Original Title: Turning Noise into Profits

Original Authors: @cryptondee, @castle_labs

Original Compilation: zhouzhou, BlockBeats

Editor's Note: Prediction markets enable the market to accurately reflect the probability of a single verifiable event by providing risk capital, transparent rules, and real-time information aggregation mechanisms. Narrative trading focuses on market sentiment and the momentum of stories, transforming the ever-changing narrative content into tradable assets through tools like sentiment oracles. The combination of both provides mechanisms for assurance and capital support, along with a rich and diverse source of content, driving the pricing, trading, and hedging of narrative assets in the crypto market, opening up a new investment domain.

The following is the original content (reorganized for better readability):

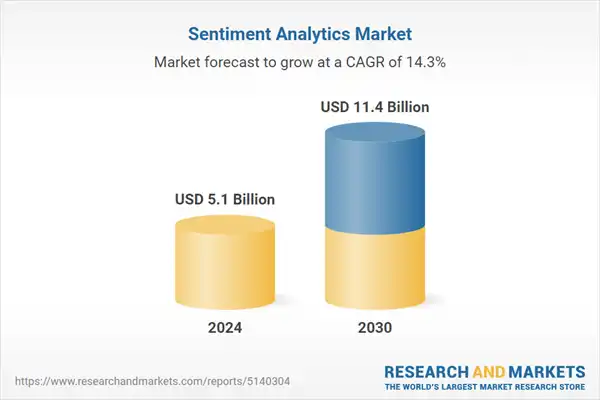

In the next five years, global spending on AI-driven sentiment analysis is expected to grow from $5.1 billion in 2024 to $11.4 billion by 2030, with a compound annual growth rate of 14.3%.

During the same period, thematic ETFs focused on specific trends and narratives are projected to have a compound annual growth rate of 16%, three times faster than mutual funds; while the assets of actively managed ETFs surged by 37% in 2023, reaching $923 billion.

These trends collectively indicate that capital is flowing towards products that can transform overall market sentiment into investable exposure. In the crypto space, this shift is even more pronounced, as crypto asset prices are being repriced around the clock.

In the crypto market, narrative trading relies on the stories that capture investor attention—breakthroughs in layer-two networks, shifts in regulatory policies, or celebrity endorsements—rather than discounted cash flow models or technical charts.

Sentiment-driven trading converts crowd sentiment into quantitative signals. By mining social media and news headlines, natural language processing models have about a 50-55% accuracy rate in predicting stock returns the next day.

The rise of thematic ETFs in traditional finance and the surge in perpetual contract trading volumes in the crypto market reflect a strong demand for tools that allow direct participation in narratives—an opportunity that @noise_xyz aims to seize.

Noise is Here

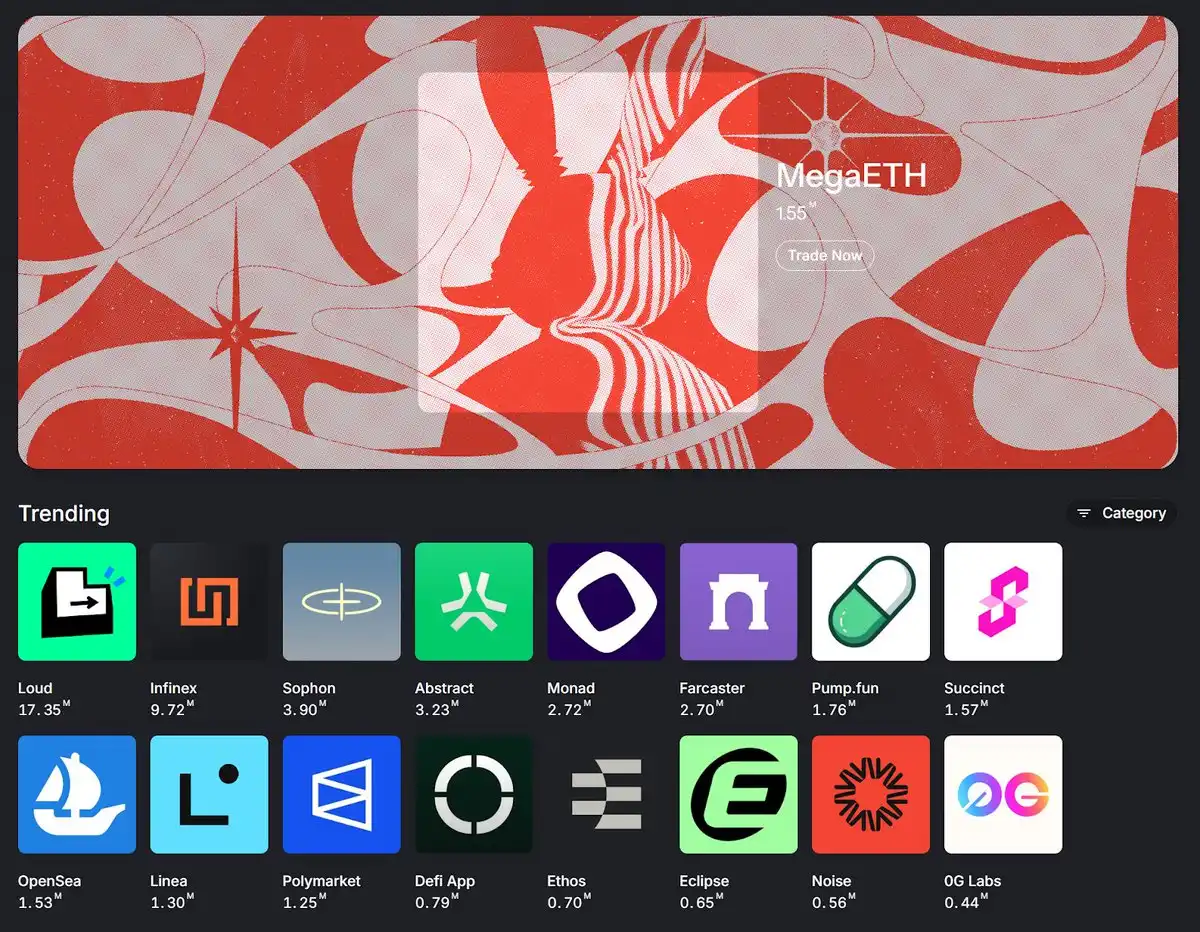

Noise is a narrative trading protocol built on @MegaETH_labs. It is powered by real-time sentiment oracles provided by @Kaitoai, capable of converting sentiment scores from protocols like MegaETH, Noise, or PumpFun into tradable long or short products.

By decoupling trading from token prices, Noise offers a transparent way for users to speculate or hedge on the heat and sustainability of crypto narratives.

However, the success of such protocols depends on their ability to achieve the following:

Objective Scoring—Narratives must be defined and quantified in a tamper-proof manner;

Efficient Execution—Trades need to be completed on a secure, low-latency, low-cost platform;

Deep Liquidity—The market must have sufficient capital support to remain active and sustainable.

Currently, the demand for understanding and trading crypto market sentiment is continuously growing. Thematic ETFs reflect investors' preference for "narrative-driven investments," while the massive trading volume of crypto perpetual contracts indicates a strong demand for leveraged speculative tools.

If Noise can stably convert trend narrative data into tradable financial instruments on the high-performance platform MegaETH, it is expected to bridge the gap between this demand and infrastructure, thus opening up a brand new and highly potential market track.

From the narrative lifecycle to market design, to understand why the three pillars mentioned above are crucial, we first need to break down two foundational concepts: narrative trading and prediction markets.

How Narratives Rise and Fall

Cryptocurrency price cycles rarely rely on traditional discounted cash flow models. Instead, they often revolve around the rise and fall of certain stories:

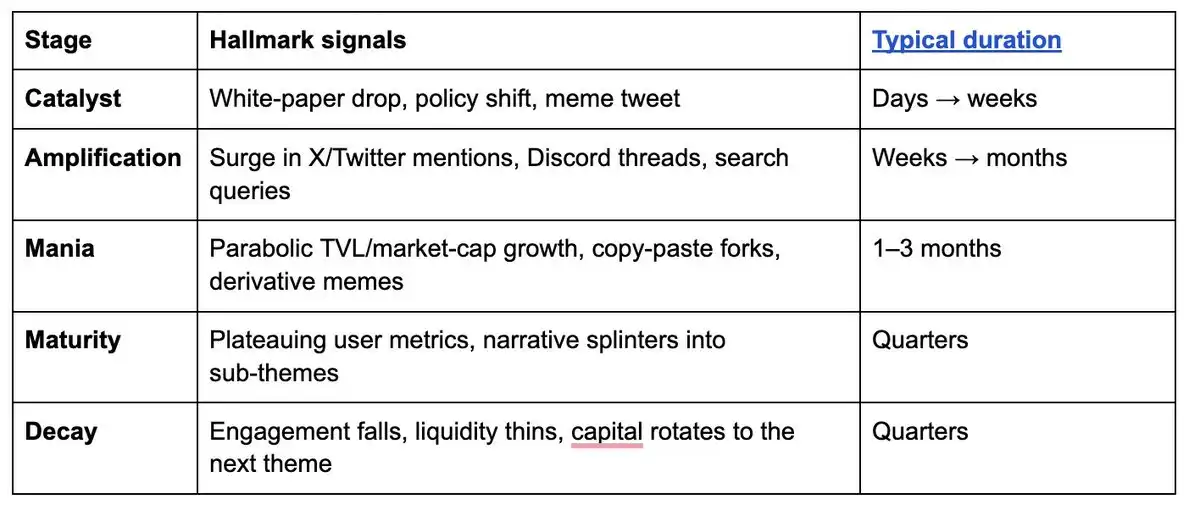

A narrative typically follows a predictable path:

The starting point is the catalyst: for example, the release of a white paper, the signaling of policy changes, or a viral meme that can attract attention within days or weeks.

If the concept takes root, it enters the "amplification phase": mentions on Twitter, discussions on Discord, and search popularity gradually rise, attracting early capital and developers.

Next comes the frenzy period, lasting 1 to 3 months: on-chain data and token prices soar rapidly, imitative projects flood in, and mainstream media begins to report.

Then growth slows, and the narrative enters the "maturity phase," lasting a quarter or longer, as fundamentals begin to catch up, and the narrative focus diversifies into multiple sub-themes.

Finally, it enters the decline phase: social discussions cool down, liquidity dries up, and capital shifts to fresher narratives, often reusing experiences and profits gained from the previous cycle.

Therefore, a tradable "narrative asset" must consider which stage the story is currently in, measuring not only its heat (volume) but also its velocity.

Narrative Markets vs. Prediction Markets: A Quick Comparison

Both narrative markets and prediction markets allow people to price the future and rely on collective sentiment, but they differ in three key aspects:

Different Speculative Focus: Prediction markets focus on single, verifiable events (e.g., interest rate cuts, election results, whether Bitcoin will exceed $100,000 by year-end); narrative markets track an evolving story (e.g., "AI agents will reshape the crypto industry," "Layer-2 will account for 80% of transaction volume").

Different Nature of Trading Assets: Prediction markets trade binary probabilities between $0 and $1; narrative markets trade indices of thematic narrative heat and dissemination speed provided by oracles.

Different Settlement Methods: Prediction markets settle in one lump sum after the event outcome is clear; narrative markets rely on continuous updates from oracles, adopting a rolling settlement mechanism based on a transparent scoring model.

Insights from Prediction Markets

Taking @Polymarket or @Kalshi as examples, when a new contract is launched, such as "Will the Federal Reserve cut interest rates at the next meeting?"

Traders will immediately price based on current information and update market expectations with each data release, rumor, or speech until the settlement date. The price of this contract acts like a "living poll," continuously absorbing small changes in information to reflect collective expectations.

The goal of narrative trading is similar, except it deals not with hard data but with the "softer" heat of stories. Here, the "event" is the market's ongoing belief in a narrative.

The effective incentive mechanisms of prediction markets also apply to narrative trading:

Voting with money makes opinions more honest: traders are not speculating out of thin air but betting on how the story will evolve;

Transparent rules build trust: everyone knows the basis for scoring and data sources;

Real-time repricing mechanisms: the market can quickly absorb new information, just as narratives can rapidly heat up or cool down on social media.

In summary: prediction markets provide mechanisms, capital, and information aggregation capabilities; narrative trading provides the content itself. The combination of the two constructs a new framework that can "price, trade, and hedge narratives."

Competitive Landscape Analysis

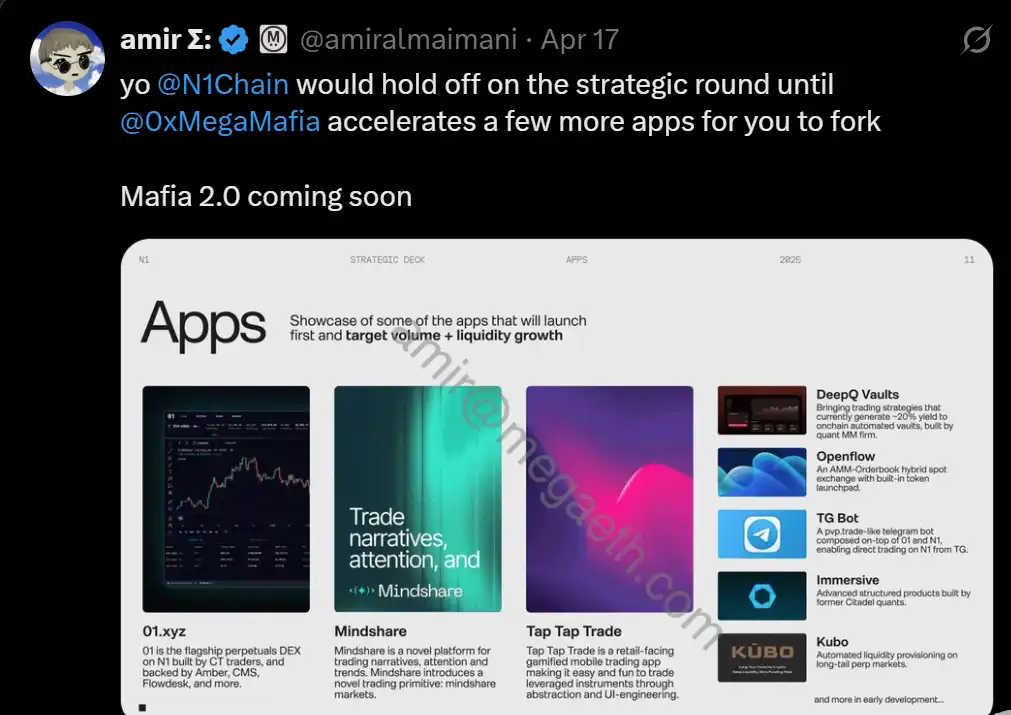

The concept of turning "narratives" into an asset class is still very new, and almost all projects in this space are still in the "stealth development" phase. So far, only two teams—Mindshare on N1 and Narrativexyz on Monad—have made public moves, both only revealing intentions without disclosing specific mechanism designs.

In a Pitch Deck on N1, Mindshare is described as:

"A platform for trading narratives, attention, and trends"

"A new type of social finance application where users can directly trade crypto narratives"

Aside from this, the project has left almost no substantial traces: the official website's images fail to load, there is no favicon, the Twitter account has only about 3,400 followers, with just two posts, and no documents, code repositories, or token information have been disclosed. The founder's account "Mindshare Minder" has almost no public history.

In short, while the concept has been thrown out, the specific execution path and architectural design—such as the choice of oracle—remain completely unknown.

In contrast, Narrative first appeared four months ago through a tweet, claiming to be a "narrative trading protocol built on Monad."

An overview of the Gate.io ecosystem also mentioned that Narrative will bundle tokens into carefully curated "thematic" baskets, allowing users to gain relevant exposure without holding multiple positions.

Aside from this, the project team has remained largely silent: no white paper, no UI sketches, and no code repository, with only one co-founder (@KinglouiEth) having some influence on social media. How the protocol will score narratives, settle, and deliver remains completely speculative.

In summary, the race to turn "narratives" into tradable underlying assets is still in its early stages, and the first team to combine verifiable sentiment data with frictionless execution will define the entire track.

Conclusion

Data from the past decade shows that capital continues to flow into products that can package collective market beliefs: sentiment analysis dashboards in traditional finance, thematic ETFs in the stock market, and perpetual contracts in the crypto market.

Narrative trading is the next natural evolution: it allows investors not only to price a token but also to price the "story itself" that drives those tokens up.

Even in its early version, the project needs to demonstrate three core capabilities:

Objective sentiment scoring data sources

Low-friction execution mechanisms

Sufficiently deep liquidity pools to support real price discovery

For investors and developers, the next step is simple: focus on testing data, personally experience the product logic, and decide what role your capital or code will play in this new narrative market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。