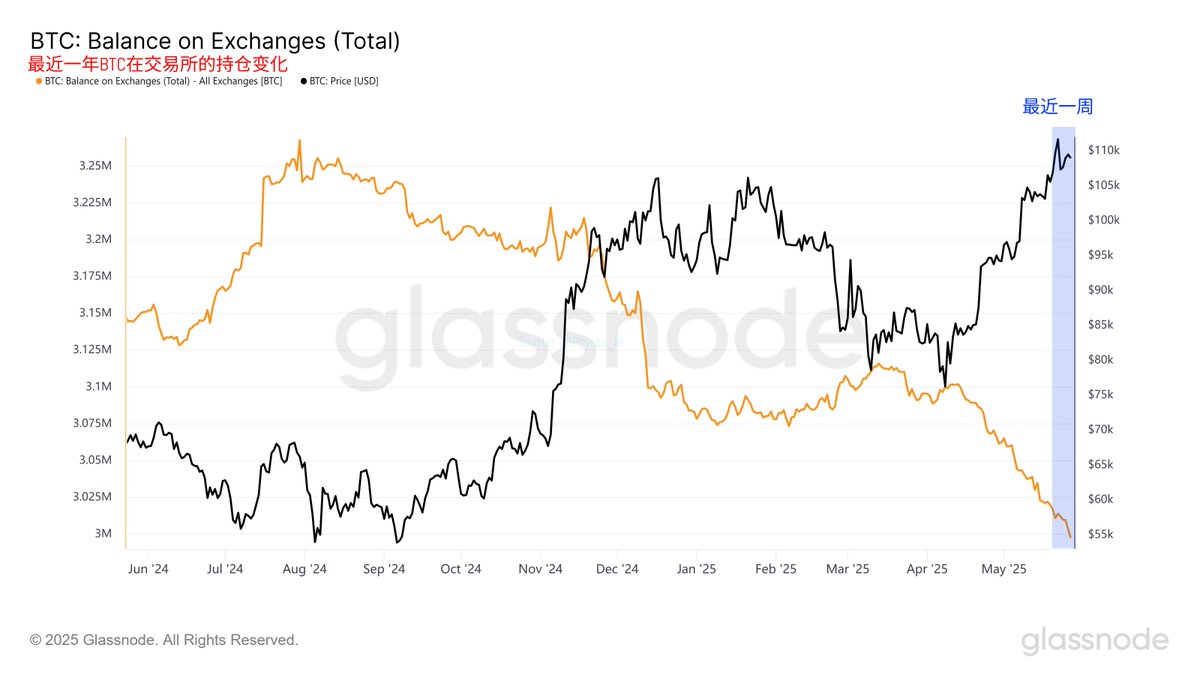

The exchange inventory remains a key data point I recommend, as it reflects the sentiment of Bitcoin investors. From the current data, the exchange inventory has continued to show a decreasing trend up to today, which indicates that more investors are optimistic about the future of BTC. Even with the current price nearing $110,000, more investors are actively holding Bitcoin.

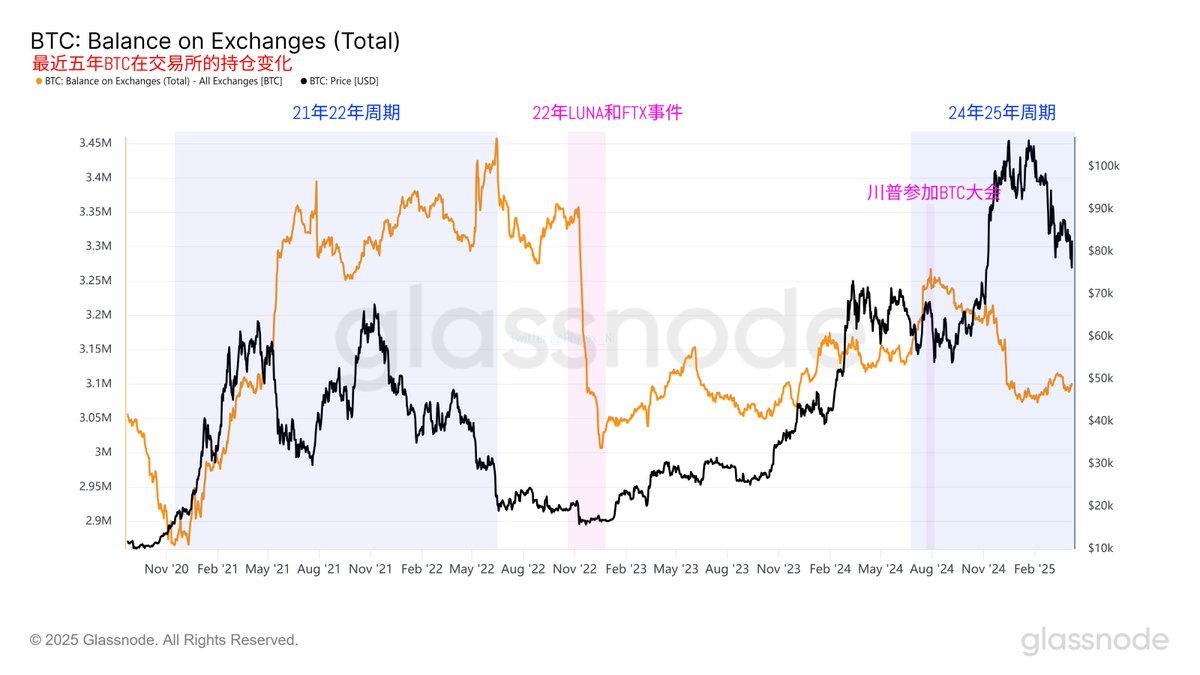

They do not intend to trade $BTC in the short term; otherwise, the inventory of BTC on exchanges should be increasing, not decreasing. Although the exchange inventory data does not necessarily mean that a decrease will lead to an increase in BTC prices, nor does an increase in inventory guarantee a decrease in prices, it does provide a clearer view of whether investors prefer long-term holding or short-term trading.

Historical data clearly shows that during the 2021 cycle, as the exchange inventory increased, BTC prices also rose. This indicates that more investors at that time were looking to sell BTC at high points rather than holding it. Thus, more BTC was transferred to investors in anticipation of a better exit time.

Currently, the situation is the opposite; investors are more willing to hold rather than trade.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。