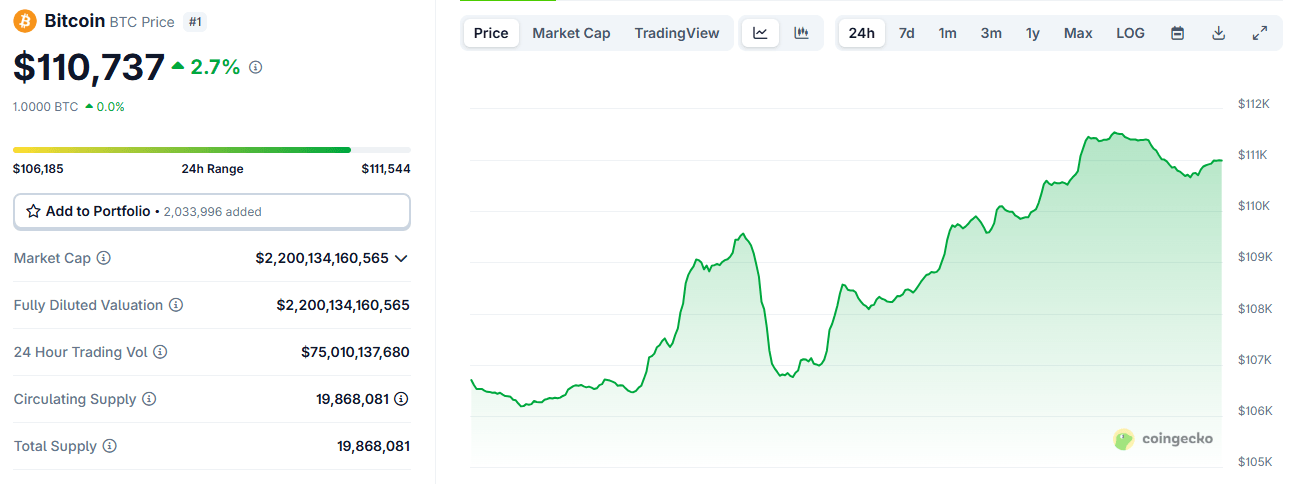

On May 22, bitcoin’s market capitalization briefly surpassed the $2.2 trillion mark after the top cryptocurrency hit a new all-time high of just over $111,500. This impressive milestone propelled bitcoin ( BTC) ahead of Jeff Bezos’ Amazon, whose market cap stood around $2.17 trillion on the same day. Additionally, this achievement helped push the crypto economy’s market cap past the $3.6 trillion mark, surpassing Microsoft’s market cap of $3.39 trillion.

According to data from Coingecko, bitcoin’s rally brought its 24-hour and seven-day gains to just over 3% and nearly 10%, respectively. At that price, the cryptocurrency traded more than $1,000 above its January 20 peak, which coincided with the inauguration of pro-crypto Donald Trump as U.S. President.

This latest rally appears to be fueled by the growing adoption of bitcoin as a treasury asset by publicly listed companies. As recently reported by Bitcoin.com News and other media outlets, more companies announced for the first time that they were adding bitcoin to their treasury assets. Meanwhile, pioneering bitcoin-adopting companies, including Michael Saylor’s Strategy and the Japanese-listed entity Metaplanet, continued to increase their BTC holdings.

In addition to enhancing the appeal of BTC, the purchase of the cryptocurrency by an increasing number of corporations is seen as shrinking the supply of bitcoins available on the open market. Proponents of the crypto asset argue that this mismatch in the supply and demand will inevitably lead to an increase in BTC’s fiat value.

Meanwhile, unlike in mid-April, when it appeared to be correlated with traditional markets, BTC has bucked the trend, gaining more than $35,000 since April 9, when it dropped to just over $75,000. At the time of writing, BTC’s year-to-date gain stood at nearly 18%, making it one of the best-performing assets in 2025 so far.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。