"You might not believe it, but because I like Labubu, I became the sales champion of the store this month," said Jani, a sales representative for a luxury handbag brand and a fervent enthusiast of trendy toys. In an interview with Rhythm BlockBeats, she openly shared her sales secret:

"Praising their bags is not as effective as complimenting the Labubu hanging on their bags; customers will feel that you really understand them."

This marks the sixth year of collaboration between Labubu and Pionex. As early as around 2020, it had already sparked a wave in the Chinese market. However, it was the series of street photos featuring BLACKPINK member Lisa hanging Labubu on top luxury bags like LV and Hermes that truly propelled this trendy toy into the international spotlight last year.

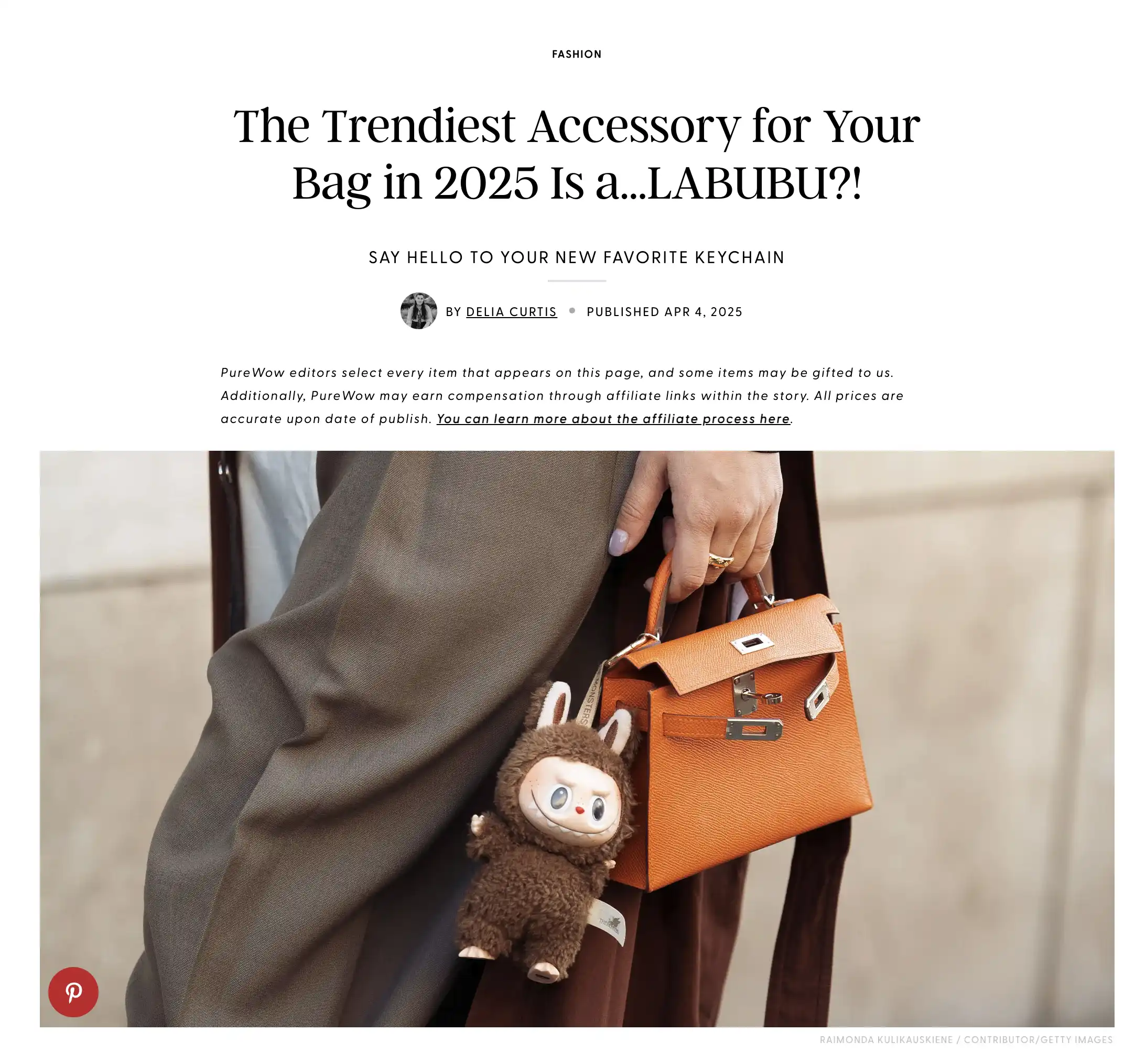

International fashion media: Is LABUBU the most popular bag accessory of 2025?

As a result, more and more top celebrities began showcasing their Labubu. Five years later, this IP swept through the fashion circles of Southeast Asia and Europe and America, even making it to the covers of foreign fashion media: "Is LABUBU the most popular bag accessory of 2025?"

Global fashion icon Rihanna was spotted with a pink Labubu hanging from her Louis Vuitton tote bag as she exited the airport; pop music award magnet and new international fashion darling Dua Lipa showcased two Labubu on her orange handbag on Instagram, becoming a trending topic; Lisa's name is well-known among young people in China, and her Instagram Story often features a wall full of Labubu collections, making her a wild brand ambassador for Labubu.

For ordinary people, not being able to afford Hermes is okay. A Labubu priced under 200 yuan can provide a star-like experience and even allow participation in the top trendy circles' social consensus.

If you're lucky enough to draw a hidden version with less than a 1% chance, the price can multiply tenfold or more; even if you draw a regular version, hanging it on your bag, posting it on social media, or sharing it on Xiaohongshu can still yield emotional value and social validation.

"There are many tricks to buying different hidden versions; the sound when shaking it should be a rustling sound, it should feel a bit harder when touched from the side, and there are subtle differences in weight," Jani relies on her ability to identify hidden versions, managing to secure them for her clients when others can't.

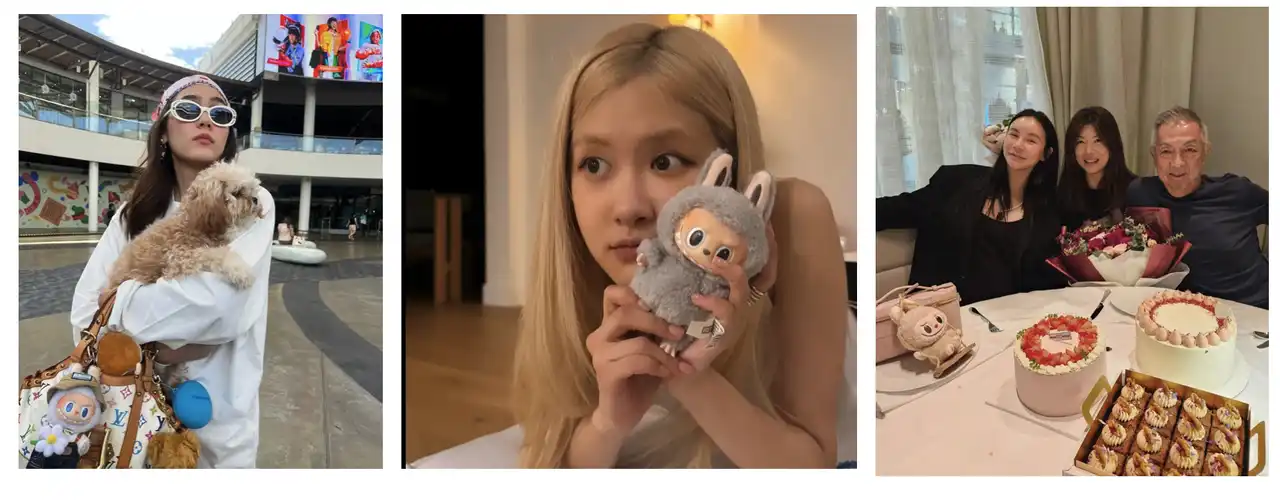

From left to right: Thai actress Hargate, Blackpink member Rose, Singapore billionaire Peter Lim's heir Kim Lim

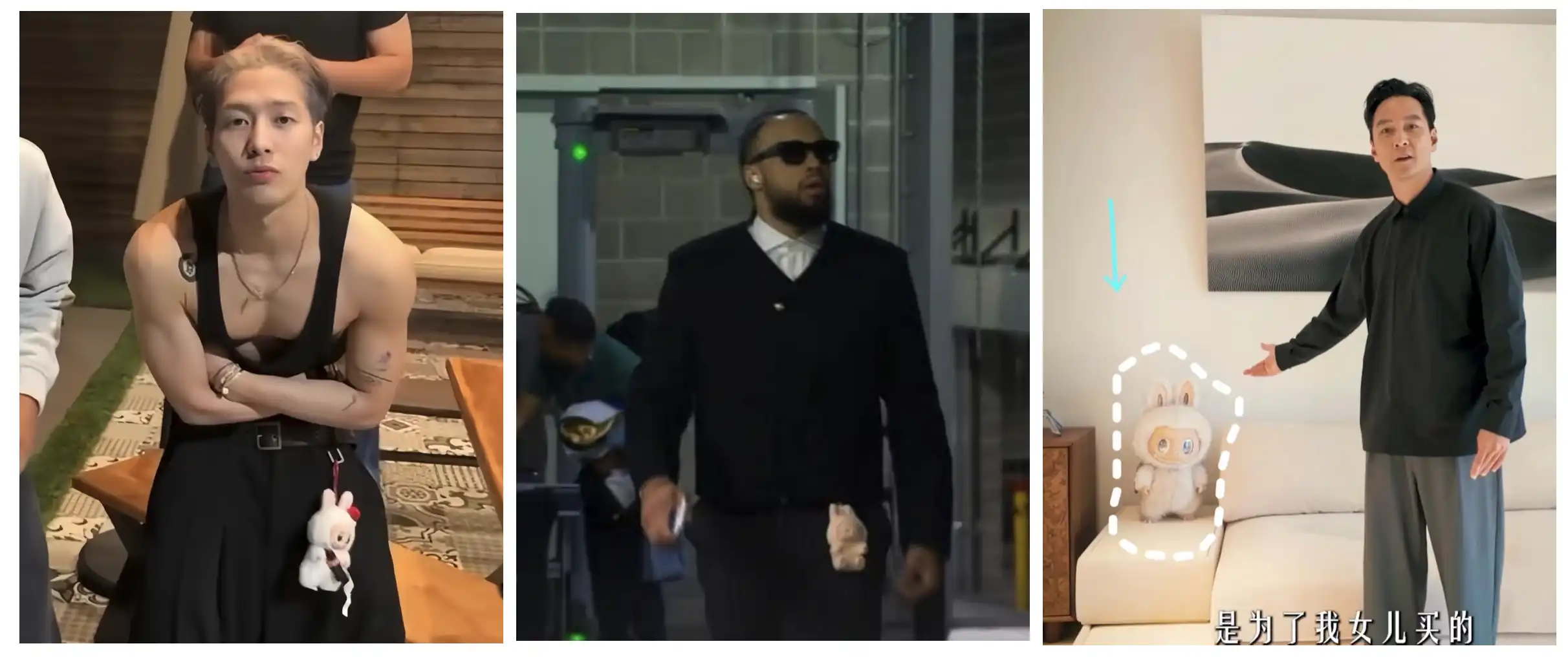

Labubu "male waist, female bag hanging," has become a new trend in the fashion circle.

In fact, this is not Labubu's first moment in the spotlight. Around 2020, Labubu experienced its first breakout moment. The blind box culture quickly swept through Generation Z, satisfying individual expression while triggering a game around "scarcity." The joy of drawing a hidden version is akin to winning a lottery. In the secondary market, some Labubu have skyrocketed from hundreds to thousands of yuan, and unboxing videos of "drawing hidden versions" have become a phenomenon on social platforms.

In a sense, Labubu has long ceased to be just a toy; it has become a financial product that can be priced, speculated upon, and circulated.

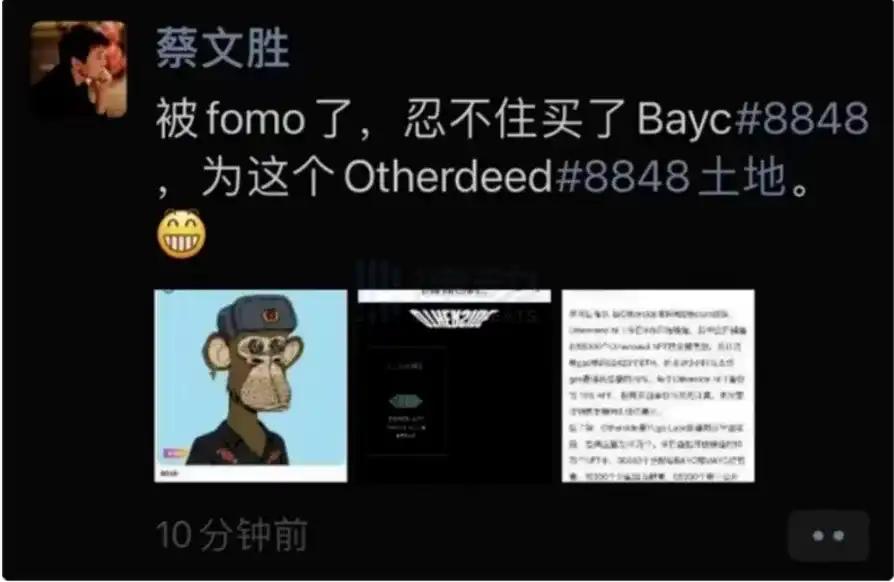

Coincidentally, around 2020, during Labubu's first wave of popularity, another financial product with a trendy cultural IP was also exceptionally hot in a more virtual space—NFTs, which might be very familiar to friends in the crypto circle.

The climax of NFTs arrived during an auction on March 11, 2021, when renowned artist Beeple's NFT work was sold at Christie's auction, with the final price reaching $69.34 million. This NFT artwork became the 53rd most expensive artwork in the world, and Beeple entered the top three in terms of artwork value among living artists.

Beeple's "Everydays: The First 5000 Days" sold for over $69 million. This artwork appears to be a colorful pixel collage but is actually composed of 5,000 individual images, a result of Beeple's daily creations over more than 13 years.

The internet also provided a perfect boost for NFTs. The two largest social platforms on the planet, Tencent and Facebook, simultaneously focused on augmented reality and virtual reality (AR/VR), which is no coincidence. They envisioned the future internet as the Metaverse, a world where the virtual and real can seamlessly connect, and the term NFT has been discussed multiple times in relation to the Metaverse, perfectly fitting the concept of ownership.

In just a few months, the term "NFT" landed worldwide.

American rapper Soulja Boy, with 5 million followers on Twitter, released his own NFT; Mark Cuban, owner of the NBA champion team Dallas Mavericks, issued NFTs; a dunk by superstar LeBron James was turned into an NFT and sold for $250,000; top football clubs like Barcelona and AC Milan also launched their own NFTs.

During that round of NFT frenzy, the most representative IP was undoubtedly BAYC (Bored Ape Yacht Club).

This avatar-based NFT project launched by Yuga Labs went live in the spring of 2021, initially priced at only 0.08 ETH (about $200), and sold out within 24 hours. It quickly became popular as a social avatar on various platforms like Twitter and Instagram.

Jimmy Fallon showcased his ape on his talk show, calling it "the identity symbol of the next era"; Snoop Dogg and Eminem performed together at the MTV awards wearing BAYC images; Justin Bieber spent $1.3 million to purchase a rare ape; top athletes like Curry and Neymar promoted it; artists like Jay Chou and JJ Lin also showcased their BAYC avatars; even the traditional finance sector caught this trend: Meituan Group chairman Cai Wensheng and venture capitalist Zhu Xiaohu are both holders.

A small image can signify identity labels and "social assets."

In terms of trading, BAYC has pioneered the pinnacle paradigm of NFT assetization: at its peak, a single one sold for as much as $400,000 (about 150 ETH), with floor prices exceeding 100 ETH, and total trading volume across the network surpassing $1.5 billion.

NFTs and Pionex are essentially doing the same thing: using a seemingly toy-like medium to stimulate participation, expression, and a sense of belonging within a certain circle.

Their process of "financial productization" is also remarkably similar: both have significant avatar/image recognition; both emphasize scarcity: rare and limited editions; both are tied to celebrity effects, triggering viral phenomena; both have formed a market structure from "original price entry" to "secondary speculation."

Labubu is a tangible NFT, while NFTs are a more virtual Labubu.

However, there is only one Wang Ning, and the NFT circle is still not broad enough. Since 2022, the fates of Labubu and NFTs have gradually diverged.

In the second year after BAYC reached its peak, the overall crypto market entered a downward cycle, and the NFT myth began to cool down. BAYC, once a leader in the NFT space, became a leader in decline—its floor price dropped from 150 ETH to below 20 ETH, now only 13 ETH, equivalent to one-tenth of its peak value. Holders gradually "dropped out," and the once bustling community has quieted down. What was once the "business card" of the crypto circle has begun to be mocked as a "sign of being trapped at the top of the chain," with losses of at least $300,000.

Meanwhile, Labubu's popularity continues to soar, firmly holding the top spot in trendy toys.

"The audience for Labubu surprisingly overlaps significantly with those who buy luxury handbags," Jani said. "Some customers initially just browse casually, but as soon as I see Labubu on their bag, the conversation flows easily, and we can chat for a long time, ultimately making the customer happy to buy a bag."

However, Jani revealed that some girls actually seek a more suitable "bag carrier" for their beloved Labubu, stepping into a luxury store for the first time to buy their first designer bag. With the Labubu IP, Pionex, in its 15th year, has begun to reverse influence the sales logic of luxury goods.

There has even been a somewhat magical moment in the capital market: Pionex's stock price has soared, with its K-line over the past few years resembling the 20-fold growth of Bitcoin in 2017, and its market value even briefly surpassed that of luxury giant Gucci's parent company.

Looking back, Hong Kong artist Long Jiasheng, who created the Labubu character ten years ago, might find it hard to imagine that this somewhat "quirky" and furry sprite has now naturally become Pionex's most profitable IP, completely surpassing the veteran IP MOLLY, and rightfully taking center stage.

The Labubu collaboration originally priced at 599 yuan can now be traded in the secondary market for 14,000 yuan, an increase of over 20 times; the trendy shoes in collaboration with Vans have reached transaction prices of 2,000 to 3,000 dollars in overseas markets, rivaling limited edition Yeezys; specific limited series (such as "Big Into Energy" or the "Wings of Fortune" collaboration with Pronounce) have seen prices soar due to radical designs and regional limitations (like exclusivity in Thailand and Singapore).

We are witnessing the same generation redefining "ownership" through two parallel universes.

In addition to "on-chain avatars" and "offline toys," there exists a more hidden, enduring, and actively traded "consensus asset market" in a larger virtual space—game skins.

Although CSGO has been remade and renamed CS2, prior to that, CSGO had existed for over 10 years, so when discussing the game's skin items, people still tend to casually refer to it as CSGO.

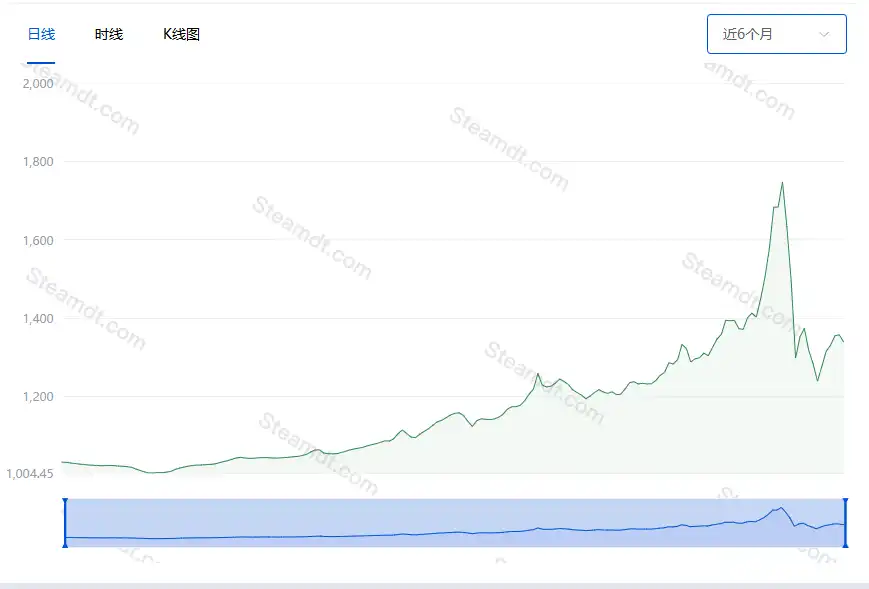

Half a month ago, the CS item market experienced a "crash." According to SteamDT's CS item sector index data, after a prolonged bull market lasting about six months, the CS item market fell 30% within a week from its historical peak, akin to a "312" crash in the crypto circle.

According to a report by Dexerto, by the end of April this year, the total market value of the CS item market exceeded 4.5 billion dollars. Data from the CS2 Case Tracker shows that in the first four months of 2025, over 113 million item cases were opened in CS. If we calculate based on each case key costing 2.49 dollars, players contributed nearly 300 million dollars in revenue to Valve (the company behind Steam and CS) just in the first four months of 2025.

Like Pionex, the CS item market took ten years to enter the public eye.

"When CSGO was first launched, there was no introduction of in-game items and item market mechanisms; you could say that skins saved this game," said Cookie, a long-time player of both NFTs and CSGO. "Although this sounds a bit like hindsight, many people who don't play CS now know about the game because of the skyrocketing prices of items, so this game, which became popular during the internet café era, has not fallen and remains popular to this day."

In August 2013, CSGO first introduced the item mechanism, and the Steam market also supported the trading of CS items. During the subsequent NFT boom, the CS item market gained attention and popularity due to its similarities with NFTs. Looking back at the design of the item mechanism at that time, one can't help but admire Valve as the pioneer of rarity design in a certain sense.

CS items have both rarity level distinctions and randomness in wear and pattern templates, leading to some items being able to sell for top market prices even if their acquisition probability is not the highest rarity level due to their wear and pattern template.

"Wear does not mean that a player's skin will wear down with use in the game, but rather the integrity or glossiness of the item skin," Cookie explained.

The difference between high and low wear on the same weapon skin

Pattern templates can be simply understood as a gun sometimes not being able to display a complete "picture." Because the coverage area of the skin is limited, which part of the "picture" is displayed on the weapon can make a world of difference.

A similar example in NFTs is Dmitri Cherniak's generative art project Ringers, which produced the image Ringers #879, resembling a goose, and was sold for 1,800 ETH (about 5.6 million dollars) to 3AC, making it one of the most expensive generative art pieces on the market at that time.

This AK-47 has a surface quenching; although both have a "brand new factory" level of wear, the one on the left has only an ordinary pattern template, showing a sparse and uneven distribution of blue on the weapon. The one on the right, however, features the top-tier #661 pattern template, with a large and concentrated distribution of blue at the muzzle and top of the gun. Therefore, the listing price for the left one on the BUFF market is only around 2,500 RMB, while the latter is in the millions, even though the AK-47 surface quenching is not the highest rarity level weapon skin.

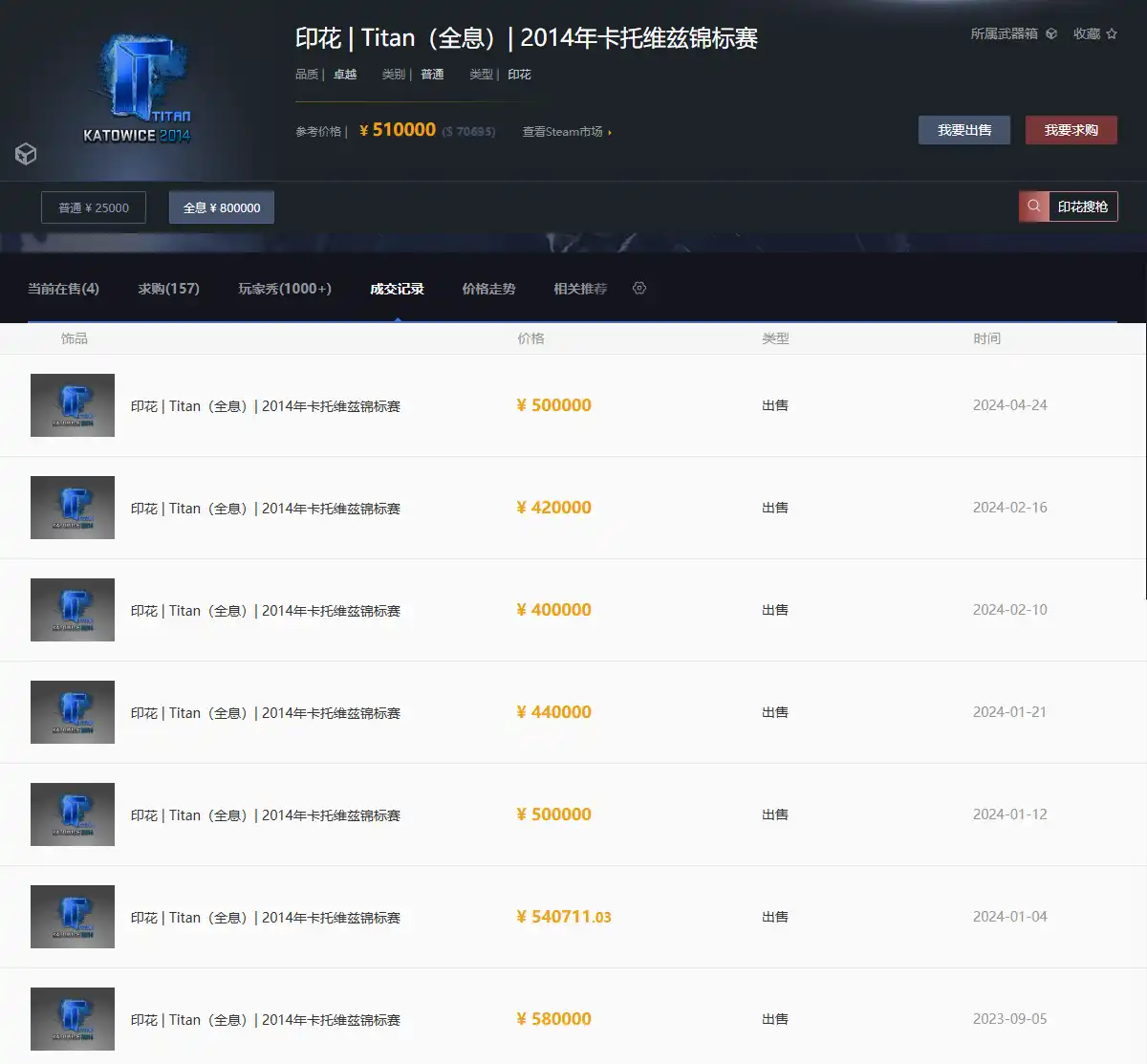

Moreover, the CS sticker system and esports events have endowed items with additional narrative value. In 2014, the sticker item mechanism was launched in CS. This mechanism seemed simple, allowing players to apply some prints to weapon skins, evolving from being overlooked to becoming another important pillar category in CS items. Team disbandments and player retirements cause related stickers to skyrocket in value.

Team stickers like Titan and iBUYPOWER launched during the Katowice 2014 Major (the Major is the top-tier event in the CS esports system, where official stickers are released for teams and players that successfully qualify) later became highly valuable due to their limited availability and aesthetic appeal.

The first wave of development in the CS item market is somewhat similar to Bitcoin, both taking root in "gray areas." Bitcoin thrived on the dark web, while CS items flourished on virtual gambling sites.

Before 2016, many items were used as gambling chips to bet on esports match outcomes on platforms like CSGOLounge, even participating in roulette. This gameplay quickly drove up item prices and led to issues like underage participation and match-fixing, ultimately prompting the authorities to step in and regulate, issuing cease and desist letters to several item gambling sites, including CSGOLounge, demanding they stop unauthorized gambling activities using the Steam API.

The CS item market briefly cooled down but did not completely retreat; the symbolic significance of high-end items for player identity has become deeply ingrained.

Just as Labubu enthusiast Jani loves to watch "trendy toy unboxing videos, especially for hidden versions," owning a dream knife in CS is a pursuit for every long-time viewer of matches and gamers, spawning a plethora of CS unboxing videos and live streams, experiencing the thrill of turning a bicycle into a motorcycle.

"The most typical example is CS streamer Qiezi, who rose to fame around 2018 and boosted the popularity of CSGO in China," Cookie recalled. At the same time, NetEase's CS item trading platform BUFF was launched, and the cooperation between third-party item trading platforms and Steam entered a stable phase. Some third-party trading platforms that allowed for fiat currency settlements promoted the emergence of systematic arbitrage mechanisms like stockpiling and flipping, further clarifying the financial characteristics of CS items.

During the pandemic, the number of Steam users reached an all-time high, with players flooding in and unboxing volumes skyrocketing. Coupled with the rise of the NFT concept, the label "off-chain NFT" transformed CS skins from in-game items into part of the "digital collectibles" ecosystem—possessing an independent pricing system and a consensus on scarcity.

"At this stage, CS items also have 'opinion leaders,' and the independent pricing system is basically complete. There are established values for what wear level and pattern template of which gun are worth. On Bilibili, there are already many CS item guide videos, and new content is continuously being produced," Cookie said.

It can also be seen that the CS item market shares many similarities with NFTs in the crypto circle: random minting, rarity creates differentiation in value and liquidity. Rare items are expensive but hard to sell, while floor items are cheap but easy to move. Even in the CS item market, there are original skins like the claw knife and butterfly knife, which serve as price indicators similar to Bitcoin's market cap.

"However, because CS is truly an excellent game, unmatched in the FPS genre, the liquidity in the CS item market is significantly better than that of NFTs," Cookie added. "Rather than saying that these young people's interests have developed speculative attributes that shouldn't exist, I prefer to say that this is a collective consciousness among young people, granting them unique asset pricing power."

Such examples appear in CS items, in NFTs, and continue to emerge across various groups.

Let's start with sneakers. Over the past 10 years, Nike and Adidas may not have designed any technological innovations, but they have turned "sneakers" into financial products: a pair of AJ1 "Chicago" originally priced at 1,299 yuan can now be traded for 4,000 yuan on platforms like Dewu; after Yeezy was discontinued, all models skyrocketed, with some colorways doubling in price; collaborations with Solomon and Asics, once belonging to the running community, have now become new favorites for sneaker resellers.

Now let's talk about bags. From the Porter collaborations beloved by women, Jacquemus mini bags, to the Supreme toolbox and LV Yayoi Kusama collaborations that men scramble for, each could potentially be a bargaining chip to resell on Xianyu.

In the hierarchy of the trendy circle, whoever carries a limited edition item feels like they have an extra rare NFT in their wallet address.

Reselling sneakers, bags, and NFTs seems to carry a "middle-class attribute," but what about cigarette cards?

Don't laugh; cigarette cards have become a spiritual totem for kids born after 2010 on platforms like Xiaohongshu and Douyin.

Behind this is a wave of "card collecting" among elementary school students. From the initial Ultraman to the gradually popular My Little Pony in 2023, and this year's Nezha series cards, with prices ranging from 2 yuan, 5 yuan to 10 yuan, the profit margin for the company behind the cards, Kayo, is as high as 71%, earning more than Pionex in 2024.

In fact, when obtaining Series A financing, Kayo boldly signed a bet agreement with investors (Sequoia and Tencent), which mentioned that the company must complete its IPO by the fifth anniversary of the preferred stock issuance date (i.e., by 2026), or it would trigger a buyback, with an annualized interest rate of 8% for the buyback.

The main form of Kayo cards

You might think that young people are wasting money, but in fact, they are establishing a new pricing model: emotions, community, culture, aesthetics, discourse power, and traffic can all be priced.

Everything can be speculated on; it's just that each generation has its own "heavenly beads."

In the theory of "value investing," MEME coins and dog coins have always been marginalized, even in the bubble-filled crypto world. But seeing this, I think many who previously couldn't understand dog coins and meme coins in the crypto space should now grasp why young people are so enthusiastic about trading coins.

They are more like participants in a decentralized youth culture investment—except the assets are not a company or project, but a joke, an image, or even a phrase.

PEPE was originally just a character in an online comic by cartoonist Matt Furie in 2005, but it later evolved into a widely recognized MEME symbol on the internet, gathering a community of countless anonymous artists who created various Pepe images that play diverse roles in different cultural contexts and social media platforms.

This PEPE meme coin quietly launched in the spring of 2023. There was no white paper, no team introduction, and not even a practical scenario—just an image. Yet, within three days of its launch, the price skyrocketed by 7,000%, and its market value surpassed 1 billion dollars. Even BitMEX co-founder Arthur Hayes called himself a "frog believer," making PEPE a hallmark of the new generation of meme coins.

In fact, all cryptocurrencies have meme attributes, just in varying degrees, including Bitcoin.

As the first successful cryptocurrency, Bitcoin's philosophical significance, its anonymous founder Satoshi Nakamoto, and its spirit of resisting traditional financial systems all endow it with meaning that transcends technology.

So from this perspective, Bitcoin itself is the earliest MEME; it represents the pursuit of power, freedom, and systemic change. This symbolic meaning surpasses its function as currency, becoming a hallmark of a cultural and social movement. Later on, there emerged various meme trends that you can hardly name all of.

At the peak of this movement was the personal meme coin issued by U.S. President Trump, from which young people in China earned unimaginable financial gains in just two days. A post-95s Chinese youth, code-named "0xSun," became the champion of this 48-hour movement with profits in the tens of millions of dollars.

Today's meme coins seem to be filling the gaps in the traditional crypto space, increasingly pursuing global hot topics. Thai internet celebrity hippos, squirrels killed by the Democratic Party, and suddenly viral memes on TikTok all have their own meme coins.

Behind every meme coin, young capital is using real money to chase the most trending topics. Of course, Labubu is no exception.

This phenomenal IP has also seen the community launch a meme coin on-chain, skyrocketing a hundredfold in just one month, with returns surpassing any financial product related to Pionex.

The gameplay of meme coins is almost identical to that of CS items, NFTs, and trendy toys: initial low price + random wealth, triggering collective FOMO; strong visual memory points (Shiba Inu, frogs, anime avatars); community-driven, relying on word of mouth rather than official announcements; emotion-driven, emphasizing "consensus precedes value."

You will find that this generation of young people may all be doing the same thing through different media: in an era of information explosion, blurred identities, and thin senses of the future, they are using an irrational enthusiasm to construct their own "pricing rules" in the world they belong to.

I remember Yuval Noah Harari mentioned in "Sapiens" that Homo sapiens initially communicated interpersonal information through "gossip" and other means, establishing stable and close interpersonal organizations by commenting on others. Later, people formed a common imagination through "storytelling" to build broader trust, such as in religion, nations, currencies, companies, and so on. On this basis, adding some scarcity and limited editions makes the narrative top-notch.

Therefore, whether it's Labubu, NFTs, meme coins, or CS items, anything that can form a strong group identity is something this generation of young people is keen to speculate on.

After finishing this article, the editor, who is full of the rhythm of meme coins, also bought their first Labubu and sent it to eight friends…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。