Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

RWA Market Performance

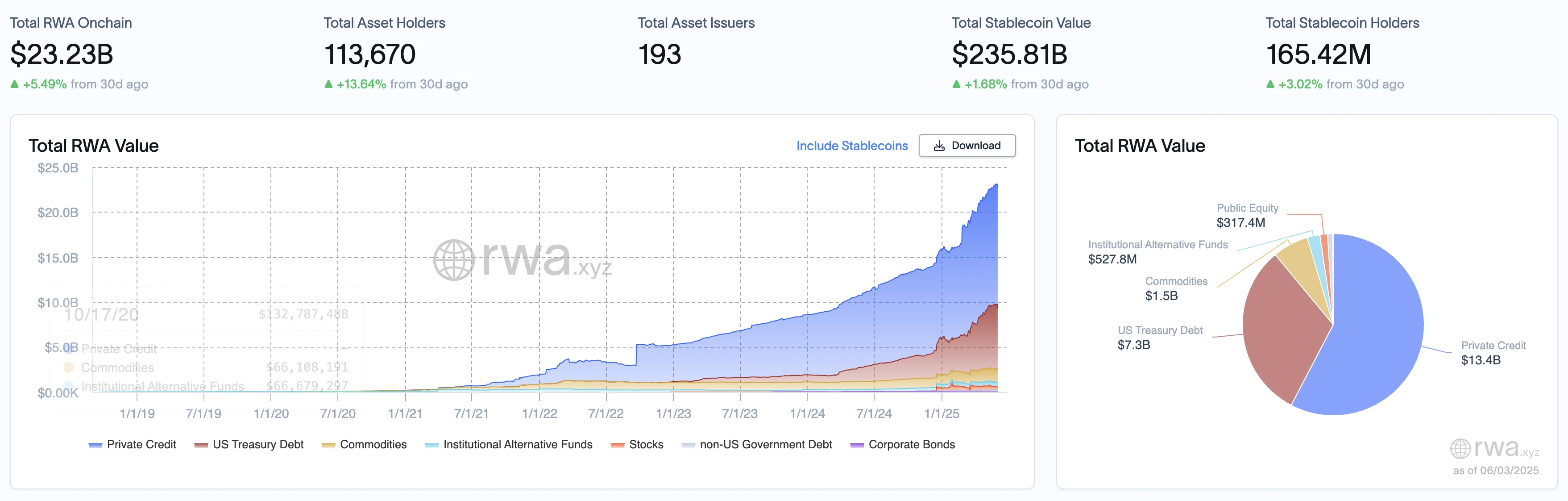

According to the latest data from RWA.xyz, as of June 3, 2025, the total on-chain value of RWA reached $23.23 billion, an increase of approximately 1.17% from $22.96 billion on May 27. The total number of on-chain asset holders grew significantly from 102,846 to 113,670, a rise of 10.54%. The number of asset issuances increased from 192 to 193. Meanwhile, the total value of stablecoins slightly rose from $234.76 billion to $235.81 billion, an increase of 0.45%; the number of stablecoin holders also grew from 164.34 million to 165.42 million, a growth of 0.66%.

In terms of asset categories, Private Credit continues to dominate, with its value increasing from $13.3 billion to $13.4 billion. Although its proportion has slightly adjusted, it remains the core component of the current RWA ecosystem. The growth of US Treasury Debt is more pronounced, rising from $7.1 billion to $7.3 billion, with its proportion steadily increasing, indicating a growing market demand for safe assets.

Commodity assets remained stable at $1.5 billion; Institutional Alternative Funds grew from $518.3 million to $527.8 million, showing a continuous upward trend despite limited growth. Notably, public equity assets were explicitly disclosed for the first time this week at $317.4 million, indicating that this category may begin to receive more attention.

Trends (compared to last week)

Private credit assets continue to grow, indicating a solidified dominant position in the on-chain asset system. The increase in US Treasury assets is relatively more pronounced, with a steady rise in proportion, reflecting a shift in investor risk preference towards defensive assets in the current global macro environment. Small asset categories like commodities and alternative funds maintain slight growth, showing a persistent demand for diversified asset allocation and hedging from institutions. The separate disclosure of public equity assets signifies an increased emphasis on tracking and transparency by the platform, which may become an important direction for the expansion of RWA assets in the future.

In summary, this week, RWA on-chain assets maintained an overall stable growth trend (continuing for several weeks), with an investment structure centered around a combination of "high yield + robust defense." It is recommended that investors continue to focus on private credit opportunities while gradually increasing allocations to US Treasury, alternative funds, and other low-volatility assets; for newly disclosed categories like stocks, maintaining medium to long-term tracking is also advisable to explore their development potential and allocation value within the RWA structure. Overall, the strategy should dynamically adjust the asset structure based on risk control to achieve a balance between stable returns and long-term layout.

Key Events Review

US Senate may vote on GENIUS Stablecoin Bill before June 9

The US Senate is currently discussing amendments to the bipartisan GENIUS Bill, with a vote possible before June 9.

Market News: BlackRock plans to purchase 10% of Circle Internet's IPO shares

BlackRock plans to subscribe to about 10% of Circle's proposed IPO shares, indicating its high confidence in the stablecoin market. Circle, the issuer of USDC, plans to raise up to $624 million through this IPO, which has received a positive market response and is expected to be priced on June 4.

BIS Report: Stablecoins impact US short-term Treasury rates, may weaken central bank policy tools

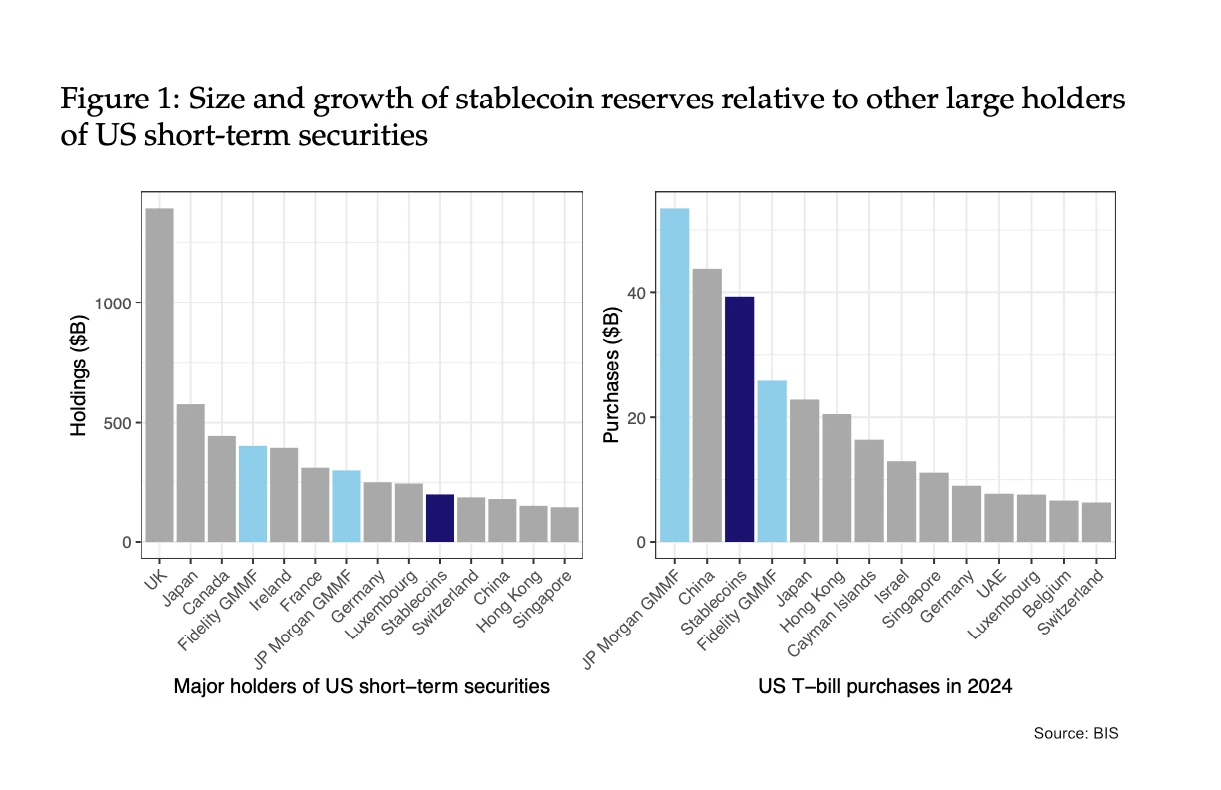

The Bank for International Settlements (BIS) latest research indicates that the stablecoin market's influence on US Treasury rates is becoming increasingly significant, especially for short-term Treasuries. The report states that in 2024, stablecoin issuers became the third-largest net buyers of US Treasury bills, surpassing several countries, including China. BIS estimates that if stablecoin issuers sell $3.5 billion in Treasury bills, it would raise short-term rates by 6-8 basis points, while equivalent purchases would only lower rates by about 3 basis points.

The study also warns that the continued expansion of stablecoins may weaken the Federal Reserve's ability to control interest rates and could even pose systemic financial risks. BIS points out that this situation is similar to the "Greenspan Paradox" of the early 2000s, when a surge in foreign debt holdings rendered Federal Reserve policies ineffective. Additionally, some governments may indirectly intervene in interest rates by encouraging stablecoin investments in Treasury bonds, which could affect central bank independence and trigger further discussions on regulation and stability.

Sony considers issuing stablecoin for internal finance and consumer payments

According to fintech expert Simon Taylor, Sony is exploring the possibility of issuing its own stablecoin for internal financial management and consumer payment scenarios. During its latest Investor Day event, Sony stated that this move aims to enhance the efficiency of fund operations and reduce cross-border costs while aligning with the growing trend of crypto payments.

Sony has not yet disclosed specific implementation plans or regulatory responses, but this move signifies a further deepening of the integration between large tech companies and digital finance. Taylor noted that the stability and efficiency of stablecoins make them ideal tools for corporate operations and user payments, and Sony's entry may drive more traditional companies to pay attention to this field.

Dubai Land Department launches property tokenization platform Prypco Mint based on XRP Ledger

The Dubai Land Department (DLD) has partnered with real estate fintech company Prypco and infrastructure provider Ctrl Alt to launch the first property tokenization platform, Prypco Mint. This platform will tokenize property ownership contracts and synchronize with official real estate records, deployed on the XRP Ledger blockchain. This initiative is part of a government-supported project, aiming to tokenize 7% of Dubai's real estate market, equivalent to $16 billion, by 2033. The platform currently only supports transactions in UAE Dirhams and is limited to UAE ID holders, with plans to expand global access in the future. Zand Digital Bank serves as its banking partner, with oversight from the Central Bank of the UAE, Dubai Virtual Assets Regulatory Authority (VARA), and the Dubai Future Foundation's real estate sandbox.

Hot Project Updates

Ondo Finance (ONDO)

Official Website: https://ondo.finance/

Introduction: Ondo Finance is a decentralized finance protocol focused on structured financial products and the tokenization of real-world assets. Its goal is to provide users with fixed-income products, such as tokenized US Treasury bonds or other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, high-liquidity assets while maintaining decentralized transparency and security. Its token ONDO is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application scope within the DeFi ecosystem.

Recent Updates: On May 28, Ondo Global Markets announced that it will tokenize and put NYSE and NASDAQ stocks and ETFs on-chain, featuring the following characteristics:

24/7 Accessibility: Trading available around the clock.

Margin Trading Support: Usable for leveraged trading.

DeFi Composability: Seamless integration with decentralized finance protocols.

On May 29, Ondo announced Zodia custody, now supporting USDY, with support for OUSG (tokenized US Treasury fund) coming soon. Additionally, on the evening of May 30, the Ondo website (ondo.finance) underwent approximately 30 minutes of maintenance to upgrade its infrastructure.

Plume Network

Official Website: https://plumenetwork.xyz/

Introduction: Plume Network is a modular Layer 1 blockchain platform focused on the tokenization of real-world assets (RWA). It aims to transform traditional assets (such as real estate, artwork, equity, etc.) into digital assets through blockchain technology, lowering investment barriers and enhancing asset liquidity. Plume provides a customizable framework that supports developers in building decentralized applications (dApps) related to RWA, integrating DeFi and traditional finance within its ecosystem. Plume Network emphasizes compliance and security, committed to providing solutions that bridge traditional finance and the crypto economy for institutional and retail investors.

Latest Updates: On May 28, Plume announced the official launch of Plume Genesis (the first phase of the mainnet), allowing users to borrow, earn yields, and stake RWA through Morpho Labs on the first day. On the same day, Plume launched Plume Starboard (a tool to track and reward community contributors through the Galxe platform). Users can enhance their rankings and earn rewards by participating in ecosystem tasks (such as staking and providing liquidity).

On May 29, Plume Network issued a statement mourning the unexpected passing of its co-founder Eugene. The official statement noted that Eugene was a talented, curious, and passionate leader who made significant contributions to the development of Plume. The team is in shock and grief, pledging to continue advancing Eugene's vision.

Related Articles Recommended

RWA Weekly Report: Summarizing the latest insights and market data in the industry.

《Asset Transformation and the Ecological Leap of Coinsidings under the RWA Boom》

From the implementation of RWA in Dubai's real estate to the expansion of Coinsidings' global tourism asset chain, we are witnessing a new narrative about asset freedom and equitable distribution.

《Hong Kong, Major Positive News! This Sector Soars Collectively!》

The A-share digital currency sector has soared collectively, with Huaxi Securities, Guohai Securities, and China Merchants Securities discussing the impact of the Hong Kong stablecoin bill on the market outlook.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。