According to Bitfinex analysts, bitcoin (BTC) dropped nearly 8% from its record peak of $111,880, reached after a relentless 50% surge over the last 45 days. The market strategists say that this marks bitcoin’s first meaningful pullback since its April lows of $74,501.

The correction follows a period characterized by minimal retracements, according to the latest Bitfinex Alpha report. Simultaneously, the analysts noted that bitcoin derivatives markets indicate potential turbulence. Options open interest recently surged to an unprecedented $49.4 billion high, reflecting heightened institutional hedging and speculative activity.

The analysis explains that while this figure dropped to $39 billion due to May’s options expiry, analysts view the peak as a sign traders are positioning for larger price swings. Perpetual futures open interest also spiked near the all-time high, contributing to the subsequent leverage flush-out.

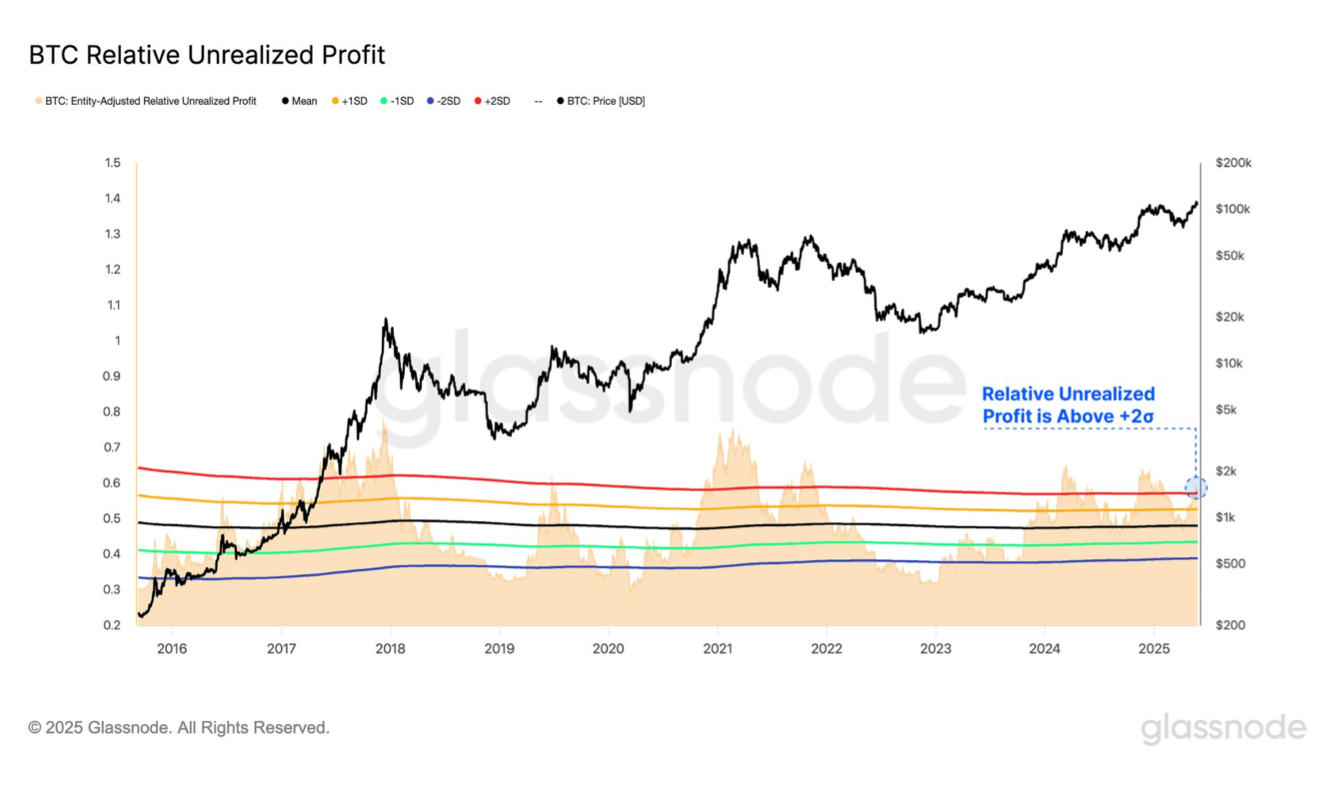

Aggressive profit-taking is another factor behind the pullback, Bitfinex analysts say. “A useful gauge of this dynamic is the Relative Unrealised Profit metric, which measures the scale of paper profits across the network relative to market capitalisation,” the Bitfinex analysis states. “At present, this indicator is breaking above its +2 standard deviation band—a region that has typically marked the onset of euphoric phases in prior cycles.”

The analysts added:

These euphoric zones are often accompanied by elevated volatility and, crucially, tend to be short-lived. Statistically, only around 16 percent of all trading days in Bitcoin’s history have seen Relative Unrealised Profit reach such extremes.

The correction also coincides with renewed macroeconomic pressures. The unexpected reinstatement of U.S. tariffs triggered a broad risk-off sentiment, pushing 30-year Treasury yields above 5% for the first time since 2009. This tightened liquidity environment pressured both traditional and digital asset markets.

Amidst this market shift, significant industry developments unfolded: Gamestop invested $513 million in bitcoin, the U.S. Labor Department rescinded its 2022 guidance discouraging crypto in 401(k) plans, and Russia’s central bank authorized crypto-linked instruments for qualified investors, signaling further institutional integration.

Despite the correction, Bitfinex analysts believe bitcoin remains structurally strong, characterizing the move as a “healthy reset” following a historic rally rather than a breakdown. However, the confluence of technical indicators, profit-taking, and macro headwinds suggests near-term volatility is likely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。