The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to the attention and likes of all coin friends, and reject any market smoke bombs!

After communicating with many friends in the past two days, I have a very intuitive feeling that many friends are currently stuck in short positions. However, everyone's mindset is quite extreme. The advice given by Lao Cui is basically to stop loss and change direction, but none have succeeded. Lao Cui is the same; when Bitcoin hit a price starting with 7, the main view was still that there would be a new low. Looking at the current situation, it is completely off the mark. If everyone follows their inertia, they might still choose to be bearish at the hundred thousand mark. Lao Cui's response is also to directly stop loss and change direction. I also understand everyone's thoughts; undoubtedly, under the continuous new highs of Bitcoin, other coins are stable and solid. In this round of rebound, only Bitcoin has performed the most brilliantly. Many friends have the illusion that the increase has been consistent, and even some small coins have surpassed Bitcoin's increase. If you want to compare the returns of these two, you should examine both coins comprehensively. From a single perspective, it is difficult to have an objective evaluation; for example, Ethereum can represent the vast majority of coins. At the beginning of the year, Bitcoin was around 110,000 and still unstable, while Ethereum was around 4,000. Currently, Ethereum is barely stabilizing at 2,600. Although the short-term comparison shows almost the same increase, the returns are not the same. Currently, the best choice still has to be Bitcoin.

I still hope everyone does not act too blindly. During the 2024 Federal Reserve interest rate cut cycle, Bitcoin also experienced a single-day drop of 17%. This asset, known as "digital gold," had a correlation with the Nasdaq index as high as 0.8 during the Russia-Ukraine conflict, completely exposing its speculative nature. Data from the Cambridge Centre for Alternative Finance shows that 58% of global Bitcoin trading volume comes from the leveraged derivatives market. This value system, based on algorithmic consensus (hash algorithms), is encountering cognitive shocks from traditional finance. When the Bank for International Settlements announced that "90% of central banks worldwide are developing digital currencies," how much survival space is left for Bitcoin? However, this viewpoint can also be easily shattered. How many people would be willing to use official cryptocurrencies if we think from another perspective? More people choose Bitcoin initially because of its convenient liquidity and unspeakable secrets. The impact of official currencies on Bitcoin is not too significant. But the current volatility is constantly reminding everyone that Bitcoin has speculative attributes. After making profits from contracts, it is best to convert to spot trading. This pace of maintaining growth will not last long. Lao Cui estimates that a downward trend may be coming soon.

The contradiction between fiat currency and cryptocurrency is that sovereign countries will never tolerate the loss of currency issuance rights. The latest report from the International Monetary Fund (IMF) shows that 83% of Bitcoin nodes are still concentrated in North America and Europe. The so-called "decentralization" is merely a facade for a new type of financial hegemony. Meanwhile, the pilot program for China's digital yuan has covered 560 million people, with transaction volumes exceeding 18 trillion. Fiat currency, backed by the government, will generate more transactions on a national basis, and these two do not conflict. Additionally, with Russia leading the way in trading energy with Bitcoin, Bitcoin has already gained considerable support to some extent. The peak of Bitcoin this year is certainly unpredictable. From a long-term perspective, Lao Cui's view remains the same as last year; even if you hold positions above 100,000, you can still achieve considerable returns. As long as you do not blindly short, this wave of market can still yield satisfactory profits. The specific entry points can be controlled by each individual.

Stronger regulation: The power restructuring of global capital markets. On the day the U.S. SEC approved the Bitcoin spot ETF, BlackRock raised $620 million in a single day. However, looking closely at the terms: the custodian must pay a 300% margin, which is equivalent to putting traditional financial shackles on crypto assets. Speaking of regulation, Lao Cui would like to mention the platform issues that everyone is concerned about. Many friends have heard stories about some small platforms to varying degrees. Lao Cui has also experienced the entire process and can say that the trading platform's explosive period was from 2016 to 2019. Various platforms emerged, causing many traders to suffer losses. However, since 2019, domestic regulation has become stricter, starting with the joint statement on May 19, which basically wiped out domestic platforms. Most platforms currently have some official background, whether in the form of regulatory certificates or other appearances. The trading environment in recent years has indeed improved compared to before, but it does not rule out the existence of garbage platforms. Lao Cui also knows some insider information and has explained some platforms in detail over the past two years. If you have doubts, you can communicate with Lao Cui, especially users with evidence are welcome to submit to Lao Cui. Because of these influences, Lao Cui will no longer provide platform recommendations in the future. If you want to enter the crypto space, just look for the leading ones.

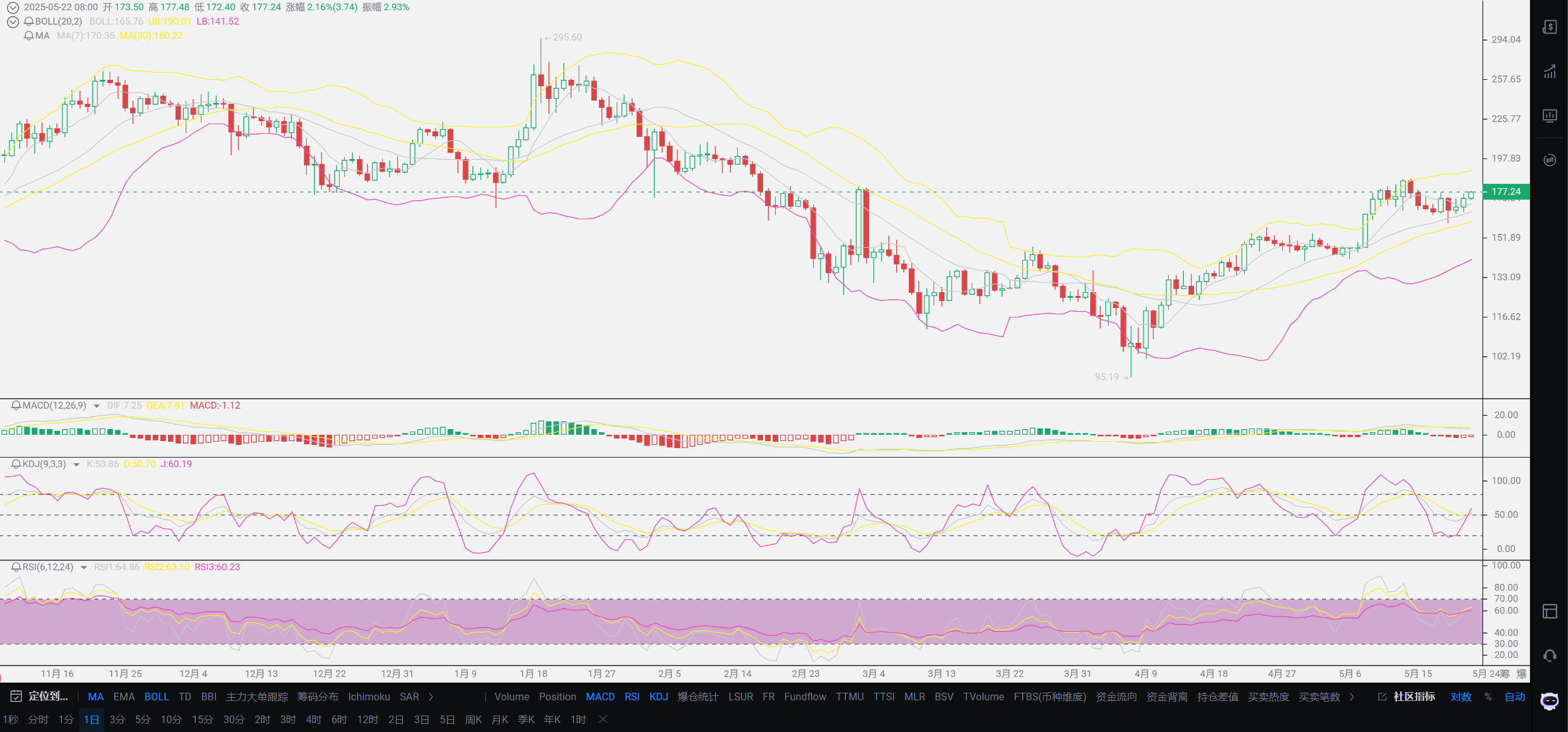

Lao Cui's summary: Many friends have known Lao Cui since around 2012, and everyone is very clear about Lao Cui's views. Lao Cui is not optimistic about the future of the cryptocurrency market. Especially in the future, quantum computers are likely to break the elliptic curve encryption algorithm, and the blockchain empire will collapse in an instant. Technology will continue to develop, and whether the improvement in computing power and algorithms can conquer cryptocurrencies is a topic that Lao Cui has a definite answer to. Do not mythologize cryptocurrencies too much; the underlying logic ultimately boils down to layers of encryption through code. In reality, where there is a lock, there will be a key. The only good news for Bitcoin is that there are less than a million left to be developed. Technological progress may reduce packaging costs, but what about other small coins? This is a very fatal signal. If the mining time cannot keep up with technological progress, most small coins may be cleared out. Looking at the recent market, Bitcoin has already broken through the new high of 110,000, and there has not been a deep correction today. After a short-term correction, it will still challenge the high point. Everyone needs to have some patience. After this wave of impact, Lao Cui will also layout a new round of entry points, and you can pay attention to Lao Cui's later views. Due to the recent trend, it is basically consistent with Lao Cui's thoughts, so the article is more focused on answering everyone's questions. As for the market analysis that everyone wants to see, Lao Cui will also make an overall judgment when he has time to provide some reference. For the current trend, users who have not entered can maintain a wait-and-see attitude. Before the interest rate cut, there will definitely be another deep correction space, with Bitcoin at least around 10,000 to 20,000 points. However, it will definitely maintain growth at this stage. This breakthrough will not give short positions an opportunity to exit. The best choice for the most bearish positions was already given by Lao Cui when it was at 100,000. When to cut losses and when to hold on, do not be obsessed with immediate benefits.

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess. A master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on a single piece or a single area, aiming for the ultimate victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。