Key Points

Bitcoin is the first decentralized digital currency, enabling peer-to-peer value transfer without intermediaries.

Its underlying blockchain uses a proof-of-work mechanism to secure transactions and validate blocks.

Traders can participate in spot and contract markets, while holders can earn yields by staking BTC through platforms like XT Earn.

Bitcoin serves as both a store of value and a means for cross-border remittances, payments, and decentralized finance.

What is Bitcoin?

- Essentially, Bitcoin is a decentralized digital currency that allows anyone to send or receive value online peer-to-peer without relying on banks or payment institutions.

Since its inception in 2009, Bitcoin has evolved from a niche experiment into a global financial phenomenon, attracting significant interest in "Bitcoin Overview," BTC price fluctuations, and trading tools such as spot BTC/USDT and BTC contracts.

This guide will provide a comprehensive understanding of Bitcoin's history, how it works, and its practical applications, while demonstrating how to conduct spot trading, stake holdings through XT Earn, and securely store your coins. Whether you are a novice or an experienced trader, you will deepen your understanding of the Bitcoin ecosystem.

Table of Contents

History and Evolution of Bitcoin

Bitcoin vs. Other Cryptocurrencies

Practical Applications of Bitcoin

How to Buy and Store Bitcoin (BTC)

History and Evolution

The story of Bitcoin began in October 2008 when the founder, using the pseudonym Satoshi Nakamoto, published the "Bitcoin Whitepaper," proposing a peer-to-peer electronic cash system. By January 2009, the genesis block was mined, marking the birth of a decentralized ledger. Early users could exchange Bitcoin for just a few cents; by the end of 2010, a programmer famously bought two pizzas for 10,000 BTC, vividly illustrating its value at the time.

Image Credit: Bitcoin Whitepaper (Bitcoin.org)

In the following decade, Bitcoin's market capitalization soared, reaching several milestones in BTC price: it first surpassed $1 in February 2011, exceeded $1,000 by the end of 2013, and approached $20,000 in December 2017. Each bull market sparked public interest and led to the creation of thousands of altcoins. Between 2020 and 2021, institutional investors began to allocate BTC into their balance sheets. To this day, Bitcoin's journey demonstrates the power of decentralized innovation and the appeal of censorship-resistant assets.

Image Credit: TradingView

How Bitcoin Works

- Blockchain Basics

Bitcoin operates on a decentralized ledger called the blockchain, where each transaction is recorded sequentially in blocks. Nodes around the world hold copies of the ledger, ensuring the network is transparent and immutable.

- Mining and Consensus

Mining nodes compete for the right to record transactions by solving complex cryptographic puzzles (proof of work). The first node to find a valid solution packages the new block onto the chain, receiving BTC block rewards and transaction fees. This consensus mechanism prevents fraud and double spending.

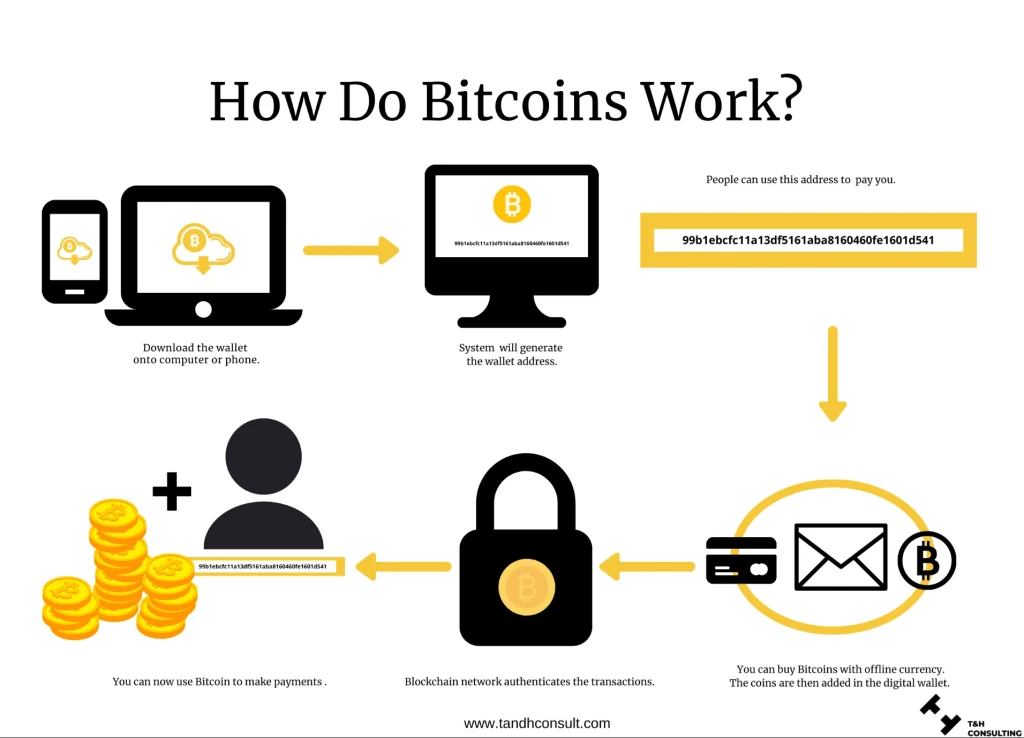

- Detailed Transaction Process

Initiating a Transaction: Users create a transaction in their wallet, filling in the recipient's address and amount.

Broadcasting the Transaction: The transaction information propagates through the Bitcoin network.

Verifying the Transaction: Miners confirm that the input has not been spent again.

Packaging onto the Chain: Valid transactions are included in a new block and added to the blockchain.

Confirmation Complete: As more blocks are generated afterward, the transaction is considered confirmed (“How Bitcoin Works Step by Step”).

Image Credit: T&H Consulting

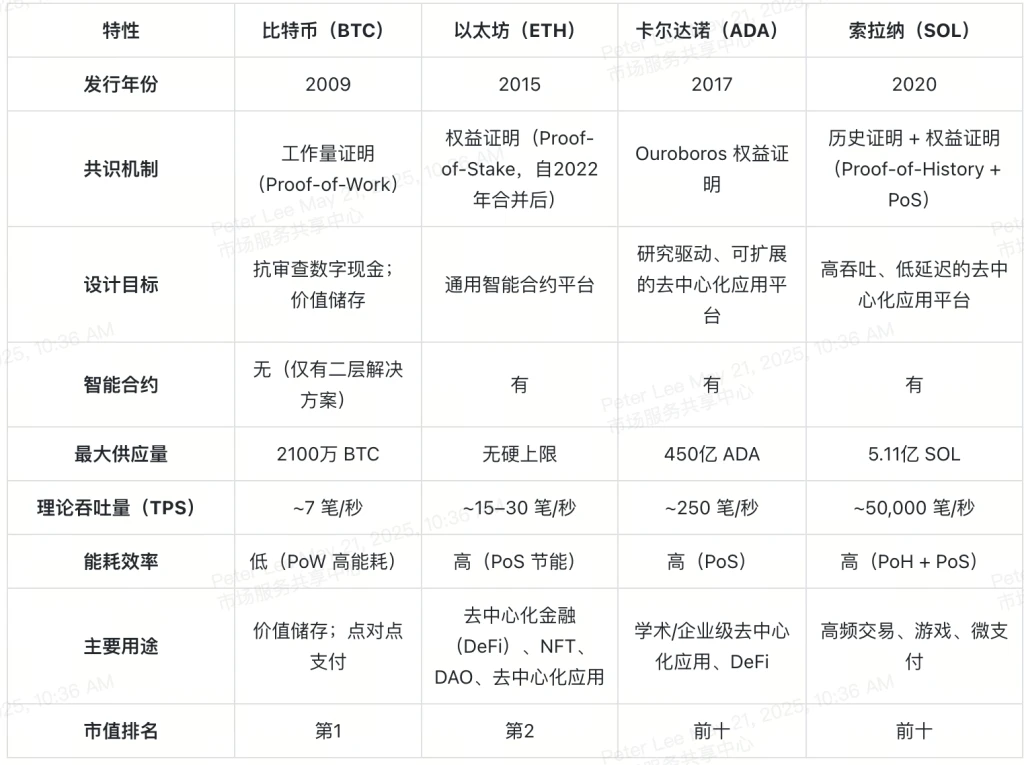

Bitcoin vs. Other Cryptocurrencies

Bitcoin initiated the cryptocurrency wave, but countless "altcoins" have emerged since. The fundamental difference between Bitcoin and projects like Ethereum, Cardano, and Solana lies in their design goals: Bitcoin focuses on censorship-resistant digital cash and value storage, while many altcoins emphasize smart contracts, scalability, or specific applications.

Altcoins often experiment with different consensus algorithms (like proof of stake) to improve energy efficiency or introduce programmability to support decentralized applications. Despite the continuous innovation, Bitcoin remains dominant due to its first-mover advantage, decades of security through hash power, and the largest global user and developer network.

The entry of institutions further solidifies Bitcoin's leading position. Many investors view it as "digital gold," hedging against inflation and geopolitical risks. In contrast, altcoins may have higher growth potential but also face greater technical and regulatory risks. In summary, altcoins enrich the ecosystem, while Bitcoin, with its proven track record and brand influence, remains the flagship of the crypto space.

Bitcoin Trading (BTC)

Spot Trading

In the spot market, you buy and sell actual BTC. Common trading pairs include BTC/USDT, allowing for instant settlement between stablecoins and Bitcoin.

XT.com BTC/USDT Spot Trading Pair

Contracts and Derivatives

BTC contracts allow you to bet on Bitcoin price movements without holding the physical asset. Leverage can amplify profits but also increases risks, necessitating strict risk management. Popular contracts include BTC/USDT and BTC/USD.

Stake BTC through XT Earn.

Although Bitcoin itself is not a proof-of-stake token, lending platforms like XT Earn offer yield products commonly referred to as BTC staking. You can lend BTC to institutional borrowers and earn interest under transparent terms.

Bitcoin Practical Use Cases

Beyond speculation, Bitcoin plays a role in several real-world scenarios. First, it serves as a store of value, similar to digital gold, helping people protect their wealth in regions with currency devaluation or strict capital controls.

Second, Bitcoin empowers cross-border remittances. Traditional remittance services are costly and slow; using BTC in conjunction with USDT channels can complete international transfers in under an hour at a lower cost.

Third, Bitcoin supports peer-to-peer payments. Merchants and individuals can receive payments via QR codes, enabling almost instant, low-fee experiences for small transactions through the Lightning Network.

Fourth, Bitcoin drives decentralized finance experiments. Wrapped BTC (WBTC) and other tokenization methods allow Bitcoin to flow into the smart contract ecosystem, supporting various DeFi applications such as lending and yield farming.

Finally, Bitcoin provides a trust-minimized diversification option for investment portfolios. Its low correlation with traditional assets makes it an attractive hedging tool. Whether for value preservation, payments, or entering DeFi, Bitcoin continues to expand global financial inclusivity.

Image Credit: B2BInPay

How to Buy and Store Bitcoin (BTC)

Choose an Exchange

Select a reliable platform—such as XT.com—to trade BTC/USDT. Pay attention to liquidity, fee levels, and security measures like cold storage and multi-factor authentication.

Wallet Options

Custodial Wallets: The exchange holds your private keys, making it convenient but requiring trust in the platform.

Non-Custodial Wallets: You control your private keys, with software wallets (mobile/desktop) balancing security and usability.

Hardware Wallets: Offline storage devices like Ledger and Trezor can prevent theft to the greatest extent.

Security Best Practices

Enable two-factor authentication (2FA) on all accounts.

Regularly back up your recovery phrases offline and store them securely.

For long-term holding, it is recommended to use a hardware wallet.

Be cautious of phishing websites; always verify URLs and never disclose your private keys.

Image Credit: Cointribune

Risks and Precautions

Price Volatility

BTC prices can fluctuate by 5–10% or even more within a single day. While there is potential for quick gains, there can also be significant losses.

Manage your positions wisely and diversify risks.

Use stop-loss or take-profit orders to lock in profits or limit losses.

Regulatory Uncertainty

Countries have varying attitudes toward Bitcoin, with some supporting it and others restricting or even banning it.

Stay informed about local laws and tax requirements.

Keep records of your trades and holdings for compliance checks.

Security Threats

Risks such as exchange hacks, phishing emails, and malware are always present.

Never reuse passwords or disclose your private keys.

Separate trading funds from long-term holdings: keep only trading coins on exchanges and store long-term assets in cold wallets.

Fraud and Scams

Various high-yield promises and phishing airdrops are rampant.

Be wary of projects that seem too good to be true.

Only operate on reputable platforms and conduct your own due diligence before investing.

Future Outlook for BTC

Institutional investment and an increasingly clear regulatory environment are reinforcing Bitcoin's legitimacy. Major companies and funds continue to accumulate BTC, and the launch of spot Bitcoin ETFs is attracting more retail and institutional capital. Meanwhile, on-chain developments like the Taproot upgrade and Lightning Network expansion enhance privacy, scalability, and everyday usability.

Looking ahead, these technological innovations are expected to lower transaction fees and speed up transaction times, thereby improving user experience and creating more new scenarios, positively impacting BTC prices. As global macro uncertainties persist, Bitcoin's status as a decentralized store of value will further solidify, attracting more capital and technological investment.

Summary

Bitcoin is a truly decentralized and censorship-resistant digital currency. From Satoshi Nakamoto's white paper to today's thriving global network, Bitcoin combines security, scarcity, and transparency. Whether you want to engage in spot or contract trading, earn interest through XT Earn, or hedge against inflation with Bitcoin, the Bitcoin ecosystem offers a rich array of tools for users with different needs. To learn more, consider consulting authoritative resources and trying small BTC trades on XT.com to experience the charm of this groundbreaking technology firsthand.

Common Questions about Bitcoin (BTC)

What is Bitcoin?

A decentralized digital currency with a fixed supply of 21 million coins, secured by blockchain and proof-of-work (PoW) mechanisms.

How to buy Bitcoin?

Register and deposit on exchanges like XT.com, then choose BTC/USDT spot trading to purchase.

How to store Bitcoin?

For long-term holding, it is recommended to use a hardware wallet; for daily small amounts, you can choose a software wallet or a custodial wallet from an exchange.

Can you make money with Bitcoin?

Yes—services like the "staking" offered by XT Earn allow you to lend BTC and earn interest.

What are the risks of investing in Bitcoin?

High price volatility, regulatory uncertainty, security threats (hacking, phishing), and various scams.

How to use Bitcoin for payments?

You can pay via on-chain transfers or the Lightning Network, with merchants supporting QR codes or invoices for payments.

Quick Links

– Half a Million Dollar Incentive to Kick Off Trading Frenzy: MNT × XT Carnival Complete Guide

– May Economic Calendar for Crypto Traders: Must-See Events

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with more than 1 million monthly active users and over 40 million user traffic within the ecosystem. We are a comprehensive trading platform supporting over 800 quality cryptocurrencies and more than 1,000 trading pairs. XT.COM supports a rich variety of trading options, including spot trading, margin trading, and contract trading. XT.COM also has a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。