Founded by Jordan Fish "Cobie," Echo today announced the launch of its new product Sonar. Unlike the previous community round product "small circle," this tool will support anyone to conduct public token sales on the platform. An increasing number of VCs are supporting retail investors in early investments, reflecting a shift in the current investment market. The emergence of Sonar also expands this model to a broader scope. Can it replicate the fervor of the 2015 "ICO" boom?

What is Echo

Echo was founded by crypto KOL Jordan Fish, better known as Cobie @echodotxyz, in March 2024. Cobie was previously the head of growth at Lido and hosted the popular Web3 podcast UpOnly. The core of Echo lies in the "lead investor recommendation mechanism," where users can create investment communities as lead investors, share projects with members, and earn commissions.

Since its launch, over 30 crypto projects have raised funds through Echo, including well-known projects like Ethena, Morph, Usual, Hyperlane, Dawn, Monad, Initia, and MegaETH. In one year, a total of $100 million was raised, with MegaETH completing a $10 million financing in two rounds through the Echo platform in December 2024. The first round raised $4.2 million in 56 seconds, and the second round raised $5.8 million in 75 seconds, marking the largest financing currently conducted by Echo.

Initially, Echo's structure resembled an "elite alliance" of crypto investors, favoring high-potential projects recognized by a small circle, such as Larry Cermak, CEO of The Block, and Marc Zeller, founder of Aave, who have created their own Echo communities. Users wishing to join must first answer some questions and undergo relatively strict identity KYC verification. Additionally, some communities require certain conditions to be met to gain specific investment opportunities, with a total of 67 community leaders having created communities on Echo.

Not an Enemy of VCs, but a Distribution Platform for VCs

In January of this year, Echo stated that some venture capital firms had attempted to prevent founders from offering better terms to the Echo community or outright block community sales unless conducted at a later high valuation. Alexander Pack, co-founder of Hack VC, commented, "The reason is that while tech investment is generally a positive-sum game, capital allocation is a zero-sum game," meaning that when projects open up financing to the community, VC profits will be compressed.

Rob Hadick, a partner at Dragonfly, also shared his views in the media, stating that such platforms are actually a supplement to venture capital funding, helping projects build stronger communities while maintaining cooperative relationships with investors. He noted, "But those venture capital firms that cannot provide real value may feel threatened by the rise of these platforms. For those VC firms that do feel pressure, they either adapt or go out of business."

An increasing number of "value-creating" VCs have also joined this camp, with Paradigm, Coinbase Ventures, Hack VC, 1kx, and dao5 all creating groups on the Echo platform. Additionally, the recent emergence of the hot ecological niche "Agency" has posed many threats to such VCs. As Rob mentioned, VCs that still cannot find their positioning at this stage are gradually fading from the historical stage.

As the "attention economy" continues to be consumed, will the next step in the current market usher in a phase of "value return"?

Dreaming Back to 2015, Does Sonar Bring Back the "ICO Boom"?

In this regard, Matt O'Connor, co-founder of the currently popular ICO platform Legion, stated, "The relatively loose regulatory environment in the U.S. may promote the revival of public token sales," adding, "Once ICOs regain vitality, they may shift their focus away from the memecoin craze." In the current market environment, there are fewer projects truly focused on product development, while a significant amount of wealth is accumulating behind the scenes.

However, at that time, Echo could not address the broader market issues, with even project parties themselves stating, "We do not like this community structure." Therefore, the founding team, including Cobie, began planning a more traditional "ICO" platform early on. In February, founder Cobie revealed plans to develop an ICO platform, stating, "Currently, there is no good way to conduct initial sales; your best option might be CoinList, but it has significant limitations for several reasons." Three months later, this product was launched.

Sonar is a tool that allows founders to self-host token sales. Sales can be conducted in various formats (auction, options swap, points system, variable valuation, and allocation scale, etc.) and can choose chains like Hyperliquid, Base, Solana, or Cardano. It provides various configurable compliance tools, integrated with Echo's existing electronic identity authentication passport (existing Echo users can register for Sonar with one click). Therefore, the issuing team can also choose the regions they want to sell in (for example, prohibiting UK residents from purchasing or setting longer lock-up periods for users in certain regions).

Sonar attempts to combine community-driven sales from the ICO era with the current demand for policy compliance, aiming to address the regulatory and privacy issues faced by ICOs. It introduces a more flexible "sales model" to replace the previously popular "LaunchPad" format in the market. It encourages project parties to build their own communities and communicate directly with investors, rather than relying on Echo's platform community. This model allows investors to research projects more deeply rather than pushing a project to uninterested users who are unfamiliar with it, but this model also faces the risk of information asymmetry.

Comparison of IPO, ICO, and Sonar, graphic: Rhythm BlockBeats

In the final paragraph of the Sonar release document, Echo officially stated that its goal is "to get as close as possible to the market dynamics of the ICO era while providing compliance tools for founders who do not want to go to jail."

The First Project to Launch - Plasma

As Echo launched Sonar, Plasma announced that it would use Sonar for part of the official sale of its token $XPL. Plasma is a new blockchain built specifically for stablecoins, running in parallel with the Bitcoin network and fully compatible with EVM, allowing developers to build Ethereum-like applications on Plasma.

Plasma will offer 10% of its total XPL token supply in the Sonar sale, aiming to raise $50 million. This 10% corresponds to 1 billion XPL tokens out of a total of 10 billion, priced at $0.05 per XPL. According to the team, the fully diluted valuation of the XPL token is $500 million, which matches the valuation from Founders Fund's investment in Plasma's equity and token warrants last week.

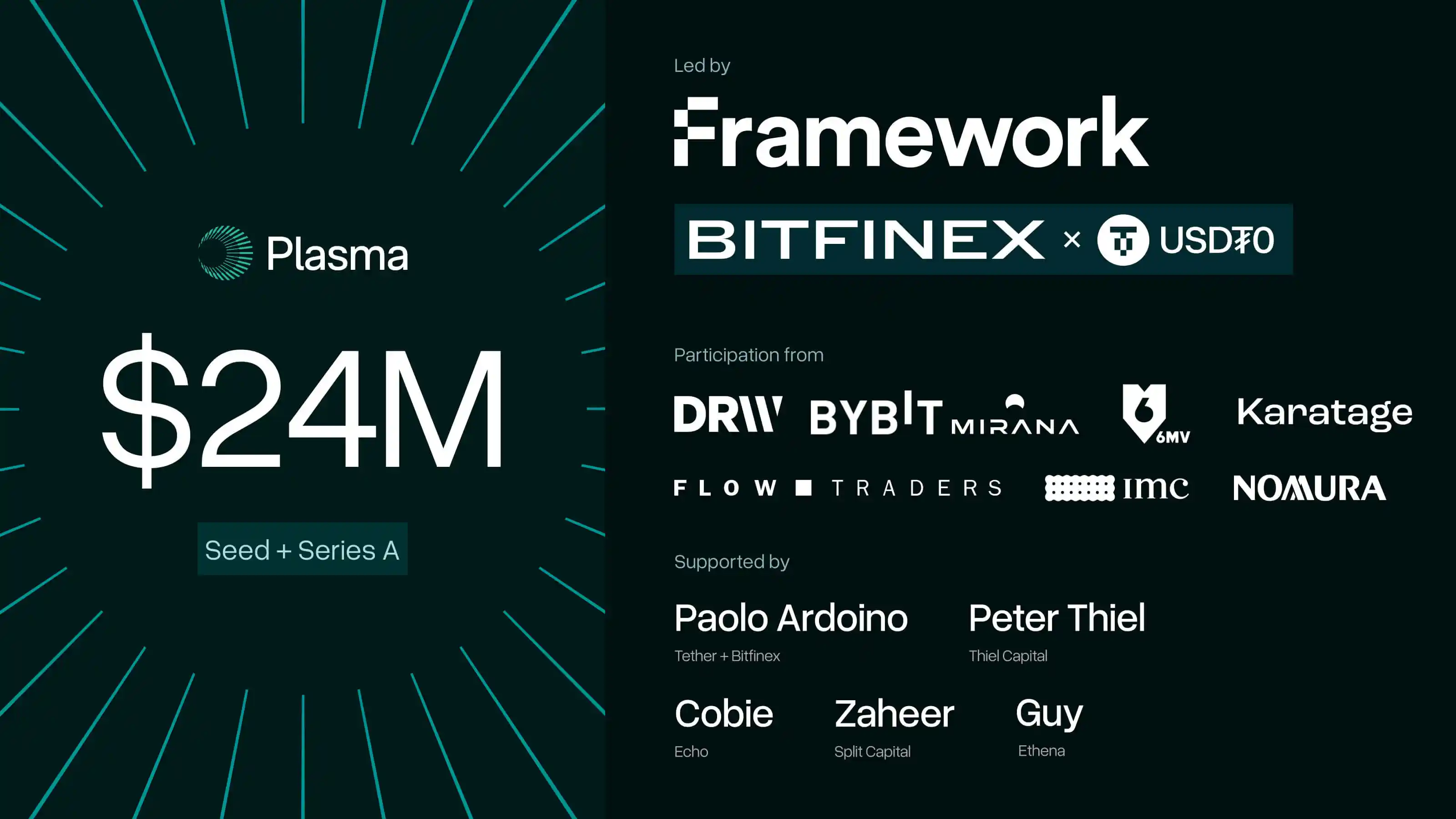

Previously, Plasma raised $24 million in seed and Series A funding, with investors including Peter Thiel, Cobie, Tether CEO Paolo Ardoino, Bitfinex, USDT0, and Bybit.

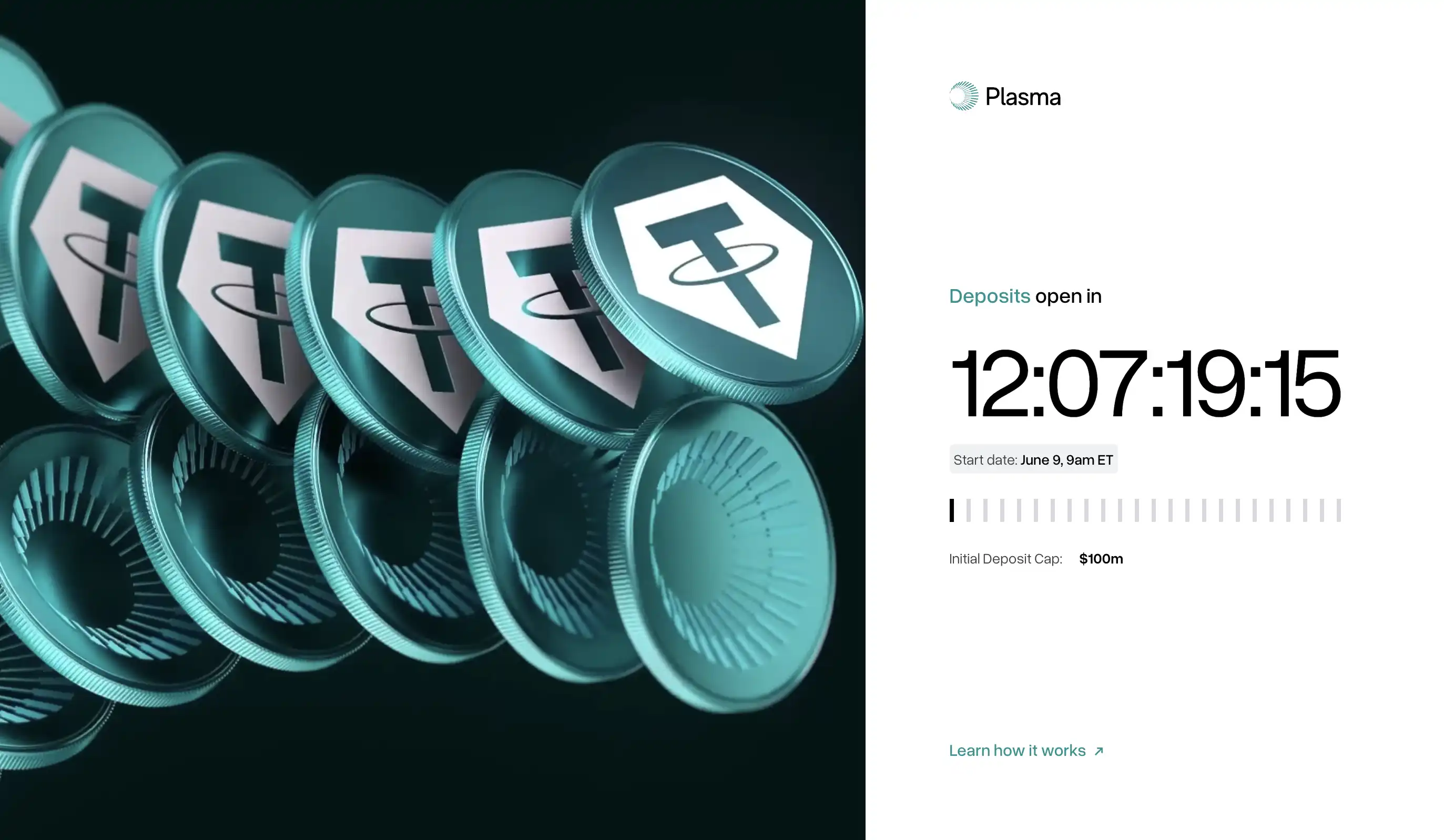

To participate in the XPL sale on Sonar, users must deposit stablecoins (USDT, USDC, and USDS, formerly known as DAI) into the Plasma vault on Ethereum. Allocations will be determined based on each participant's time-weighted share of total deposits in the vault. After the deposit period ends, holdings will be locked until the Plasma mainnet Beta version goes live, after which XPL tokens will be distributed.

The pre-sale of XPL tokens will open on June 9, with the actual sale starting a few weeks later. Global users can participate, except for UK residents and individuals in sanctioned jurisdictions, with U.S. participants facing a 12-month lock-up period, while most other participants will face a 40-day lock-up period.

With the gradual passage of the stablecoin bill, crypto companies led by Coinbase gaining recognition from traditional capital, and the SEC's "friendly" attitude, "compliant" ICOs may gradually return to the public eye. Platforms like Sonar may bring a breath of fresh air to a market filled with the restlessness of "LaunchPad."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。