Original Author: Frank, PANews

As the price of Ethereum rebounded from a low of $1,385 to $2,700, a 97.7% increase was accompanied by a complex interplay of capital dynamics. Institutional funds remained cautious in the ETF market, while the open interest in derivative contracts reached a historical peak of $32.2 billion. After a prolonged slump, the market hopes this rebound will prove that Ethereum is still a value opportunity, and the Pectra upgrade seems to support this narrative. PANews attempts to outline the current state of Ethereum through a comprehensive data interpretation, revealing an Ethereum that is undergoing a reconstruction of value.

Market and Capital: Caution in ETFs and Enthusiasm in Contracts

As of May 18, the total net asset value of U.S. ETH ETFs reached $8.97 billion, accounting for 2.89% of Ethereum's total market capitalization. Compared to Bitcoin ETFs, which account for 5.95%, this proportion remains relatively low. Overall, it is evident that Bitcoin is still more popular in the ETF market.

Additionally, from February to the end of April, the funding status of Ethereum ETFs was mostly in outflow. It wasn't until April 21 that funds began to flow back in, but the overall inflow data was not significant. In April, the net inflow for Ethereum ETFs was approximately $66.25 million, and as of May, the net inflow is about $30 million.

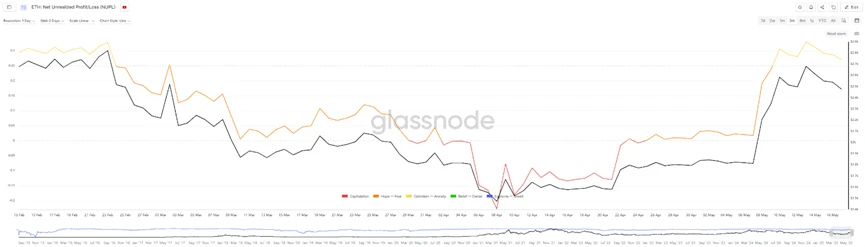

According to data from Glassnode, it was also at the end of April that Ethereum's "Net Unrealized Profit/Loss" (NUPL) value reversed back to positive. Prior to this, from April 1 to 22, the NUPL value remained negative. During this period, Ethereum's price fell below $1,800, reaching a low of $1,385, indicating that when Ethereum's price dropped below $1,800, most addresses holding positions were in a state of loss. However, such negative data can sometimes signal a market bottom, as selling pressure approaches exhaustion during this phase. As of May 17, the NUPL value peaked at 0.328, indicating that it is still in the early stages of a bull market or recovery, and has not yet reached an overly optimistic phase.

Another interesting data point is that the number of addresses holding more than 1 ETH has actually decreased as prices rebounded, while this number had been increasing during the price decline, indicating that many investors chose to buy the dip during the downturn. However, after the price rose above $1,800, some addresses opted to take profits. Nevertheless, this decrease is not significant, only about one-thousandth. With the price recovery, the percentage of profitable addresses has now reached 60%.

Although the recent price rebound is still far from historical highs, the open interest in contracts has recently reached historical peak levels. On May 14, Ethereum's contract open interest reached $32.249 billion, nearly the highest level in history. The last time the contract volume reached this figure was between January and February 2025, when Ethereum's price fluctuated between $3,000 and $3,800. This indicates that the market is still very keen on betting on Ethereum.

Overall, looking at the data from the market and capital perspective, Ethereum began to see positive capital inflows starting from the price bottom at the end of April, followed by a significant price increase, with a maximum increase of 97.7%, nearly doubling. However, from the inflow of funds, especially the flow of ETF funds, it appears that the proportion of traditional institutional capital has not yet increased significantly.

TVL Rebounds, but Low Gas Fees Fail to Activate Trading Volume

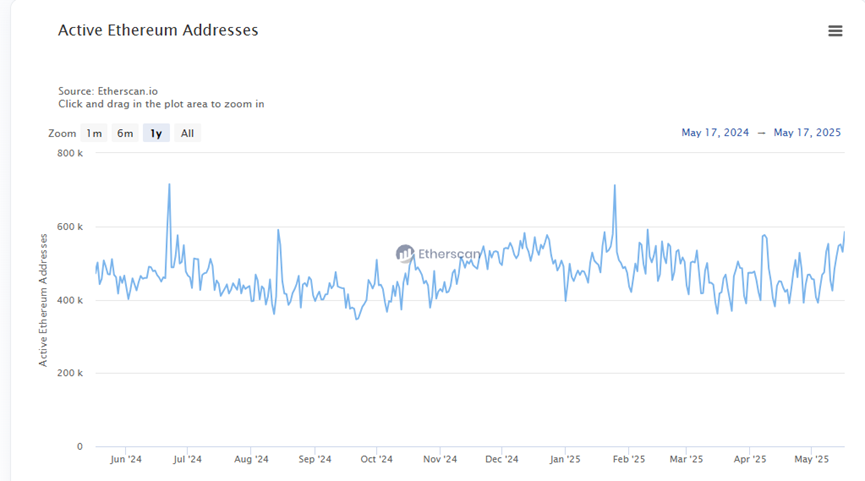

From the perspective of on-chain activity, the change in the number of active Ethereum addresses is not significant, currently fluctuating between 400,000 and 600,000 daily. This fluctuation pattern has persisted for over a year, although there has been a recent trend of breaking above the 600,000 range.

Another important metric, TVL, shows a more pronounced trend of change, with the TVL in USD rebounding from around $4.5 billion on April 22 to a peak of about $6.46 billion. However, considering the significant rise in Ethereum's price during this period, this change may not reflect the true on-chain situation. When switching to ETH amounts, it can be seen that since April 9, the amount of ETH staked on the Ethereum chain has significantly decreased, from a peak of 30.26 million to a low of 24 million, a drop of 20%.

This phenomenon may be due to some funds choosing to take profits or avoid impermanent losses during the rapid price increase of Ethereum, leading to a reduction in token amounts.

Regarding Gas changes, as of May 16, 2025, the average Gas price on Ethereum was 3.572 Gwei, a significant decrease of 21.57% from the previous day, and a sharp drop of 51.76% year-on-year. Over the past 30 days, Gas fees have generally shown a downward trend, briefly spiking to 10.61 Gwei on May 8, but recently maintaining below 8 Gwei, with a low of 1.6 Gwei on May 3. This change is related to EIP-7691 in the Pectra upgrade, which aims to reduce L2 fees by expanding blob space.

However, the extremely low Gas fees do not seem to have stimulated an increase in on-chain transactions. The daily transaction count data does not show any significant changes.

DEX Trading and Asset Landscape: Dominance of Stablecoins and Ecological Transformation

From the on-chain staking data, between April 15 and May 5, Ethereum's staking volume was consistently in a net outflow state. Notably, Coinbase has seen a 30% outflow in staking over the past six months. Currently, the validator with the most staked ETH is still Lido, with a staking volume of 9.11 million ETH.

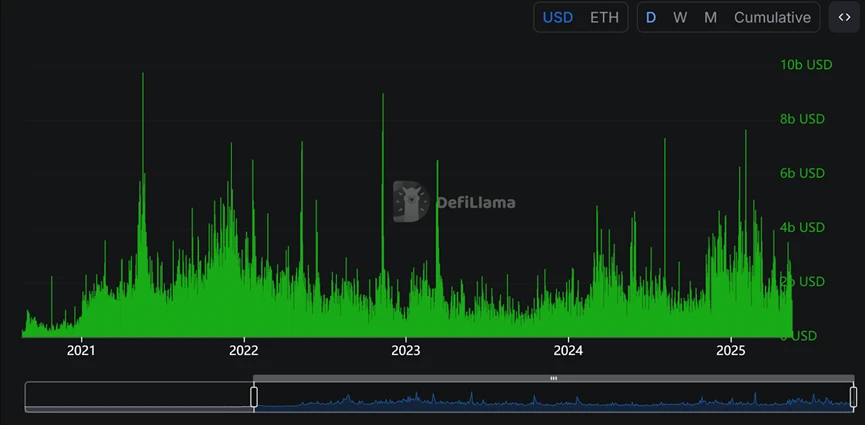

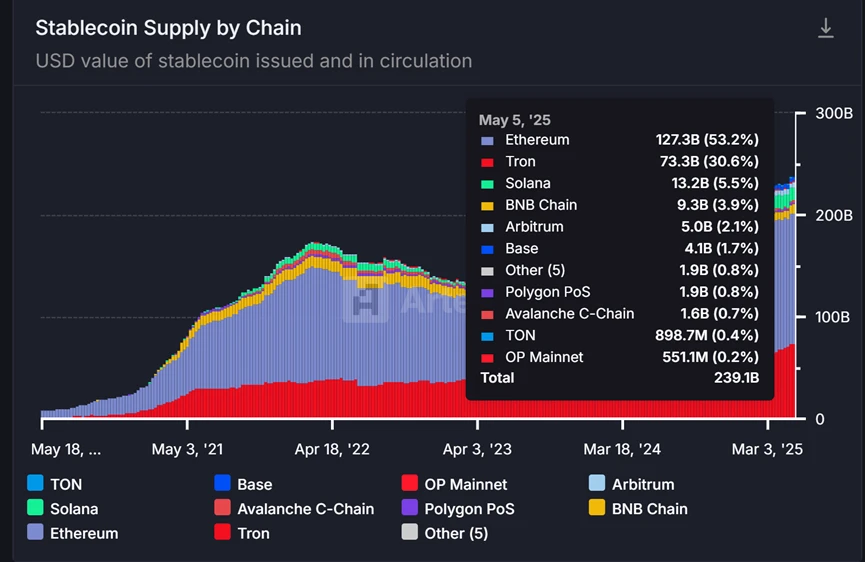

In terms of on-chain DEX trading volume, Ethereum's mainnet has clearly entered an active period since the beginning of 2025. The activity level during this period is significantly higher than in 2024, approaching the peak periods of 2021 to 2022. However, from the revenue data, the recent increase in trading activity primarily comes from stablecoin-related transactions, with USDT generating $568 million in fees on Ethereum over the past 30 days. As of May 18, Ethereum remains the largest public chain for stablecoin issuance, accounting for over 50% of the total issuance, which has reached $127.3 billion, double that of Ethereum's DeFi TVL.

Analyzing the categories of funds on the Ethereum chain reveals that nearly half of the transactions on the Ethereum chain are completed through stablecoins and ETH transfers. Moreover, the proportion of stablecoin transactions is clearly increasing, while the proportion of DeFi and ERC-20 token transactions is actually declining. This indicates that Ethereum is still transitioning towards a role as a value storage center for on-chain assets, while the development of MEME and application types seems to be constrained. Thus, it appears that Ethereum's strategy of boosting activity by reducing fees and increasing transaction speed may be difficult to achieve.

Additionally, although the average on-chain transfer amount for Ethereum has recently declined, it still remains between several thousand to ten thousand dollars. This figure is far ahead of all public chains, with Solana's average being only a few dozen dollars. This indicates that Ethereum is indeed a chain primarily for large holders.

In summary, the recent significant price rebound of Ethereum seems more like a result of the growing pains of a transformation period. On one hand, the Ethereum ecosystem is striving to optimize performance through continuous technological updates and upgrades, but these efforts seem to have not yielded the desired results. On the other hand, there is a concentration of large-scale funds and stablecoin trading, with large holders seemingly satisfied with the current quiet state of Ethereum on-chain.

Therefore, the rise and fall of a single indicator can no longer simply define whether Ethereum is "good" or "bad." The market may need to move beyond past growth narratives and re-examine and understand Ethereum's core role and long-term value in a multi-chain landscape. Rather than fixating on whether it is "rising" or "declining," it may be more insightful to recognize that after various upheavals and iterations, a more mature and "stable" Ethereum may be the inevitable direction and ultimate form of its evolution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。