Original author: cyclop

Original compilation: Tim, PANews

Everyone thinks $140,000 is the next target, but things may not develop that way.

After studying all historical scenarios and market data, why do I believe Bitcoin is about to experience a slight decline?

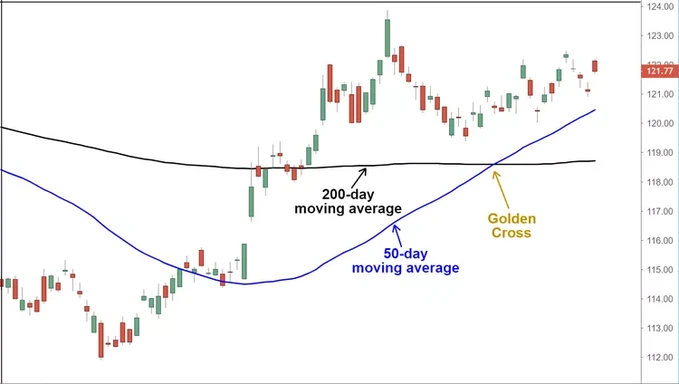

Is the Golden Cross a Blessing or a Curse?

The Golden Cross is a technical indicator pattern that occurs when the 50-day moving average crosses above the 200-day moving average. In all technical analysis, this is usually seen as a buy signal or bullish indicator.

But what if I told you that the situation is not that simple, and the Golden Cross could actually lead to a sharp decline?

Let me explain.

Yes, fundamentally, the appearance of a Golden Cross indicates that short-term momentum is surpassing long-term momentum (usually presenting a bullish trend).

However, historical data shows that every time a Golden Cross forms, Bitcoin always follows with a 10% drop, and only after this decline does Bitcoin strongly rebound and set a new all-time high.

Let’s delve into specific cases:

In February 2021, after Bitcoin's 50-day moving average crossed above the 200-day moving average, it dropped 10% within 7 days.

In March 2024, after Bitcoin dropped 11%, it violently surged to a new high.

It turns out that the appearance of the Golden Cross is merely the ultimate washout tactic before the main players push the price up, used to shake off weak hands (paper hands and retail investors), thereby facilitating a real price breakout.

Everything becomes clear; it is this breakout that triggers a wave of large capital chasing the price up.

Those who exited due to FOMO re-enter the market, further fueling a more vigorous upward trend.

This is the mechanism of the Golden Cross pattern.

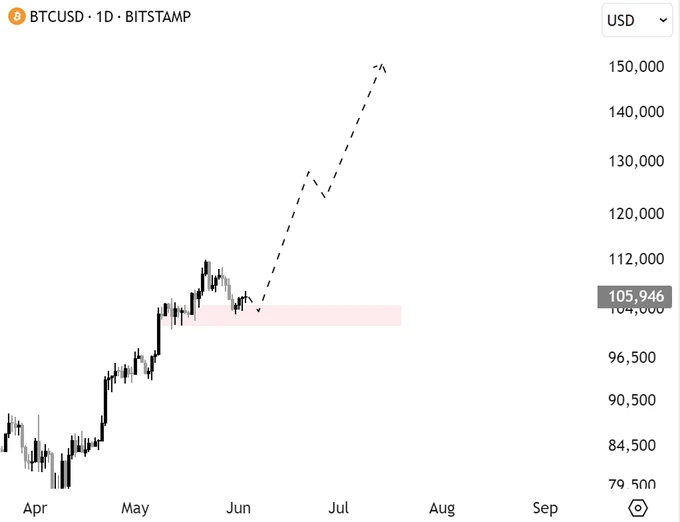

This week, Bitcoin experienced a correction of about 8%, consistent with past practices. A rebound has already occurred, indicating strong buying interest around the $104,000 to $105,000 range.

On the other hand, it is evident that the upward momentum above $110,000 has already exhausted.

(This can lead to a "news overconsumption" phenomenon, where positive news does not trigger any reaction)

What’s the Outlook?

If we can hold above $105,000 (which we are likely to do), it will aim directly for the $150,000 mark, repeating the Golden Cross pattern.

If it falls below $100,000, a slight correction to the $90,000 to $95,000 range is expected.

If you do not have a position yet, now is a good opportunity to enter; I am strongly bullish in the short term.

At the same time, I am leaning more towards a risk-averse state: only holding strong blue-chip coins like Bitcoin, Ethereum, and Solana, and selectively choosing a few altcoins with investment value, such as Cookie, W, and IOTA.

If you already have a position and are unsure whether to sell or add to it, please stick to your strategy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。