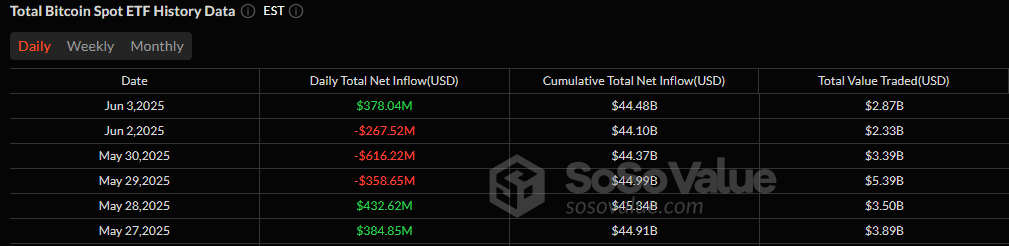

Crypto ETFs See Over $487 Million Combined Inflows

Investor optimism returned in full force as bitcoin exchange-traded funds (ETFs) returned from three consecutive days of outflows with a robust $378.04 million inflow on Tuesday, June 3. Confidence poured into Ark 21Shares’ ARKB and Fidelity’s FBTC, which pulled in $139.93 million and $136.83 million, respectively. Together, the two funds accounted for over 70% of the day’s net flow.

Blackrock’s IBIT maintained its magnet status with $57.97 million, while Vaneck’s HODL brought in $18.79 million. Rounding out the green board were Bitwise’s BITB ($14.46 million), Grayscale’s Bitcoin Mini Trust ($7.06 million), and Valkyrie’s BRRR ($3.01 million). Notably, no outflows were recorded across any bitcoin ETF, a rare signal of unanimous market confidence.

Source: Sosovalue

Trading activity was strong, with total value exchanged reaching $2.87 billion, and net assets for bitcoin ETFs ticking back up to $128.13 billion.

Meanwhile, ether ETFs extended their remarkable streak with a 12th straight day of inflows, bringing in a combined $109.43 million.

Blackrock’s ETHA led once again, absorbing $77.06 million, while Fidelity’s FETH drew in $20.97 million. Grayscale’s Ether Mini Trust contributed $8.41 million, and Franklin’s EZET added $2.99 million to cap off the day’s gains. With total value traded at $472.5 million, ether ETFs now sit at $9.81 billion in net assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。