The U.S. "GENIUS Act" (Guiding and Establishing National Innovation for U.S. Stablecoins Act) is the first comprehensive federal legislation regulating stablecoins in U.S. history, marking an important step for the U.S. in the digital finance sector. The bill was advanced in the Senate on May 20, 2025, with a vote of 66 in favor and 32 against, entering the stage of full debate and amendments.

Core Content of the Bill

1. Reserve Assets and Redemption Mechanism

1:1 Asset Backing: All stablecoins must be backed by at least an equivalent amount of high-quality, low-risk liquid assets, including U.S. dollar cash, demand deposits, U.S. Treasury securities maturing within 93 days, repurchase agreements, reverse repurchase agreements, money market funds that only invest in the aforementioned assets, and tokenized forms of the above assets that comply with applicable laws.

Redemption Rights Protection: The public has the right to redeem their stablecoins for U.S. dollars at a 1:1 ratio, and issuers must fulfill this obligation at all times, clearly specifying a timely redemption process.

2. Regulatory and Compliance Requirements

Auditing and Disclosure: Issuers must publicly disclose the size and structure of reserve assets monthly, reviewed by a registered public accounting firm, with the CEO and CFO certifying its accuracy.

Anti-Money Laundering and KYC: Issuers must comply with the Bank Secrecy Act, including requirements for risk assessment, sanctions list checks, suspicious transaction reporting, and customer identity verification.

Prohibition of Yield-Generating Stablecoins: The bill explicitly prohibits stablecoin issuers from paying interest or yields to holders to mitigate financial risks.

3. Restrictions on Foreign Issuers

- Compliance Requirements: Foreign stablecoin issuers must accept supervision equivalent to the U.S. regulatory framework within 18 months; otherwise, their stablecoins cannot be offered or sold in the U.S. through "custodial intermediaries."

Political and Market Impact

1. Consolidation of Dollar Dominance

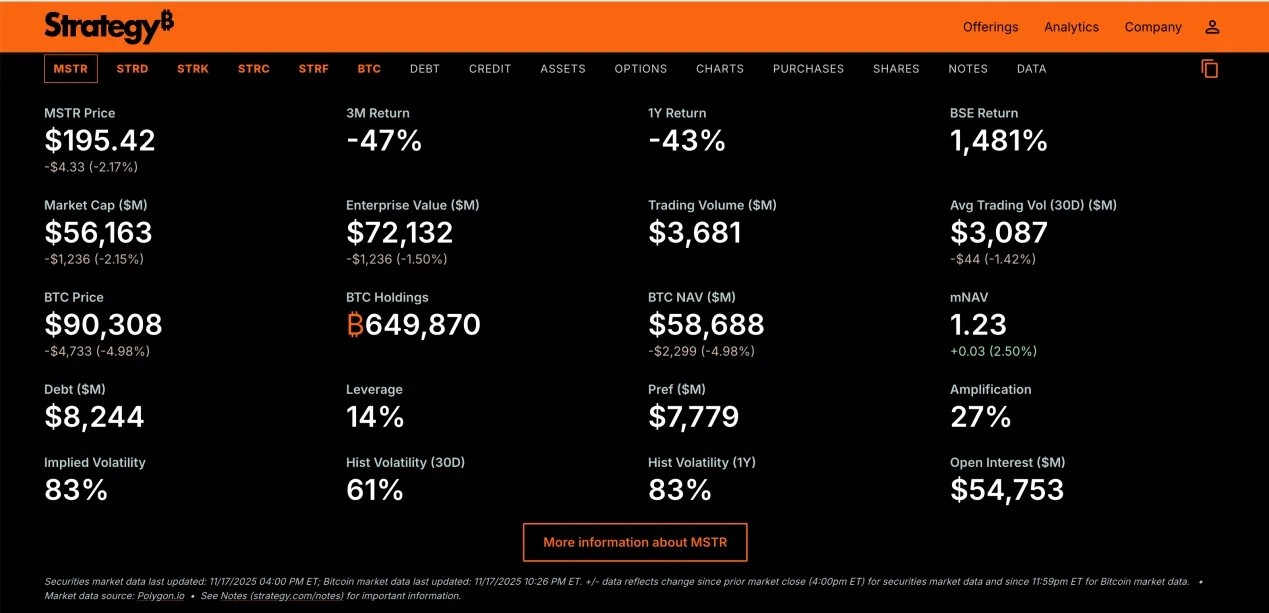

Deutsche Bank points out that since dollar-denominated stablecoins account for over 99% of the total market value of stablecoins, the passage of the bill will further consolidate the dollar's dominant position in the global financial system.

2. Potential Impact on the U.S. Treasury Market

Standard Chartered Bank predicts that by the end of 2028, the issuance of stablecoins will reach $2 trillion, potentially bringing an additional $1.6 trillion in demand for U.S. short-term Treasury purchases, helping to alleviate U.S. debt pressure.

3. Political Controversies and Conflicts of Interest

The advancement of the bill has sparked political controversy, with some Democrats concerned that the bill may indirectly support former President Trump's cryptocurrency business, thereby affecting his political interests.

Outlook and Challenges

The advancement of the "GENIUS Act" provides a clear legal framework for stablecoins, helping to enhance market confidence and promote institutional adoption. However, the final passage of the bill still faces challenges from political maneuvering and market dynamics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。