It’s been a whirlwind in the crypto realm as bitcoin (BTC) notched a fresh all-time high on May 22. Yet, in the days that followed—from May 24 through May 31—the digital asset retraced 4.13% against the U.S. dollar, easing from $109,000 to $104,500 per coin.

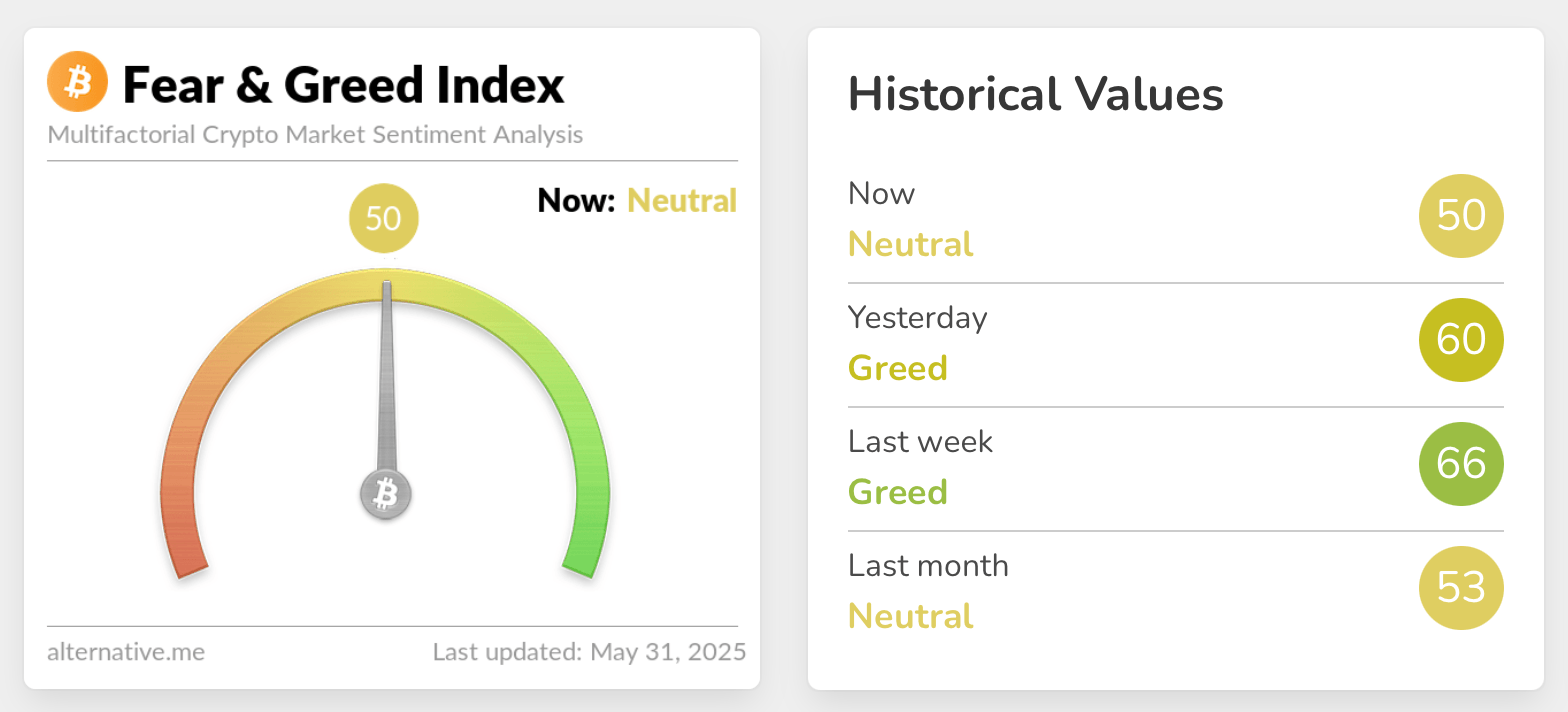

Before this reversal, the Crypto Fear and Greed Index (CFGI), maintained by alternative.me, had been hovering in euphoric territory—drifting between the “greed” and “extreme greed” bands. The gauge itself segments sentiment as follows:

- 0–24: Extreme Fear

- 25–49: Fear

- 50: Neutral

- 51–74: Greed

- 75–100: Extreme Greed

When BTC marked its all-time high (ATH)—a weighted average between $111,814 and $111,970, with some exchanges briefly touching $112,000—the CFGI entered the “extreme greed” zone the very next day. On Nov. 22, 2024, bitcoin (BTC) was trading at $98,997 per coin, while the CFGI sentiment gauge registered a lofty 94 out of 100. Fast forward to Saturday, May 31, and the CFGI now reads 50—squarely in the “neutral” range.

That’s just one point shy of tipping into “fear,” and a single mark from reentering “greed.” On Friday, May 30, sentiment sat at 60, placing it firmly in the “greed” category. In short, the emotional tide has shifted swiftly, leaving behind a haze of market ambiguity. It’s worth noting that this midpoint reading—50—aligns with BTC priced at $104,500, representing a 5.56% increase over its November 2024 valuation, despite the current tone of indecision.

This swift retreat from euphoria highlights the market’s volatility and psychological fragility following the ATH. Resting precisely at the “neutral” midpoint, sentiment teeters precariously, reflecting profound indecision among market participants during a newer form of price discovery. Despite the current ambiguity, the underlying resilience is noteworthy; the asset maintains a significant premium over its previous sentiment cycle, suggesting a potential consolidation phase before the next directional move emerges.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。