Original Title: Are Bitcoin Long-Term Holders Starting to Sell?

Original Author: Matt Crosby, Bitcoin Magazine

Original Translation: BitpushNews

After a period of volatility, Bitcoin has now reclaimed the $100,000 mark and set a new all-time high, injecting new confidence into the market. However, with the price increase, a key question arises: have the most experienced and successful Bitcoin holders—long-term holders—started to sell? This article will analyze how on-chain data reveals the behavior of long-term holders and whether the recent profit-taking is a cause for concern or merely a healthy component of the Bitcoin market cycle.

Signs of Profit-Taking

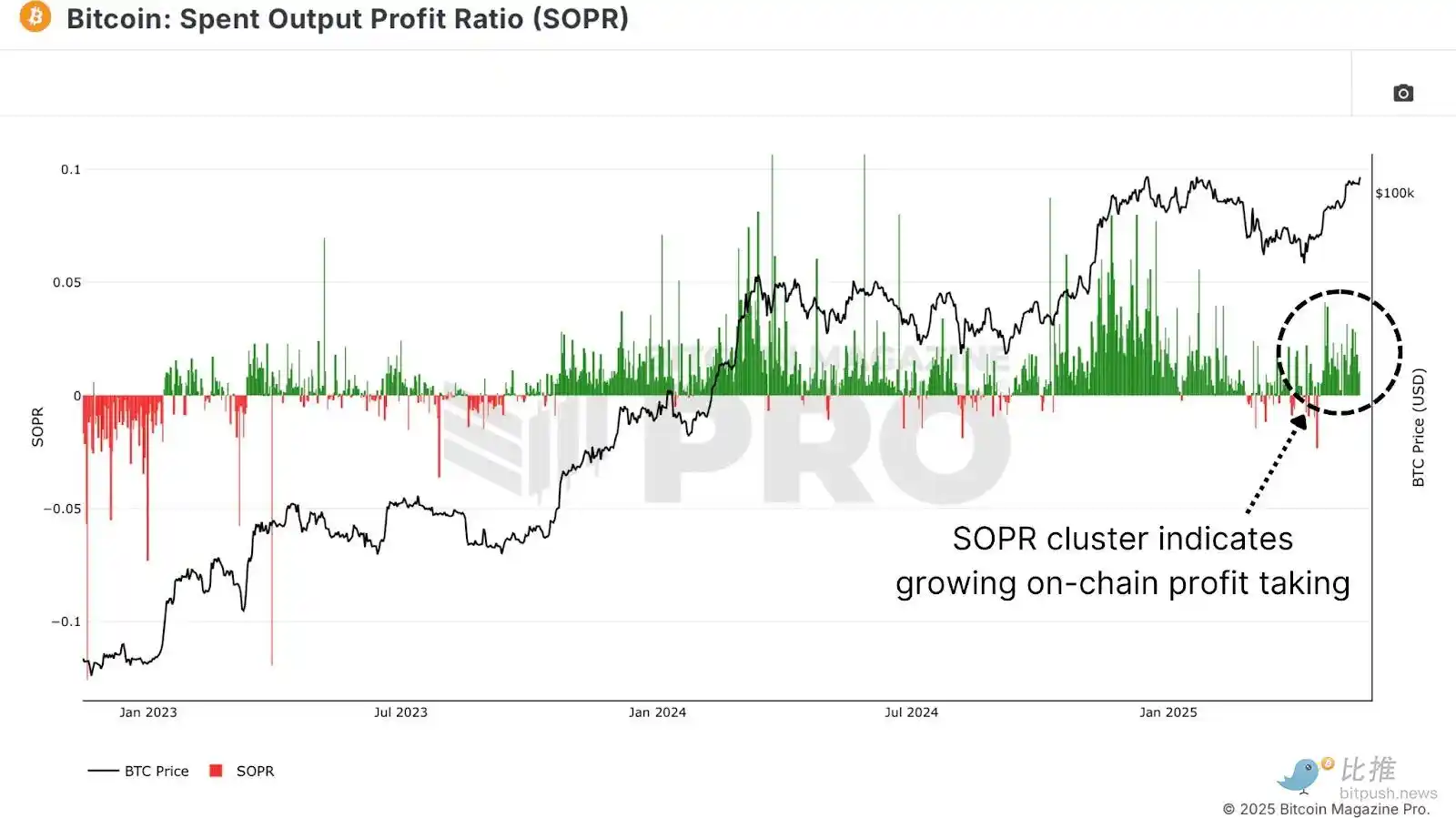

The Spent Output Profit Ratio (SOPR) provides immediate insight into the realized profits across the network. Focusing on the recent weeks, we can clearly observe an upward trend in profit realization. The clustering of green bars indicates that a significant number of investors are selling Bitcoin to realize profits, especially after the price surged from the $74,000–$75,000 range to over $100,000.

Figure 1: The Spent Output Profit Ratio indicates significant profit realization recently.

However, while this may raise concerns about upward resistance in the short term, it must be understood in a broader on-chain context. Such behavior is not uncommon in bull markets and cannot be taken alone as a signal of a cycle top.

Long-Term Holder Supply Continues to Grow

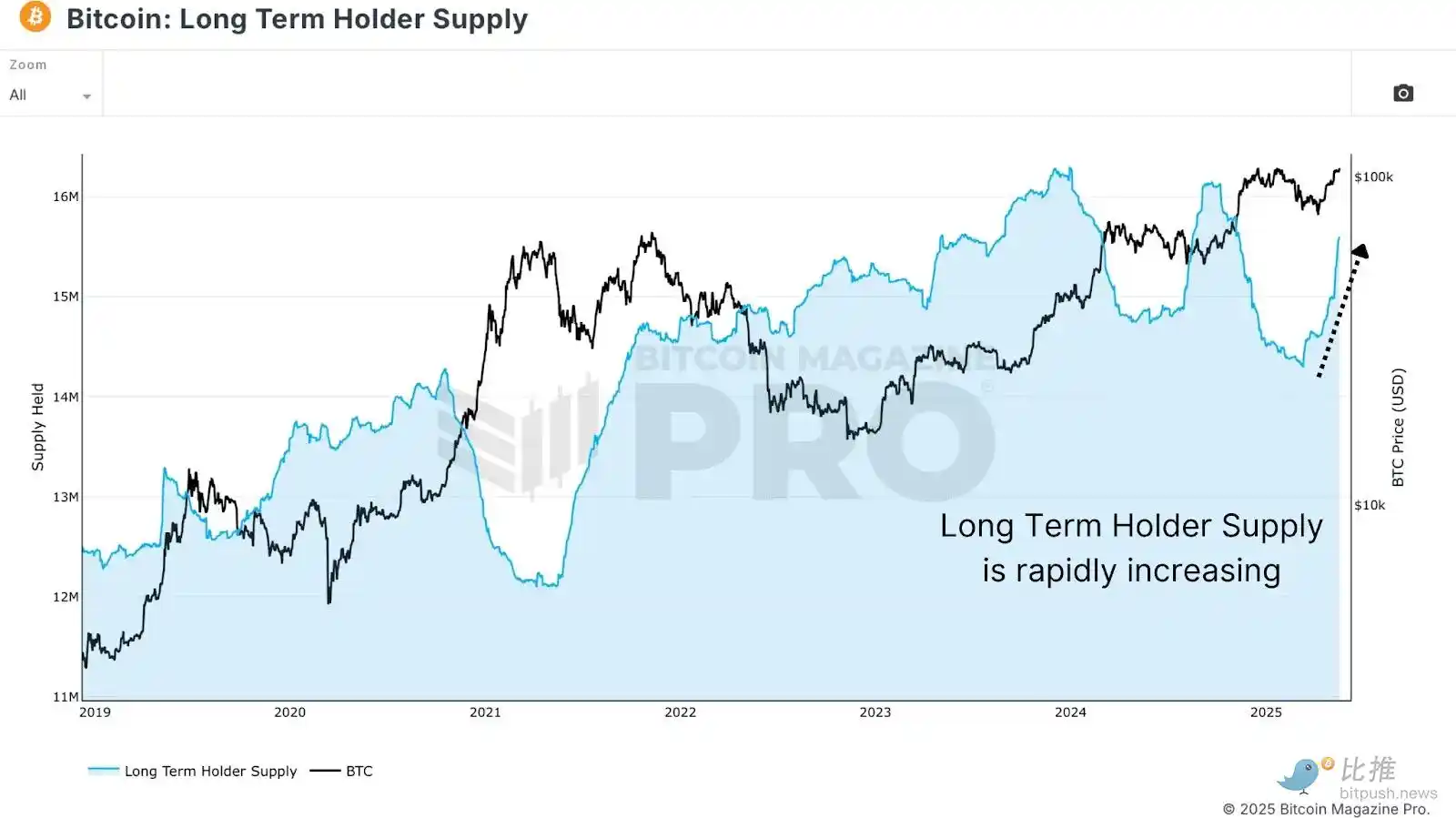

"Long-term holder supply" refers to the total amount of Bitcoin held by wallets that have held for more than 155 days. Despite the price surge, this metric continues to rise. This trend does not necessarily indicate that new buying activity is occurring; rather, it suggests that Bitcoin is "aging" into a long-term holding state over time, without being transferred or sold.

Figure 2: The supply of Bitcoin held by long-term holders is clearly increasing.

In other words, many investors who bought in late 2024 or early 2025 are still holding their coins and transitioning into long-term holders. This is a healthy dynamic typically seen in the early or mid-stages of a bull market and has not yet shown signs of large-scale distribution.

HODL Waves Analysis

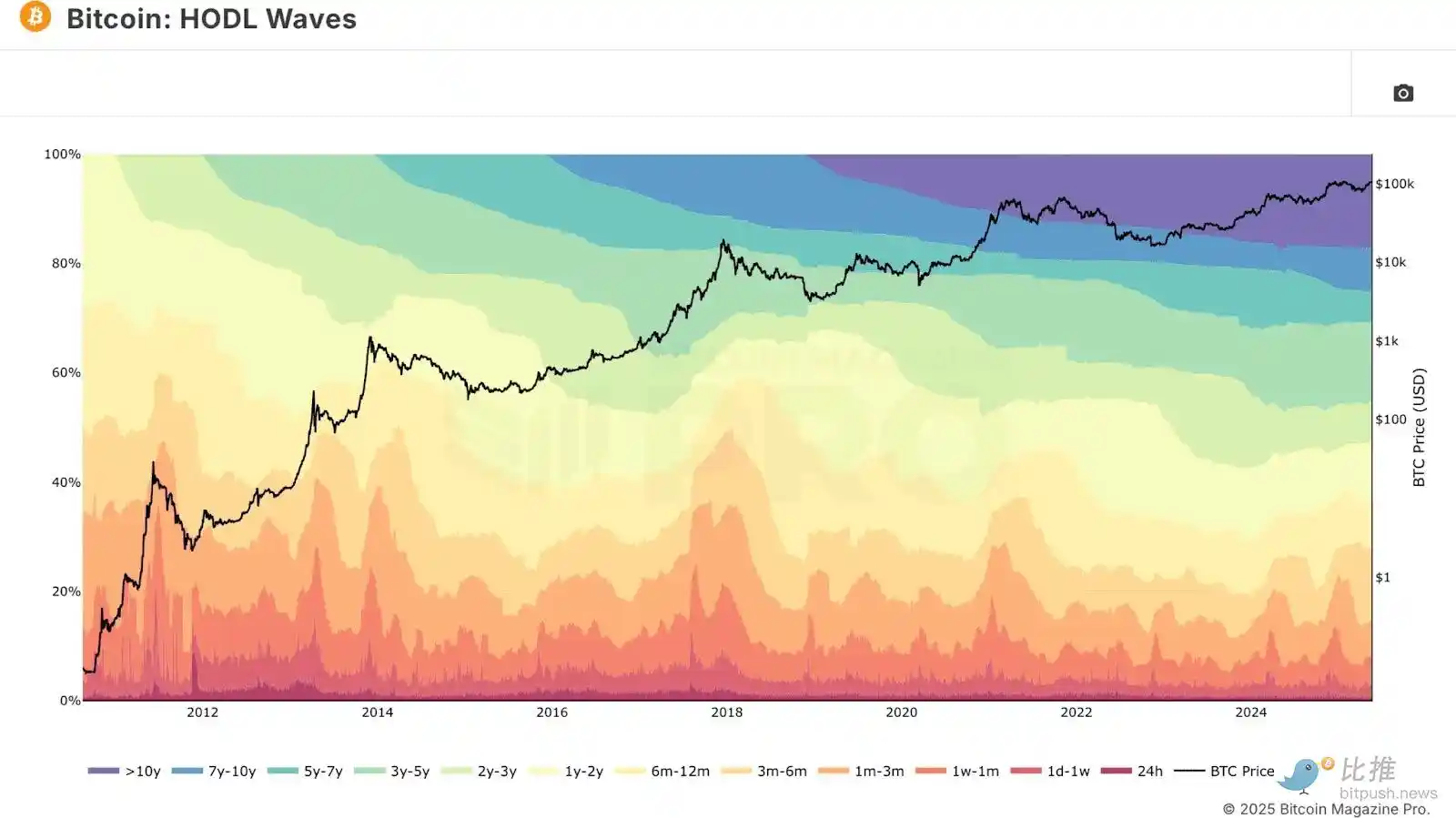

To delve deeper, we used HODL Waves data, which stratifies wallets by the age of their holdings. Focusing on wallets that have held for 6 months or longer, we find that over 70% of the Bitcoin supply is currently controlled by medium to long-term holders.

Figure 3: HODL Waves analysis shows that medium to long-term investors hold the majority of Bitcoin.

Interestingly, although this proportion remains high, it has begun to decline slightly, indicating that some long-term holders may be selling, even as the long-term holder supply continues to grow. The primary driver of the growth in long-term supply seems to be short-term holders gradually "aging" into the 155 days or more holding range, rather than large-scale buying of new funds.

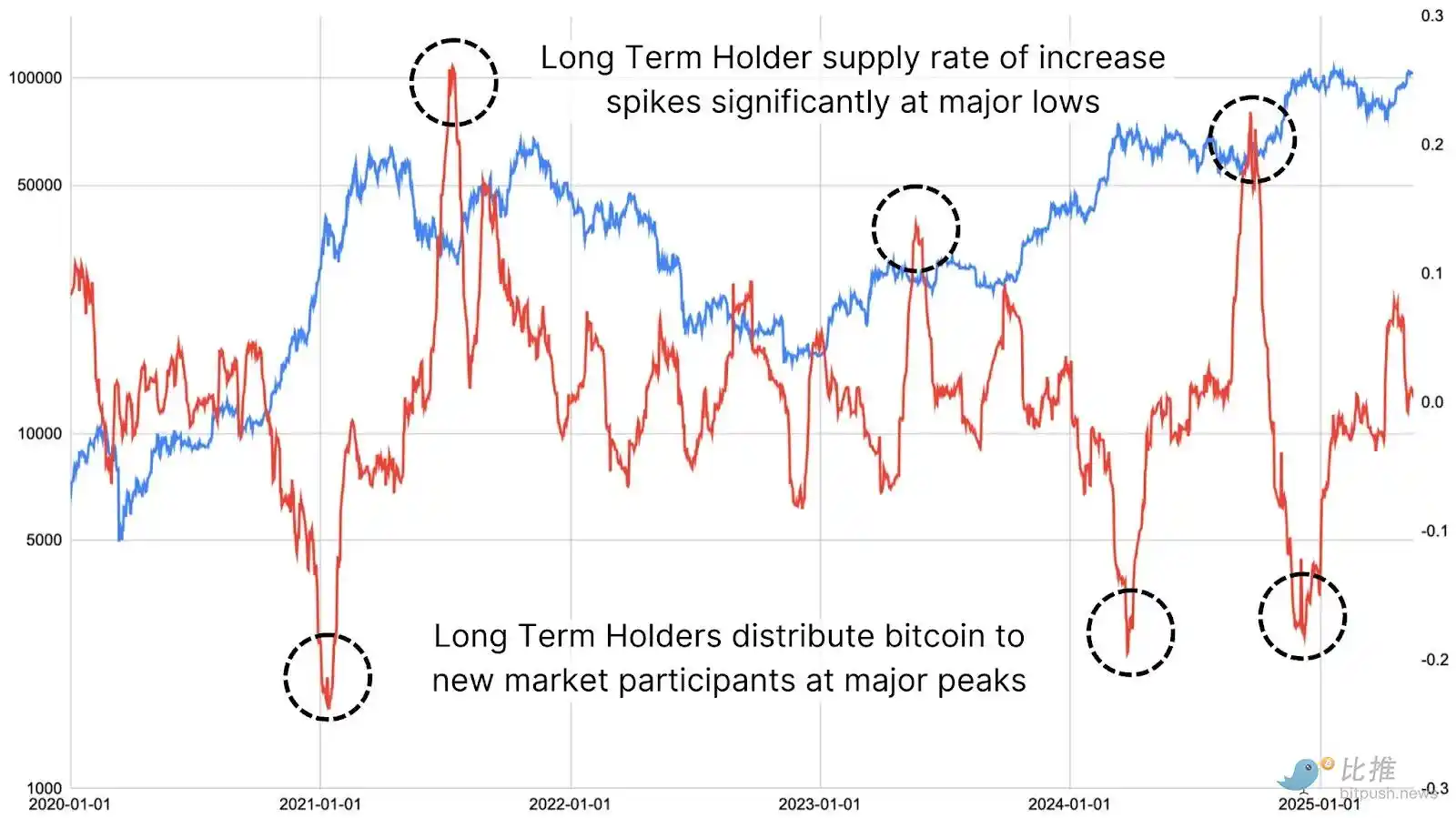

Figure 4: The change rate of long-term holder supply is inversely related to Bitcoin price.

By using raw data provided by the Bitcoin Magazine Pro API, we analyzed the change rate of long-term holder balances categorized by wallet holding age. When this metric declines significantly, it has historically often coincided with cycle tops. Conversely, when this metric rises sharply, it often corresponds to market bottoms and deep accumulation phases.

Short-Term Changes and Distribution Ratios

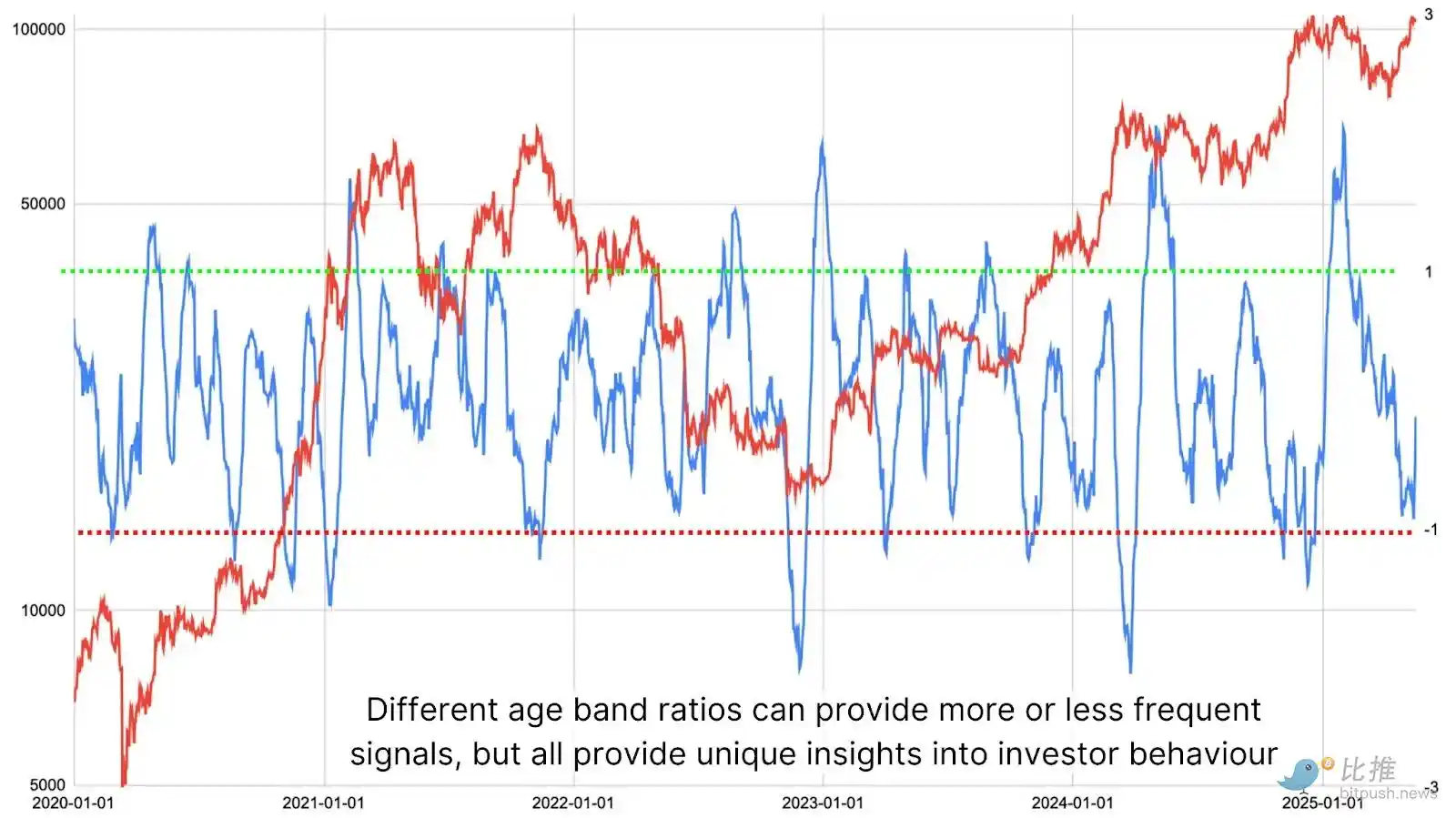

To enhance the precision of these signals, the data can be further segmented by comparing "recent market entrants (0–1 month)" with "mid-term holders (1–5 years)." This age distribution comparison can provide more frequent and real-time insights into distribution behavior.

Figure 5: The holding age distribution ratio provides valuable market insights.

We find that when the ratio of 1–5 year holders to new entrants declines sharply, it has historically coincided with Bitcoin price tops. Conversely, when this ratio rises rapidly, indicating that more Bitcoin is flowing into the hands of more experienced investors, it often precedes significant price increases.

Changes in long-term investor behavior are one of the most effective ways to assess market sentiment and the sustainability of price fluctuations. Historical data shows that long-term holders tend to outperform short-term traders by buying in times of panic and holding long-term. By analyzing the age distribution structure of Bitcoin, we can more accurately capture market tops and bottoms without relying on price trends or short-term sentiment.

Conclusion

Currently, long-term holders are exhibiting only slight selling behavior, far from the scale seen at previous cycle tops. There is indeed some profit-taking occurring, but the pace appears to be entirely manageable, indicative of a healthy market environment. Considering the current stage of the bull market and the participation of both institutional and retail investors, the data suggests that we are still in a structurally strong phase, with further price upside potential as new funds continue to flow in.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。