At the start of 2025, the Bitcoin (BTC) market experienced intense volatility. Now, the leading cryptocurrency has reclaimed the $100,000 mark, setting a new all-time high and reigniting bullish sentiment across the market.

However, as prices continue to surge, a key question has emerged: Are long-term holders — seasoned investors who have weathered multiple bull and bear cycles — beginning to take profits? This article dives into on-chain data to examine the latest behavior of Bitcoin's long-term holders, exploring whether the recent wave of profit-taking signals a looming market risk or simply reflects a healthy phase within Bitcoin’s broader market cycle.

Signs of Profit-Taking Begin to Emerge

The Spent Output Profit Ratio (SOPR), a key metric used to assess realized gains and losses across the Bitcoin network, has shown a notable uptick in recent weeks. This suggests that an increasing number of investors are locking in profits. The clustering of green bars on the chart indicates a surge in realized profits, particularly following Bitcoin’s breakout from the $74,000–$75,000 range to new highs above $100,000.

While this trend may raise short-term concerns about potential resistance to further price gains, broader on-chain indicators suggest this is a typical pattern during bull markets. On its own, this profit-taking activity does not signal that Bitcoin has reached the top of its current cycle.

Bitcoin SOPR Indicator. Source: BiTBO

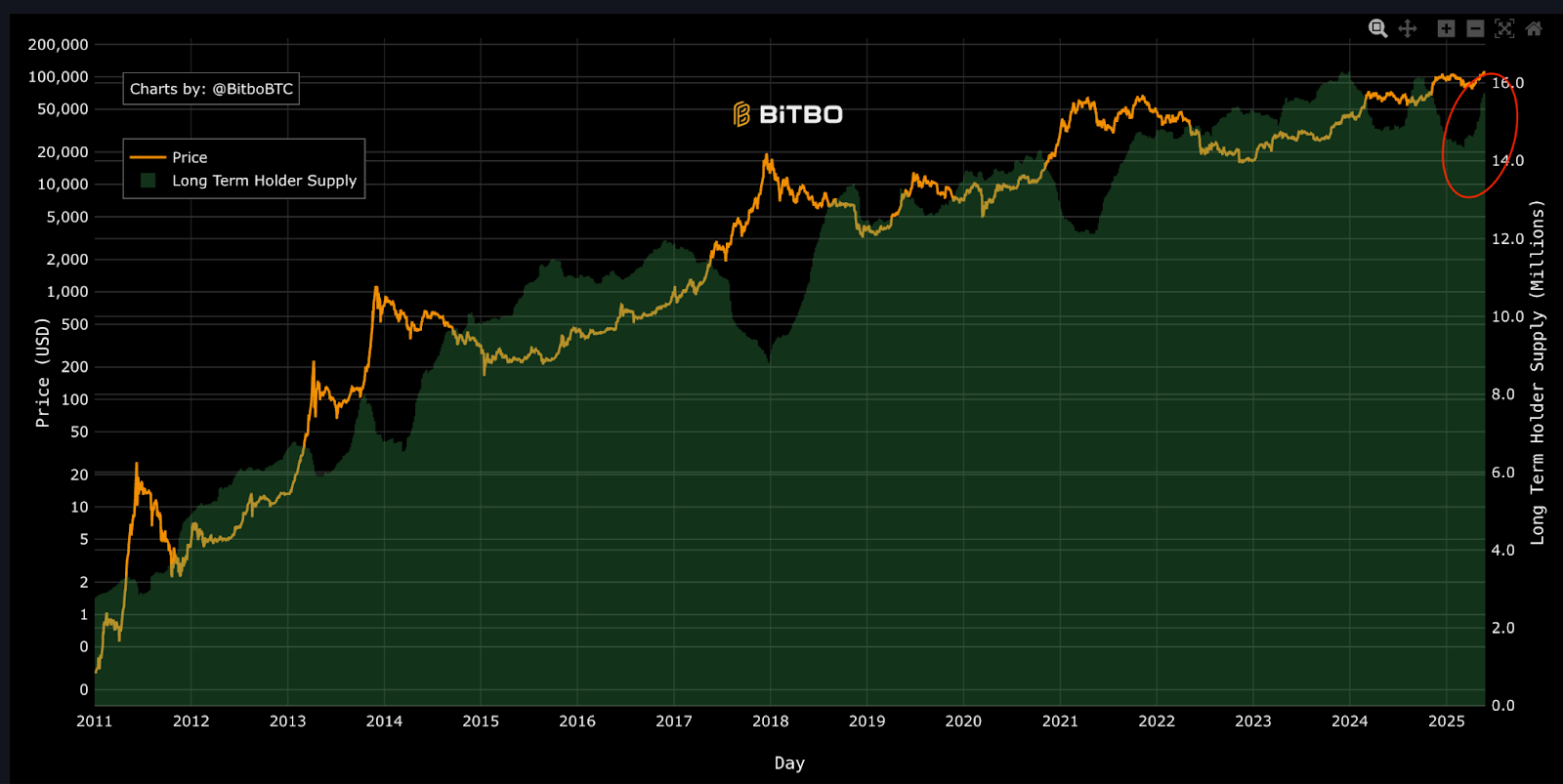

Long-Term Holder Supply Keeps Growing

Even as Bitcoin’s price continues to climb, the amount of BTC held for more than 155 days is steadily increasing. This doesn’t necessarily point to a fresh wave of accumulation, but rather suggests that a significant portion of coins are remaining untouched—aging into long-term holdings.

In other words, many investors who entered the market in late 2024 or early 2025 are holding firm, gradually transitioning into long-term holders. This shift in ownership structure is typical of the early to mid-phases of a bull market and, so far, shows no signs of widespread distribution or panic selling.

Changes in Bitcoin Long-Term Holdings. Source: BiTBO

Institutions Accelerate Bitcoin Accumulation via ETFs

BlackRock’s iShares Bitcoin Trust (IBIT) significantly ramped up its Bitcoin holdings in May, purchasing approximately 8,000 BTC worth nearly $877 million. This marked the largest single-day capital inflow for the fund that month. With this acquisition, BlackRock's total Bitcoin holdings have reached 639,000 BTC, securing its position as the second-largest Bitcoin holder in the world—trailing only Bitcoin’s pseudonymous creator, Satoshi Nakamoto.

Meanwhile, the social media company Trump Media & Technology Group, associated with former U.S. President Donald Trump, plans to raise approximately $3 billion to purchase Bitcoin and other crypto assets, demonstrating strong corporate interest in digital currencies.

At the same time, Trump Media & Technology Group, the social media company affiliated with former U.S. President Donald Trump, announced plans to raise around $3 billion in funding, part of which is intended for purchasing Bitcoin and other crypto assets. This move underscores growing corporate interest in digital currencies.

Meanwhile, Blockstream CEO Adam Back speculated that the U.S. government could be holding as much as 1 million BTC. If confirmed, such a holding would have profound implications for the market.

Additionally, Strategy (formerly known as MicroStrategy) made four separate Bitcoin purchases in May. The most recent buy involved 4,020 BTC at an average price of $106,237 per coin. The acquisition was funded primarily through the sale of various equity instruments between May 19 and May 25.

Global Bond Market Turmoil Boosts Bitcoin’s Appeal as a Safe-Haven Asset

As bond yields soar to multi-year highs, the traditional safe-haven status of U.S. Treasury bonds is being seriously challenged. The 10-year Treasury yield has climbed to 4.48%, while the 30-year yield has surged to 5.15% — its highest level since October 2023. With the U.S. national debt ballooning to $36.8 trillion and interest payments projected to exceed $952 billion by 2025, the pressure on federal finances is mounting rapidly.

Japan, the largest foreign holder of U.S. Treasuries with $1.13 trillion in holdings, is facing its own debt pressures. Since April, the yield on Japan’s 30-year government bonds has skyrocketed from negative rates to 0.5%, and recently hit a record high of 3.1%. Prime Minister Shigeru Ishiba warned that Japan’s fiscal situation is now “worse than Greece’s,” highlighting the increasingly global nature of the sovereign debt crisis.

Amid this mounting pressure on bond markets, Bitcoin is gaining traction among institutional investors as a politically neutral store of value. Assets under management (AUM) in spot Bitcoin ETFs have surged past $104 billion — an all-time high — reflecting growing institutional confidence in Bitcoin’s safe-haven properties amid traditional market instability.

Matrixport: Maintaining a Strongly Bullish View, but Advises Taking Profits Recently

After breaking through $110,000 to reach a new all-time high, Bitcoin’s price has recently been consolidating at elevated levels. Over the past few days, Bitcoin has been oscillating between $106,000 and $110,000, with intensified battles between bulls and bears, leading to a more cautious market sentiment. This sideways movement reflects investors taking a wait-and-see approach after the sharp rally, with no clear short-term direction as they await new macro signals or fresh capital inflows to drive the next phase of the market.

As of 4 PM on Tuesday, May 27, Bitcoin was hovering around $108,900.

A cryptocurrency financial product service platform released an analysis on Monday stating: “Bitcoin is setting new all-time highs — but without the usual signs of frenzy. Trading volume remains sluggish, and funding rates indicate a lack of market enthusiasm. We have maintained a strongly bullish view since mid-April, and Bitcoin has indeed performed well. However, to sustain the current upward momentum, broader market participation may be needed. At this stage, it may be wise to take some profits.”

A crypto financial services platform released an analysis on Monday stating: “Bitcoin is reaching new all-time highs—but without the usual signs of frenzy. Trading volumes remain subdued, and funding rates indicate a muted market sentiment. We have maintained a bullish stance since mid-April, and Bitcoin has indeed performed well. However, sustaining the current upward momentum may require broader market participation. At this stage, taking some profits might be a prudent move.”

Summary:

Current on-chain data suggests that long-term Bitcoin holders are only engaging in mild profit-taking, far from the large-scale sell-offs that have historically signaled market tops. While some investors have begun to realize profits, the pace remains steady and is considered a normal, healthy phenomenon in a bull market. Given the current stage of the cycle, combined with strong institutional and retail positioning, the market continues to show robust support. With capital inflows remaining strong, there is still significant upside potential for Bitcoin in the near future.

Related: Top 10 "False Airdrop" Danger Signals and Prevention Guide

Original: “After Bitcoin (BTC) Rises to $110,000, Are Seasoned Players Starting to 'Quietly Cash Out'?”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。