This week, U.S. Treasury yields approached critical thresholds: The 30-year bond briefly breached 5% for the first time in 16 years, fueled by Moody’s decision to downgrade America’s credit rating to Aa1, which magnified unease over fiscal stability. The 10-year yield lingered around 4.483%, while shorter-term notes attracted tempered interest, signaling guarded investor sentiment.

U.S. 30-year bond yield.

While analysts dismissed near-term liquidity alarms, they cautioned that the downgrade reveals eroding trust in policymakers’ capacity to address mounting obligations. Moody’s move paralleled S&P’s 2011 cut and Fitch’s 2023 adjustment, attributing its stance to “political brinkmanship” and escalating shortfalls. Speaking with CNBC, Mizuho Securities’ Vishnu Varathan labeled the shift “dire but inconsequential” for current markets.

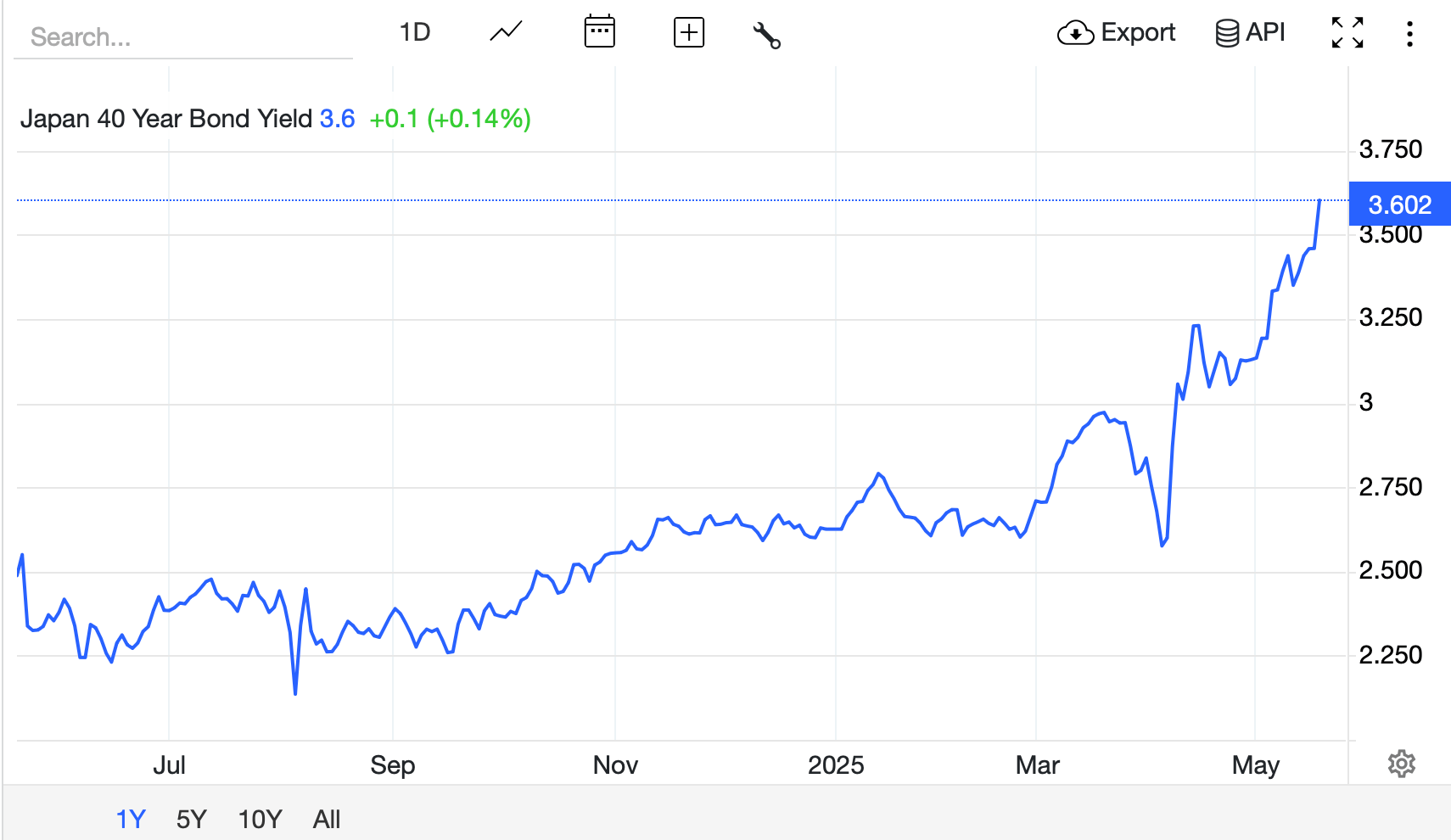

Still, echoes of October 2023—when a 5% 10-year yield preceded a prolonged equity downturn—have traders anticipating turbulence. Moreover, global fissures widened: Japan’s 40-year government bond yield reached its highest since 2007, as officials compared fiscal strains to “Greece in 2011.” European long-term yields similarly edged upward, highlighting systemic strains.

Japan 40-year bond yield.

Reportedly, capital has been migrating to 3- to 6-month Treasuries, shunning longer maturities amid expectations of sustained monetary restraint. Regulators have also deployed liquidity buffers and banking adjustments to cushion duration exposure, yet doubts endure. So-called risk-free assets now carry hidden liabilities, spurring appetite for gold, bitcoin ( BTC), and select equities. The classic 60/40 portfolio’s defensive veneer grows tenuous as sovereign uncertainties infiltrate core holdings.

Skeptics argue that fiscal solutions remain elusive without extraordinary central bank support. April’s abrupt yield spike—ignited by trade disputes—necessitated tariff reversals to stabilize nerves, exposing the economy’s fragile equilibrium. With faith in sovereign collateral fraying, markets increasingly pivot toward instruments perceived as outside the system.

As the 10-year yield probes 4.5% range, defensive postures are advised. Bonds now broadcast a stark message: This turmoil reflects not fleeting chaos but a profound recalibration of debt-fueled growth models. A thornier dilemma stems from the Covid-19 era, when U.S. banking titans stockpiled long-term debt—a gamble now haunting them with colossal paper deficits.

Should interest rates maintain their upward march, these institutions risk being trapped in a fiscal straitjacket, save for a potential rescue orchestrated by the Federal Reserve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。