Bitwise Asset Management and UTXO Management released their first collaborative research report last week, publishing “Forecasting Institutional Flows to Bitcoin in 2025/2026: Exploring the Game Theory of Hyperbitcoinization.” This inaugural joint study presents a data-driven projection of bitcoin’s accelerating institutional adoption and the geopolitical dynamics potentially leading to a structurally higher demand.

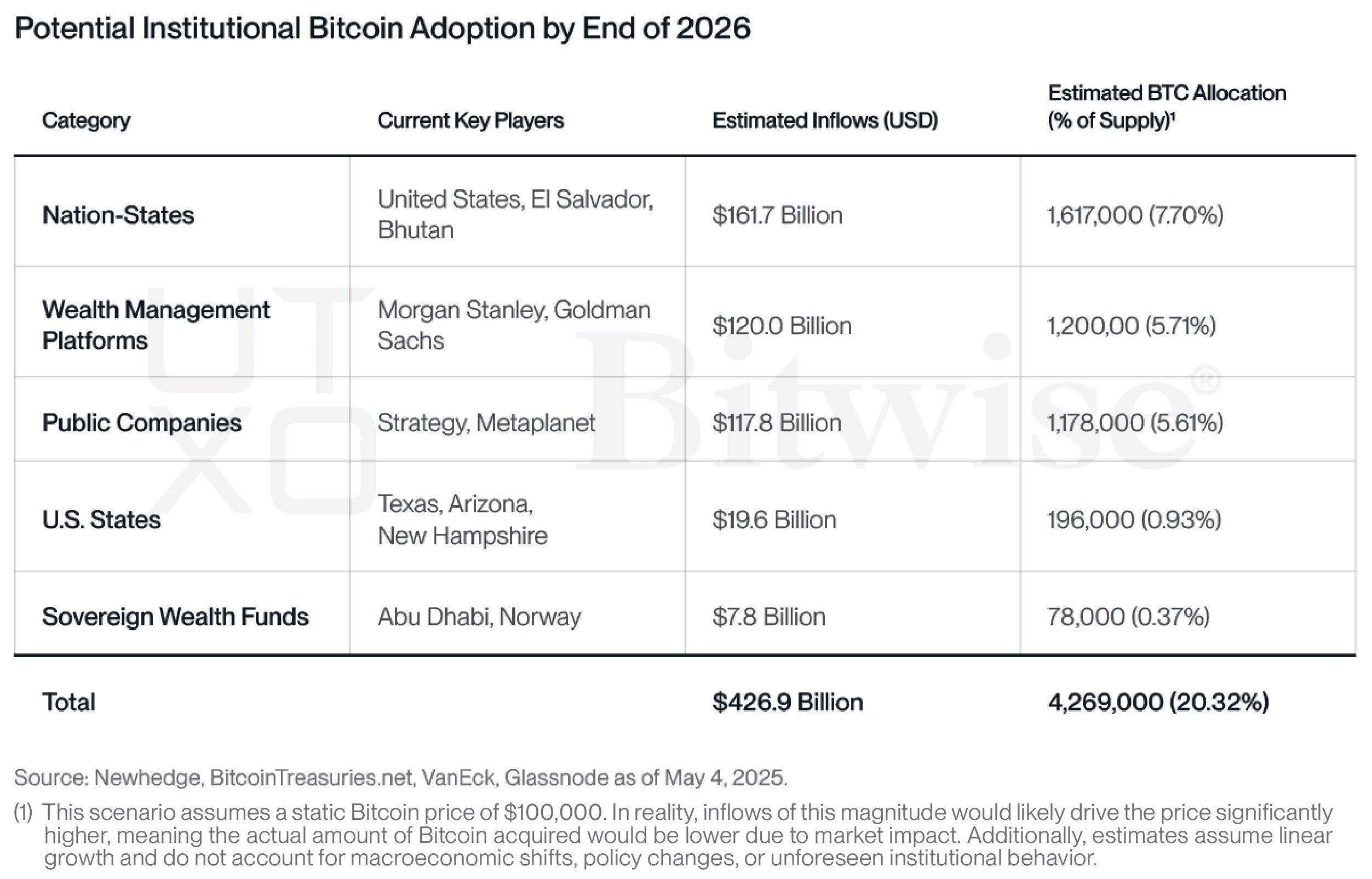

The report provides a detailed roadmap suggesting that institutional actors across wealth management platforms, corporate treasuries, and sovereign entities could acquire more than 4.2 million BTC by the end of 2026, assuming a static bitcoin price of $100,000. The authors outline a phased shift in allocation models, driven by macroeconomic conditions, legislative momentum, and the performance of spot bitcoin exchange-traded funds (ETFs). The report states:

We expect ~$120 billion of institutional funds to flow into bitcoin by the end of 2025 and ~$300 billion in 2026, totalling over 4,200,000 BTC acquired by a heterogeneous group of investors, including public bitcoin treasury companies, sovereign wealth funds, ETFs, and nation-states.

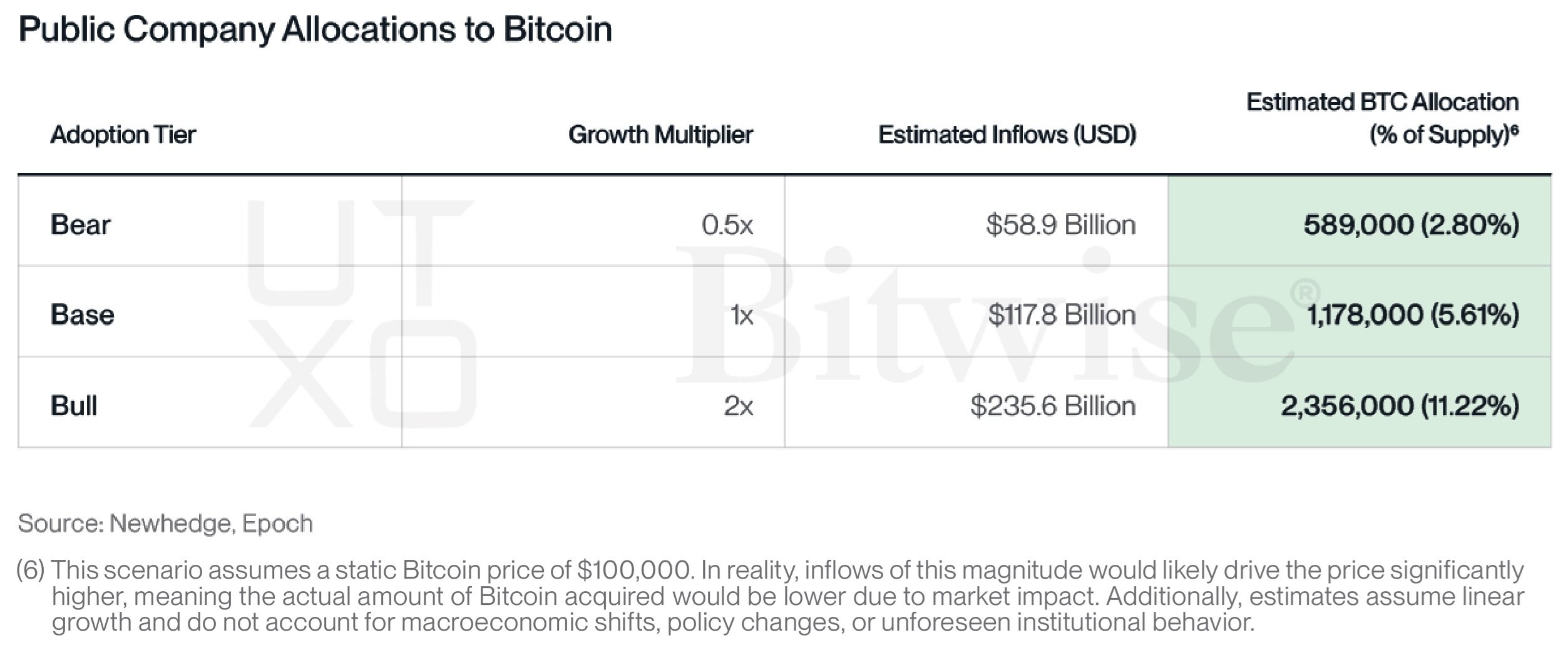

Public companies like Strategy, Metaplanet, and newcomers like Twenty One are setting new precedents in capital deployment, integrating bitcoin not just as a treasury reserve but as a metric for operational performance. Signaling a transformative approach to asset management across multiple sectors, the report continues:

We expect that over 1,000,000 BTC will be accumulated under this new accumulation paradigm by the end of 2026.

In addition to tracing capital flows, the report evaluates the rise of bitcoin-native yield infrastructure. As bitcoin becomes entrenched in institutional portfolios, demand is emerging for yield-generating strategies that allow firms to grow bitcoin holdings without divestment. With developments in Bitcoin Layer 2 solutions and decentralized protocols, the researchers forecast a new $100 billion market opportunity. While hurdles remain, including smart contract risk and evolving regulation, the study underscores the structural legitimacy of bitcoin as both a store of value and productive asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。