On Monday, the US stock market is closed, so whether the market can return to a normal sentiment will have to wait until Tuesday to find out. Although the price of $BTC has slightly declined on Sunday, this is mainly due to the emotions of a small number of investors. Whether it can emerge from Trump's shadow will depend on the performance of American investors on Tuesday.

Over the weekend, Trump did not create any further disturbances. In the coming week, there is only the PCE data on Friday, and there are no other key data points, so investors' focus remains on whether Trump will resolve the tariff issues with the Republican Party in Europe and mobile manufacturers. The last time, the auto tariffs provided a certain buffer period.

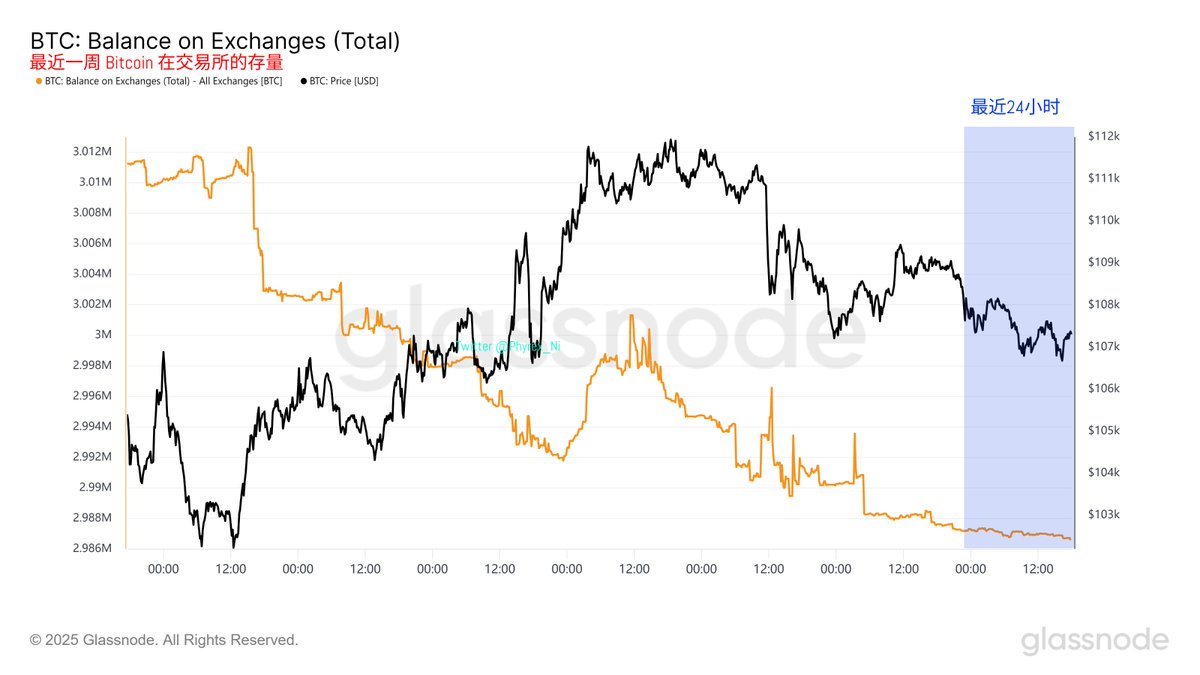

From the data perspective, the inventory on exchanges over the weekend reflects the investors' mindset, showing no significant changes. Most investors have not panicked due to the current price, but it is also clear that without the operations of institutions and market makers during the holiday, the purchasing power for $BTC is only average.

From the data of Bitcoin held for over a year, there have been signs of increased holdings from investors for two consecutive days. Although it cannot be said that this is already the reversal point for BTC prices, preparations should be made accordingly. If long-term held BTC continues to increase in the coming week, it is very likely that the high point for BTC prices has already ended.

Unless long-term holders continue to distribute next week, the turnover rate over the weekend continues to decline, and investors' buying and selling interest remains very low. Selling by loss-making investors has further increased, while profit-making investors are still in a wait-and-see state.

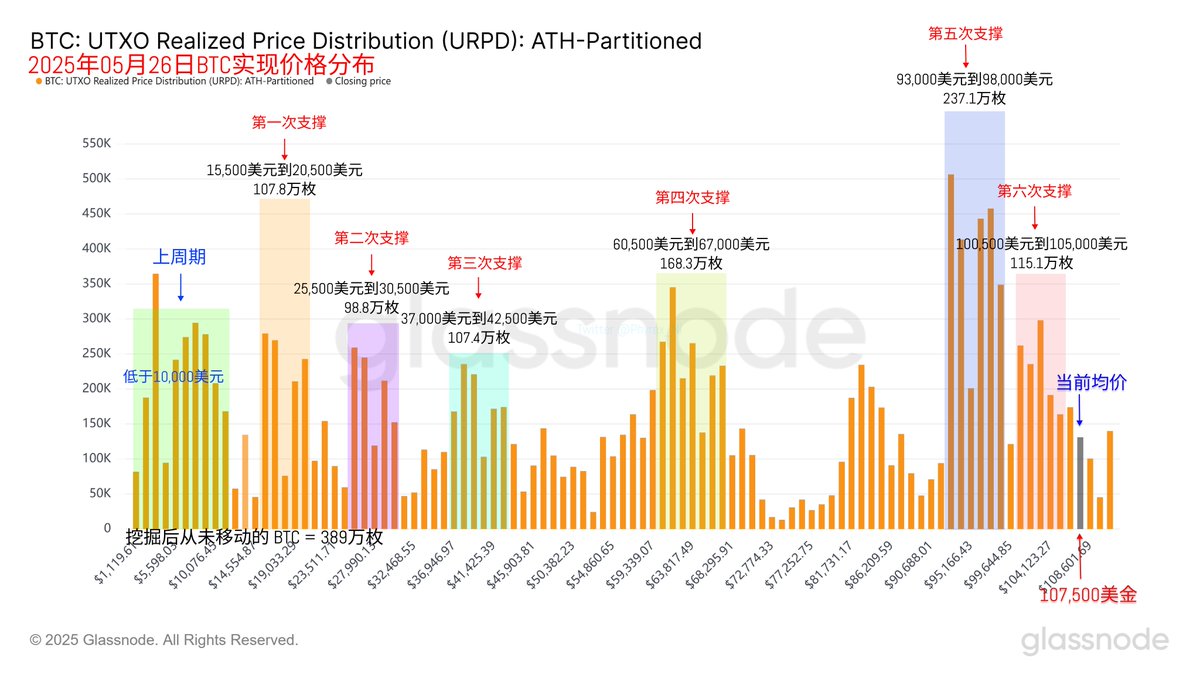

Currently, holders in the range of $93,000 to $98,000 are still the best support. In the short term, BTC's trend will primarily depend on Trump's attitude towards tariffs, as the Federal Reserve's decision is still quite some time away.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。