[This article is based on the post by X user @beiming8888]

As the global cryptocurrency market experiences renewed turbulence, Bitcoin's price strongly broke through $107,000 in mid to late May, reigniting widespread discussions about the return of a cryptocurrency bull market. However, behind the price surge, a severely underestimated yet structurally significant variable is quietly brewing—the advancement of stablecoin legislation in the United States, which may fundamentally change Bitcoin's macro positioning and subtly become a "non-traditional weapon" for the U.S. to address its sovereign debt issues.

1. Stablecoin Legislation: Not Technical Details, But Macro Financial Tools

On May 18, 2025, the U.S. Congress once again advanced the stablecoin regulatory framework, with one of the core requirements of the bill being that compliant stablecoin issuers must hold short-term U.S. Treasury securities or cash as reserve assets to ensure a 1:1 peg.

On the surface, this is to protect user funds and enhance transparency; in essence, this regulation constructs a perfect currency-debt closed loop:

Stablecoin companies (like Tether/USDC) must invest the dollars exchanged by users into short-term U.S. Treasuries;

U.S. Treasuries themselves become the core collateral for "stablecoin issuance rights";

Increased stablecoin issuance → Increased demand for short-term U.S. Treasuries → Supports U.S. Treasury liquidity → Indirectly helps the U.S. Treasury reduce refinancing pressure.

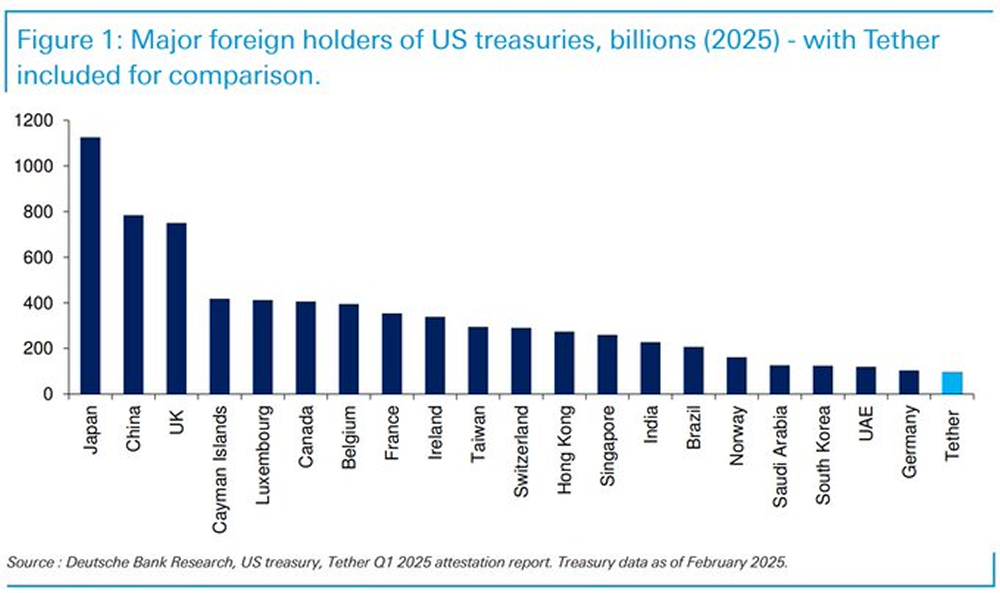

Taking Tether as an example, its holdings of U.S. Treasuries have surpassed $100 billion, accounting for over 60% of its total reserves, making it one of the major holders of U.S. Treasuries outside of Japan and China.

2. Is Bitcoin Becoming an Indirect Catalyst for "Dollar Digitalization"?

The biggest variable in this closed loop comes from Bitcoin.

Stablecoins require continuous expansion on the demand side, and Bitcoin, as the "traffic hub" of the crypto asset ecosystem, plays a natural role as a stablecoin engine:

Bitcoin price rises → Investors flock to exchanges → Stablecoin trading volume surges → Issuers issue more USDT/USDC to meet liquidity demands;

More stablecoins in circulation → More U.S. Treasuries purchased → Pressure on the U.S. Treasury refinancing market decreases;

The capital market sees U.S. Treasuries being effectively absorbed → Expectations for U.S. fiscal credit improve → The attractiveness of dollar assets rebounds.

In other words, the rise of Bitcoin is no longer merely a market behavior but a "trigger" in the grand chess game of the digitalization of the dollar system. A structural positive feedback loop forms between U.S. Treasuries, stablecoins, and BTC.

3. Trump and Stablecoins: A Political and Economic Game Bypassing the Federal Reserve?

Behind the current stablecoin legislation may lie a deeper game.

It is well known that U.S. Treasury bonds are issued by the Treasury Department, while the authority to issue currency rests with the Federal Reserve. The essence of stablecoins is a form of "quasi-currency" generated without relying on the Federal Reserve, backed by assets. If such currency gains legal status, it essentially transfers part of the dollar issuance authority from the Federal Reserve to market-oriented institutions (stablecoin issuers).

The Trump team has repeatedly signaled "support for innovative financial instruments" and "promoting a free crypto market" in recent campaigns. Some market voices suggest that the stablecoin legislation is, in fact, a political financial strategy by the Trump faction to bypass the Federal Reserve and strengthen fiscal control—expanding fiscal issuance space without violating the Constitution and transferring systemic leverage through the crypto market.

This is a power chess game that seems unrelated to Bitcoin but may unexpectedly boost BTC's market value.

4. On-Chain Data and Technical Validation: Funds Are Quietly Positioning

From on-chain and technical chart perspectives, this round of Bitcoin's rise differs from the traditional bull market initiation logic.

Capital inflow situation: According to CryptoQuant data, from May 18 to 21, the net inflow of BTC to exchanges was negative for three consecutive days, with on-chain transfer volumes decreasing but the number of active addresses increasing, indicating that a large number of tokens were transferred from exchanges to self-custody wallets, suspected long-term capital accumulation.

Holding structure: Glassnode data shows that HODLer holdings have reached an all-time high, with USDT trading pairs accounting for over 73% of active trading volume, indicating that the market's trust in stablecoins is translating into new buying power for BTC.

5. Outlook: Will BTC Become the Anchor Point for Global Liquidity Rebalancing?

In the context of diminishing dollar credit and increasing structural liabilities in traditional finance, Bitcoin is no longer merely a "safe-haven asset" or "risk asset," but a tool for global liquidity redistribution.

For the U.S., the rise of BTC frees up issuance space for stablecoins, benefiting U.S. Treasuries;

For institutions, BTC serves as a low-correlation, high-freedom global asset allocation tool;

For gray market/offshore funds, BTC becomes a tax evasion transfer channel;

For developing countries, BTC is a new anchor to hedge against local currency depreciation.

Conclusion: Stop Viewing BTC Merely as a Trading Asset; It Is Becoming a Strategic Vehicle for Dollar Digitalization

This is not just a price-driven bull market; it is an asset revaluation shaped by policies, structures, and financial games. Bitcoin is not the end of a bubble but a new starting point in the digitalization path of the old order. The "stability" of stablecoins is created by the "instability" of BTC to generate demand; the rise of BTC is not just market speculation but a byproduct of the struggle for financial sovereignty.

This is a systemic opportunity. In the next 3-5 years, Bitcoin may no longer just be an asset but a digital extension of the dollar's globalization.

This article only represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。