OneKey has a higher mind share among Chinese users than all other similar products, making it the most recognized hardware wallet currently.

OneKey is taking its first step into the unicorn club of the Web3 crypto space.

This open-source crypto hardware wallet (cold wallet) company has seen user assets and DeFi scale grow 11 times over the past three years, with product sales climbing at an average annual rate of nearly 300%.

It is reported that OneKey has announced the completion of its Series B financing, with a valuation of $150 million. This round was led by YZi Labs (formerly Binance Labs), marking the largest investment in the hardware wallet sector to date. Past supporters include top venture capital firms such as Dragonfly, Ribbit Capital, and Coinbase Ventures.

This six-year-old startup, with 60 employees, is known for its open-source code, strong security reputation, and low-key pragmatic qualities, with its products being long adopted by major exchanges and well-known project teams.

"From day one, OneKey has been a completely open-source product. We are confident in our code, and the community can rest assured."

— Yishi Wang, Founder and CEO of OneKey

Asset Security Requires Hardcore Solutions

For new crypto users, managing private keys is always a painful task, whether using Bitcoin, Ethereum, Tron, or Solana.

Many people use plugin wallets that generate private keys in an online environment. Some prefer to avoid the hassle of private key details and keep their funds on major exchanges like Binance. However, if you want to truly control your private keys and isolate risks from network attacks, malware infections, and backdoor vulnerabilities, choosing an open-source and audited hardware wallet or cold wallet is essential.

Earlier this year, a well-known "multi-account browser" was reported to have quietly updated its code, leading to a massive theft of private keys from ordinary users and yield farming studios. Fortunately, many studios used OneKey hardware wallets, which provided physical private key isolation and manual confirmation, allowing them to avoid disaster.

According to WeChat Index statistics, OneKey has a higher mind share among Chinese users than all other similar products, making it the most recognized hardware wallet currently. It is also the only hardware wallet co-branded and adopted by leading exchanges such as Binance, OKX, Bybit, and Bitget.

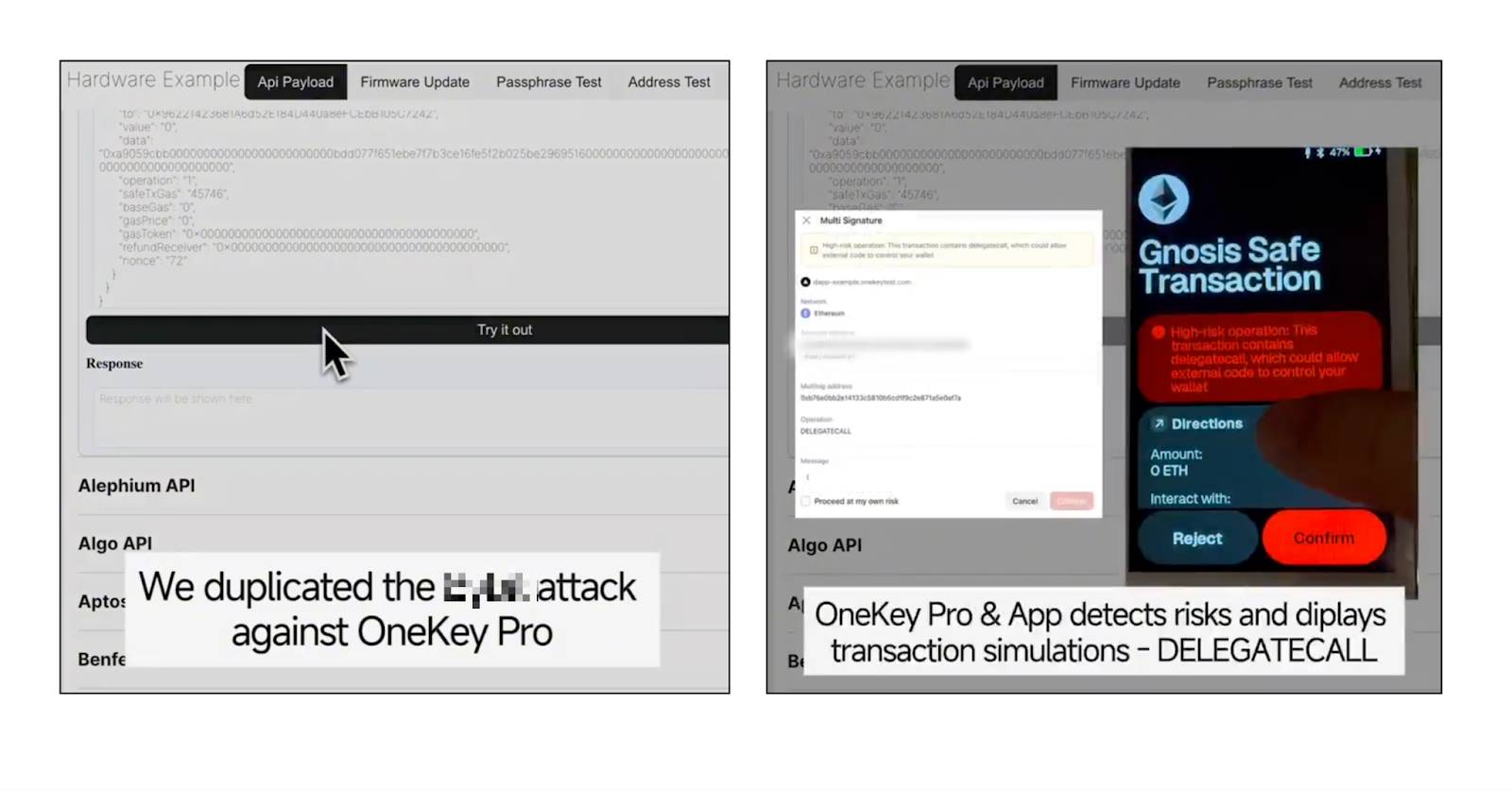

At an offline event for security experts, OneKey's technical team demonstrated their hard power in security design. At that time, a certain exchange experienced a hacking incident involving over $1.5 billion in stolen funds, due to the hardware wallet they used being unable to parse the complex calls of the Safe contract, only displaying a string of indecipherable code on the device, ultimately leading to operator misauthorization.

If OneKey series products were used, the transaction would be correctly parsed, fully displaying the call structure and providing risk warnings. This capability is due to OneKey's long-term investment in contract parsing and interaction security for hardware wallets and app wallets.

The average price of a hardware wallet is just over $100. No one wants to pay exorbitant "security tuition." Between the cost of purchase and the painful consequences, a hardware wallet is the obvious choice.

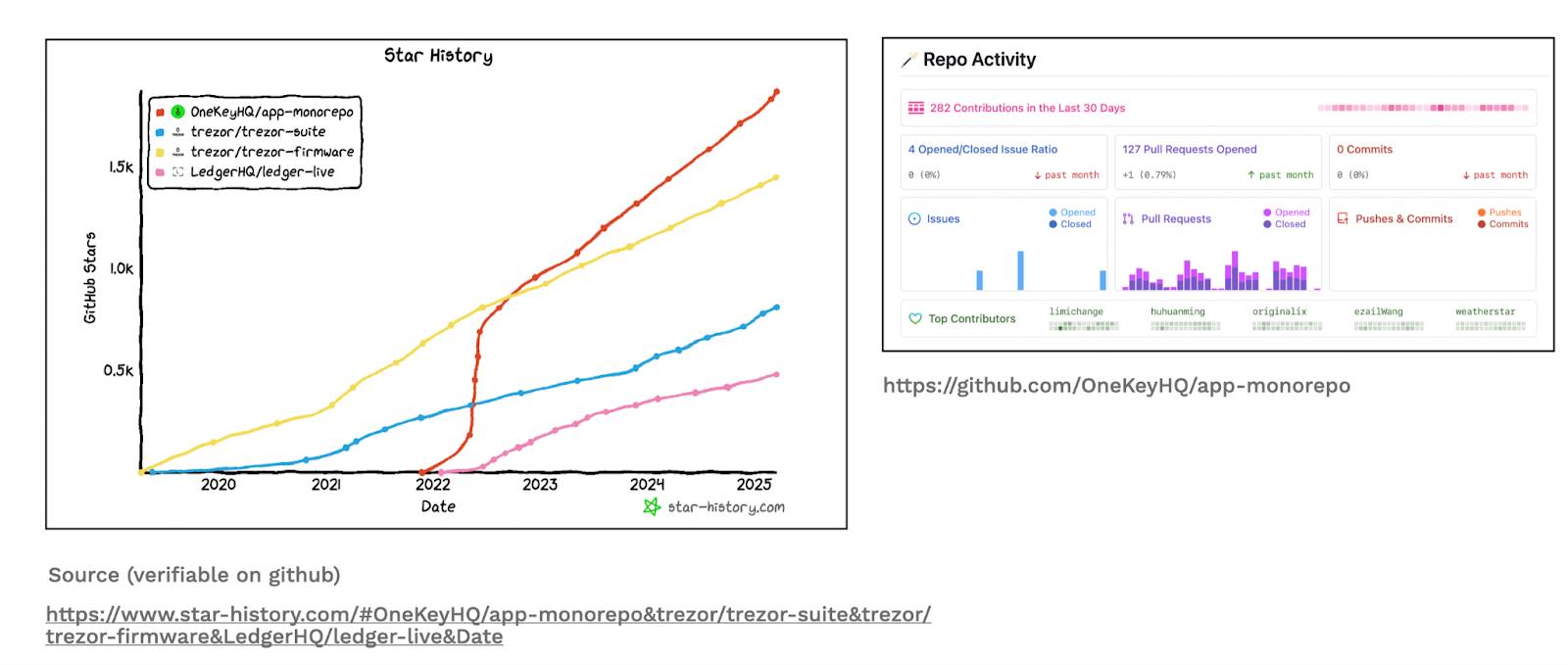

In the open-source field, OneKey maintains a high level of activity, with issue and PR handling speeds on GitHub even surpassing many well-known software companies. Community users can review and reproduce all of OneKey's code and firmware compilation processes at any time, providing unprecedented transparency and audit capabilities for users and security experts.

Compared to many hardware wallets in the industry that adopt closed-source designs, OneKey has achieved comprehensive open-source from hardware to underlying firmware to UI. OneKey believes that true security comes from complete transparency.

Surpassing Cycles and Challenging Boundaries

The company has achieved some success in the Asian market and is ambitiously setting its sights on overseas markets.

In the corridors of the JW Marriott Hotel in Hong Kong, Yishi Wang is bustling about for the annual Web3 event. As he walks briskly, he tells investors, "Our team is distributed across multiple countries and regions, including mainland China, Hong Kong, Japan, South Korea, Dubai, and Italy, with a dealer system spanning multiple global economies. If we were just a remote team for a Web3 online product, the path would be straightforward; but we are a hardware fintech company, managing complex supply chain collaboration and technical closed loops, which is a huge challenge."

The complexity and difficulties also represent a moat, and the core team members are confident in facing these challenges. OneKey's Chief Growth Officer Niq Chen is an early participant and well-known collector in the NFT space. As a member of Generation Z, he has experienced two crypto market bubbles and deeply realizes, "What is truly worth doing are products and companies that have long-term influence and value, doing challenging things with excellent people."

Currently, OneKey's growth in German-speaking regions far exceeds that of other markets, with users from Germany, Austria, and Switzerland providing feedback on usage issues daily through communities and emails. As a result, the team quickly launched German language support.

In Brazil, OneKey's performance has also exceeded expectations. The team traced back to find that it initially started with key opinion leaders in crypto communities trying and actively recommending OneKey, leading to viral spread. It also attracted many local dealers and even OTC offline stores to join and promote.

OneKey's Chief Sales Officer Mildred stated, "This has given us great inspiration. If we penetrate product strength, solve real needs, and satisfy customers, the overseas market can grow naturally."

[Many bloggers recommended OneKey at the Binance Blockchain Week offline exhibition in Dubai]

Regarding technology and talent, Yishi has consistently expressed a pioneering stance on social media. He publicly stated that he cannot accept engineers who cannot efficiently and securely use AI coding by 2025. This statement has sparked some controversy, but he remains firm in his pioneering requirements for technical talent.

He openly expressed his desire for smart and highly effective individuals: "Different team sizes and varying levels of intelligence determine the organizational methods, making them completely different life forms from traditional large companies. I think it's not excessive for the DeepSeek team to have an average annual salary of $1.5 million because their RPE is at a much higher level than others." In Yishi's view, AI has significantly increased individual productivity. The same tools used by different people can yield vastly different results. "The AI era has rewritten the efficiency model. If you use old standards to hire, you will only attract outdated people."

Members of this entrepreneurial team come from companies like ByteDance, DJI, and OPPO, and they have established an internal security lab, OneKey Anzen, specifically to test and crack various existing hardware wallets for security research.

In the past six months, the crypto market has been turbulent, and many entrepreneurs worry that macroeconomic downturns and systemic financial collapses will pose significant obstacles in the crypto space. Yishi is also aware that during such cycles, one should not blindly expand or haphazardly increase headcount. "We may be one of the companies in the world with the largest user fund volume per employee." He paused, "Every crypto cycle has its exiters, but we are always present. Without patience, you cannot create the iPhone of the crypto industry."

"I have gathered a group of true enthusiasts who understand crypto, hardware, and security. These people are constantly challenging boundaries, repeatedly self-denying, not calculating KPIs, but building what we believe is right."

[OneKey CTO, CEO, and COO with CZ]

[OneKey Eco Lead Cavin sharing security practices at an event]

Breaking the Ceiling: On-Chain Wealth Management

After the launch of the OneKey Earn module with Morpho's USDC savings product, the subscription amount quickly surpassed $62 million.

"We have almost become the golden sunflower for attracting on-chain whale DeFi users," Yishi remarked. In his view, there are only two modalities in the crypto industry that can yield significant returns: one is asset issuance, and the other is participating in asset circulation and providing irreplaceable services, such as exchanges and wallets.

With considerable positions accumulated on-chain, DeFi users began to actively seek out OneKey, hoping to capture on-chain yields while using hardware wallets for self-custody. To this end, OneKey built the Earn module, emphasizing that it does not custody user assets but serves as a secure entry point, focusing on providing a secure DeFi hardware wallet and software wallet.

But it doesn't stop there. Yishi stated that on-chain wealth management in DeFi actually has even greater imaginative potential:

Capturing protocol subsidies and public chain incentives is the first step; in the future, we will launch structured products. Taking Pendle as an example, its PT/YT model can split yield rights and principal rights, catering to different users' time preferences. However, the current order book efficiency in the market is low, and tokens are systematically mispriced.

He envisions constructing a basket of LP pools, matching liquidity according to different time preferences to enhance overall market efficiency. The financial Lego nature of the DeFi market gives us unprecedented freedom. We have the opportunity to combine permissionless secure self-custody to provide users with flexible, efficient, and in-depth investment tools, which traditional finance cannot achieve.

Yishi wrote in Slack: "If you keep focusing on competitors, you will forget what users truly need. The most important thing for a company is always making the right decisions, not just embellishing the surface. Over-consuming on trivial details is useless; relying solely on physical effort will not lead to success."

[Yishi has a golden frog sent by Ribbit Capital on his desk in Hong Kong, which is a symbolic gift from Ribbit for portfolio projects]

The Story of Hardcore Financial Security Technology Continues

OneKey is not in a hurry to occupy the spotlight but chooses to focus on refining the most fundamental and least glamorous aspects. In a rapidly changing, fervently narrative-driven industry, this slow and steady approach may seem less "exciting," but it is also more precious.

As they wrote in their Twitter announcement from YZi Labs—OneKey adheres to the values of focus, integrity, and excellence. In their quest to create the most extreme, secure, and user-friendly open-source hardware wallet, they are deeply exploring and never stopping.

OneKey Official Introduction

Founded in 2019, OneKey is one of the best-selling and safest open-source hardware wallet and cold wallet brands in the world.

From day one, its completely open-source hardcore philosophy has earned the trust of billions in assets. All of its hardware and software code has undergone security audits by SlowMist and Offside Labs and is fully open-sourced on GitHub for community review. OneKey has gained support and funding from top investment institutions such as YZi Labs, Coinbase, and Dragonfly due to its outstanding quality.

$99 entry-level security hardware + free app = $100M level institutional-grade security solution. OneKey's vision is to make institutional-level full-chain security asset self-custody technology open-source and permissionless for every crypto citizen.

OneKey Products:

Classic 1S / 1S Pure: The best-selling entry-level ultra-thin credit card-style cold wallet.

OneKey Pro: Air-gapped QR code signing, encrypted fingerprint verification, wireless charging, providing top-tier true wireless security protection.

All hardware wallets come standard with EAL6+ industry-leading security chips + anti-theft self-destruct technology, supporting almost all chains.

OneKey App: Supports over 60 blockchains (including Bitcoin, Ethereum, BNB Chain, Tron, Solana, XRP, Cardano, etc.), supports various asset types including NFTs, and covers mobile, computer, browser extensions, and web versions, easily accessing the Web3 ecosystem. It supports advanced phishing detection for websites and contracts, signature result simulation parsing, and other security features.

OneKey Official Website: https://onekey.so/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。