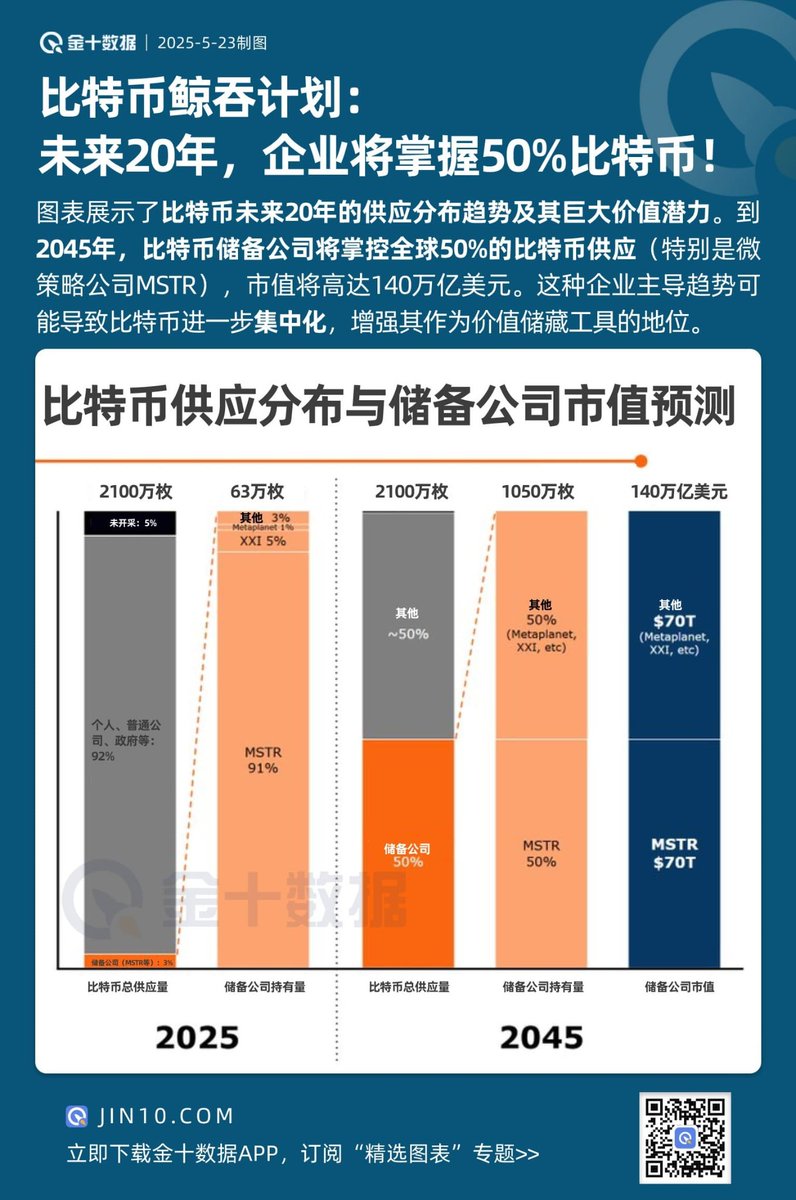

⚡️This chart from Jinshi shows that in the next 20 years, companies will control 50% of the global #Bitcoin supply——

On the surface, this appears to be a concentration of wealth, but I believe there is a deeper evolution of Bitcoin philosophy at play:

In a global environment characterized by sovereign debt expansion, weakening fiat currency credit, and continuously maximized fiscal leverage, the market will spontaneously seek out scarce assets that are not subject to sovereign constraints and cannot be easily manipulated as a store of value anchor.

Bitcoin has been chosen for this purpose. But the key point here is: it is not chosen because it is a currency, but because it can become a super reserve tool.

As more companies and sovereign funds lock up large amounts of Bitcoin, its circulating supply will further decrease, and its usage rate will decline.

It will become like gold—perhaps even purer than gold—because it does not require physical custody and can be directly cold-stored and frozen, used for pricing, collateral, and balance sheet management, rather than just a simple medium of exchange.

In the next 20 years, the role of $BTC will shift towards being a financial anchor. Its monetary aspect may weaken, but its financial, reserve, and strategic characteristics will be dramatically amplified.

In other words, the ultimate form of Bitcoin may not be a completely rebellious asset detached from sovereignty, but rather a neutral anchor point standing between sovereignty and non-sovereignty.

Its existence will become an important link in the hedging, gaming, and rebalancing among nations, institutions, and capital.

Therefore, looking at the power restructuring behind the facade of wealth, Bitcoin is not simply on the rise; it is undergoing an evolution of the financial system that is continuously integrated and absorbed by capital, institutions, and sovereignty!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。