Something big is brewing when a sitting U.S. Vice President, a convicted drug dealer, and a “vampire” all agree on the same thing. That was the scenario that played out last week when Vice President JD Vance, Silk Road creator Ross Ulbricht, and longevity expert Bryan Johnson all talked shop at the 2025 Bitcoin Conference in Las Vegas, Nevada.

Sure, you had the usual conference staples: fancy cars with bitcoin logos, bitcoin-themed mascots, and a giant eleven-foot skull built using recycled computer chips dubbed “The Skull of Satoshi.” But the real telltale sign that the cryptocurrency has entered the mainstream consciousness was the diversity of characters that converged at the Venetian Resort on the Las Vegas strip.

(The 11-foot Skull of Satoshi built by Von Wong. He says it was built using wood, recycled Styrofoam, and over 300 pieces of electronic waste. / Bitcoin.com)

Historically, the Bitcoin Conference has mostly been a gathering of enthusiasts who exclusively support bitcoin and denounce all other cryptocurrencies – the so-called “maxis,” short for bitcoin maximalists, a pejorative term coined by Ethereum creator Vitalik Buterin. As always, maxis were in full attendance last week, but so were many other factions of the bitcoin community, old and new – mining companies, exchanges, wallet startups, and other usual suspects. But the presence of politicians, restaurant chains, beauty pageant queens, bodybuilders, and coffee retailers at this year’s conference is strong proof that bitcoin has finally become a household name.

(New York City Mayor Eric Adams [pictured in the center] was one of the many politicians who addressed attendees at the 2025 Bitcoin Conference / Bitcoin.com)

“Bitcoin 2025 was the largest event in Bitcoin’s history,” said Brandon Green, Chief of Staff at BTC Inc. in a press release. “Next year, we are going to compound it into not only the biggest event in Bitcoin’s history, but one of the largest and most important events globally.”

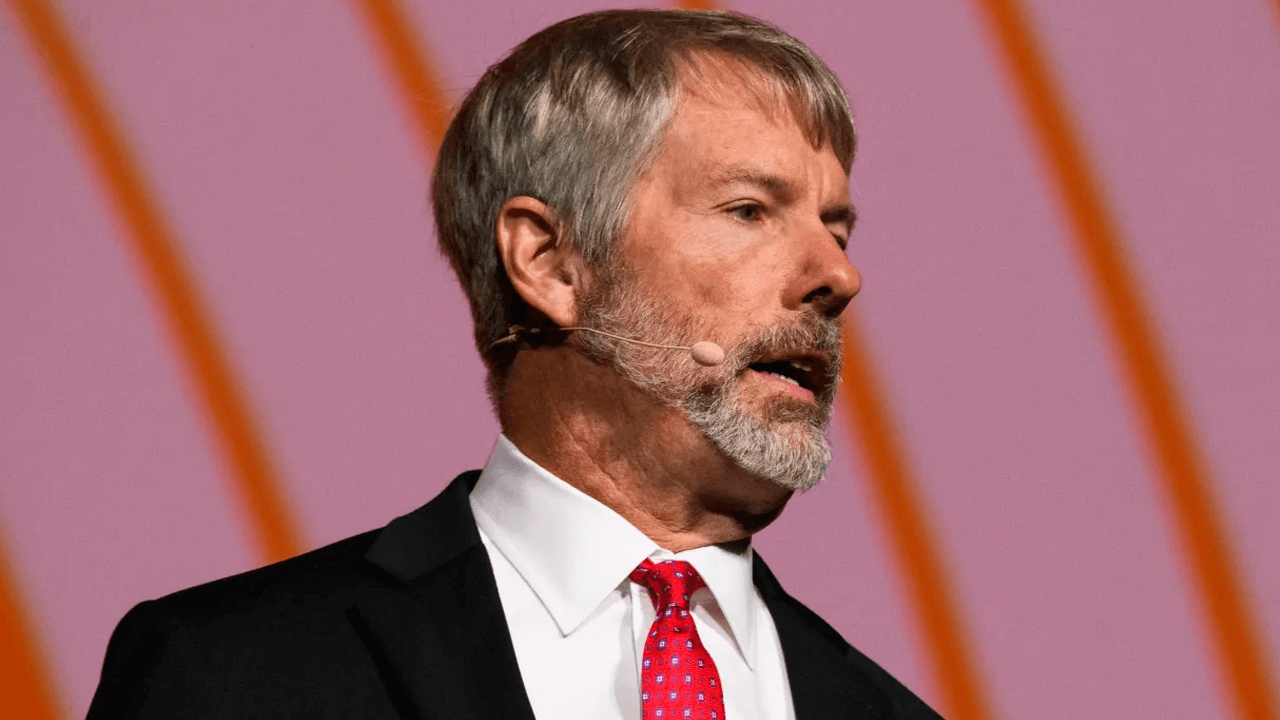

Perhaps the most significant development in the bitcoin ecosystem over the past year has been the emergence of treasury firms that hold bitcoin ( BTC) on their balance sheets as part of a corporate treasury strategy. Michael Saylor, Chairman of Strategy (Nasdaq: MSTR) pioneered the idea in August 2020 when his firm began purchasing large amounts of BTC at a time when the U.S. Federal Reserve had dropped interest rates to zero.

(Michael Saylor speaking at a previous Bitcoin conference / BTC Inc.)

“We had a $500 million software company and we had $500 million or more in our treasury that was invested in cash and credit,” Saylor explains in a 2021 corporate video. “We thought about buying gold…and eventually, we settled upon bitcoin…we liked it because we thought it was a better gold and it had big tech upside.”

And so began the world’s first bitcoin treasury firm. More than a hundred public companies have since followed suit, and many of them were represented at the conference. Saylor is now perhaps the biggest star in the industry, and Strategy currently holds 580,250 BTC or 2.763% of the entire bitcoin supply, valued at more than $61 billion at today’s price.

Besides Strategy, Strive Asset Management, Cardano Capital, and Metaplanet all made waves at the conference with their unique flavors of bitcoin treasury implementations, but the jury is still out on whether turning a public company into a BTC proxy is a sustainable approach.

“What could possibly go wrong,” is the question Standard Chartered posed in a recent research report discussing the risks bitcoin treasury firms face. “At current average purchase prices for bitcoin treasuries, it would only take a move back below USD 90,000 to put half the bitcoin treasuries (by number of companies) underwater,” the report adds. Caveat emptor.

Back in March, fast food chain Steak ‘n Shake posted a teaser on X asking, “Should Steak ‘n Shake accept bitcoin?” An avalanche of responses followed, including one from former Twitter CEO Jack Dorsey. Fast forward to last week and the firm, which boasts more than 100 million customers globally, was front and center at the Bitcoin Conference with perhaps one of the fancier booths at the entire event.

(Steak ‘n Shake booth at the 2025 Bitcoin Conference / Bitcoin.com)

Chief Operating Officer (COO) Dan Edwards told attendees during a speech that not only is the company now accepting bitcoin payments, but it’s also saving money doing so.

“The day we launched bitcoin, one out of every five hundred bitcoin transactions in the world happened at Steak ‘n Shake,” Edwards said. “Bitcoin is faster than credit cards, and when customers choose to pay in bitcoin, we’re saving 50% in processing fees.”

One way to determine if an asset has become ubiquitous is to find out how many people use it regularly. Perhaps that was the purpose of a more light-hearted event at the Vegas conference. Organizers managed to execute 4,187 point-of-sale bitcoin transactions in an 8-hour period, a feat that made it into the Guinness Book of World Records.

(Guinness World Records logo / Shuttershock)

“We are grateful to the thousands of Bitcoiners who embraced this vision and turned the conference into a living demonstration of bitcoin’s potential as an everyday currency,” said Didier Lewis, Chief Financial Officer of conference organizer BTC Inc.

Suffice to say Visa processed an average of 639 million transactions every day according to its 2024 annual report. While pitting Visa’s metrics against Bitcoin’s would be somewhat of an apples-to-oranges comparison (a fairer comparison would be to count the number of Visa transactions at the conference over the same 8-hour period), the discrepancy still shows how bitcoin is no longer considered by many as digital cash, but rather digital gold, although it’s perfectly capable of playing both roles.

But whatever its purpose, it appears this magic Internet money has gone from Silk Road to Wall Street and now Main Street.

“I would say it was a niche topic that was discussed within smaller groups eighteen months ago, and now you can’t open any publication, the Wall Street Journal, Bloomberg, CNBC, without it being on the front page,” Saylor said, and that was four years ago in 2021.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。