🧐“APR up to 8000%? Is it for real?” — 3 things you need to know about liquidity mining

By reading this article, you will understand all the questions regarding the returns and risks of OKX Alpha!

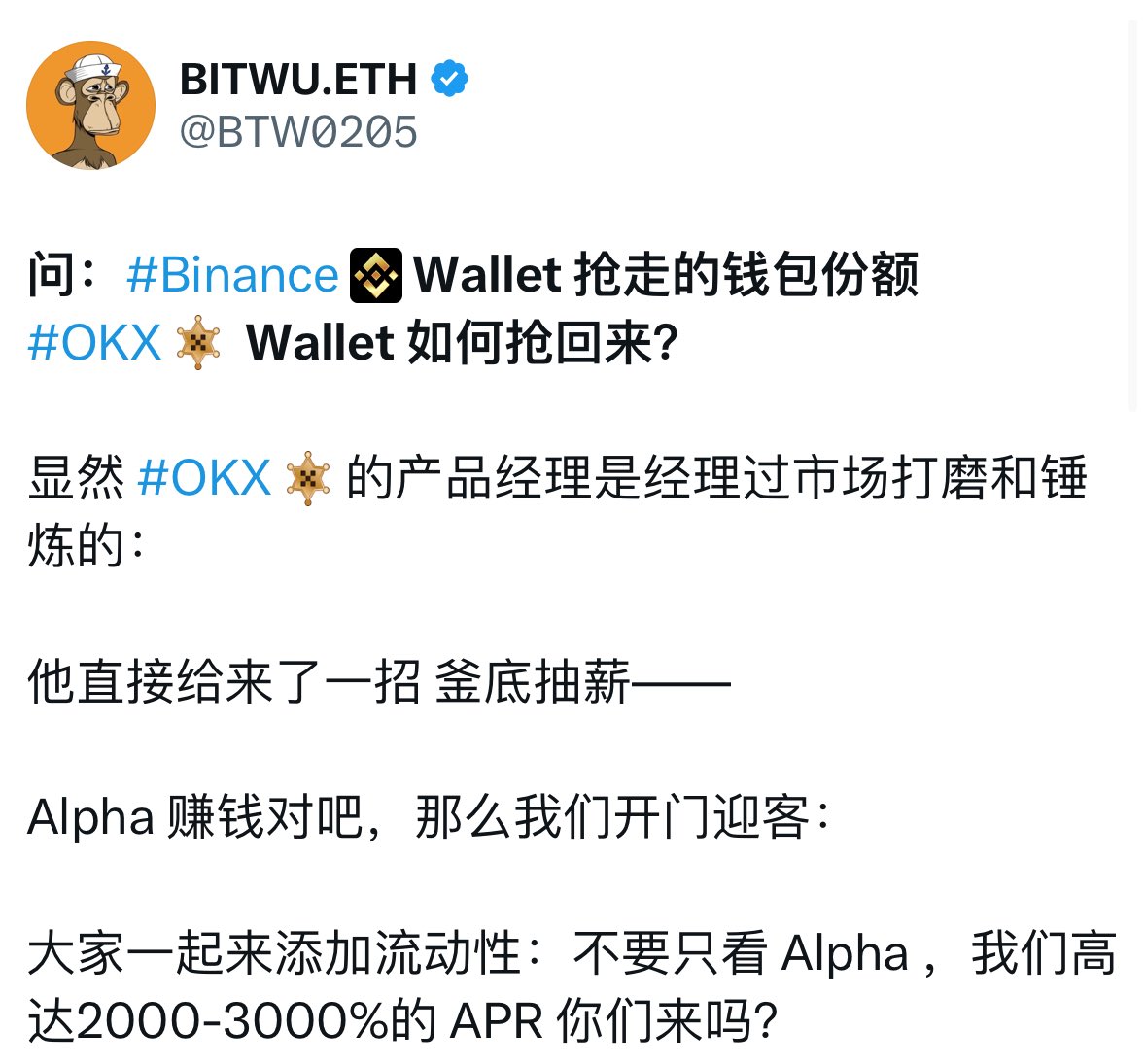

Yesterday, there was an explosion of private messages after the release about the #OKX wallet and earning returns from forming LPs —

Many people asked why the returns are so high?

Can it be sustained?

Can ordinary people participate?

How can I participate without incurring losses?

I was originally planning to write a dedicated piece,

I just saw that @Mercy_okx wrote this great article, and I feel everyone can directly use it:

This article addresses many questions we might be concerned about, such as:

1️⃣ How to choose the three key factors for a suitable liquidity pool:

Don’t just look at the yield:

1) Prioritize pools with high APR, but pay attention to whether it is sustainable.

Note: APR is an important indicator of returns, calculated based on the total fees of the liquidity pool over the past 8 hours and the TVL (Total Value Locked) ratio, updated every hour. However, it is important to note that this is an 8-hour average, not the current real-time value.

2) Choose pools with active trading to ensure sufficient fee income.

The more active the pool, the higher the returns. High trading volume means liquidity providers (LPs) can earn more fees.

3) Choose pools with less price volatility to reduce the risk of impermanent loss.

You can assist your decision by looking at the price volatility curve (the price fluctuation range over the past 24 hours).

2️⃣ How to set liquidity ranges to increase returns?

1) A narrow range can improve capital efficiency and APR, but it should be based on reasonable predictions of price fluctuations.

2) It’s best to refer to the price volatility chart from the past 24 hours to set a range that aligns better with market trends, avoiding interruptions in returns due to prices exceeding the range.

@Mercy_okx mentioned a USDT-ZKJ PancakeSwapV3 liquidity pool with an APR of 8,015.61%, but this is based on adjusted data for the PancakeV3 pool, which has high potential returns but also high risks.

Always remember that risk and return coexist; if something has a very high return and you think the risk is low, it may indicate a misunderstanding on your part.

3️⃣ What are the risks of liquidity mining?

1) Impermanent loss: Price fluctuations may lead to a decrease in asset value.

2) Price fluctuation risk: Improper range settings may lead to losses.

3) Low trading volume leads to low returns: During certain time periods (like late night in Asia), trading volume is low, and returns are almost zero.

Original article by Mercy:

https://x.com/mercy_okx/status/1927666838147920317?s=46&t=1fmViEEp4ahAv6QgAcIA2g

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。