The Federal Reserve just released the minutes from the March meeting, which primarily addressed the "policy framework adjustment" mentioned by Powell last time. The minutes show that the members reaffirmed the unwavering long-term inflation target of 2% and emphasized that anchored inflation expectations are crucial for maintaining price stability and promoting employment.

In the past, the Federal Reserve adopted an Average Inflation Targeting (AIT) approach when interest rates were near the effective lower bound (ELB), allowing inflation to exceed 2% for a period to compensate for the previous long-term undershooting of the target. However, in the current environment of high inflation and high uncertainty, most committee members believe that the effectiveness of this strategy has significantly diminished and are inclined to return to the traditional "Flexible Inflation Targeting" (FIT).

In simple terms, flexible inflation targeting is the approach currently used by most central banks, where the central bank sets a clear inflation target (such as 2%) but does not insist on hitting it precisely at all times. Instead, it allows inflation to fluctuate within a certain range and adjusts monetary policy flexibly based on factors such as economic growth and employment conditions.

In layman's terms, the central bank can tolerate inflation being temporarily below or above 2%, as long as it can roughly return to the target in the medium term. However, this does not mean that there is a significant change in the current policy path; the real significance lies in how the central bank should fine-tune its policy steps once inflation approaches 2%, so the impact on the current market is very limited.

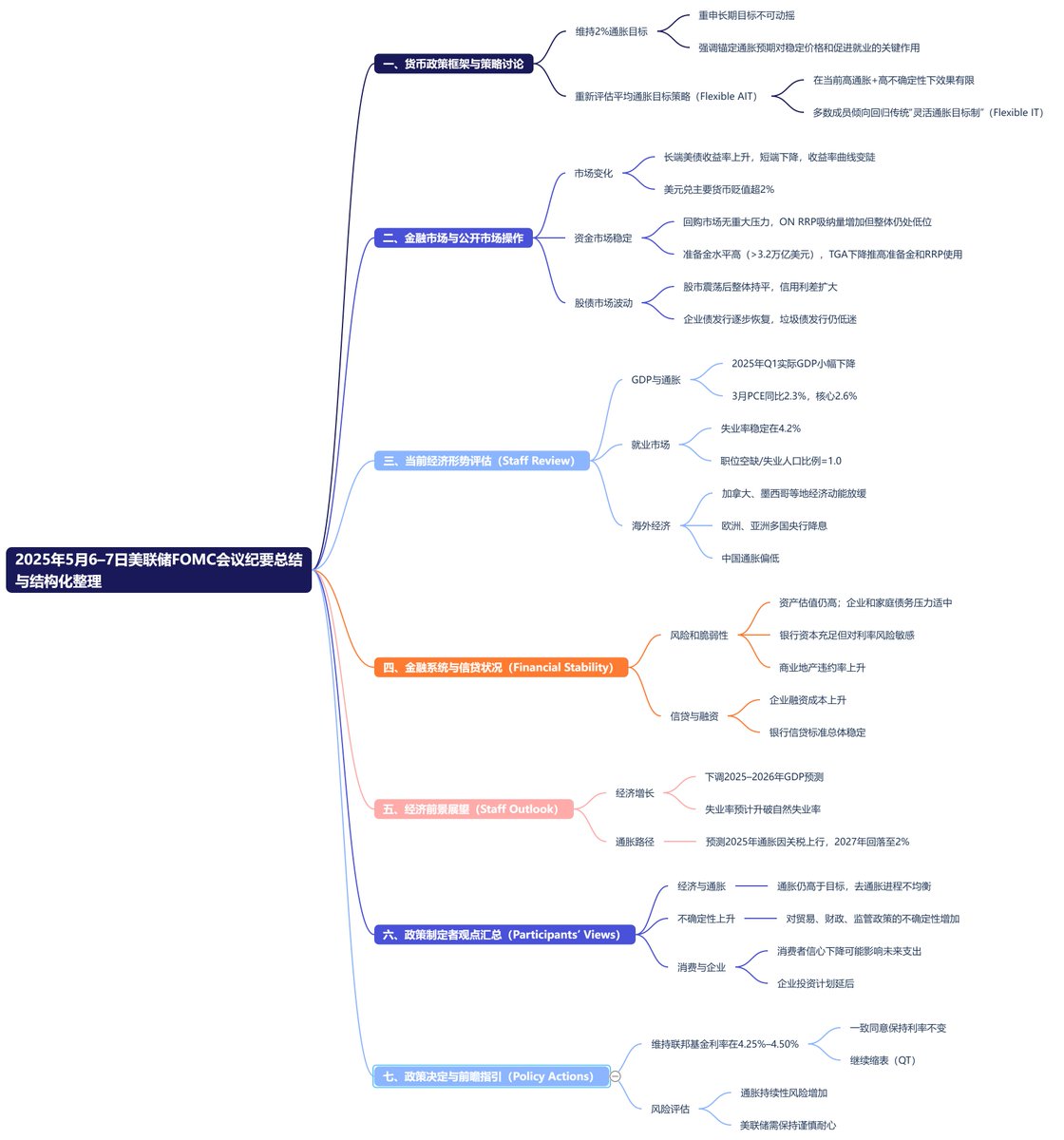

Other content is based on March, so I personally feel it is not very significant, and I have not listed them one by one; the main content is included in the mind map.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。