Yesterday, many friends consulted us in the background about the basis for the keyword "market top." Interestingly, we also discussed this issue at the dinner table that day and consistently mentioned a point in financial history, 1966-1968.

In our financial analysis process, we often use a historical financial cycle "mirror analysis" logic to compare and contrast the differences and variabilities in the market.

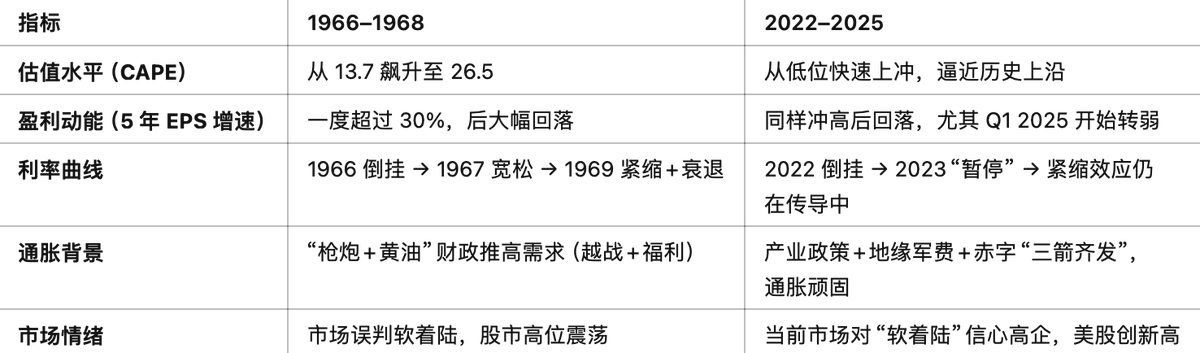

Interestingly, 2025 has financial and macroeconomic environmental characteristics that are very similar to those of 1968:

1️⃣ Similar Inflation Resilience

• Expansion of fiscal spending around 1968 (Vietnam War + Social Security) = Structural demand stimulus

• Current fiscal deficit + rebuilding manufacturing + military spending = Demand pull + supply shock

• Core inflation is highly sticky, making it difficult for the Federal Reserve to truly relax policies

2️⃣ Mirrored Monetary Policy Rhythm

• 1966 inversion → 1967 easing misinterpreted as the endpoint → In reality, a buffer before deeper tightening

• 2023 pause in rate hikes → Market interprets optimistically → In reality, QT continues, interest rate spreads have not recovered, and the tightening effect may be delayed

3️⃣ Market Turmoil

• In April 1968, Martin Luther King was assassinated, leading to riots and protests in 25 cities. Internationally, there were events like the French general strike, violent conflicts at the Democratic National Convention in Chicago, and the Soviet invasion of Czechoslovakia.

• Nowadays, Trump's administration has triggered tariff policies + geopolitical uncertainties. Internationally, there are conflicts such as India-Pakistan, Russia-Ukraine, and the Iran-Israel Middle East conflict.

4️⃣ Approaching Valuation + Earnings Turning Point

• After 1968, both CAPE and EPS turned from positive to negative → Triggering the bear market of 1970

• Currently, the CAPE Z-score is close to the upper limit; once EPS turns negative year-on-year, it could be the ignition point. EPS has also become one of the indicators we are currently paying close attention to. Once the corporate earnings cycle enters negative feedback, it often leads to layoffs or capital expenditure cuts, which need to be monitored.

Although it is said that history does not represent the future and can only serve as a reference, historical "anchoring probabilities" and "valuation limits" can be used for effective advance planning in position management. Another point is that financial history cannot predict the timing of market turning points but can provide directions and structural references for vigilance, which is very practical. Therefore, 1968 tells us: a soft landing ≠ the end; the real damage comes from the resonance of "lagging variables": peak earnings + sustained high interest rates + overheated sentiment.

Overall, all current signals are approaching a critical point. It is better to prepare some preventive plans in advance than to panic and be confused when a real crisis arrives. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。