This Week's Preview (6.2-6.8): Over $2.7 Billion in Tokens to be Unlocked in June; BTC Faces Non-Farm Data Test This Week!

Table of Contents:

- Large Token Unlock Data for This Week;

- Overview of the Crypto Market, Quick Read on Weekly Hot Coins' Price Movements/Fund Flows;

- Bitcoin Spot ETF Dynamics;

- BTC Liquidation Map Data Interpretation;

- Key Macroeconomic Events and Crypto Market Highlights and Interpretations for This Week.

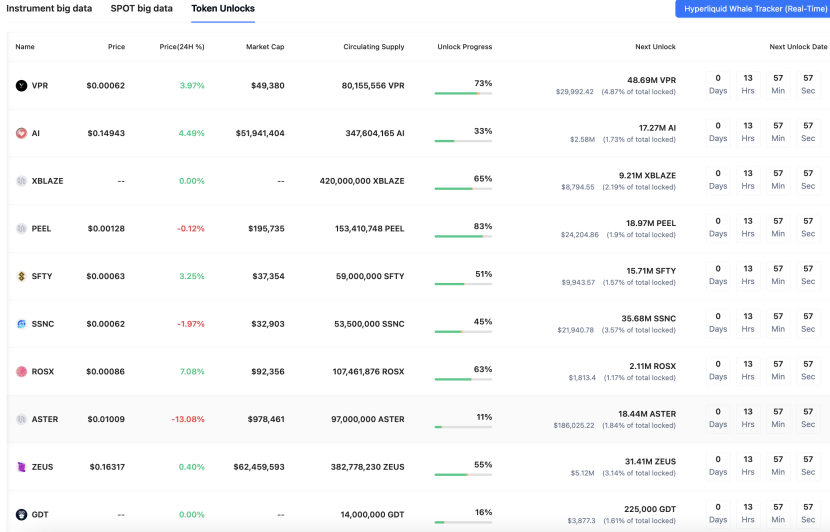

1. Large Token Unlock Data for This Week;

Coinank data shows that this week ENA, EIGEN, TAIKO, and others will experience significant one-time token unlocks, including:

Ethena (ENA) will unlock approximately 40.63 million tokens at 3 PM on June 2, accounting for 0.70% of the current circulating supply, valued at about $12.5 million;

Eigenlayer (EIGEN) will unlock approximately 1.29 million tokens at 3 AM on June 4, accounting for 0.42% of the current circulating supply, valued at about $1.7 million;

Cetus Protocol (CETUS) will unlock approximately 8.33 million tokens at 8 AM on June 4, accounting for 1.15% of the current circulating supply, valued at about $1.1 million;

IOTA (IOTA) will unlock approximately 8.63 million tokens at 8 AM on June 4, accounting for 0.23% of the current circulating supply, valued at about $1.6 million;

Taiko (TAIKO) will unlock approximately 81.55 million tokens at 8 PM on June 5, accounting for 69.37% of the current circulating supply, valued at about $46.9 million;

Spectral (SPEC) will unlock approximately 3.62 million tokens at 8 AM on June 6, accounting for 17.57% of the current circulating supply, valued at about $3.7 million;

Neon (NEON) will unlock approximately 53.91 million tokens at 8 AM on June 7, accounting for 22.51% of the current circulating supply, valued at about $6.1 million.

In June, over $2.7 billion in tokens will be unlocked, primarily led by SUI ($206.33 million), ZRO ($64.29 million), and APT ($58.52 million).

We believe that the large unlock events of multiple tokens this week need to be assessed in conjunction with market supply and demand and project fundamentals. Firstly, Taiko (TAIKO) stands out with its unlock scale, as the release of 81.55 million tokens accounts for 69.37% of the current circulating supply, valued at about $46.9 million. Such a high proportion of circulating supply flooding into the market at once may trigger significant selling pressure, especially since its ecological applications are not yet fully formed, leading to a high risk of price decline due to insufficient short-term demand. Secondly, although Ethena (ENA) has a lower unlock ratio of only 0.7%, historical data shows that its tokenomics has structural contradictions: the protocol relies on token incentives to maintain the stablecoin USDe's scale, but ENA lacks a real profit distribution mechanism, resulting in inflationary pressure and insufficient value support. Additionally, both Neon (NEON) and Spectral (SPEC) have unlock ratios exceeding 15%, and with smaller market capitalizations and lower market liquidity, this may amplify price volatility.

Overall, the impact of token unlocks on the market needs to be viewed in layers: projects like TAIKO with high unlock ratios face short-term liquidity shocks, while those like ENA, despite lower ratios, are constrained by long-term deflationary mechanism flaws, necessitating caution regarding potential chain reactions post-unlock. Furthermore, the current crypto market is under the backdrop of Federal Reserve policy adjustments and tightening macro liquidity, compounded by this week's total unlock scale exceeding $369 million, requiring the market to digest multiple selling pressures, which may lead to cautious investor sentiment. Future attention should be paid to the actual flow of unlocked tokens and the progress of ecological construction by project parties to assess whether the market can effectively absorb the supply increase.

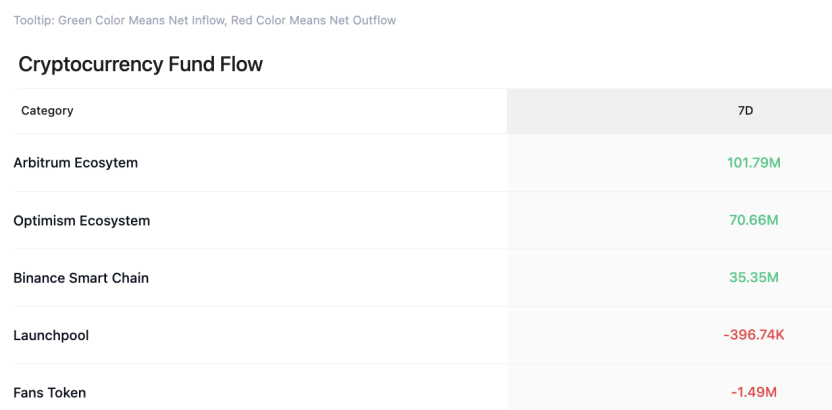

2. Overview of the Crypto Market, Quick Read on Weekly Hot Coins' Price Movements/Fund Flows

CoinAnk data shows that due to the overall downtrend in the market, over the past week, the crypto market, categorized by concept sectors, saw net inflows in sectors like Arbitrum ecosystem, Optimism ecosystem, and Binance Smart Chain, while Launchpool and fan tokens experienced smaller outflows.

In the past 7 days, the top gainers among tokens (selected from the top 200 by market cap) are MASK, ZEN, SPX, IOTX, and AB, which should continue to be prioritized for trading opportunities this week.

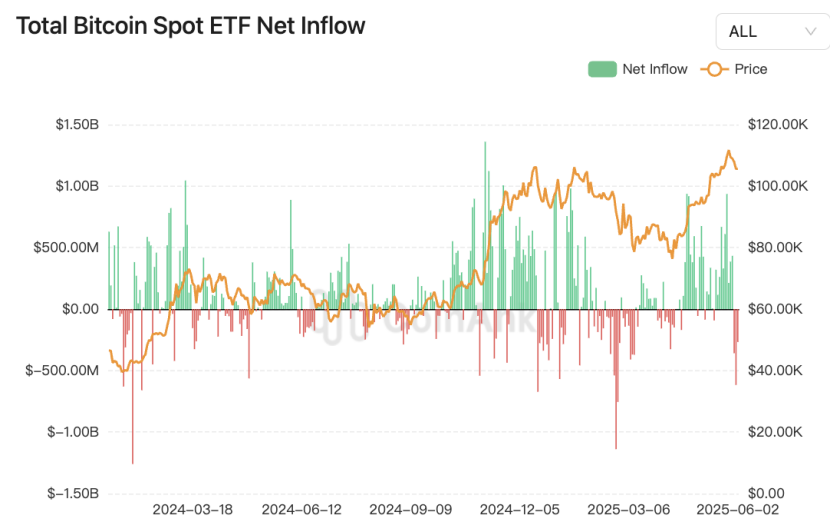

3. Bitcoin Spot ETF Fund Dynamics.

CoinAnk data shows that the U.S. spot Bitcoin ETF saw a net outflow of $267.64 million yesterday, which is this week on Monday.

During the last trading week (Eastern Time from May 27 to May 30), the Bitcoin spot ETF had a net outflow of $157 million. The Bitcoin spot ETF with the highest net inflow last week was Blackrock's Bitcoin ETF IBIT, with a weekly net inflow of $584 million, bringing IBIT's historical total net inflow to $48.57 billion. The second highest was Grayscale's Bitcoin Mini Trust ETF BTC, with a weekly net inflow of $19.81 million, currently totaling $1.4 billion in historical net inflow. The Bitcoin spot ETF with the largest net outflow last week was Ark Invest and 21Shares' ETF ARKB, with a weekly net outflow of $282 million, currently totaling $2.44 billion in historical net inflow.

We believe that the significant differentiation in U.S. Bitcoin spot ETFs at the beginning of June reflects the strategic adjustments of institutional investors and changes in market sentiment. Although Blackrock's IBIT maintains its leading position with a net inflow of $584 million for the week, the overall market has begun to see net outflows (with $157 million last week and $267 million this week), indicating an increased tendency for short-term capital to seek safety.

Blackrock's IBIT has reached a historical total net inflow of $48.57 billion, and its continuous ability to attract capital is attributed to its low fee rate (0.12%-0.25%) and institutional capital allocation needs, especially as the internal increase of IBIT by Blackrock's funds has strengthened market confidence. However, compared to the previous weeks' high inflow of $842 million, the recent slowdown in growth may suggest that some investors are taking profits at high Bitcoin prices.

Grayscale achieved a net inflow of $19.81 million through its BTC Mini Trust, which may be related to its fee reduction (from 1.5% to 0.3%) and product structure adjustments, but this scale is far from sufficient to reverse the long-term outflow trend of GBTC (with historical net outflows exceeding $1.88 billion). In contrast, Ark Invest's ARKB saw a net outflow of $282 million for the week, highlighting the vulnerability of small and medium-sized institutional ETFs during liquidity tightening periods, as its high fee rate (0.21%) and shrinking market share exacerbate capital flight.

It is noteworthy that the fund flows of ETFs and Bitcoin prices form a negative feedback loop. The current continuous net outflows may reflect a repricing of market expectations regarding the Federal Reserve's monetary policy or be related to regulatory dynamics (such as the SEC's tightening of custody reviews). If the macro environment does not improve, short-term capital outflow pressure may further suppress Bitcoin prices, prompting investors to turn to more cost-effective leading ETF products.

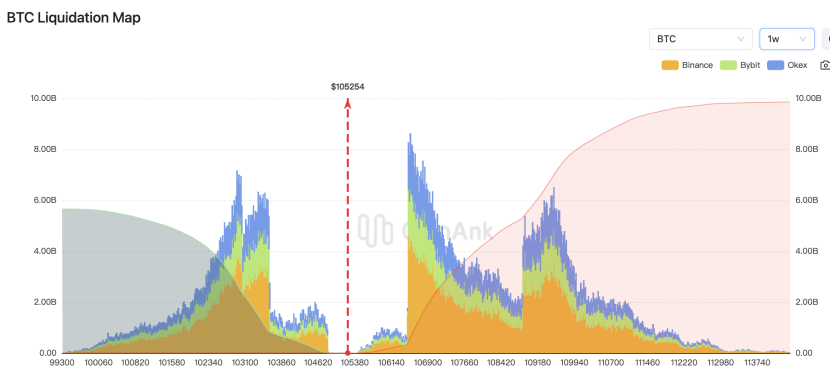

4. BTC Liquidation Map Data.

CoinAnk liquidation map data shows that if BTC breaks through $112,000 to create a new historical high, the cumulative short liquidation intensity on mainstream CEXs will reach $9.6 billion. Conversely, if Bitcoin falls below $100,600, the cumulative long liquidation intensity on mainstream CEXs will reach $5.43 billion.

We believe that the current liquidation thresholds and intensity distribution of Bitcoin reveal the risk structure of the derivatives market. Data from June 2025 indicates that if BTC breaks through $112,000, the short liquidation intensity will reach $9.6 billion, which is more than ten times the intensity of $842 million corresponding to the $88,000 level in March 2025, indicating an exponential expansion of market leverage and risk exposure. Conversely, falling below $100,600 will trigger $5.43 billion in long liquidations, which, although lower than the corresponding short scale at the same time, is still significantly higher than early data, reflecting that the accumulation of long positions at key support levels may exacerbate downside risks.

The core of liquidation intensity lies in the potential severity of liquidity shocks, rather than the actual amount to be liquidated. High-intensity short liquidations may trigger a "short squeeze" effect, where prices break through resistance levels and trigger a chain of stop-loss orders, accelerating market upward movement; while long liquidations are prone to form a negative feedback loop of panic selling. Currently, the long-short threshold has narrowed to about $11,400, highlighting the intense competition in price-sensitive ranges, where any directional breakout may lead to severe volatility due to liquidity waves.

It is important to note that the dynamic adjustment of the market leverage structure has continuously raised the liquidation thresholds. Compared to the $104,000 breakthrough in January 2025 corresponding to a short intensity of $260 million, the current data has increased 37 times, reflecting both an increase in investor risk appetite and a need for heightened vigilance regarding systemic risk accumulation. It is recommended to pay attention to liquidity verification after price breakouts; if the actual liquidation volume is significantly lower than predicted, it may indicate a substantial improvement in market depth, while the opposite may trigger price overshooting.

5. Key Macroeconomic Events and Crypto Market Highlights and Interpretations for This Week.

CoinAnk data shows:

June 3: Binance Alpha and Binance Contracts will launch Bondex (BDXN);

The re-staking protocol YieldNest plans to initiate TGE;

June 5: The SEC will hold a conference on emerging trends in asset management, with representatives from Blackrock and other institutions attending;

June 6: The U.S. will release the adjusted non-farm employment population and unemployment rate data for May.

From June 2 to June 8, many Federal Reserve officials will also be making speeches.

We believe that from the perspective of market dynamics and the macro environment, a series of events at the beginning of June 2025 will impact the crypto market in the following three ways:

Local stimulation from new project launches and protocol upgrades; Binance's launch of BDXN tokens and contract trading on June 3, along with an airdrop activity to attract user participation, may temporarily boost market activity, but caution is needed regarding the volatility risks brought by high-leverage trading of new assets. On the same day, YieldNest will initiate its token generation event (TGE), and if its re-staking mechanism is successfully implemented, it may inject liquidity into the DeFi sector, but the actual utility needs to be observed based on project progress.

Structural impacts from regulatory and institutional movements: The SEC's asset management conference on June 5 involves traditional institutions like Blackrock, and if the conference releases positive signals regarding crypto assets (such as spot ETFs), it may boost market confidence; however, if it emphasizes tightening compliance, it may suppress speculative sentiment. The SEC's previous stance on the decision regarding ETF physical redemptions remains a key variable.

Macroeconomic data dominating market sentiment: The non-farm employment data for May and the intensive speeches from Federal Reserve officials on June 6 are core variables. If non-farm employment exceeds expectations (similar to the 272,000 in May 2024), it may strengthen expectations for the Federal Reserve to delay interest rate cuts, leading to a stronger dollar and pressure on risk assets. Conversely, if the data is weak (such as an unemployment rate rising above 4%), it may alleviate concerns about liquidity tightening, benefiting the crypto market. Additionally, if Federal Reserve officials lean towards a "hawkish" stance, it will further amplify market volatility.

Comprehensive impact: Short-term project benefits may trigger localized market movements, but the overall direction of the market still depends on macro data and policy expectations. Investors need to be cautious of severe volatility before and after the release of non-farm data and pay attention to whether the SEC conference releases signals of regulatory framework clarification, which may provide key support for medium to long-term capital inflows into the crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。