This article is from “Metaplanet Is Trading at $596,154 per Bitcoin—Time to Short?”

Translated by: Odaily Planet Daily jk

Bitcoin has risen by $15,000 in just a few weeks—but the reasons are not what the market generally believes. The stock price of a “little-known” Japanese listed company, Metaplanet, reflects an implied value of Bitcoin as high as $596,154, more than five times the actual market price. Meanwhile, the Asian trading session is quietly dominating the market narrative, and a dangerous distortion of net asset value (NAV) is brewing beneath the surface.

Volatility continues to decline, and retail capital flows are changing; the signals we observe are highly similar to key turning points in history. From Japan's bond market to currency flows to cryptocurrency holding tools (like Metaplanet), some anomalies are occurring—but have yet to appear in mainstream news. If you are looking for the starting point of the next big market move, this report is worth reading.

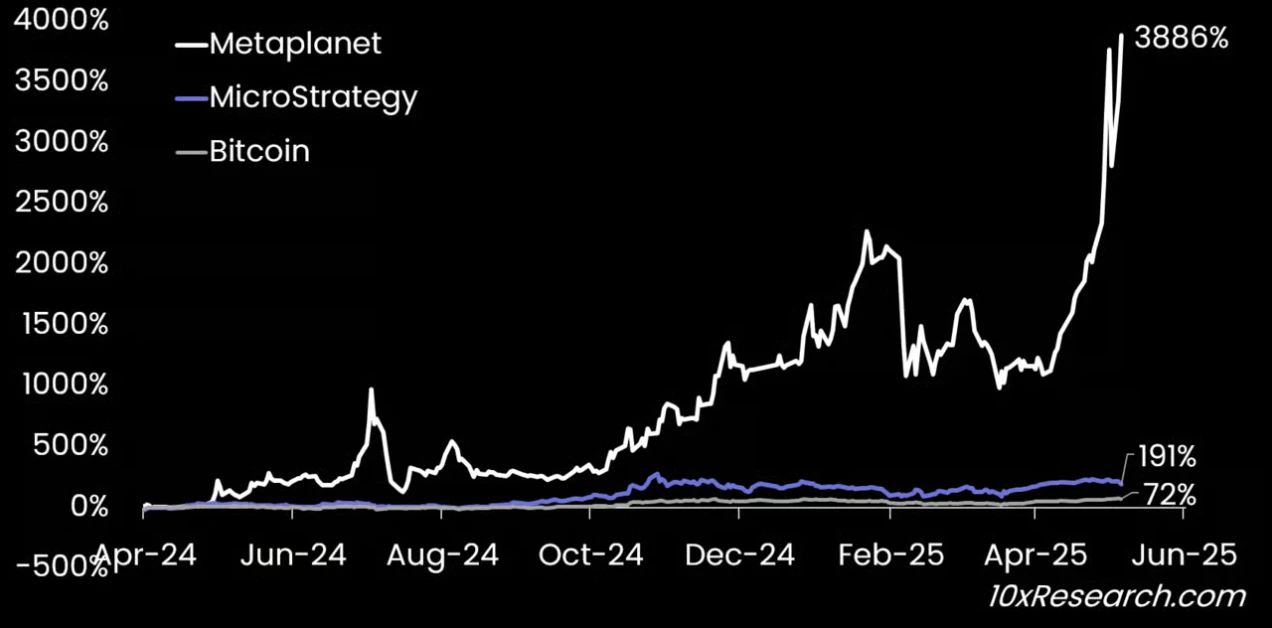

Bitcoin vs. MicroStrategy vs. Metaplanet — Who is Most Likely Overvalued?

Key Points:

Bitcoin is undoubtedly one of the most disruptive innovations of the 21st century, but many misunderstandings surrounding it remain widespread. One of the most fundamental principles—“Not your keys, not your coins”—is rarely truly valued. Today's market has strayed far from Satoshi Nakamoto's original vision of a “peer-to-peer electronic cash system.”

Today, billions of dollars in retail capital are trying to gain exposure to Bitcoin through various financial instruments, many of which often require paying a high premium. In some cases, investors are inadvertently buying Bitcoin at $596,154, while the actual market price is only $109,000, a premium of up to 447%.

Some of our market views have sparked controversy but have repeatedly been validated by the market as highly forward-looking. Notably, in December 2022, we pointed out that Grayscale's GBTC was trading at a 47% discount to NAV (when Bitcoin was priced at $18,000) and listed it as a key investment recommendation for 2023 (alongside Solana, which was priced at $13.70 at the time), when market sentiment was extremely pessimistic and there were widespread concerns about an economic recession.

On January 29, 2024, we expressed the view that “MicroStrategy may be more valuable than a Bitcoin ETF,” at which time the company's stock price was at a 7% discount to its Bitcoin holdings, effectively capturing the starting point for its subsequent market cap revaluation. We also noted on October 7, 2024, that MicroStrategy was expected to break through, when its stock price was $177 (now risen to $380).

Main Text

Most people do not understand what net asset value (NAV) is and are unaware that they may be paying an extremely high premium when gaining exposure to Bitcoin.

Some investors believe they are obtaining some form of leveraged upside, similar to the logic of Wall Street selling gold mining stocks to retail investors: these stocks are packaged as leveraged bets on rising gold prices, especially when institutions need to sell stocks to retail investors.

Currently, MicroStrategy's stock price implies a Bitcoin price of $174,100, and while this premium is not extreme, it is still significant. After all, when there are Bitcoin ETFs available that provide exposure at the actual market price (around $109,000), who would still be willing to pay such a high price? The answer often lies in information asymmetry, a lack of awareness of NAV, or effective marketing rhetoric.

Whenever MicroStrategy issues new shares to retail investors, the Bitcoin value represented by these shares only accounts for a small portion of its stock price, allowing the company to profit from the price difference and package it as so-called “Bitcoin earnings.” Existing shareholders applaud this, as new investors are effectively buying Bitcoin indirectly at $174,100 each, while the company uses this capital to purchase BTC at market prices. In the long run, this will dilute the NAV per share, with all of this cost borne by the new shareholders.

Although crypto media has called this operation a “masterpiece of financial engineering,” the reason this model works is fundamentally that: most retail investors no longer directly purchase whole Bitcoins, as the price of one BTC is now higher than that of a new car (over $45,000). Once the price of Bitcoin broke this psychological barrier, MicroStrategy's NAV quickly rose, supporting its so-called “Bitcoin earnings” strategy—but from another perspective, this is actually “extracting retail investors to finance its Bitcoin empire.”

As we previously pointed out: as volatility decreases and MicroStrategy's NAV is diluted, the company's ability to purchase Bitcoin through stock issuance is gradually being limited. However, in the past month, the company still managed to acquire $4 billion worth of Bitcoin, a feat that few can match. In contrast, despite Metaplanet's soaring stock price, it only purchased $283 million worth of Bitcoin during the same period, currently holding 7,800 BTC (with a book value of about $845 million), while the company's market cap is as high as $4.7 billion, corresponding to an implied price of $596,154 per Bitcoin.

Given its average purchase cost of $91,343 per coin, if the price of Bitcoin drops by 15%, Metaplanet's book profits will evaporate entirely. It should be noted that the company was just a traditional hotel business with a market cap of $40 million a year ago. With the appreciation of the yen (the USD/JPY exchange rate declining), increased capital repatriation, and Japan's economy entering a new phase, the decrease in foreign tourists may directly impact its core business—hotels.

More notably, the recent $15,000 rise in Bitcoin occurred mainly after the Bank of Japan's policy meeting. At the meeting, officials significantly lowered economic growth forecasts, while Japanese government bond yields soared and demand for bond auctions weakened. Meanwhile, various Asian currencies (such as the New Taiwan Dollar) appreciated significantly, despite officials denying any negotiations with the Trump administration regarding currency appreciation.

Increasing evidence suggests that the recent price movements of Bitcoin are primarily driven by the Asian trading session, possibly influenced by Michael Saylor's suggestive tweets about Bitcoin purchases or a surge in retail activity in Japan. Over the past 30 days, Bitcoin's overall increase was 16%, but the increase during the Asian trading session was as high as 25%. In contrast, the U.S. market session contributed almost nothing (prices remained flat), while the European session recorded an 8% decline. This further indicates that Asia is currently the dominant force in Bitcoin pricing. If Asian capital flows begin to weaken, Bitcoin may enter a consolidation phase.

It is worth mentioning that Google Trends show that there has not been a widespread retail Bitcoin frenzy in Japan, indicating that the parabolic rise in Metaplanet's stock price may be driven by a small amount of speculative capital rather than a nationwide enthusiasm.

At its current market cap, the stock trades at 5.47 times its NAV, representing a 447% premium, providing an enticing opportunity for arbitrage trading. Hedge funds can express market views through a pair trade: buying 5 Bitcoins while shorting $550,000 worth of Metaplanet stock (about 70,000 shares, at ¥1,116 per share, calculated at USDJPY 142). The attractiveness of such trades is increasing, especially against the backdrop of Japan expected to approve a Bitcoin ETF within the next 12 months, at which point Metaplanet's NAV premium may be significantly compressed, and valuations will trend towards rationality.

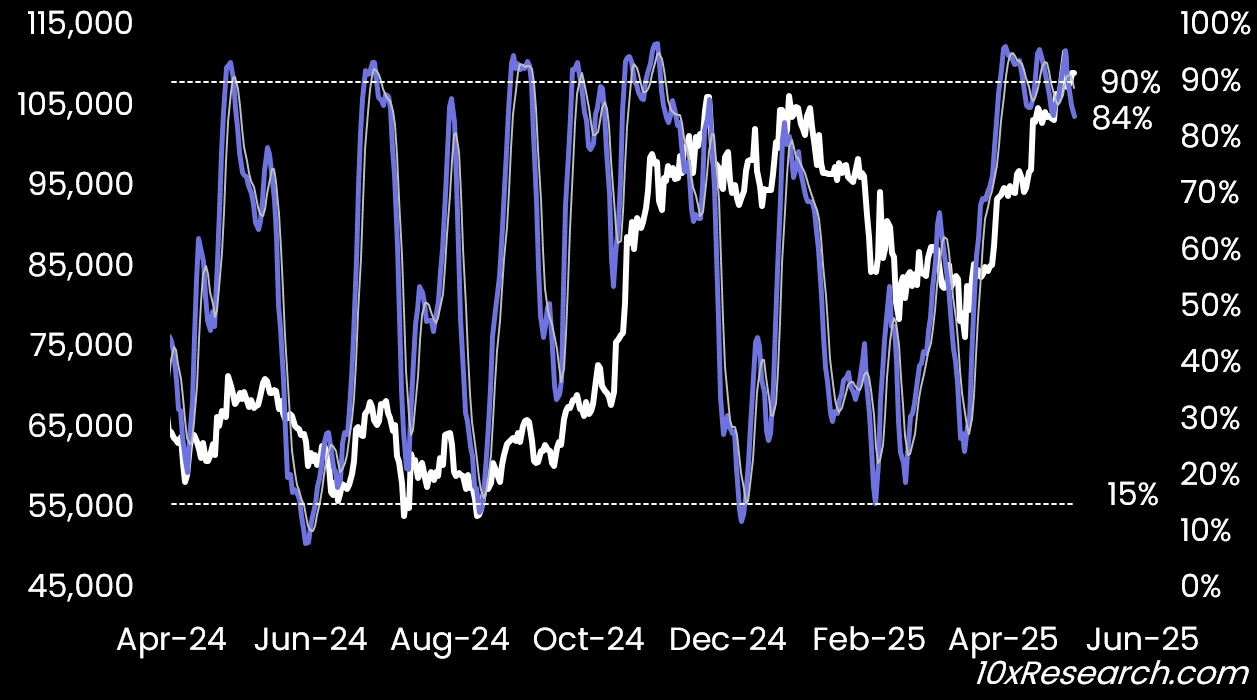

Although we accurately predicted Bitcoin's rise starting April 12, we believe the current price level is a reasonable time to take profits. If Bitcoin's price breaks through $105,000, traders should consider reducing long positions.

The options market has already issued warning signals: the implied volatility skew of Bitcoin—i.e., the difference in implied volatility between call options and put options—has dropped to nearly -10%, indicating that the market is pricing call options far higher than put options. In other words, traders are actively chasing upward trends rather than hedging against downside risks. In our experience, such extreme skew levels often reflect that the market is in a state of extreme optimism, serving as a typical contrarian signal.

Several of our technical reversal indicators (such as the Relative Strength Index (RSI) and Stochastic Oscillator) are currently showing overbought signs and beginning to reverse downward, creating a divergence with Bitcoin's price. The current gap between Bitcoin's price and our trend signals has reached $20,000, and this gap is narrowing, indicating that market momentum is weakening. We have maintained a bullish view since mid-April (when it was a contrarian view), but now believe it is wiser to reduce risk exposure and wait for a more favorable re-entry opportunity.

Chart Description: Bitcoin (left axis) and Stochastic Oscillator (right axis) — the divergence is widening.

The past six weeks' gains have indeed been remarkable, but the core of trading is risk-adjusted return management, not blindly chasing trends. At the current overvalued levels, the last batch of Japanese retail investors buying Metaplanet may bear a heavy cost.

Conclusion:

Now is the time to lock in some profits. Last Friday, we recommended buying MicroStrategy put spread options, and so far, the stock has fallen by 7.5%, achieving a 66% return on this strategy. Next, Metaplanet looks likely to become the next target for valuation correction in the coming months. Hedging short against it in relation to Bitcoin is an effective way to express this judgment.

From a broader market perspective, as June approaches and the traditionally quiet summer trading period arrives, we believe Bitcoin itself may also enter a period of consolidation. At this stage, more attention should be paid to profit-taking and risk control rather than blindly chasing higher prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。