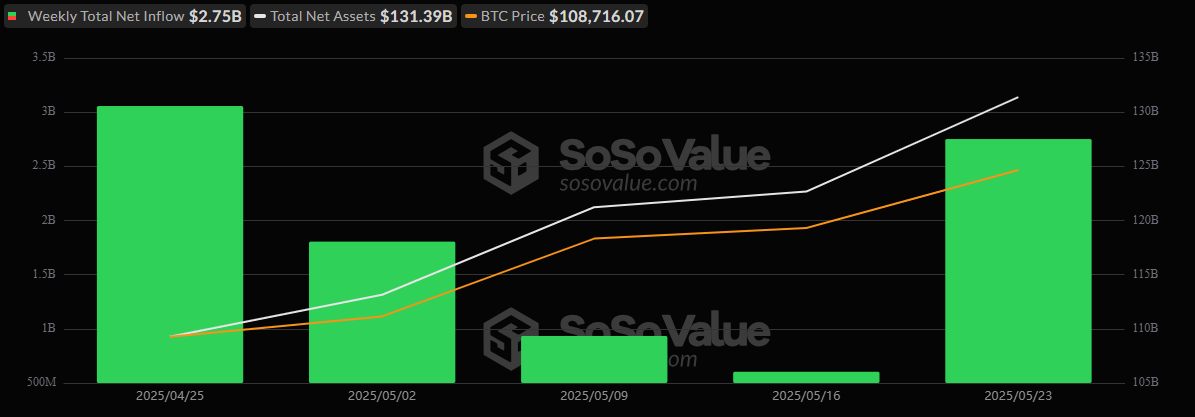

Bitcoin ETFs Record $2.75 Billion Weekly Inflow to Register 3rd Highest Weekly Inflow in History

The bulls extended their inflow run this week, and they did it with billions. Bitcoin ETFs booked a staggering $2.75 billion in net inflows between May 19 and May 23, not only extending their inflow streak to a sixth straight week but also clocking the third-highest weekly inflow in the history of spot bitcoin ETFs.

The biggest wave of capital came on Thursday, May 22, with a single-day inflow of $934.74 million. Impressively, the week remained entirely green with no outflows reported across any ETF.

Blackrock’s IBIT led the charge, attracting a towering $2.43 billion, followed by Fidelity’s FBTC at $209.84 million and ARK 21shares’ ARKB at $100.92 million.

Source: Sosovalue

Other notable inflows included Bitwise’s BITB ($42.30 million), Grayscale’s Bitcoin Mini Trust ($28.31 million), and Vaneck’s HODL ($31.24 million). Grayscale’s GBTC, however, saw a weekly net outflow of $89.17 million, and Invesco’s BTCO dipped $5.27 million.

Ether ETFs also joined the rally, locking in $248.31 million in net inflows, their second straight week in positive territory. Blackrock’s ETHA stood out with $136.41 million, while Fidelity’s FETH and Grayscale’s ETHE pulled in $37.82 million and $43.75 million, respectively. Bitwise’s ETHW and Grayscale’s Ether Mini Trust added $5.69 million and $24.64 million.

With net assets surging and trade volumes swelling, institutional appetite for crypto ETFs remains unshaken. If anything, it’s accelerating.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。