Original Title: Are Tokenized Stocks the Next「ETF's」For Bridging Crypto With Equities?

Original Author: @brianq, Santiment

Original Translation: Dingdang, Odaily Planet Daily

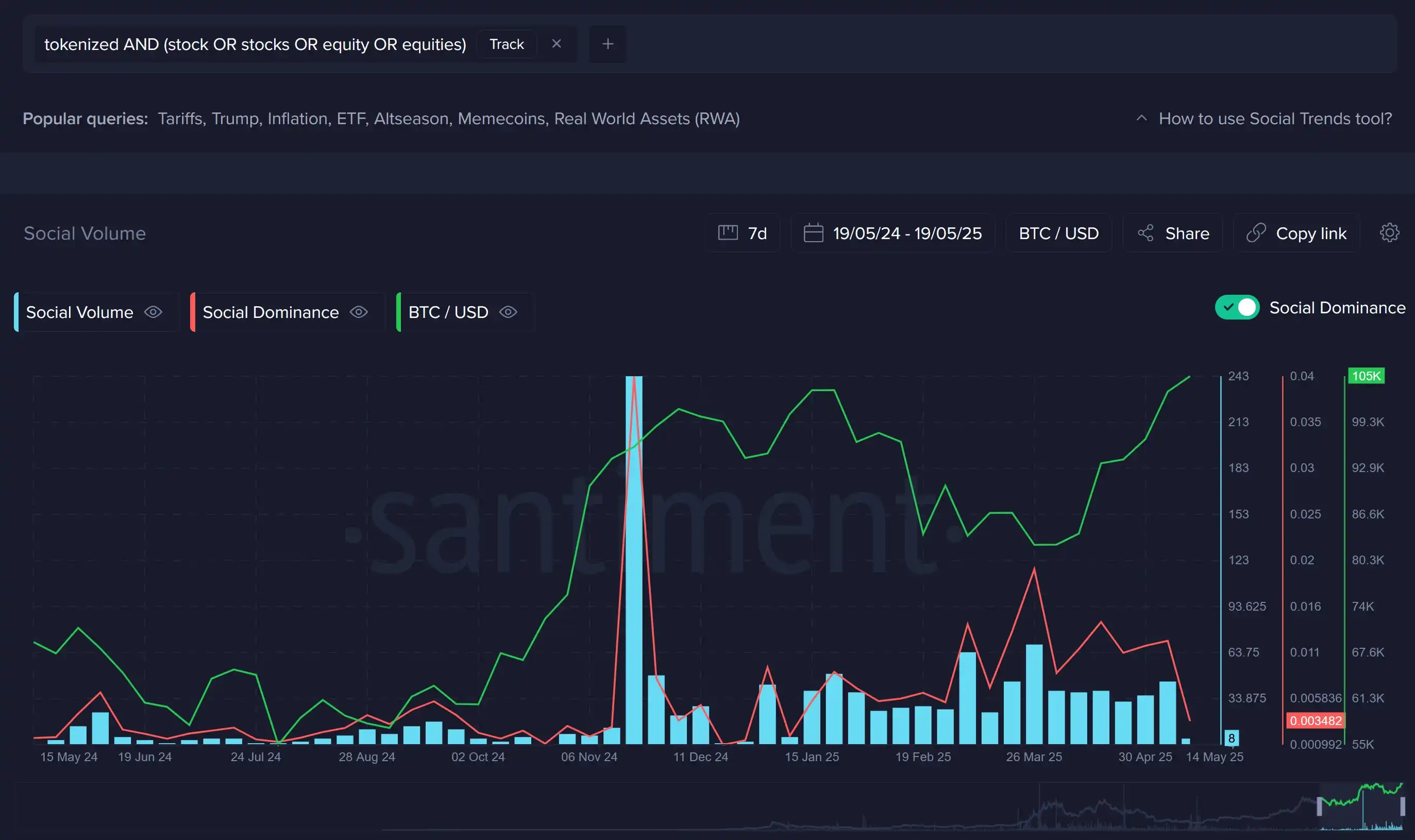

Editor's Note: Following the launch of Bitcoin and Ethereum ETFs, the boundaries between the crypto market and traditional finance are becoming increasingly blurred. Tokenized stocks, as an innovative form of putting traditional equity assets on the blockchain, are gradually gaining market attention. By converting company stocks into digital tokens that can be traded on the blockchain, tokenized stocks aim to bridge the gap between traditional finance and crypto assets. Whether it's Coinbase's pioneering attempt to issue its own stock on-chain or Wall Street giants accelerating their entry, various signs indicate that a new financial era built on on-chain stocks may have quietly begun. So, are tokenized stocks a bubble or the next trillion-dollar opportunity? Below is the original text published by the on-chain data analysis platform Santiment, translated by Odaily Planet Daily:

Introduction

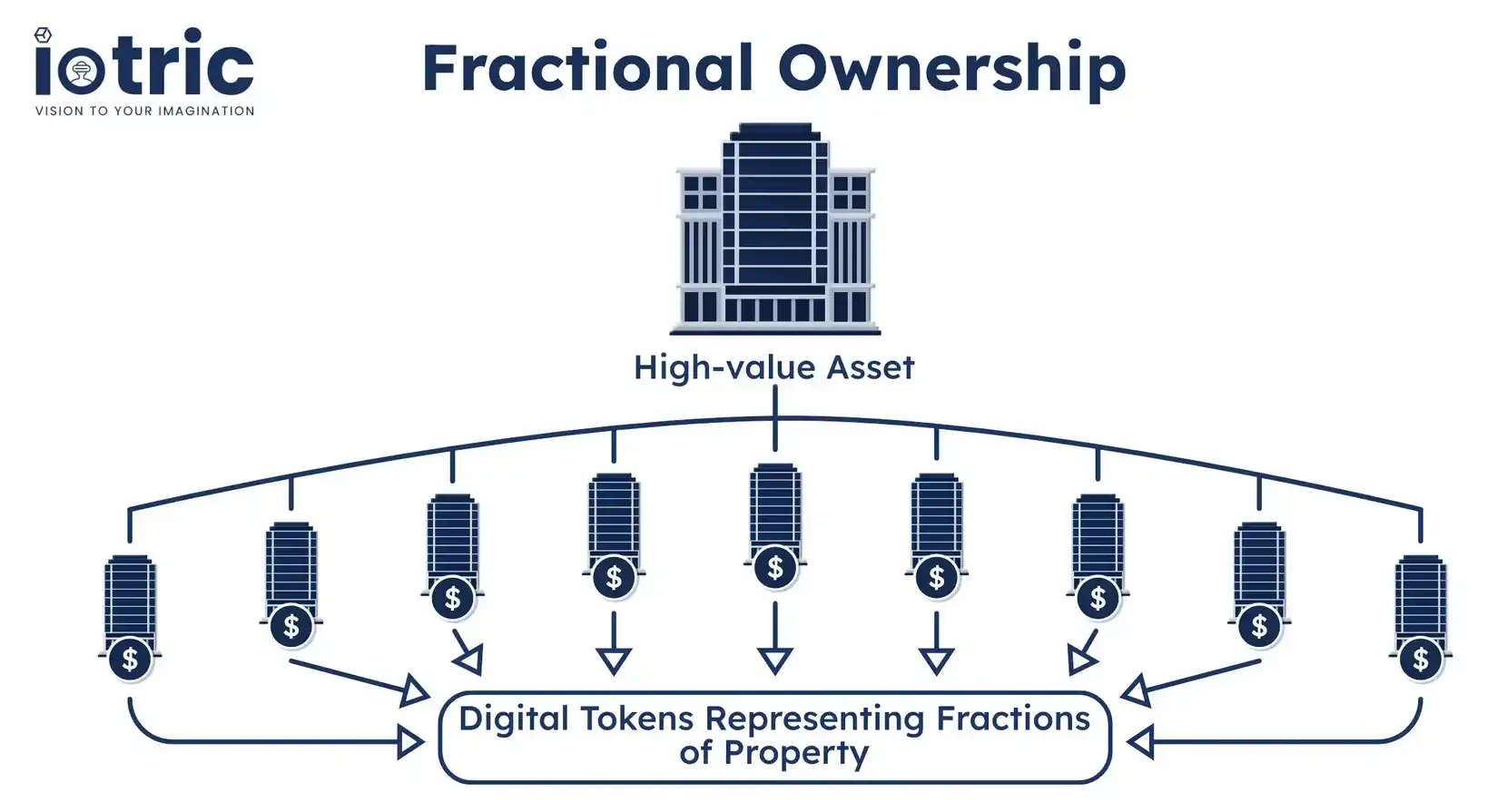

Are tokenized stocks a reliable investment choice? Essentially, they combine the value of traditional stocks with the technological advantages of blockchain. Unlike traditional stocks held in brokerage accounts, tokenized stocks are blockchain-based digital tokens that are anchored to actual company shares. This form allows investors to participate in investments with a lower threshold and in a fragmented manner, breaking the traditional market's limitations on capital amounts.

In early 2025, Coinbase announced it would issue an on-chain token version of its own stock on its Ethereum Layer 2 network, Base. This move not only highlights the mainstream crypto platform's focus on this field but also signals the accelerated integration of traditional finance and blockchain technology.

Fast Trading and 24/7 Liquidity: The Core Advantages of Tokenized Stocks

Traditional stock trading often faces issues such as long settlement periods and limited trading hours, while the emergence of tokenized stocks brings a new solution to this model. Blockchain-based trading enables instant settlement, allowing investors to quickly respond to market fluctuations.

Innovative platforms like AlloX have specifically built trading markets for tokenized stocks, supporting 24/7 uninterrupted trading, lower fees, and on-chain settlement mechanisms, which undoubtedly greatly enhance trading efficiency and rewrite the time and cost logic of traditional stock markets.

Wall Street Giants Are Also Getting Involved: From Concept to Practice

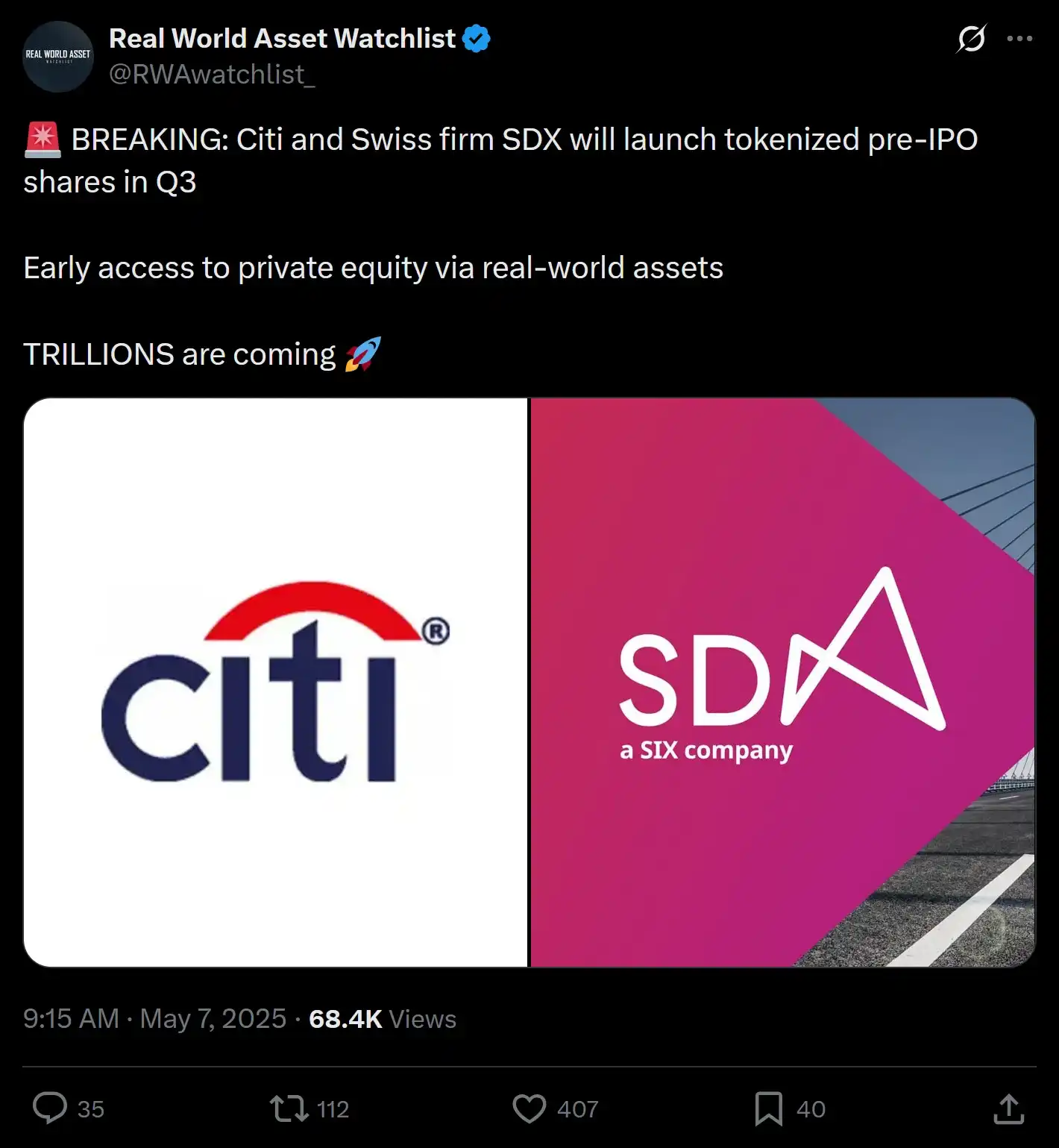

Not only crypto-native platforms but traditional financial institutions are also rapidly entering the space. Citibank has partnered with the Swiss digital exchange SDX to promote the tokenization of shares in private companies, allowing global investors to access the previously high-threshold venture capital market.

At the same time, JPMorgan has launched actual asset token products on-chain, indicating that this trend is not only recognized but is gradually being implemented.

By April 2025, the total market capitalization of the tokenized stock market had surpassed $350 million. Several industry experts predict that this figure is expected to reach $1 trillion in the future.

Although regulation is still in a gray area, policies are gradually opening up under the push of a "crypto-friendly" government in the United States. Meanwhile, Switzerland and the European Union have already established clear compliance frameworks, bringing confidence to the entire market, and indicating the potential for the next wave of institutional-level incremental capital.

The "Stabilizer" for Crypto Assets: A New Way to Hedge Risks with One Click

For crypto investors, tokenized stocks are not only an extension of asset allocation but also a new means of risk management. By converting crypto assets like Bitcoin or Ethereum into on-chain stocks, investors can achieve cross-market asset allocation, thereby enhancing the stability of their portfolios.

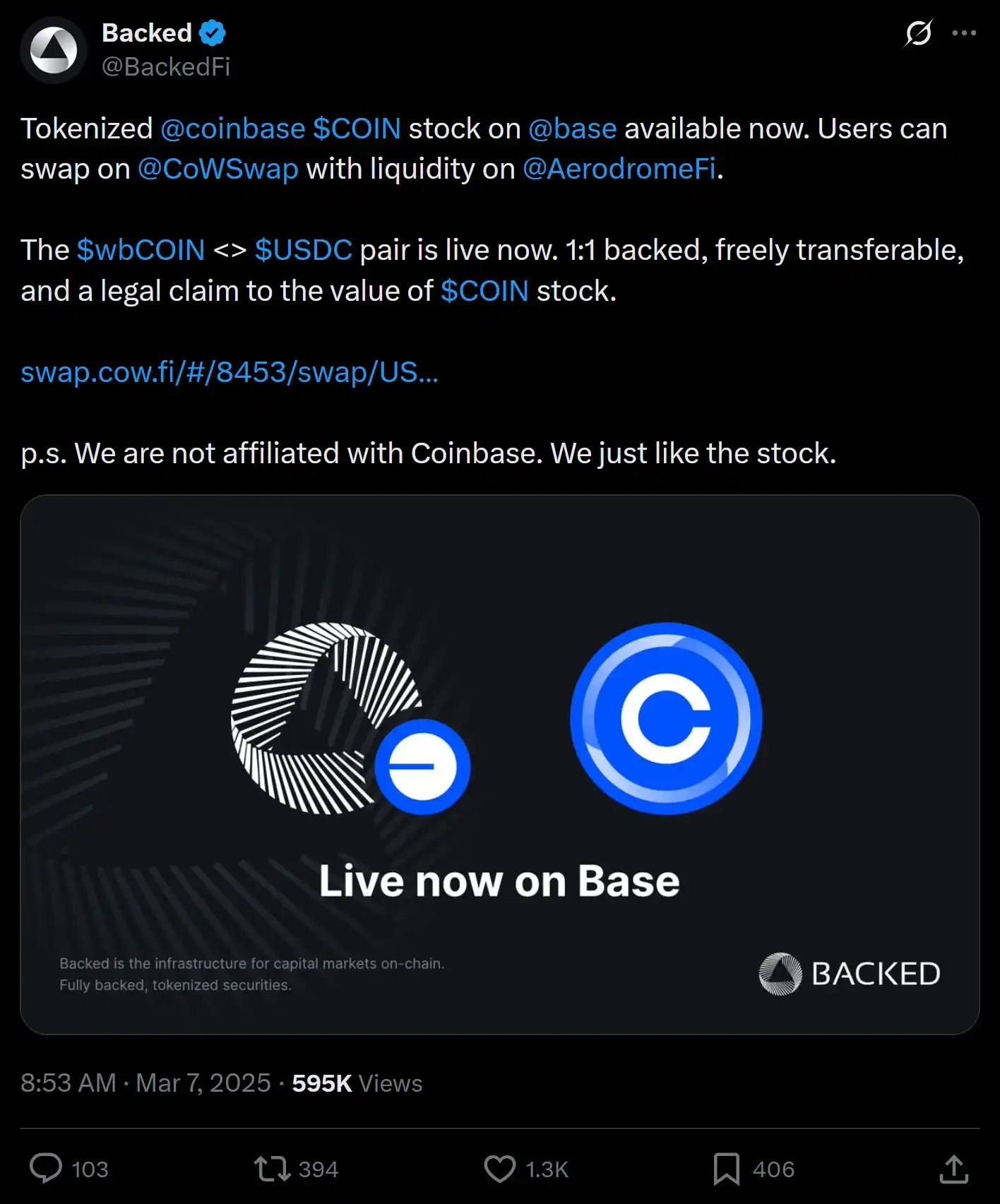

For example, Backed Finance recently announced on X the launch of a token version of Coinbase stock, $wbCOIN, clearly stating that the token is "fully collateralized, freely transferable, and has legal equity rights." This announcement quickly generated 595,000 interactions, indicating that market interest in such products is rapidly heating up.

Companies are also actively exploring the potential of tokenized stocks as a financing tool. Compared to traditional methods, tokenized stocks not only lower the financing threshold but also allow global investors to participate more conveniently in early-stage investments.

Traditional giants like BlackRock and JPMorgan have already launched on-chain tokenized products, indicating that tokenized stocks are not just a "new toy" for the crypto circle but may evolve into a new infrastructure for cross-border finance.

Conclusion: Connecting Both Ends, Not Replacing Anyone

Tokenized stocks are unlikely to completely replace traditional stock markets, but their greatest value lies in "connecting"—opening the door to the crypto world for traditional investors while providing crypto users with tools to anchor real assets.

Just as the launch of Bitcoin and Ethereum ETFs made it possible for mainstream capital to enter the crypto market, tokenized stocks are also expected to become an important channel for the next round of capital inflows. In the future, they may become a key link for the crypto world to truly "break out."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。