Many friends know that I am a long-term investor, but to be honest, the foundation of long-term investment lies in having a certain level of life security. If you are struggling to make ends meet, it is indeed difficult to become a long-term investor. At the very least, you need a basic guarantee for your living expenses. Once you have that basic guarantee, dollar-cost averaging may be the best approach.

If you are overly concerned about daily price fluctuations and do not adequately distinguish between $BTC and non-Bitcoin cryptocurrency assets, it is indeed not suitable for long-term holding. Some coins can drop to zero after being held for a while.

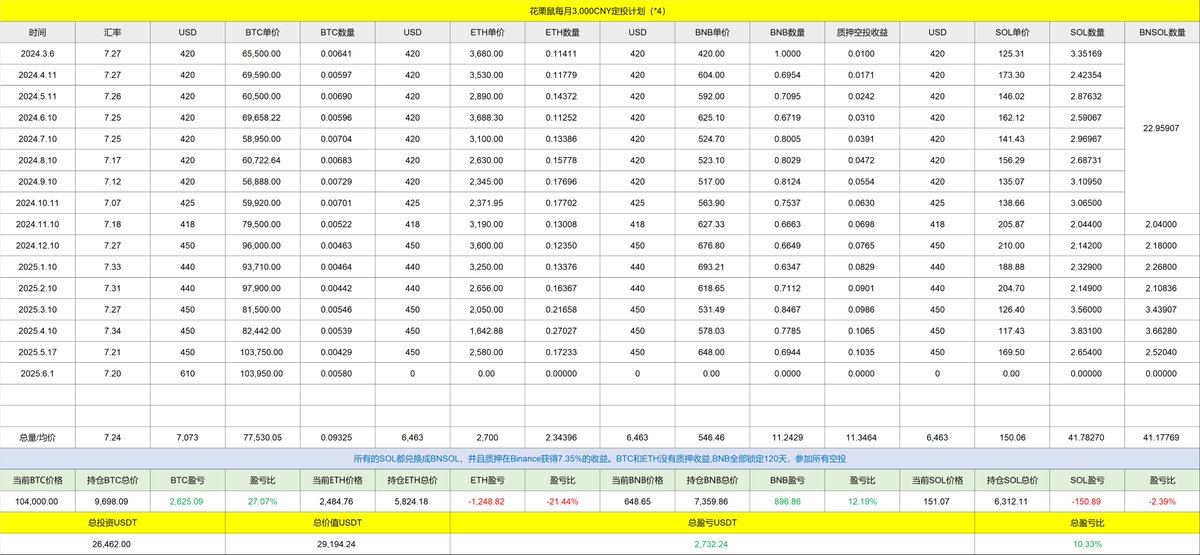

Today, I am still looking at my dollar-cost averaging list. After 15 months of investment, Bitcoin has yielded over 27%, $ETH is down 21%, $BNB has gained over 12%, and $SOL is down 2.4%. The total return from these four investments is still over 10%.

A total return of 27% over 15 months (annualized return of over 20%) is quite significant, at least outperforming more than 60% of investors, including institutional investors in the U.S. stock market. Berkshire Hathaway's Class A shares (BRK.A) have an estimated return of about 25.5% in 2024, while the S&P 500 index has increased by 25.0% during the same period.

Of course, I also know that many friends say they came to the crypto space to turn their fortunes around, aiming for single coins like A8 and A9, and that a mere 27% is nothing. I agree and wish you all great results, but I am definitely not envious.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。