Original Authors | Konstantin Lomashuk, Artem Kotelskiy

Compilation | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

Editor's Note: Recently, U.S. publicly listed companies have begun to "reassess" Ethereum. SharpLink Gaming plans to invest up to $1 billion in purchasing ETH as a strategic reserve through stock sales; BTCS has also purchased 3,450 ETH for approximately $8.42 million. These movements may be sending a clear signal: ETH is transitioning from "on-chain fuel" to "enterprise-level strategic asset."

From a developer community experimental platform to the infrastructure of DeFi, and now to long-term allocations in corporate finance, Ethereum's role is undergoing a profound transformation. In this wave of value reassessment, how should we understand the technological logic and economic model behind ETH?

Odaily Planet Daily has translated and refined the in-depth article "Ethereum Roadmap: Becoming the Root Chain of the 'World Computer'" co-authored by early Ethereum investor and Lido co-founder Konstantin Lomashuk and Cyber•Fund research director, Princeton math PhD Artem Kotelskiy. This article systematically outlines Ethereum's development trajectory, protocol evolution, scaling paths, and its positioning in the Rollup era, attempting to answer a key question: Why is ETH worth being "held long-term"?

Note: Due to the length of the original text, the translator has made some cuts and optimizations to enhance readability without affecting the original meaning.

DeFi: Ethereum's First Product-Market Fit (PMF)

From its inception, Ethereum has aimed to create a globally shared, trustless computing platform. After ten years of development, it has evolved from an early technical experiment into the core foundation of decentralized finance (DeFi), blockchain space markets, and on-chain application ecosystems.

To understand how ETH has reached its current state, we must start from a key turning point—the product-market fit (PMF) of DeFi. This occurred during the bear market from 2018 to 2020, as protocols like ERC20, Uniswap, DAI, Aave, and Compound emerged, transforming Ethereum into a self-custodial, composable, permissionless financial system. The explosion of DeFi was a natural alignment of technological innovation and market demand.

The "DeFi Summer" of 2020 marked the peak of this trend, with locked assets rapidly increasing, and on-chain transaction volumes surpassing centralized exchanges for the first time, revealing the network value of ETH. However, the subsequent high transaction fees exposed Ethereum's scalability bottlenecks and foreshadowed future technological transformations.

The Value Turning Point of ETH: From EIP-1559 to The Merge

If DeFi showcased Ethereum's practical value, then the two upgrades of EIP-1559 and The Merge endowed ETH with a long-term value logic.

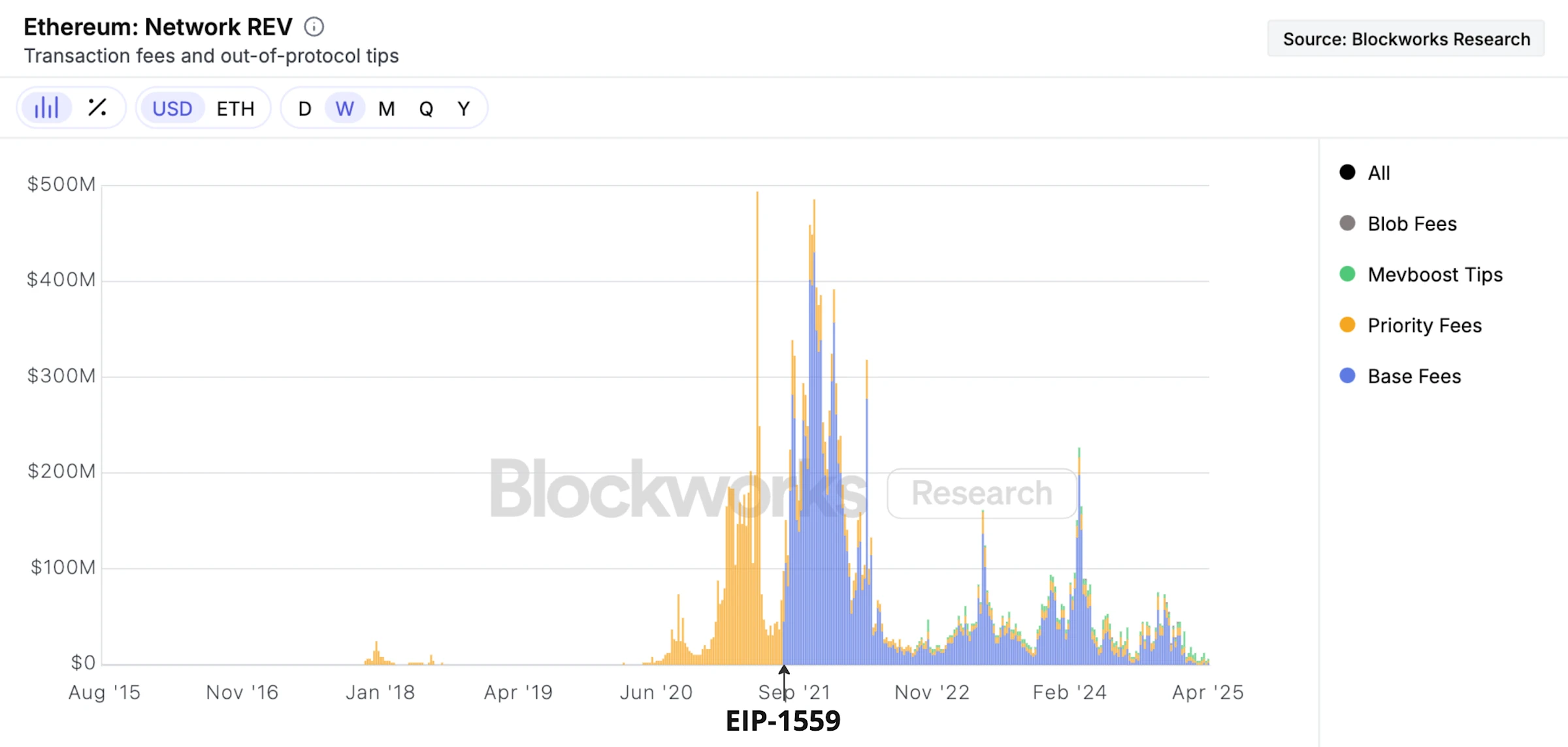

In 2021, EIP-1559 was introduced, fundamentally changing Ethereum's fee mechanism. The original "priority gas auction" model was replaced by a base fee, with the portion of fees paid by all users no longer going to miners but being directly burned. This means that the more active the network, the more ETH is burned, reducing inflationary pressure and strengthening the value support of ETH.

The indigo section shows that ETH began to achieve "value recirculation" through the burn mechanism.

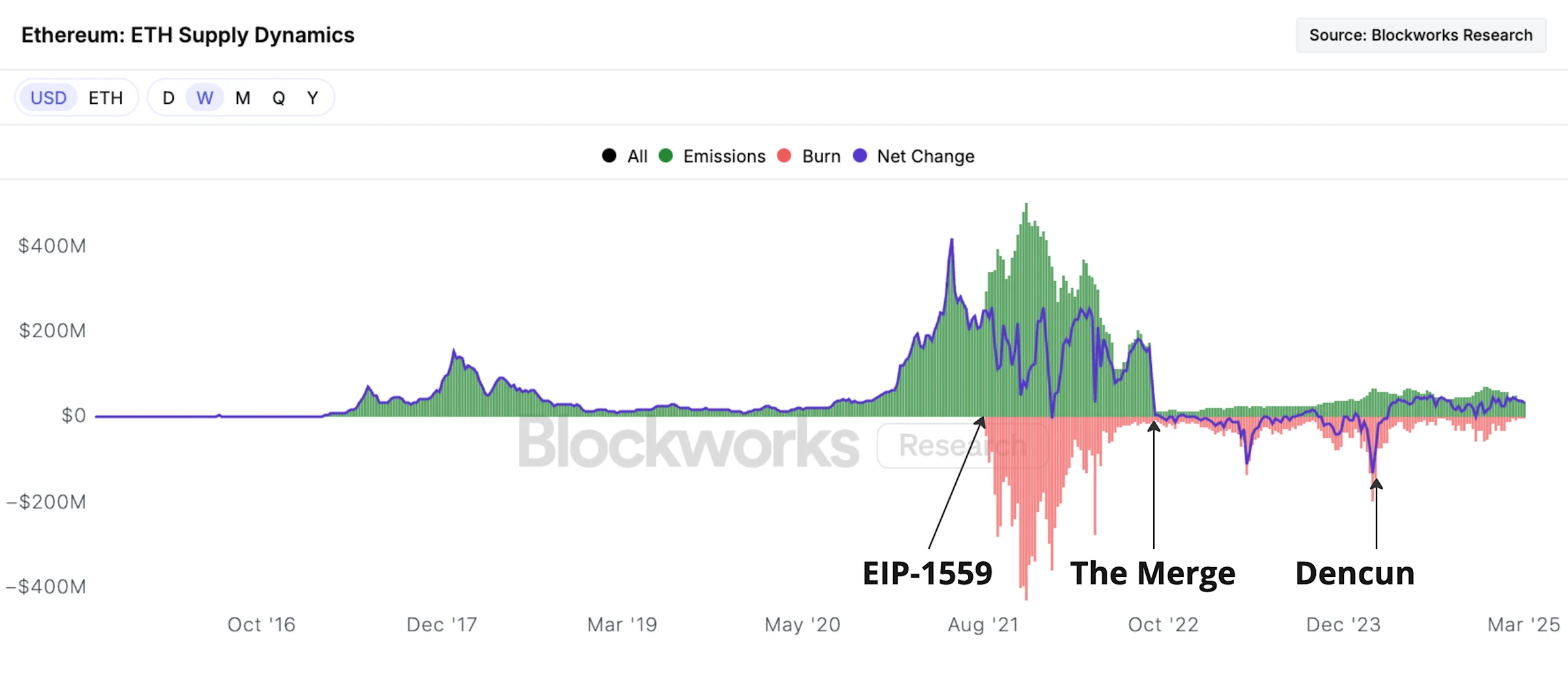

In September 2022, Ethereum completed a historic upgrade: the consensus mechanism switched from proof-of-work (PoW) to proof-of-stake (PoS), marking the official implementation of "The Merge." This transformation was technically challenging yet crucial—it reduced Ethereum's energy consumption by 8,000 times and lowered the annual issuance rate required for network security from 4% to less than 1%.

After this, ETH's "net inflation rate" turned negative for a considerable period.

Green represents the weekly new issuance of ETH, orange represents the weekly burn of ETH, and blue represents the net difference between the two.

Long-Term Belief in the Rollup Era: Cooperation or Parasitism?

Scalability is Ethereum's core challenge. Faced with the trilemma of decentralization, security, and scalability, Ethereum ultimately chose the Rollup solution. Rollups execute transactions off-chain, only writing state changes and data to the main chain, ensuring the security of the main chain while significantly increasing transaction throughput.

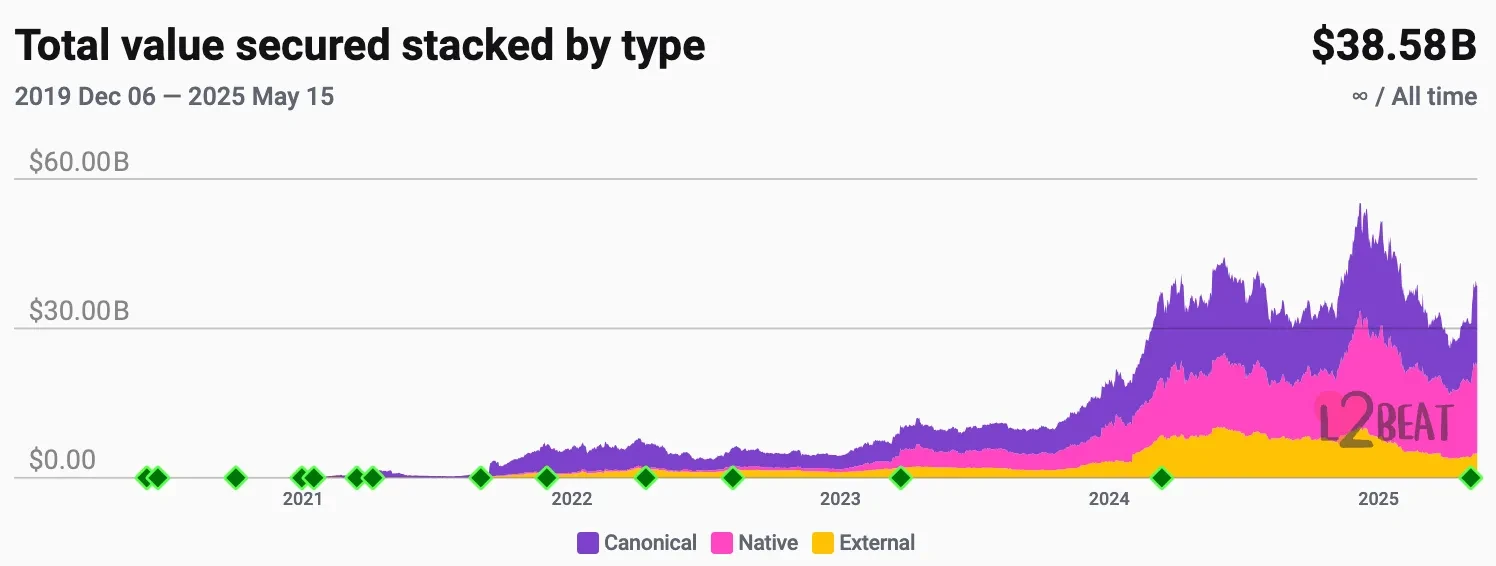

This also transformed Ethereum from a mere "execution platform" to a "security layer + data availability layer," forming a "Rollup-centric" scaling route.

However, Rollups are not just a technical revolution; they have also changed the logic of ETH's value flow. In the past, users directly paid fees to the main chain, but now most transactions are completed through Rollups, reducing the direct transaction demand on the main chain. Rollups earn revenue by reselling block space, but since the Cancun upgrade, their direct fee expenditures to the main chain have significantly decreased, sparking discussions about "parasitism." In reality, Rollups serve more as "business extensions" of Ethereum, relying on the main chain's security and data services, bringing in more users and transactions.

Although the transaction demand on the main chain has decreased, the expansion and upgrading of the main chain are still actively progressing, aiming to increase processing capacity by a hundredfold or even a thousandfold in the coming years, providing stronger security and data support for L2. Rollups and the main chain together form a complementary ecosystem, both dividing labor and collaborating, laying the foundation for Ethereum's sustainable development in the future.

Current Indicators of Ethereum: Crisis and In-Depth Factor Analysis

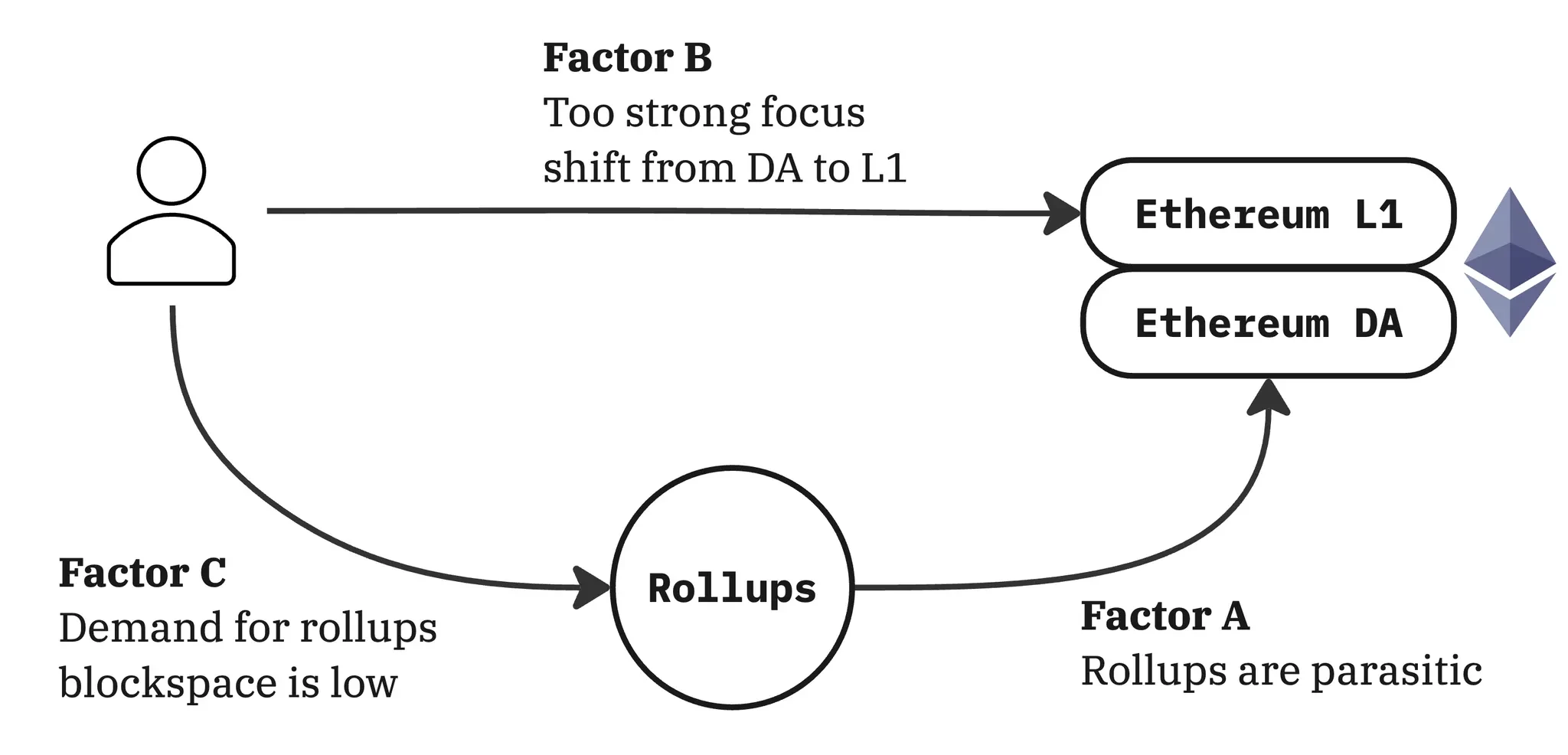

Since the collapse of FTX in 2022, the overall crypto industry has maintained growth, but ETH has significantly lagged behind Bitcoin (BTC) and Solana (SOL). The price of ETH is highly correlated with Ethereum network fees, and since 2022, fee growth has been sluggish, especially compared to the 2018-2022 cycle and Solana's performance in this cycle, revealing significant revenue pressure. The main reasons are threefold:

Factor A: Rollup "Parasitism"

While Rollups profit from user fees, they have not yet returned sufficient value to the Ethereum mainnet.

From the data, this factor exists, but its current impact on overall revenue is relatively small. The total weekly revenue of Rollups is only in the millions of dollars, and their fees are low, partly because Rollup sequencers can support gas limits far exceeding those of the mainnet, allowing them to avoid charging users high fees like L1 networks.

More importantly, it is still early to question whether Rollups have not given back to the mainnet. In fact, the Ethereum community has "unexpectedly" adopted a strategy of providing data availability (DA) space to Rollups for free to attract as many aggregation layers as possible; this "subsidy" was the correct way to build the ecosystem in its early stages.

Factor B: Shift of L1 Strategic Focus to DA, Marginalization of Mainnet Development

Since the initiation of the Rollup route, Ethereum's strategic and user growth focus has almost entirely leaned towards Rollups, while the expansion and maintenance of the mainnet have been relatively neglected.

This bias is indeed true to some extent. In addressing the high fees of the mainnet, Ethereum chose to bet its future on Rollups, and this "all-in" strategy overlooked the potential of L1 itself. Looking back now, as the fragmentation issues of Rollups gradually emerge and we have found feasible L1 scaling paths (such as access lists and the development of zkEVM), it seems that the strategic underinvestment in L1 may have been excessive.

However, it must be acknowledged that this judgment is based on hindsight. The Rollup route was a pragmatic response to the congestion issues of the mainnet at the time, while solutions like zkEVM were still far from realization. Therefore, it was difficult to allocate resources reasonably between L1 and DA at that time.

Moreover, even if we now have a clear path to increase L1 gas limits by 100 times, achieving performance above 10,000 TPS and supporting a comprehensive public chain computing platform will still inevitably require some form of horizontal sharding. In this context, choosing a Rollup-first strategy at that time was still a reasonable decision.

Factor C: Rollup's DA Demand Has Not Surpassed Mainnet's DA Supply

This is the most critical and overlooked deep issue: the demand for data availability space (DA) from Rollups has not yet substantially exceeded Ethereum's supply.

Rollup sequencers are very efficient in packaging transactions for upload to the mainnet, achieving extremely high compression rates, resulting in them consuming far less blob space than theoretical values. Additionally, some user activities in this cycle (such as meme coin trading) have also been diverted to Tron and Solana.

Before the Pectra upgrade (May 7, 2025), with an average of 3 blobs per block, Ethereum's DA supply was approximately 210 TPS. Until November 2024, this supply consistently exceeded market demand. Even after demand increased, the blob gas prices indicated that they had not risen significantly, suggesting that demand had not yet outstripped supply. Recently, Pectra has doubled the blob target to 6 per block, further increasing DA supply, which far exceeds actual demand.

Therefore, Factor C is fundamentally the variable that affects Factors A and B. Once the demand for blob space from Rollups truly exceeds supply, blob fees will enter a market discovery phase, leading to a qualitative change in the overall fee structure of the Ethereum network.

How to Assess the Value of ETH? The Business Logic of Ethereum

Is ETH a productive asset or a currency? We firmly believe that ETH should primarily be a productive asset and only secondarily a currency.

The reason lies in the fact that Ethereum's strongest moat comes from its technological advantages: a trust foundation and stability tested over years, neutrality and censorship resistance brought by decentralization, a leading DeFi ecosystem, a high-quality research and developer community, and a robust network activity assurance mechanism. Ethereum is truly an unstoppable "global computer."

Secondly, as a productive asset reliant on technological adoption, the monetary value of ETH can be solidified and strengthened. While ETH as a currency can more easily transcend technological iteration cycles, the most prudent path is to first establish Ethereum as a technological platform, ensuring the sustainability of its economic model, after which its currency attributes will naturally emerge. Conversely, relying solely on "hype around ETH as a currency" cannot build a solid foundation.

In short, the price of ETH consists of three parts: the discounted value of future fees, the currency premium (as a store of value, medium of exchange, or even unit of account), and the speculative premium (including cultural and meme value). Although the latter two have a significant impact, to strengthen all three, the key is to maximize the underlying network revenue, which is the foundation of ETH's value.

Ethereum's Long-Term Rollup Strategy: Why It Is Correct? The Truth About the Competition with Solana

The reason Ethereum firmly chooses a "Rollup-centric" scaling route is clear: it is the only architectural design that can balance security, scalability, and neutrality.

From a technological supply perspective, Ethereum is currently the most secure and decentralized smart contract platform. Through validating bridges and data availability layers (DA), Ethereum can "wholesale" the security of the main chain to Rollups, helping them build their own chains without needing to establish a new trust system.

From a market demand perspective, users ultimately do not care which chain they are using—they only care about "where transactions are the cheapest and safest." In the long run, the most rational choice is to become a Rollup, buying security, DA, and consensus, directly connecting to Ethereum. This will naturally create a market convergence phenomenon: Rollups will build their services around Ethereum's "neutral ledger," rather than dispersing to other isolated chains.

Ethereum vs. Solana

Based on fee revenue in 2024, some believe Solana has begun to surpass Ethereum in the blockchain space market. However, Solana's strategy centered on hardware expansion carries high risks, with the network experiencing periodic overloads. If blockchains are to realize their full potential, namely the large-scale migration of financial infrastructure on-chain, Solana will ultimately need to turn to sharding for scalability, while Ethereum is already far ahead in terms of security, Rollup infrastructure, and ecosystem adoption.

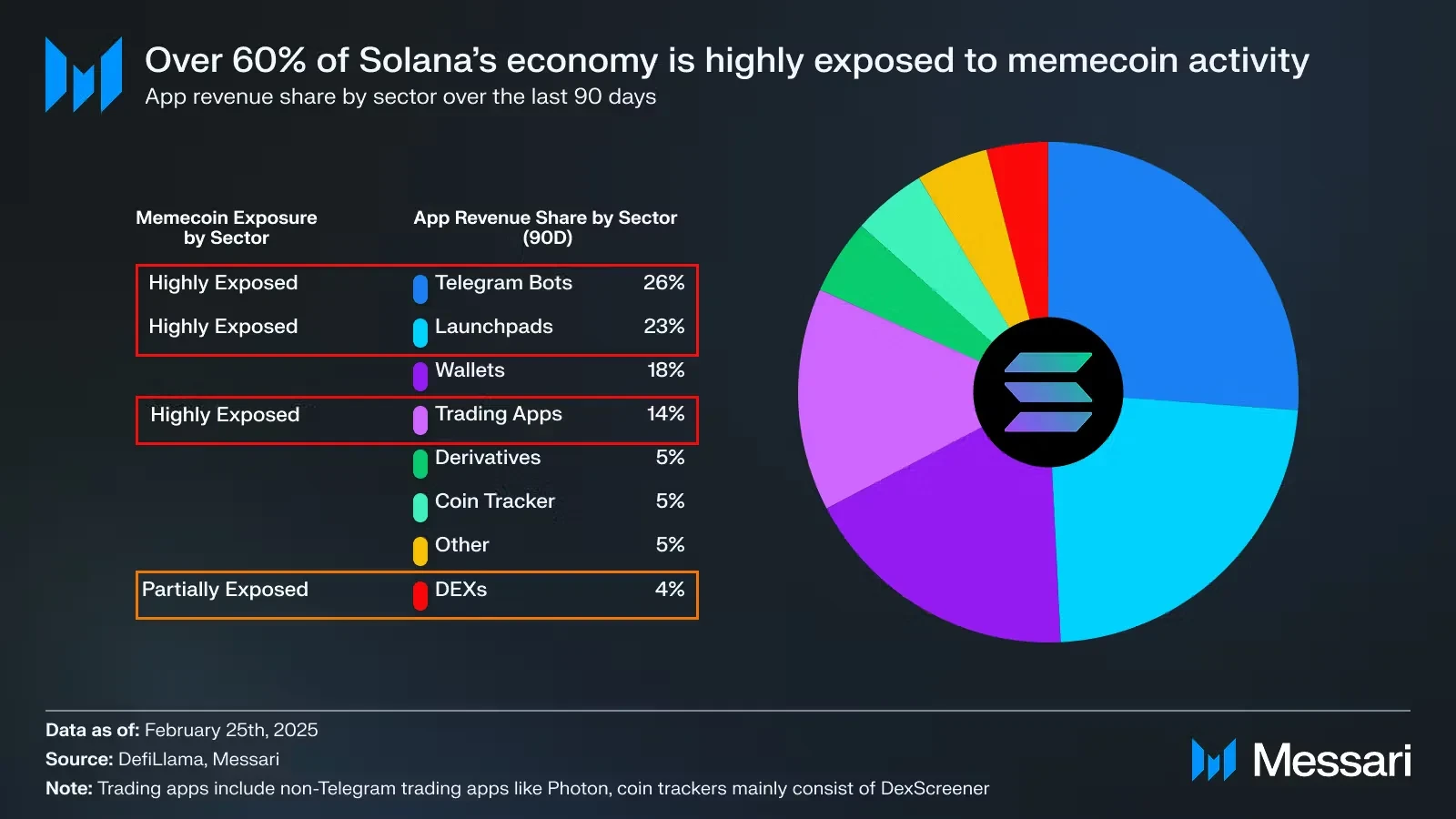

More critically, most on-chain activities on Solana stem from the Memecoin craze. Data shows that such transactions once accounted for over 50% of its DEX trading volume. However, Memecoins are a short-term, zero-sum game phenomenon—once the hype fades, their "high-income" myth is hard to sustain.

In contrast, Ethereum focuses on high-retention scenarios like DeFi, where these protocols are driven not by frenzied speculation but by the on-chain migration of real financial activities.

The most significant and important difference: Solana's validation nodes are centralized, while Ethereum has the most diverse staking network globally. This decentralization itself is the strongest moat.

Issues with the Rollup Strategy

If the Rollup route is correct, and Ethereum's long-term future is bright, why is ETH's price underperforming?

On a technical level, the biggest flaw of Rollups is the lack of default interoperability, leading to state fragmentation, which severely impacts user and developer experience.

On a commercial level, the key issue is that Ethereum has not clearly communicated the commercial strategy for Rollups:

Short-term adoption strategy: How to drive rapid growth for Rollups?

Long-term moat: Why won't Rollups turn to other data availability platforms?

The Commercial Strategy of Rollups: Expansion, Differentiation, and Moat

1. Ethereum should prioritize expansion and continuously provide ample and low-cost data availability (DA)

The technical network market in which Ethereum operates is highly competitive and rapidly changing, and the ultimate winner will enjoy strong network effects. In this environment, the correct strategy is to provide high-quality products and rapidly expand the user base at extremely low or even nearly free prices, which is the growth path of most successful tech networks.

Therefore, Ethereum must keep data availability (DA) prices low to minimize the entry barriers for Rollups. After the Cancun upgrade, Ethereum provided a capacity of 3 blobs, with supply exceeding demand in the short term, effectively suppressing prices. This strategy, although not intentionally designed, has achieved good results.

2. Solve Rollup interoperability to enhance user and developer experience

Interoperability is the biggest shortcoming of Ethereum in the Rollup era. Fragmentation severely affects users and developers; solving interoperability is key to unifying the experience and narrowing the gap with integrated chains, while also being crucial for building a liquidity moat.

The community is actively promoting solutions such as ERC-7683 for instant medium-scale asset cross-chain exchanges and 2-of-3 OP+ZK+TEE for hour-level large asset cross-chain bridges.

3. Differentiation strategy and moat construction

Ethereum needs to achieve differentiation in DA services to attract marginal Rollup customers while building a moat to lock in ecosystem clients.

The key moat comes from three major network effects: trust, liquidity, and composability. Currently, the demand for cross-Rollup composability is unclear, with the main value concentrated in trust and liquidity. These two aspects will naturally expand from Ethereum L1 to the Rollup ecosystem after solving interoperability.

In terms of trust, Rollups enjoy the highest security assurance through Ethereum DA, while independent chain security is weaker. The security of Rollups using Ethereum DA continues to strengthen, solidifying the moat.

In terms of liquidity, the institutional-level liquidity of Ethereum L1 is a crucial factor for Rollup selection. After connecting to Ethereum DA, Rollups can access the entire ecosystem's institutional liquidity, significantly enhancing capital efficiency and forming a solid moat.

Thus, the market will drive Rollups to use Ethereum DA to obtain the highest security and liquidity. Ethereum should strengthen these two advantages and attract institutional clients through branding and trust.

The Path of Value Recirculation: From "Maximizing Fees" to "Maximizing Value Carrying"

When Ethereum expands data availability (DA) to the million TPS level (e.g., through solutions like 2D PeerDAS), and the Rollup ecosystem is voluntarily and firmly bound to Ethereum DA, Ethereum will gain significant fee revenue.

At the main chain level, the widespread adoption of DeFi and enterprise applications will become the main driving force, while the popularity of Rollups will further amplify this effect. At the same time, Rollups will also pay fees for interoperability and settlement services, contributing further revenue.

At the DA level, the key to achieving a sustainable economy lies in raising the minimum blob price. The specific approach is to monitor the overall revenue of Rollups and set a reasonable minimum price, allowing Rollups to pass a certain proportion of value back to Ethereum.

For example, in the coming years, if Rollups capture the CeDeFi payment market, processing about 10,000 TPS with annual revenues in the billions, while Ethereum DA supply exceeds 10,000 TPS, the blob transaction fees, although not fully entering market price discovery, could be set at a minimum fee of 0.3 cents per DA transaction, potentially generating about $1 billion in annual revenue for ETH holders.

Further covering high-frequency trading markets, such as social, trading, and AI agent coordination, Rollup TPS could reach 30,000 levels, bringing DA fee revenue exceeding $10 billion, while transaction costs remain below one cent.

Such revenue is influenced by ETH prices and other factors; the minimum price needs to be dynamically adjusted, likely determined by community consensus, similar to today's gas limit mechanism. Future research will also need to delve into optimal pricing strategies for blobs, such as improving the correlation with Ethereum L1 fee markets. Additionally, as Ethereum transitions to zkEVM or RISC-V, new technologies like SNARK infrastructure will help enhance fee capture efficiency.

The key is that at this stage, we should not rush to extract value directly from transactions but should maximize support and promote high-value activities in Ethereum blocks and blob space. This will not only generate and enhance network effects but also help Ethereum seize the expanding block space market, solidifying its economic foundation. The path of value recirculation is therefore very clear.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。