In the past two days, the AI proxy protocol meme coin PAYAI, which integrates ElizaOS, libp2p, and IPFS on Solana, has surged from zero to a market value of $10 million, currently maintaining around $3 million, attracting market attention. However, it was not the technology or product of PayAI that revived it, but rather a mention by Cuy Sheffield, the head of Visa's crypto division, on the X platform.

In August last year, Visa participated in the investment of an AI proxy project called Payman, advocating for an on-chain proxy economy where AI pays "employers" to complete marketing tasks. Since then, Visa has shown interest in AI+Crypto, not just out of curiosity, but as a strategic judgment after in-depth research. This provides important context for understanding Visa's ongoing promotion of an on-chain clearing system, stablecoin deployment paths, and systematic layout for the next generation of payment networks.

With significant breakthroughs in the U.S. stablecoin bill today, Visa is no longer just a traditional payment intermediary; it is attempting to build a new clearing network architecture centered around stablecoins. In April 2025, this direction received a clearer annotation—Visa officially joined the Paxos-led global dollar network (USDG) stablecoin alliance, becoming the first traditional financial institution to participate in building a de-banked global clearing system.

Visa is migrating the financial intermediary model it has dominated for decades onto the blockchain, and in the future crypto infrastructure, it does not want to become the second SWIFT but intends to be the first "on-chain Visa."

From Product Manager to Head of Visa Crypto

Cuy Sheffield's career path is difficult to define by traditional means. Growing up in a rural town in Ohio, basketball was his early way of building confidence and seeking recognition. In college, he chose to attend Pomona College in California, gradually developing a strong interest in entrepreneurship and technology. After graduation, he joined a startup called TrialPay, focusing on the mobile app advertising ecosystem. In the process of building genuine relationships with clients, he unexpectedly developed a passion for sales, laying the foundation for his later transformation.

In 2015, TrialPay was acquired by Visa, and Sheffield joined Visa as a product manager, subsequently working in the company's strategic partnership department, primarily responsible for connecting with startup tech companies. It was during this time that he began to notice early signs of the crypto industry and tried to understand the potential systemic opportunities within it.

In 2018, the number of cryptocurrency users worldwide first surpassed 40 million, and Visa established a special "Crypto Innovation Exploration" initiative. Sheffield seized this opportunity to propose forming an internal crypto team, aiming not to invest in crypto assets but to serve the users overlooked by traditional payment networks. His logic was straightforward: emerging wallets and trading platforms like Coinbase, Binance, and MetaMask were attracting tens of millions of young users, but they could hardly complete payments within Visa's system—this was a structural user gap Visa faced and an opportunity for an underlying technology update.

He convinced management and skeptics alike. Starting in 2019, he officially became the head of Visa Crypto, embarking on a journey of collaboration with companies like Anchorage and Coinbase. His LinkedIn profile states: "Committed to bringing Visa into the Web3 era." He has gradually been seen by the industry as a key translator between the traditional financial world and on-chain systems.

Sheffield has publicly expressed his passion for the crypto world, consistently engaging on Twitter to learn and interact in order to understand community language and technical boundaries. He also mentioned that his "superpower" is the ability to translate complex concepts into easily understandable language, and he always strives to be one of the best at explaining the crypto world to the public. This ability to explain and his personal involvement have allowed him to stand out within Visa, becoming a promoter and spokesperson for this systemic transformation.

Visa's "Crypto Lab"

Visa has always been known for its stability, not being adept or enthusiastic about "radical narratives." The company's shift towards crypto technology is not a sudden strategic leap but a gradual process of systemic evolution. Under Cuy Sheffield's leadership, Visa has divided its on-chain strategy into several phases, from initial technological awareness to subsequent business restructuring, while maintaining a balanced judgment of risks and opportunities.

The first phase roughly began in 2019, during which Visa's main goal was not to integrate blockchain technology but to establish a basic understanding of the emerging crypto ecosystem. The company invested in custodial service providers like Anchorage to ensure compliance in accessing on-chain assets, while also collaborating with trading platforms like Coinbase and Crypto.com to issue crypto Visa cards, initially probing the payment paths and consumption behaviors of crypto users.

In 2021, Visa launched the Crypto API, providing banks with access tools for stablecoin settlements. The essence of this move was not to directly enter the on-chain clearing market but to observe how crypto assets influence its payment model through "embedded technology." Sheffield likened this phase to the "e-commerce forcing the credit card system"—crypto is not an enemy that disrupts Visa but an external variable that compels it to update its underlying logic.

By 2022, compared to the previous phase of technological experimentation, Visa's strategic focus clearly shifted towards building a clearing path centered around stablecoins.

First, it partnered with Circle to pilot the deployment of USDC as a clearing medium on mainstream chains like Ethereum and Polygon. At the same time, Visa no longer viewed stablecoins as speculative assets or payment fringes but officially positioned them as "clearing tools for the digital age." In 2023, Visa expanded its pilot to Solana, showcasing a real-time clearing process for cross-border transactions using USDC at a developer conference, significantly faster than traditional cross-border clearing systems.

In addition to stablecoins, Visa also began exploring new scenarios such as NFT payments, DAO participation mechanisms, and automatic payment of on-chain gas fees via credit cards, attempting to transform itself from a payment network operator into a systemic service provider for the on-chain ecosystem.

The third phase gradually unfolded from 2024, with the strategic focus shifting from technology deployment to the reconstruction of the global clearing architecture.

Visa accelerated its integration with multiple public chain networks like Solana, Avalanche, and Polygon, collaborating with both traditional and emerging payment service providers like Worldpay, Nuvei, and Stripe to promote the application of on-chain payments in traditional merchant channels.

In 2024, Visa launched the Crypto Advisory service, providing integrated solutions covering crypto custody, wallet systems, and stablecoin circulation for bank clients, officially incorporating crypto business into enterprise-level financial infrastructure.

Entering 2025, Visa's crypto strategy began to enter a substantive implementation phase, with a series of key collaborations and product launches indicating its shift from experimental exploration to systematic deployment.

In April of this year, it was reported that Visa joined the USDG stablecoin alliance led by Paxos, collaborating with new financial institutions like Robinhood, Kraken, and Galaxy Digital to build a non-bank-led global clearing network. In this alliance, Visa's role is no longer that of a traditional payment intermediary but a key "backbone router" between on-chain transaction flows and capital clearing paths.

Subsequently, one of the most significant developments was Visa's partnership with the Middle Eastern fintech platform Rain, which fully tokenized Visa card receivables into USDC, achieving on-chain real-time clearing. This means that traditional credit card business has, for the first time, freed itself from the constraints of interbank clearing processes, becoming a "native on-chain payment tool," significantly improving the efficiency and transparency of fund settlements, and laying the foundation for Visa to build a 24/7 global clearing network.

At the same time, Visa also launched a stablecoin payment card program in the Latin American market, partnering with Bridge to introduce USDC-linked Visa cards in six high-inflation countries, including Argentina, Mexico, and Colombia. These cards are priced and consumed directly through on-chain balances, providing users with an anti-inflation payment option amid severe fluctuations in local currencies, and helping Visa expand a "de-intermediated payment scenario" that does not require local bank support.

On the enterprise side, Visa further promoted the "on-chaining of bank assets" by launching the Visa Tokenized Asset Platform (VTAP). This platform provides bank clients with one-stop services from stablecoin minting, custody to destruction, supporting them in deploying their own clearing mechanisms onto the on-chain system. Several banks, including BBVA, have participated in this plan, aiming to issue and circulate their own stablecoins through VTAP, forming a complete closed loop connected to Visa's payment network.

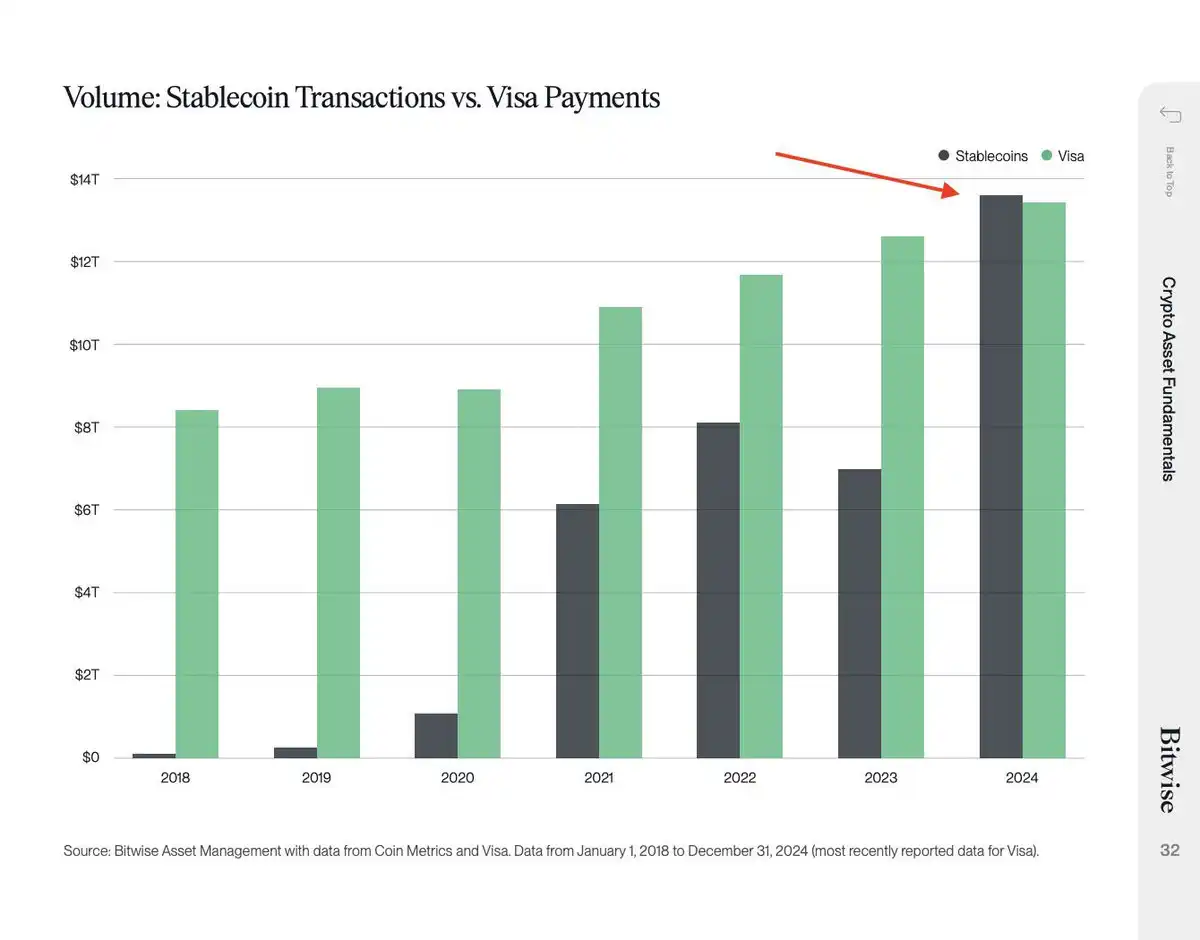

Behind these deployments is a change in the structure of global capital flows. Bitwise data shows that in 2024, the total volume of global stablecoin transactions has for the first time surpassed Visa's traditional payment processing scale.

Stablecoins have risen from marginal assets to mainstream clearing media, making it impossible for Visa to maintain its industry dominance through traditional means and necessitating a redefinition of its role in the global payment network through on-chain paths. This reality has prompted Visa to shift its crypto strategy from peripheral experimentation to core business reconstruction, also signaling that the global clearing system is entering a new era dominated by stablecoins.

Exploring Crypto: Passive Defense or Active Transformation?

At a time when the global payment system is still in the early stages of transformation, Visa's shift is not a radical disruption but a thoughtful role reconstruction. Fundamentally, Visa has traditionally played the role of an interbank credit intermediary: relying on its clearing network, dispute resolution mechanisms, and credit endorsement model to provide efficient and secure payment channels for hundreds of millions of users and merchants worldwide.

This system was irreplaceable in the Web2 era. However, as we enter the on-chain world, with stablecoins enabling peer-to-peer transfers and round-the-clock clearing, this trust structure based on "intermediaries" is being replaced by the technology itself. The advantages of traditional processes are gradually being weakened, and the value of intermediaries is being reassessed.

Visa's chosen path is not resistance but active integration. Under Cuy Sheffield's leadership, the company is gradually redefining itself as an "on-chain credit confirmer" and "standard setter for payment protocols," rather than merely an extension of traditional finance.

Visa collaborates with custodial service providers like Anchorage and Fireblocks to ensure it has the technical deployment capabilities at the on-chain node level; it is also exploring the inclusion of new asset types such as CBDCs, NFTs, and DAOs into verifiable payment paths, providing access standards and risk control support that meet Visa's level. On the user side, Visa is attempting to incorporate stablecoins into its rewards system, designing a reward mechanism based on on-chain interaction behaviors, thereby making on-chain identity and credit usable assets in the real world.

This reconstruction is not limited to mature markets like Europe and the U.S. In regions with weak financial infrastructure, such as Latin America and Africa, Visa is instead adopting a lighter approach, bypassing the banking system to directly provide on-chain clearing services between wallet providers and merchants. This represents a redefinition of the underlying structure of the "global credit infrastructure": no longer predicated on bank accounts, but centered around on-chain assets, identities, and clearing paths. In the European and American markets, Visa is assisting traditional banks in entering the stablecoin clearing track through the launch of the VTAP platform and Crypto API, attempting to build a composite financial network composed of banks, merchants, and on-chain assets.

Behind all this is Visa's systematic promotion of a new credit architecture: not controlling user assets, not storing on-chain data, but constructing a "trusted clearing path" that covers the globe. This is not a blind following of the crypto narrative, nor a complete abandonment of the existing system, but an updated understanding of its own role. Visa is neither SWIFT nor intends to become Coinbase; it is shaping itself into an "on-chain backbone service provider" that possesses structural organizational capabilities and technical adaptability.

Visa's uniqueness lies not in its ability to accommodate crypto, but in its attempt to build a new payment track based on stablecoins. It does not provide wallets or custody user assets, but it continues to play the role of "on-chain credit confirmer" among 1.5 million merchants and 14,500 institutions worldwide. By coordinating the circulation paths between fiat and stablecoins, Visa has effectively become a de-banked clearing hub.

As we enter 2025, Visa's stablecoin strategy is no longer a question of whether to participate, but rather "how to lead." What Cuy Sheffield is promoting is a systematic project centered on institutional adaptation that has lasted five years—it's not about making Visa a crypto-native company, but about making Visa a coordinator and standard setter in the on-chain financial order.

Stablecoins are not a challenge to Visa; they are the direction of Visa's self-evolution. Cuy Sheffield plays the role of the institutional architect in this reconstruction. He is not enthusiastic about speculative trends, nor has he ever shouted slogans for some "revolutionary technology." What he is promoting is an updated path that starts from institutions and processes within the financial system. He understands that Visa cannot become a crypto-native company, but it can become one of the most organized non-crypto institutions in the on-chain system.

Visa's future has never been about "whether it will be replaced by crypto," but rather "how to become a part of the crypto world." The path chosen by this payment giant is neither conservative nor reckless—it is steadily constructing a brand new financial infrastructure within the structure of time. And this future has quietly begun to unfold.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。