Stablecoin payments totaled $94.2 billion from January 2023 through February 2025, according to a new industry study. The research, conducted by analytics firm Artemis alongside Castle Island Ventures and Dragonfly, tracked transactions from 31 payment companies to map the expansion of fiat-pegged cryptocurrencies in global commerce.

Source: Artemis on X.

The Artemis report highlights how monthly volumes surged 215% during the period, climbing from under $2 billion to $6.3 billion. Business-to-business (B2B) transactions emerged as the largest category, reaching a $36 billion annual run rate by February 2025. Card-linked payments followed at $13.2 billion annually, while peer-to-peer transfers plateaued at an $18 billion annual pace.

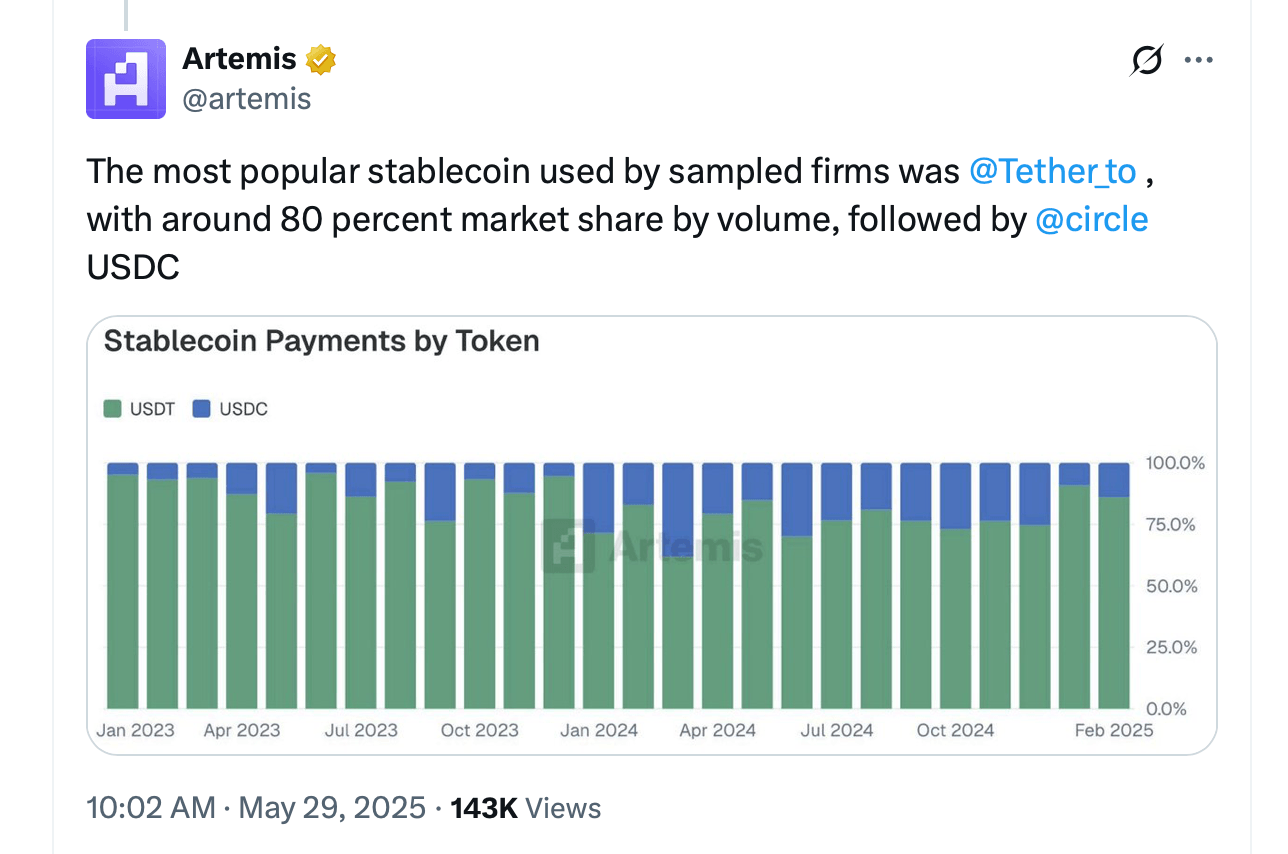

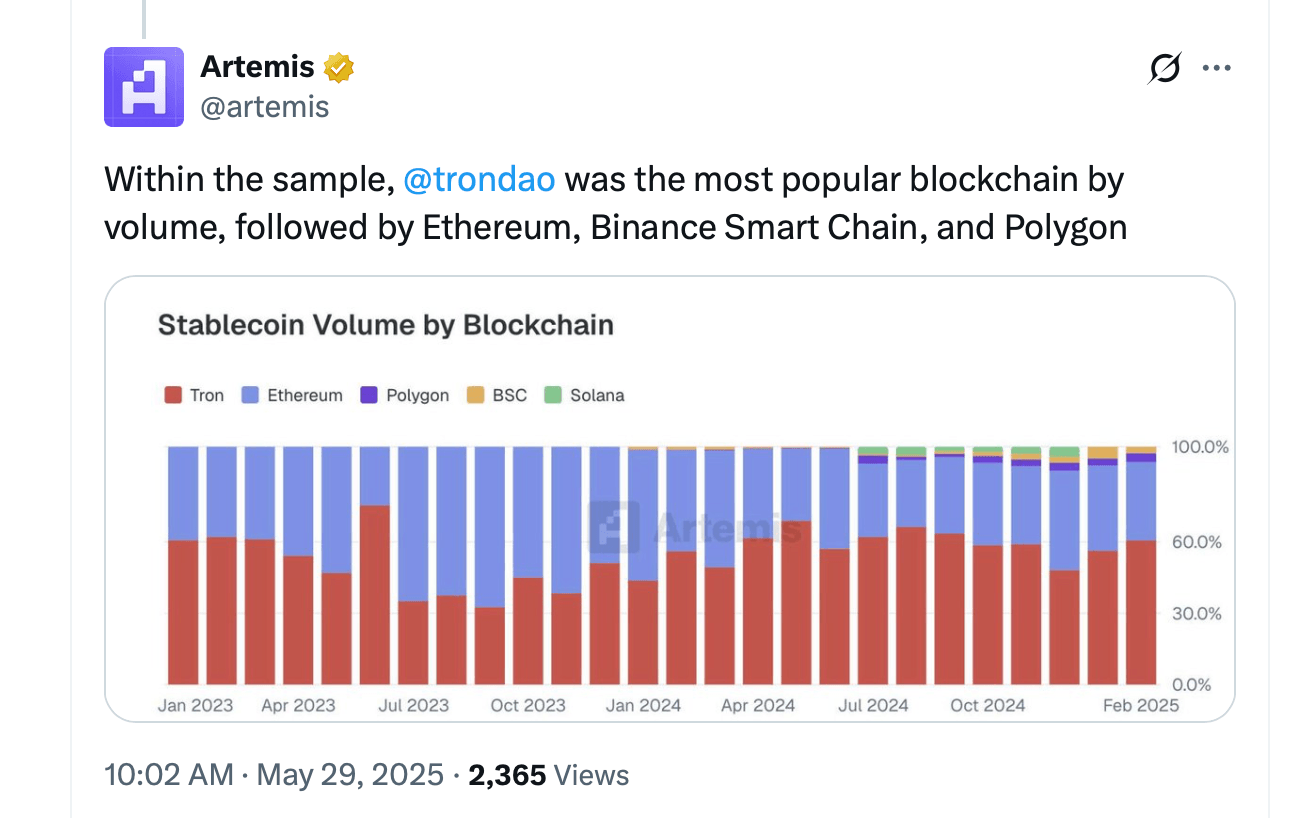

Tether’s USDT dominated stablecoin usage with approximately 80% market share among sampled firms. The report notes that Circle’s USDC accounted for most remaining volume. Tron was the most utilized blockchain for settlements, followed by Ethereum and Binance Smart Chain.

Source: Artemis on X.

“The most popular blockchains employed to settle customer flows, as a share of value sent, were Tron, followed by Ethereum, Polygon (Ethereum L2), and Binance Smart Chain,” the report’s authors explain. “This mirrors survey findings from our 2024 report which found that users preferentially used those same five blockchains, albeit with Ethereum being the most popular network.”

Regionally, the United States, Singapore, and Hong Kong originated the highest transaction volumes. Latin America and Africa showed particularly strong adoption of Tron and Tether‘s USDT for cross-border settlements. Prefunding services—advancing capital for instant settlements—grew notably, reflecting demand for liquidity solutions.

The report attributes this growth to stablecoins’ efficiency in treasury management and international payments. The findings signal stablecoins’ evolution from speculative assets to functional payment tools, especially for enterprises. Researchers documented transactions across B2B, consumer cards, remittances, and payroll use cases.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。