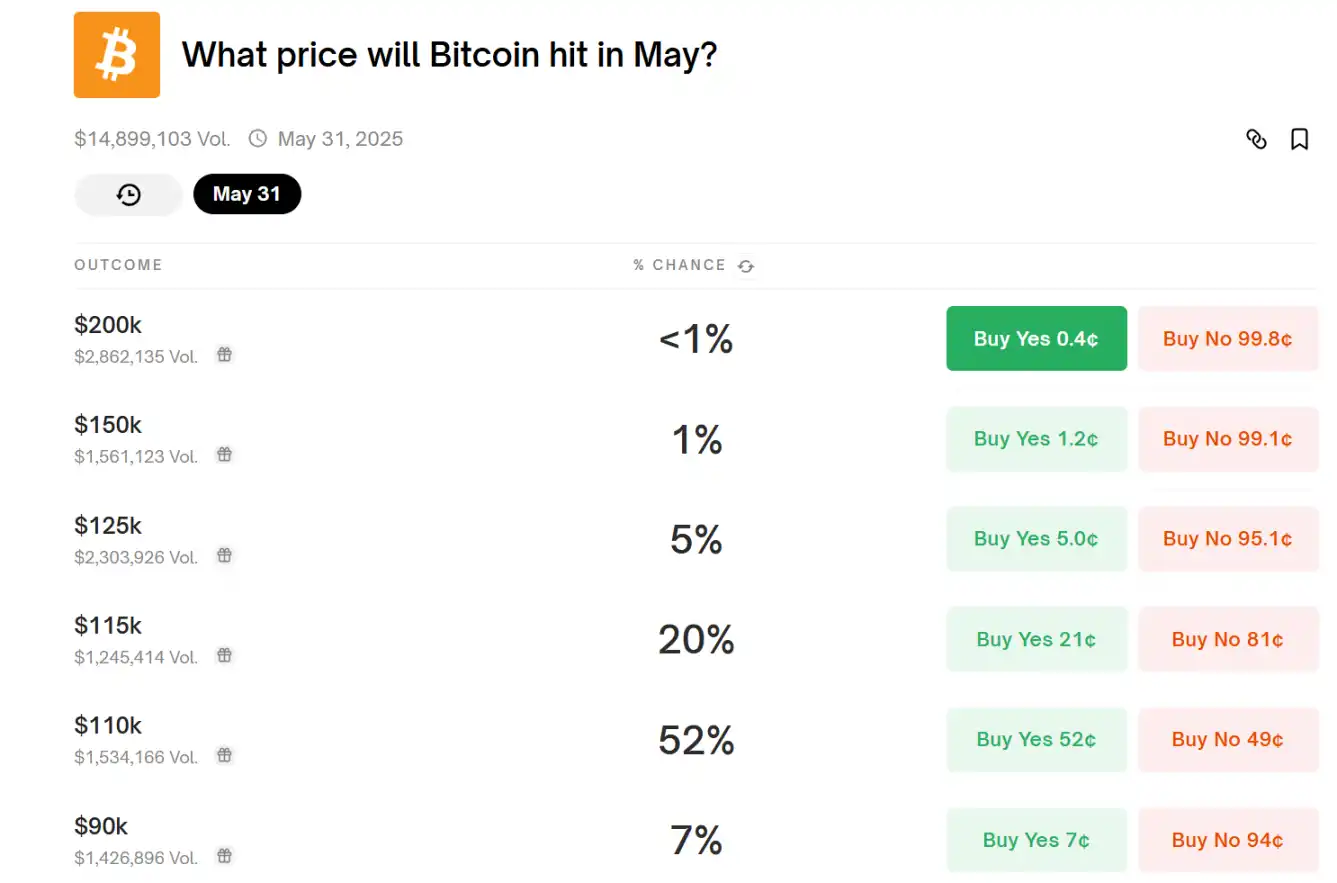

Polymarket predicts a 52% chance that BTC will reach $110,000 this month. The latest data shows that the probability of BTC hitting $110,000 this month on Polymarket has risen to 52%, up from just 37% on May 17.

The prediction market also forecasts a 20% chance that Bitcoin will exceed $115,000 in May, indicating strong bullish momentum. Currently, the total trading volume on this prediction market is approximately $15 million.

Trader James Wynn: The Probability of Bitcoin Falling Below $100,000 is Low

Trader James Wynn tweeted that it would be great if BTC could pull back below $100,000 so he could increase his position. Unfortunately, he feels that this may not happen.

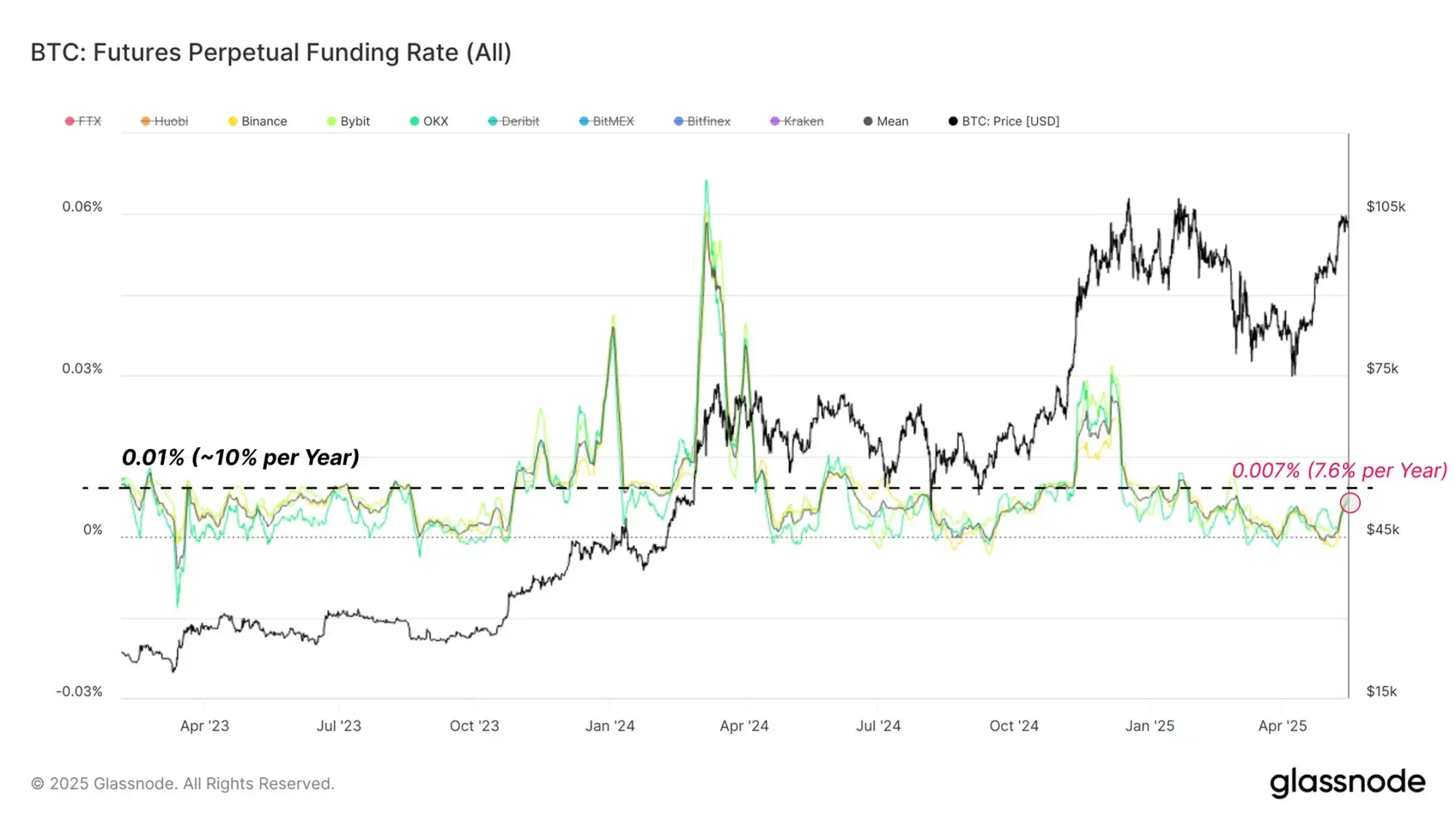

Glassnode: Bullish Positions Remain Moderate, Limited Leverage Indicates a Healthy and Sustainable Market

Glassnode tweeted that despite the significant rise in BTC prices, the funding rate for perpetual futures remains at a neutral level of about 0.007%, indicating that bullish positions are still relatively moderate. The derivatives market seems to be catching up with the spot market, and limited leverage suggests a healthy and sustainable trend.

Willy Woo: Bitcoin Still Has Room to Rise, Expected Compound Annual Growth Rate May Stabilize at 8% in 15 to 20 Years

Renowned cryptocurrency analyst Willy Woo posted on social media, "Bitcoin has long passed the stage of several-fold annual growth seen in 2017. The year 2020 was a key year for Bitcoin's 'institutionalization,' as companies and sovereign entities began hoarding Bitcoin, with the compound annual growth rate dropping from over 100% to 30-40%. Bitcoin is now traded as the latest macro asset in 150 years, and it will continue to absorb global capital until it reaches some 'equilibrium point.'

Considering a long-term monetary expansion of about 5% and GDP growth of 3%, I believe Bitcoin's eventual annual compound growth rate will stabilize around 8%. It may take another 15 to 20 years to reach this 'equilibrium point.' There are almost no other publicly investable assets that can match Bitcoin's long-term performance."

Grayscale Research Director: Bitcoin's Market Share May Stabilize Between 60% and 70%, Rather Than Entering an Altcoin Season

Zach Pandl, the research director at cryptocurrency asset management firm Grayscale, stated in an interview with Decrypt that Bitcoin's market share may stabilize between 60% and 70%, rather than experiencing a significant decline. "When the market focuses on macroeconomic instability and risks to the dollar, Bitcoin's dominance may rise, while its dominance may decline when the market pays attention to various applications of blockchain technology and innovations in the crypto space."

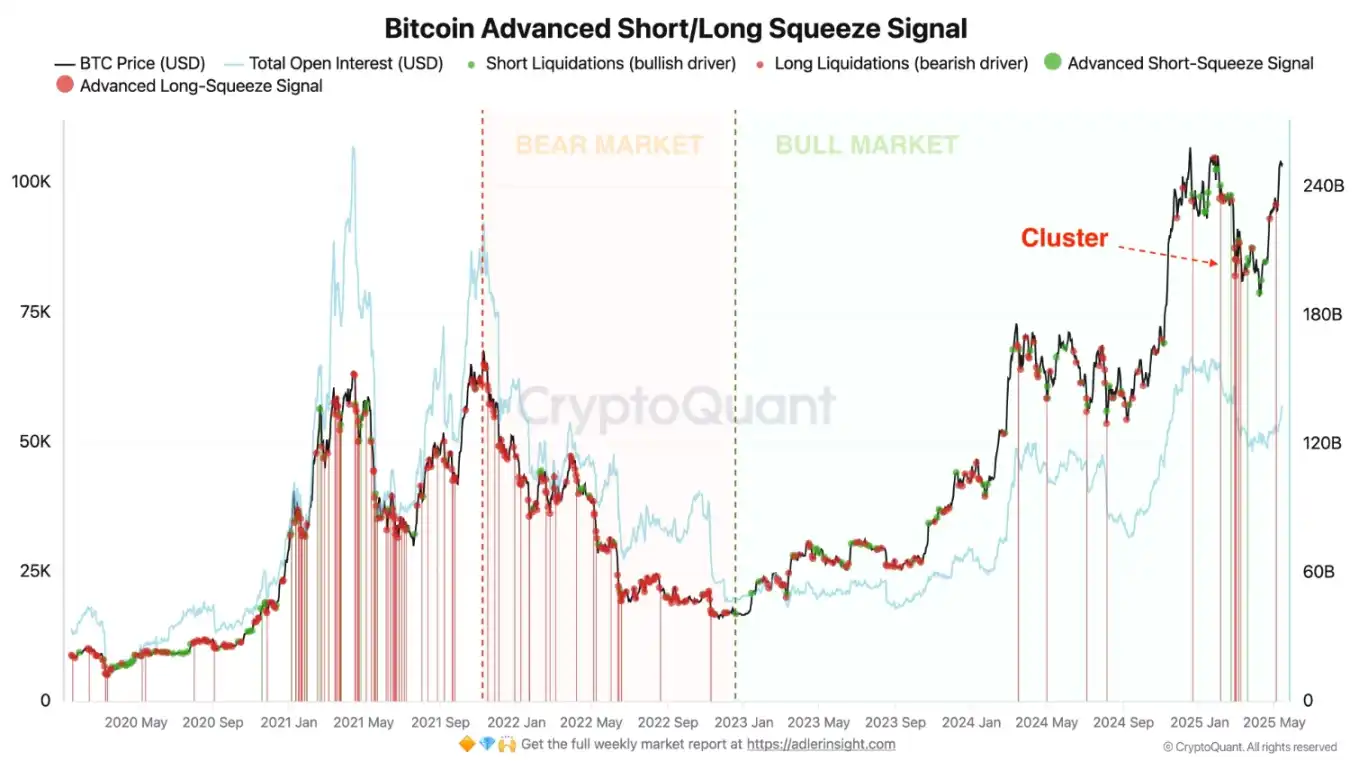

CryptoQuant Analyst: Current Cycle's Short Sellers are More Cautious, Typically a Bullish Signal

CryptoQuant analyst Axel Adler Jr. stated that compared to the bull market in 2021, short sellers in the current bull market cycle are more cautious when establishing short positions. There was only one significant liquidation of long positions during the pullback when Bitcoin's price reached the $80,000 level. The analyst pointed out that this shift in sentiment indicates that short sellers are becoming more risk-averse, which is typically seen as a bullish signal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。