Original author: Jacob King

Original translation: zhouzhou, BlockBeats

Abstract: The author points out the significant influence and potential risks that entities like Tether, Bitfinex, and Strategy have on the actual adoption of Bitcoin.

Editor's Note: Recently, a Twitter article about Bitcoin and Tether sparked widespread discussion in the English community, with a single tweet garnering over 800,000 views. The author, Jacob King, takes on the role of a staunch Bitcoin bear, stating that the Bitcoin market is manipulated by "insiders" like Tether and Bitfinex, maintaining a facade of price stability through false demand, circular buying, and unlimited money printing. Jacob believes that the so-called "government and institutional entry" is a manufactured narrative, essentially a Ponzi scheme, and that once liquidity crises arise, the market will face a collapse.

The following is the original content (reorganized for readability):

The entire story of Bitcoin is a carefully orchestrated illusion, crafted by insiders to make you believe that governments and institutions are "fully participating"—leading you to think that the market's prosperity is driven by real demand.

But in reality, this is the largest bubble in human history, destined to become the most severe financial scandal ever.

Ask yourself: If Bitcoin is truly decentralized and that powerful…

Why do the same few forces always control the narrative, hold the wallets, and influence the laws?

It's all a smokescreen, and here is the evidence.

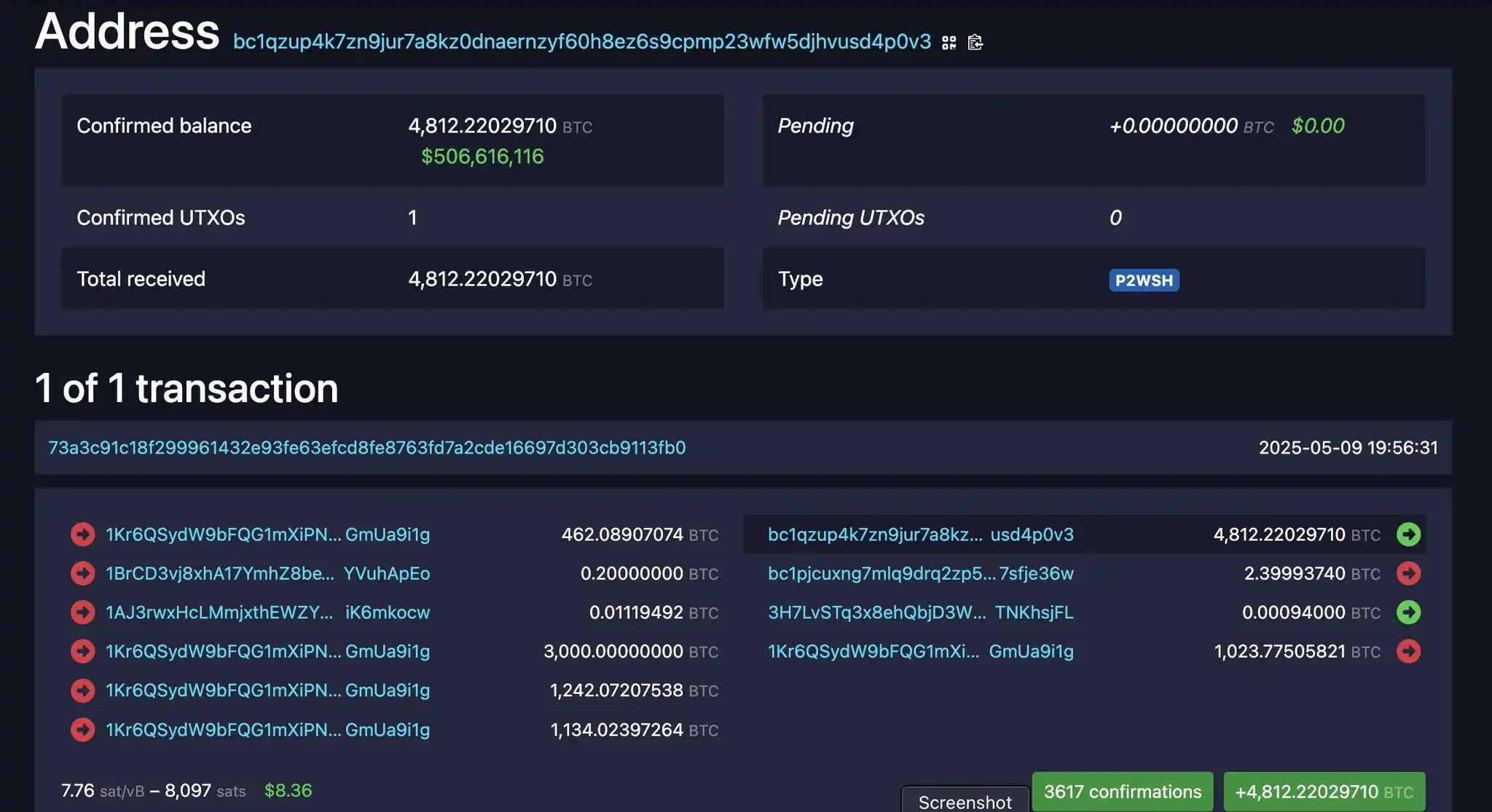

The so-called Bitcoin "investment" by El Salvador is a carefully manufactured illusion.

There is no evidence of any purchases; the latest blockchain data shows that of the 6,114 Bitcoins in their treasury, 6,111 were not bought at all—but were directly transferred from Bitfinex and Tether.

There is no doubt that they are behind it. By the way, Tether personally drafted all of El Salvador's Bitcoin-related legislation.

This is not "national adoption," but a liquidity laundering scheme disguised as government action, aimed at making retail investors believe, "If even the government is buying, you should too."

No wonder the corrupt Bukele is willing to cooperate; Tether bribes everything, treating El Salvador as a puppet.

Bukele reaps media exposure, Bitfinex gains liquidity, and Tether continues to survive.

And those who haven't kept up may not know: El Salvador has quietly abandoned its plan to adopt Bitcoin as legal tender because the entire experiment has completely failed. The Chivo wallet has effectively gone bankrupt and closed, with a usage rate plummeting by 98.9% after launch.

Not even Tether and its internal network can save it—because there is no real market demand.

Jack Mallers is a central figure in this circle—extremely closely related to the Tether-Bitfinex operational system.

His new company, Twenty One Capital, claims to be making large-scale Bitcoin investments. But on-chain data shows that as much as 14,000 Bitcoins (over $2 billion) come directly from Tether's reserves.

They claim there is significant market demand, but the only recorded investor in them is Tether—a company found to have lied to investors and committed fraud. Too suspicious…

This is not investment; it is internal accounting—yet another "shell company performance," part of this vast liquidity circus. Mallers' other company, Strike, has long been closely tied to Tether. It relies 100% on Tether for its payment transactions.

This is not innovation; it is a variant of monopoly.

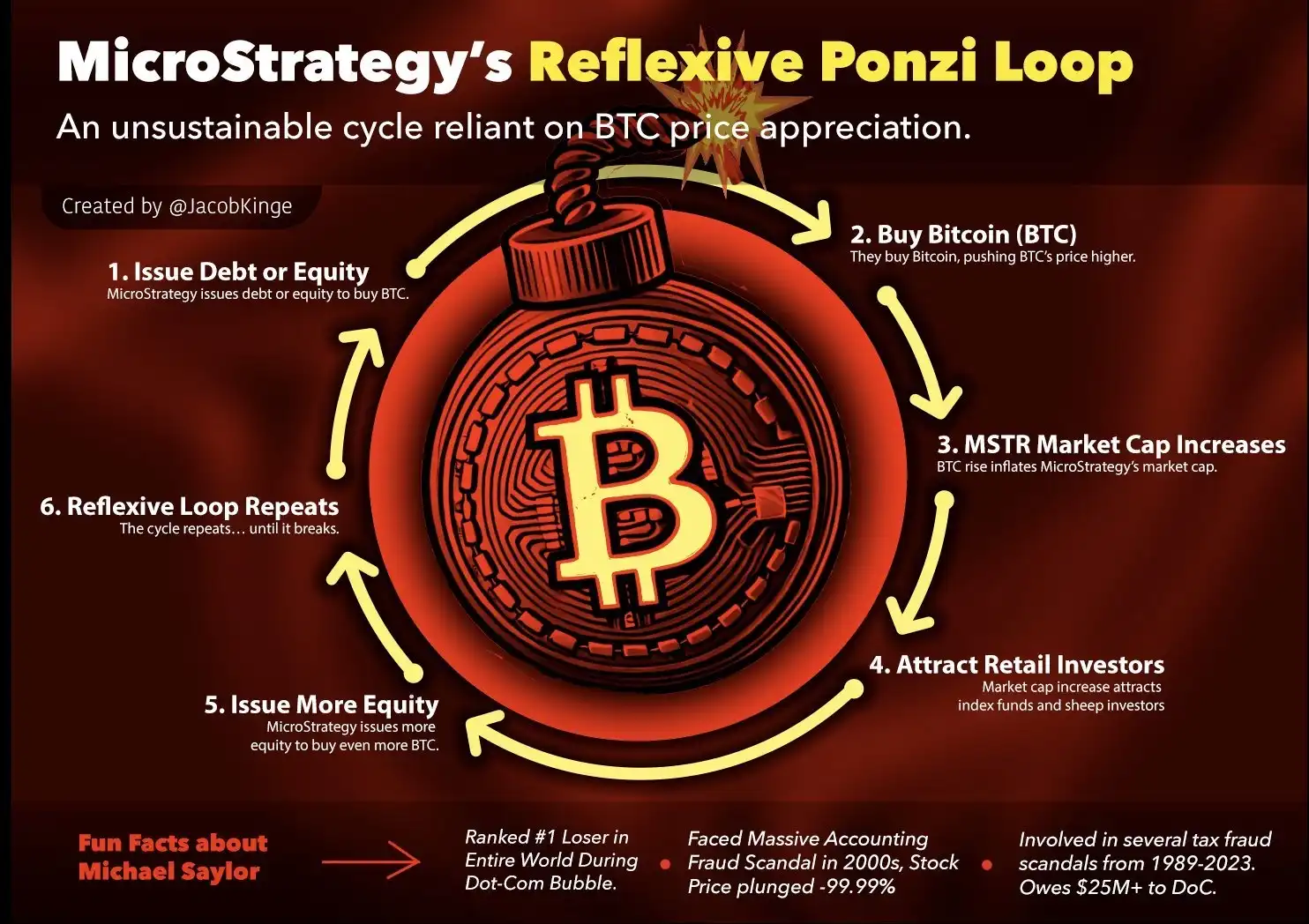

Michael Saylor is also playing the same reflective Ponzi loop game.

I am sure Saylor is connected to the internal circle that supports the entire scheme. His company, MicroStrategy, is not "innovating"—it is one of the most aggressive and highly leveraged stocks in the market. Their so-called "investment in Bitcoin" is actually just shearing Bitcoin's wool.

Their routine is very clear:

Financing → Buy Bitcoin → Inflate price → Refinance → Repeat.

This is a closed-loop scam built on "hope" and "hype."

What Saylor promotes is not a concept of "hard currency," but a desire to keep this scheme going a little longer—so he can reap the most benefits before the music stops.

Tether and Bitcoin are caught in a cyclical endorsement trap—Tether supports Bitcoin, and Bitcoin, in turn, supports Tether. This structure is a ticking time bomb that could explode at any moment.

At the Bitcoin 2025 conference, Bitcoin extremist and author of "The Bitcoin Standard," Saifedean Ammous, finally voiced what everyone was thinking:

"Tether is quietly accumulating Bitcoin, continuously expanding its reserves. One day, its Bitcoin reserves will exceed its dollar reserves. At that point, Tether will not only maintain its peg but may even appreciate. Imagine: a 'stablecoin' worth more than $1, backed not by U.S. Treasuries, but by Bitcoin."

This is almost a replay of the Mt. Gox and Lehman Brothers collapses: once liquidity breaks, this house of cards will collapse instantly. There are no real assets backing it, only a pile of unstable mutual endorsements.

Get ready—a monumental collapse is on the way.

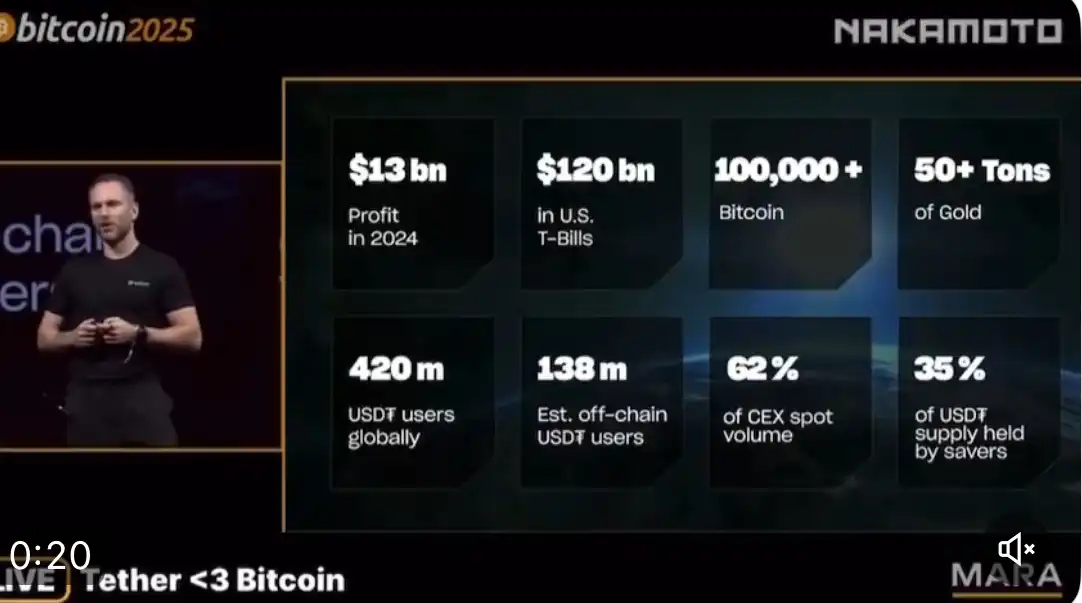

At the Bitcoin 2025 conference, Tether announced it holds over 100,000 Bitcoins and 50 tons of gold.

It sounds very suspicious. Let's look at its operational process:

- Tether creates USDT out of thin air, printing millions (or more);

- Uses these newly printed Tether to buy Bitcoin, driving up the price;

- Sells off excess Bitcoin for dollars and gold as "reserves";

- Then showcases these reserves to prove its "legitimacy";

- Meanwhile, the Bitcoin extremists in the audience (believing in the herd) cheer, thinking everything is real.

Tether's critics have actually been right all along. Years ago, we pointed out: Tether is quietly buying Bitcoin, while they were still denying it. Now, they don't even pretend anymore. Tether is the only major buyer in the entire Bitcoin market—everything relies on its continuous money printing and buying support.

This is the ultimate "house of cards." Once it collapses, no one will be able to save it.

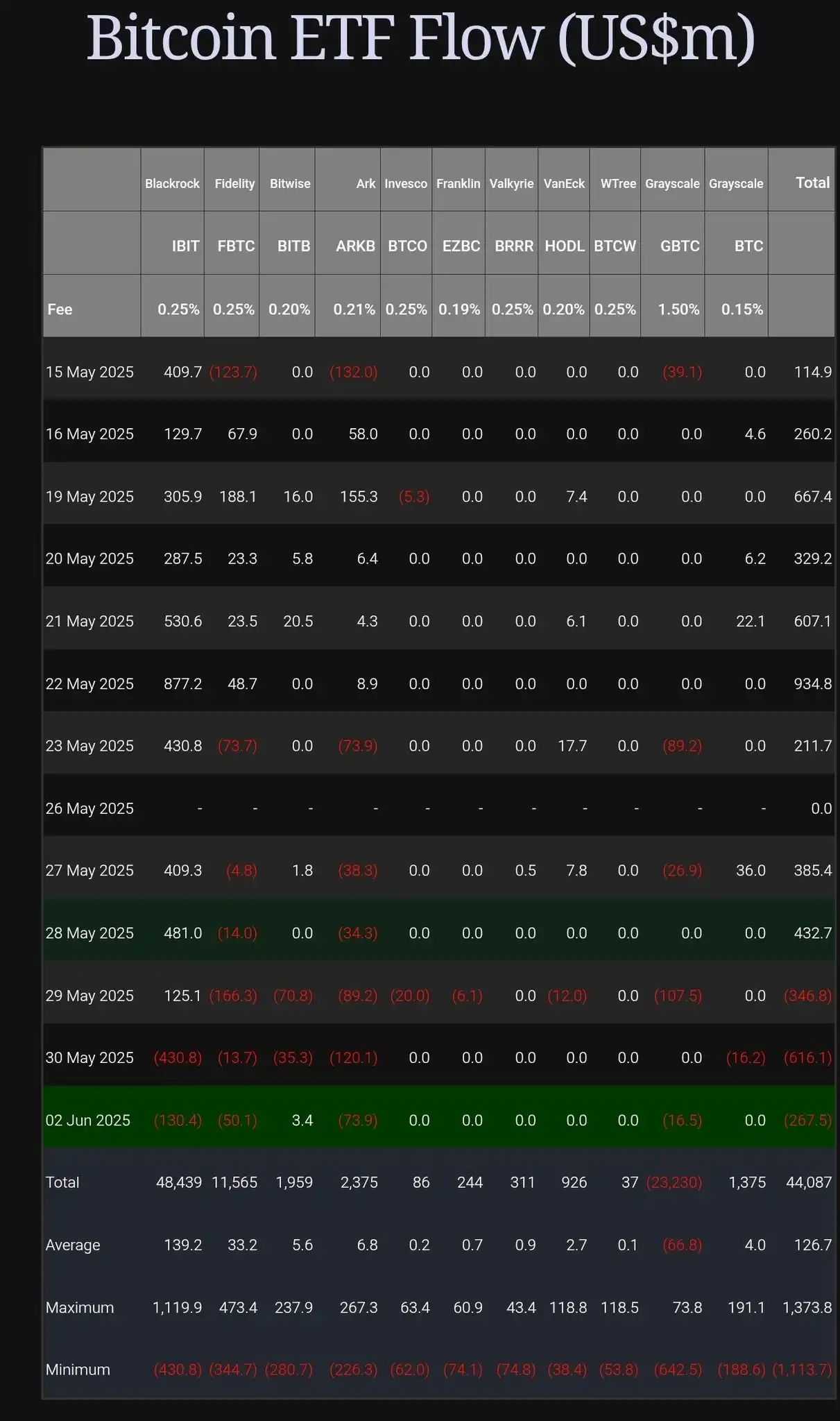

The so-called "institutional Bitcoin demand" is just a passing trend.

On June 2, Bitcoin spot ETFs saw a net outflow of $267.5 million, marking the third consecutive day of significant fund withdrawals. This is not a coincidence—this trend has been ongoing for months, indicating that institutions are rapidly retreating.

As early as the end of 2021, Bitcoin ETF inflows reached billions of dollars, coinciding with the peak of market frenzy. But since then, institutional interest has plummeted by over 91%. The ongoing outflows reflect a decline in market confidence, tightening regulations, increased volatility, and uncertain profit prospects.

Institutions were supposed to be the "backbone" of Bitcoin prices, but now they are collectively fleeing. The so-called "institutional entry" was merely hype and FOMO at the time. Smart money has quietly exited.

To make matters worse, even the relatively "crypto-friendly" SEC (U.S. Securities and Exchange Commission) is becoming cautious. They are reportedly hesitant to approve more Bitcoin spot ETFs from institutions like Bitwise and Grayscale, citing weak anti-fraud protection mechanisms.

The entire Bitcoin ecosystem is essentially a game of "smoke and mirrors." This industry is not supported by real demand but is manipulated by a group of insiders (like Tether and Bitfinex) who continuously control coins and liquidity, carefully creating the illusion of "adoption waves" and "market enthusiasm."

They have built a powerful narrative system, successfully convincing the public that "governments and institutions are entering in droves." But the reality? This is just a sophisticated pump-and-dump scheme.

If you are clear-headed enough to see through this noise, you will realize how dangerous this is. The price of Bitcoin is not driven by natural growth or real institutional demand, but almost entirely relies on Tether's infinite money printing to buy BTC to maintain the price. Currently, over 90% of Bitcoin buy orders are backed by Tether's funding. And once the U.S. government (currently being pushed by the Trump camp) implements strict regulations on stablecoins, this "liquidity faucet" will be turned off, and the Bitcoin market will face a brutal liquidation.

Bitcoin will ultimately not only fail to break $100K but may even drop below $10K. The so-called "institutional demand" has long disappeared, and internal players are gradually being exposed; this artificially supported illusion is destined to last only a short while.

This entire narrative is a manufactured illusion, a house of cards that will collapse the moment reality strikes.

Please be vigilant: this is not "the hard currency of the future," but a financial bomb on a countdown.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。