According to Grayscale Research, the market capitalization tokens in its AI crypto sector has grown nearly fivefold from $4.5 billion in 2023 to $20 billion so far. However, since the start of 2025, the growth of these tokens has been muted with the best performer in this subsector Bittensor’s TAO, the largest AI asset by circulating market cap, having grown by 2%. Elizaos, which is down by 80%, is the worst-performing asset in this category so far.

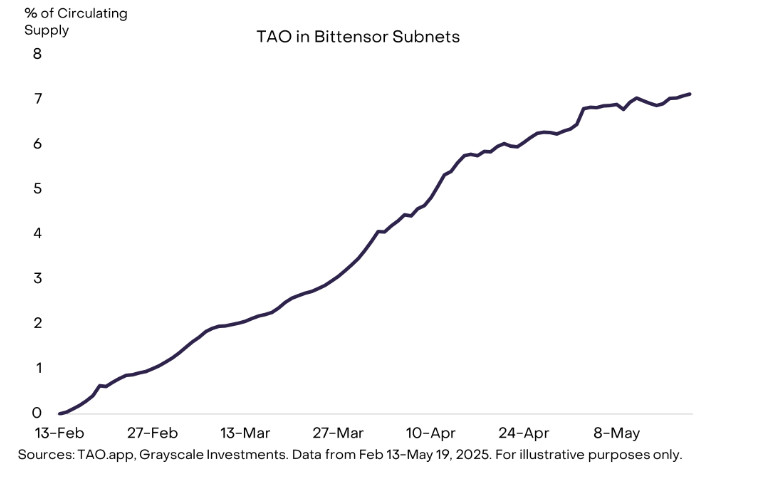

Yet, despite the seeming underwhelming performance so far, the Grayscale Research report asserts that the subsector is poised for further growth. The report cites Bittensor’s first “halving” which is set to occur later this year as well as the accelerating interest in AI applications on the network — known as subnets. According to Grayscale Research, since the February launch of the dTAO upgrade, which made subnets investible for the first time, the share of circulating TAO allocated to subnets has climbed from to more than 7%.

Besides the growth of subnet TAO emissions, the report distributed training as another promising area for the AI crypto sector. To highlight the potential of distributed training, the report cites Prime Intellect which successfully trained models larger than 30 billion parameters using distributed GPUs. According to the report, Prime Intellect’s success using decentralized infrastructure may be an indication the AI landscape is on the cusp of a major shake-up.

“At scale, we believe these types of protocols could have a substantial impact on the AI landscape by tapping into the roughly 30% idle compute capacity sitting in data centers, potentially reducing both the costs and barrier to entry for AI model training,” the Grayscale Research report stated.

Prime Intellect along with Gensyn, and Nous Research, which recently raised $50 million via a Series A funding round, are identified in the report as protocols likely to bolster the AI crypto sector.

The Grayscale Research report also identifies one protocol Grass network’s ability to generate tens of millions in annualized revenue from selling scraped web data to AI labs as another reason why investors should be optimistic about this sector. The potential regulatory clarity on stablecoins is also cited as another to be optimistic. However, the report cautions investors to monitor regulatory developments including the GENIUS stablecoin bill for clues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。