Key Indicators: (4 PM May 19 -> 4 PM May 26 Hong Kong Time)

- BTC against USD increased by 6.8% (103.2k USD -> 110.2k USD), ETH against USD increased by 7.3% (2.405k USD -> 2.58k USD)

- Congratulations to Bitcoin for reaching a new high! After breaking the previous highest price, the price first surged to 111.9k USD, then fell below the resistance level of 108.25-109.75k USD due to Trump's tariff news and significant selling pressure, but has since fluctuated within a narrow range. Based on the current situation, we tend to believe that the market will gradually rise in a relatively stable manner (with some local fluctuations), which may quickly push the price towards the target of 125k USD. Active bilateral trading may lead to the price continuing to consolidate for a few days, especially if the Bitcoin conference in the coming days does not have a significant impact, but we believe the next price peak will come soon. If the price retraces and falls below the key resistance level of 101-101k USD, it may further drop to 93-94k USD.

Market Themes

The market's risk sentiment remains, but momentum is gradually weakening. Trump's threat to impose a 50% tariff on the EU starting in early June led to a decline in US stocks and an increase in US bonds, but he quickly retracted this threat and is preparing to reach an agreement on July 9. The ongoing uncertainty in US policy continues to impact the dollar, with gold prices rising to nearly 3400 USD, while G10 currencies against the dollar are also gradually rising.

Despite the weakness in US stocks, Bitcoin profited from the decline against the dollar this week, with prices briefly rising to a new high of 112k USD before encountering some resistance. The news of Trump's 50% tariff on the EU led to a sell-off of short-term long positions, pulling the spot price back to 107k USD. However, the price found good support here and returned to 109k USD before the cryptocurrency conference. Ethereum continues to stabilize in the range of 2400-2700 USD, and the market is clearly holding fewer and clearer positions. Stablecoins continue to develop actively, and ETF inflows remain strong, but further increases from here may require new catalysts.

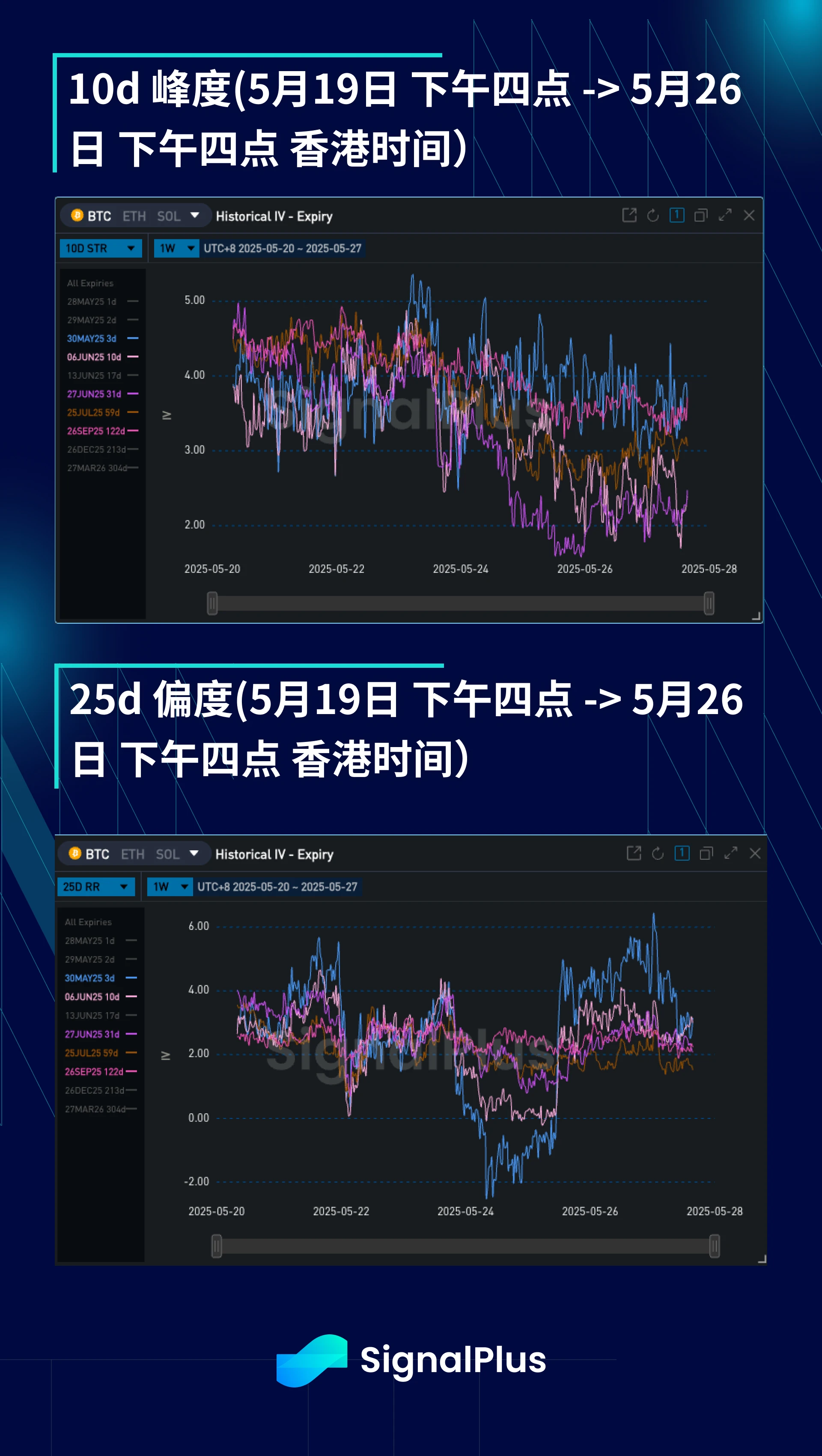

BTC ATM Implied Volatility

Last week, as bullish momentum in the market increased, actual volatility began to recover from low levels, with short-term high-leverage positions appearing, but these were cleared after Trump's tariff news on the EU. Although local high-frequency volatility rose to the forties and just above fifty, the price ultimately fluctuated within the range of 105-112k USD, and the daily actual volatility remained very low, indicating that the market is still in a mean-reversion state, with long Gamma positions quickly pulled back during price fluctuations. Therefore, in the absence of directional trading, although actual volatility has increased, implied volatility remains stable.

The term structure remains steep, with the market looking for sellers at the front end of expiration dates to support long positions from June to September. The expiration dates during the week unexpectedly rose, as the market priced in a premium for the upcoming Bitcoin conference in Las Vegas, with the May 28 expiration date including speakers from the first day, and the market priced in a 2% price fluctuation that day. This pricing is relatively low compared to other Bitcoin conferences, but it must be acknowledged that the importance of this conference is not very clear.

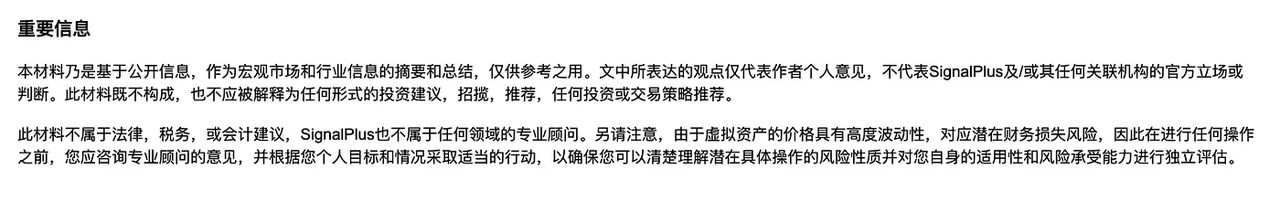

BTC Skew/Kurtosis

After a week of relatively stable price fluctuations, skew attempted to break historical highs as the price rose, but fell along with the rapid price retracement. Short-term skew even tilted downward due to Trump's tariff event on the EU on Friday, and the subsequent rise in actual and implied volatility confirmed that a downward tilt was reasonable. However, with Trump's rapid change in attitude and the potential positive factors from the upcoming Las Vegas conference, the front-end skew tilted upward again.

The kurtosis continued to decline over the past week due to ongoing selling on the wings. The market struggled to continue supporting long positions in the middle and wings, thus willing to sell the wings to reduce the impact of a downturn. Given that the spot price has been very restrained in its local movements, and the possibility of actual volatility (and implied volatility) sharply rising and tilting to one side (such as during last Friday's significant drop), we believe it is very worthwhile to hold kurtosis in this environment.

Wishing everyone good luck this week!

You can use the SignalPlus trading sentiment feature for free t.signalplus.com/news, which integrates market information through AI, making market sentiment clear at a glance. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant's WeChat, please remove the spaces between the English and numbers: SignalPlus 123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。