Original Title: Circle IPO - Time for Stablecoin Summer?

Original Author: @TaikiMaeda2

Original Translation: zhouzhou, BlockBeats

Editor's Note: Circle will IPO on the NYSE under the ticker CRCL, potentially igniting a "stablecoin summer." The IPO is valued at $6.7 billion, supported by Cathie Wood and Larry Fink, generating significant market interest. CRCL is seen as the best bet on the growth of stablecoins and blockchain, likely leading to a reevaluation of DeFi asset valuations.

The following is the original content (reorganized for readability):

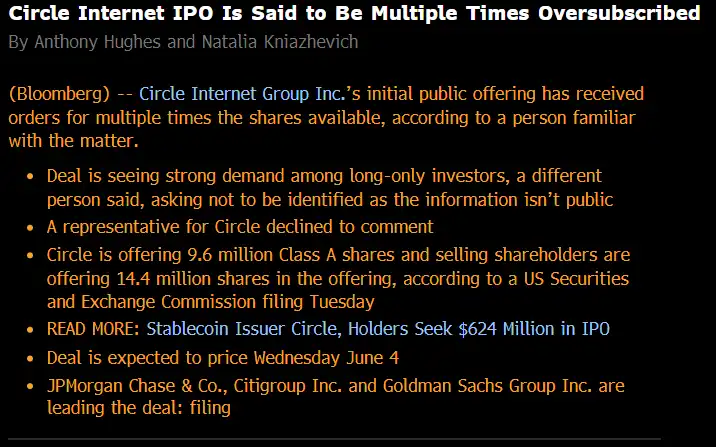

On June 5, @Circle will list on the New York Stock Exchange under the ticker CRCL, marking the most anticipated IPO since Coinbase ($COIN) in 2021.

For this IPO, Circle plans to issue 24 million shares, raising $624 million, with a target valuation of $6.7 billion.

Reports indicate that Cathie Wood's ARK fund will subscribe for $150 million, and Larry Fink (CEO of BlackRock) will invest an additional $60 million, together accounting for about 35% of this financing.

Bloomberg states that this financing has been oversubscribed.

Wood and Fink can be seen as KOLs in traditional finance, likely to jointly promote the "stablecoin narrative" through media exposure among institutions and retail investors.

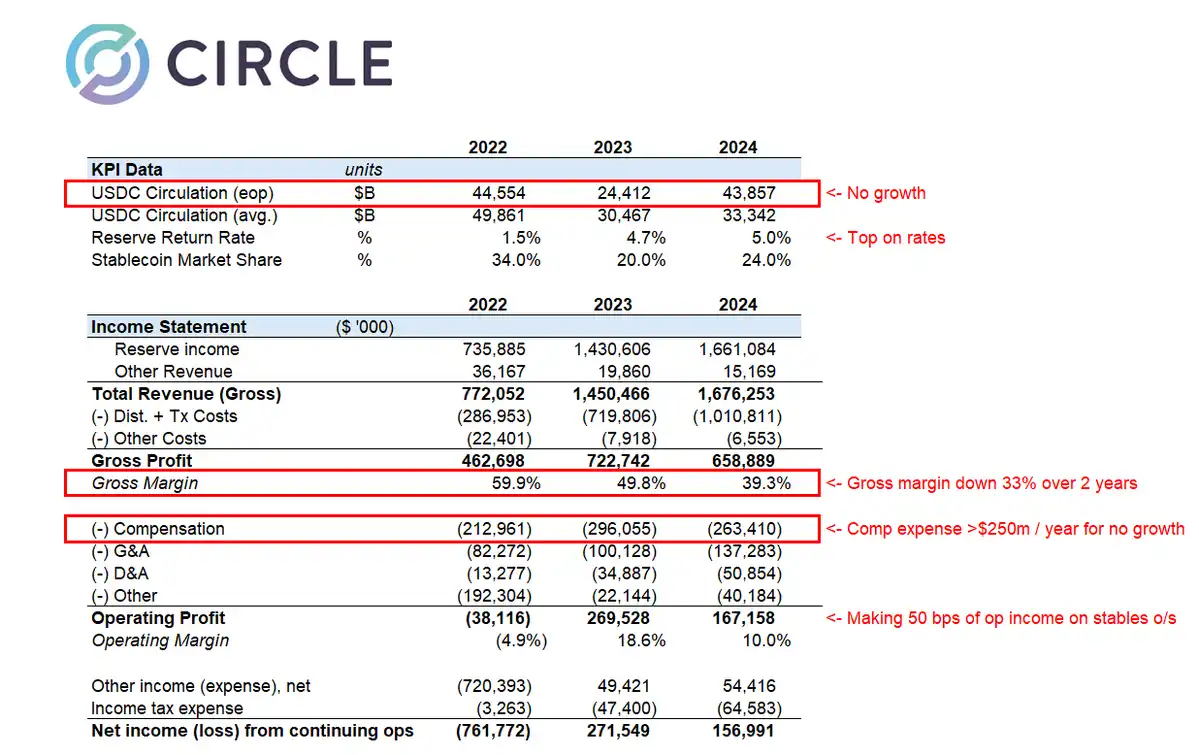

People in the crypto space often criticize Circle for its high operating costs (thanks to @TheOneandOmsy) and point out that it has "leaked" a lot of value to Coinbase.

However, the reality is that Circle's stock may be one of the few ways to bet on the growth of stablecoins and blockchain technology.

Given that this is a conventional IPO rather than a direct listing, insiders cannot sell their shares within the first 180 days. If the subscription is indeed oversubscribed as reported, it is very likely that CRCL will perform well after its listing.

For those in the crypto space, it can be seen as a token launch with a "low circulating supply + high complete valuation," backed by traditional finance big names (Wood, Fink).

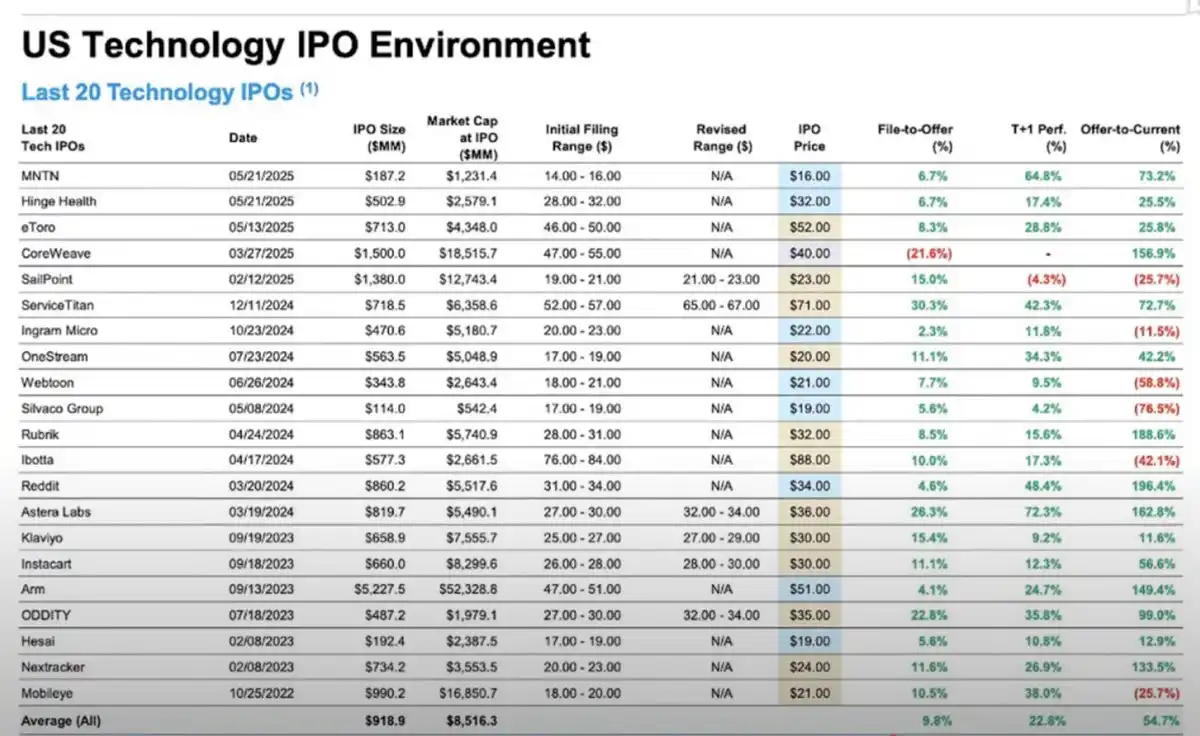

We are currently in a period where tech IPOs are performing exceptionally well, so I tend to disagree with the pessimistic sentiment surrounding CRCL in the market. USDC is currently the second-largest stablecoin by market cap, with strong distribution channels, and the issue of high operating costs can be optimized. The GENIUS Act is also about to be implemented.

If we look at the average "issue price to current price" increase of 54.7% for tech stock IPOs, $CRCL, with a $6.7 billion valuation at listing, is expected to break the $10 billion market cap in the short term.

The key question is: how significant will this be for DeFi and the entire crypto market?

Is the Summer of Stablecoins Coming?

The trading performance of $CRCL will greatly influence the valuation trends of DeFi assets. After all, if CRCL's market cap is similar to ENA's, how can ENA justify having a $5 billion FDV?

If CRCL quickly surpasses a $10 billion market cap, projects closely related to stablecoins with actual cash flow may also see their valuations rapidly increase.

For example: if Circle's net profit in 2024 is $157 million and its market cap is $10 billion, then MKR (rebranded as SKY) earning $107 million at its current $1.4 billion valuation looks much more attractive.

Of course, this comparison method is not perfect, but the core idea is: if TradFi is willing to pay for CRCL, its "valuation anchor" effect is likely to impact the entire DeFi ecosystem.

Perhaps, the summer of stablecoins is about to begin?

Trading Opportunities

I believe CRCL's IPO provides a good trading opportunity for DeFi:

Positive Beta Targets: Stablecoin issuers like MKR and ENA will directly benefit;

Marginal Beneficiary Targets: Related ecosystem projects like $PENDLE, $SYRUP, $AAVE also have logical connections;

Derivative Effects: If these coins start to take off, contract/spot DEXs will also see increased on-chain activity.

Additionally, I personally believe that CRCL itself is a good investment target.

Of course, some are concerned that this IPO is a "top signal"—after all, Coinbase's last IPO coincided with Bitcoin's peak on April 14, 2021. But I believe the market is not as "bubbly" this time:

Back in 2021, BTC's market share (BTC.D) was collapsing, while now, altcoins have been "hammered," and market sentiment is more subdued.

In summary: this time is different; perhaps the summer of stablecoins is truly coming.

Another important distinction is that $COIN went public through a direct listing, meaning retail investors were essentially providing "exit liquidity" to insiders when buying in.

In contrast, CRCL is a conventional IPO, with insiders having a 180-day lock-up period, making such issues less likely.

To summarize:

I believe CRCL will perform very well after its listing. It may be one of the best targets currently for betting on the development of stablecoins and the growth of blockchain technology.

Buying Circle stock itself is a trading opportunity. But I also believe it could trigger a small-scale DeFi season, as CRCL's valuation may "raise the ceiling," allowing for a reevaluation of high-quality DeFi projects.

If I'm wrong and $CRCL's stock price falls below the issue price after listing, then this trade would be a clear failure, and I could directly cut losses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。