TL;DR

Stablecoins have long been regarded as the "crown jewel of the cryptocurrency industry," but early developments primarily focused on algorithmic stablecoins, such as Ampleforth's AMPL and Terra's UST (LUNA). These projects aimed to break free from reliance on dollar assets by constructing encapsulated "dollar stablecoins" through algorithmic mechanisms, with the goal of promoting widespread adoption of stablecoins in the crypto and DeFi ecosystems, ultimately expanding to traditional off-chain users. Additionally, there are significant differences in their path choices. Ampleforth is dedicated to creating a native settlement unit that belongs entirely to the crypto world, thus it does not maintain a 1:1 peg with the dollar; whereas TerraUSD (UST) attempts to maintain a stable peg to the dollar to be used more broadly as a payment and value storage tool.

This year, with the emergence of Ethena, DeFi stablecoins are no longer solely anchored to price stability but have begun to anchor to "sources of yield." A new class of "strategy-based stablecoins" is rising, which essentially packages hedging strategies or low-risk yield products into $1 face value tradable tokens. For example, Ethena's USDe is akin to a fund share, generating yield through a delta-neutral strategy that goes long on stETH and shorts perpetual contracts, distributing returns to holders in the form of sUSDe. This type of stablecoin structure is viewed as securities by regulatory bodies such as Germany's BaFin due to its similarity to hedge fund subscription shares.

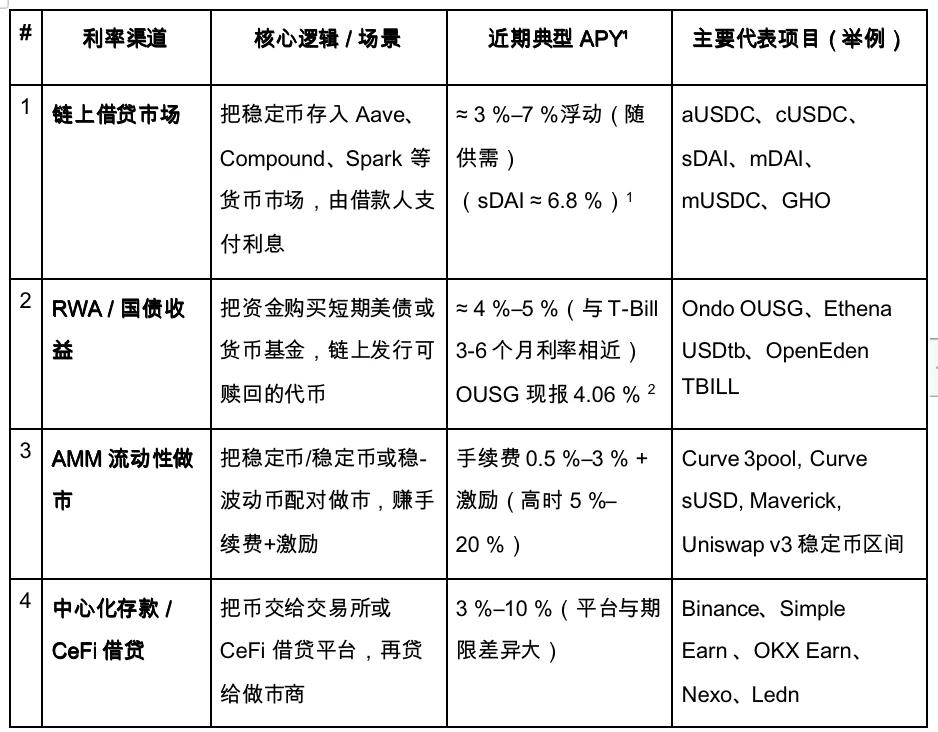

When systematically analyzing the yield mechanisms behind stablecoins, the article categorizes them into nine major types, including on-chain lending, real-world assets (RWA), AMM market making, CeFi deposits, protocol savings rates (such as DSR), fixed-rate notes, derivatives hedging, staking yields, and strategy aggregation vaults. The annualized yields for each channel are generally concentrated in the 3–8% range under current market conditions, with some special periods (such as USDC de-pegging or high funding costs) briefly exceeding double digits.

Despite the current appearance of homogeneity among strategy-based stablecoin projects, their core differences lie in three key dimensions: sustainability of yield structure, transparency of yield disclosure, and whether they are built on a compliant foundation. Currently, stablecoins based on real-world assets (RWA), such as USDY and OUSG, have a relative advantage in compliance and have gained a certain degree of regulatory recognition, but their growth ceiling is limited by the market structure of U.S. Treasury bonds. In contrast, derivative-linked stablecoins like USDe offer greater flexibility and yield potential but are also more dependent on the open interest (OI) in the perpetual contract market, making them more sensitive to market volatility.

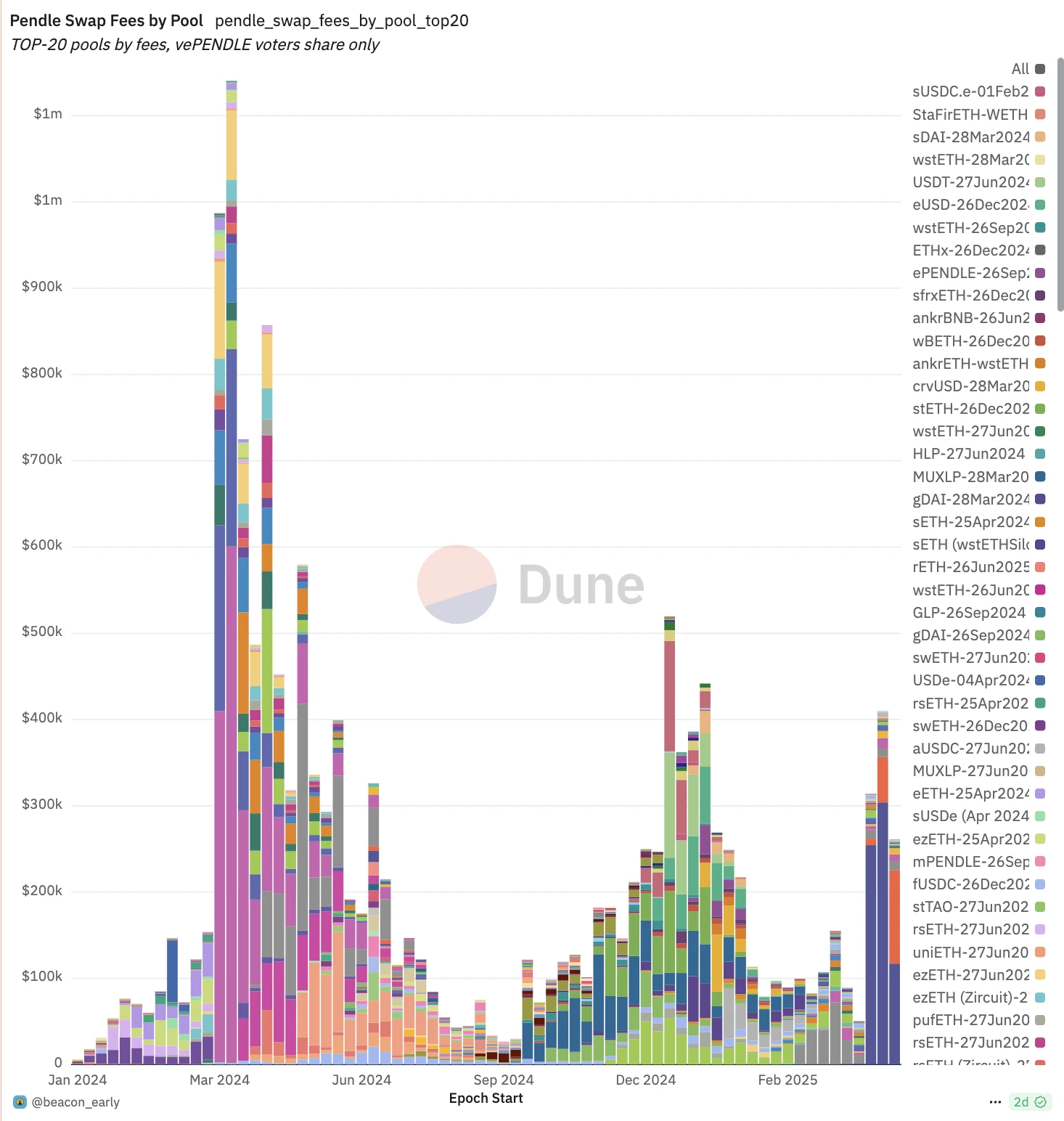

In this trend, the most benefited infrastructure project is Pendle. The protocol constructs an on-chain interest rate market by decomposing yield-bearing assets into fixed principal (PT) and floating yield (YT), thereby promoting the standardized development of "interest rate hedging" and "yield transfer." As more stablecoin projects adopt Pendle to manage their cash flows, its TVL, trading volume, and bribe mechanisms are expected to see further growth.

We believe that future strategy-based stablecoins will evolve towards modularity, regulatory friendliness, and clear yields, while projects with unique sources of yield, good exit mechanisms, and liquidity moats (ecosystem adoption) will become the cornerstone of the next "on-chain money market fund." However, such products may still be classified as securities by regulatory bodies, and potential compliance challenges should not be overlooked.

Strategy-Based Stablecoins

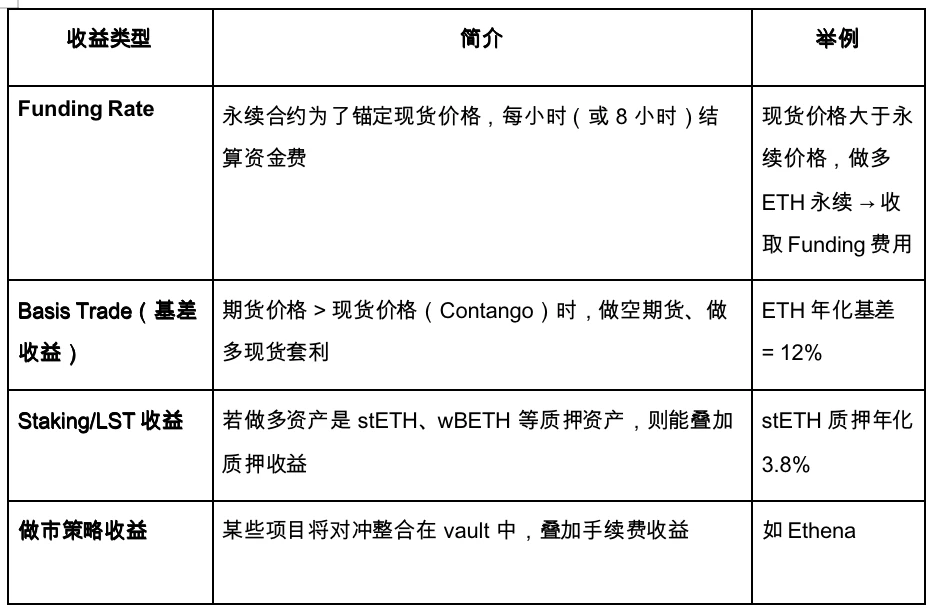

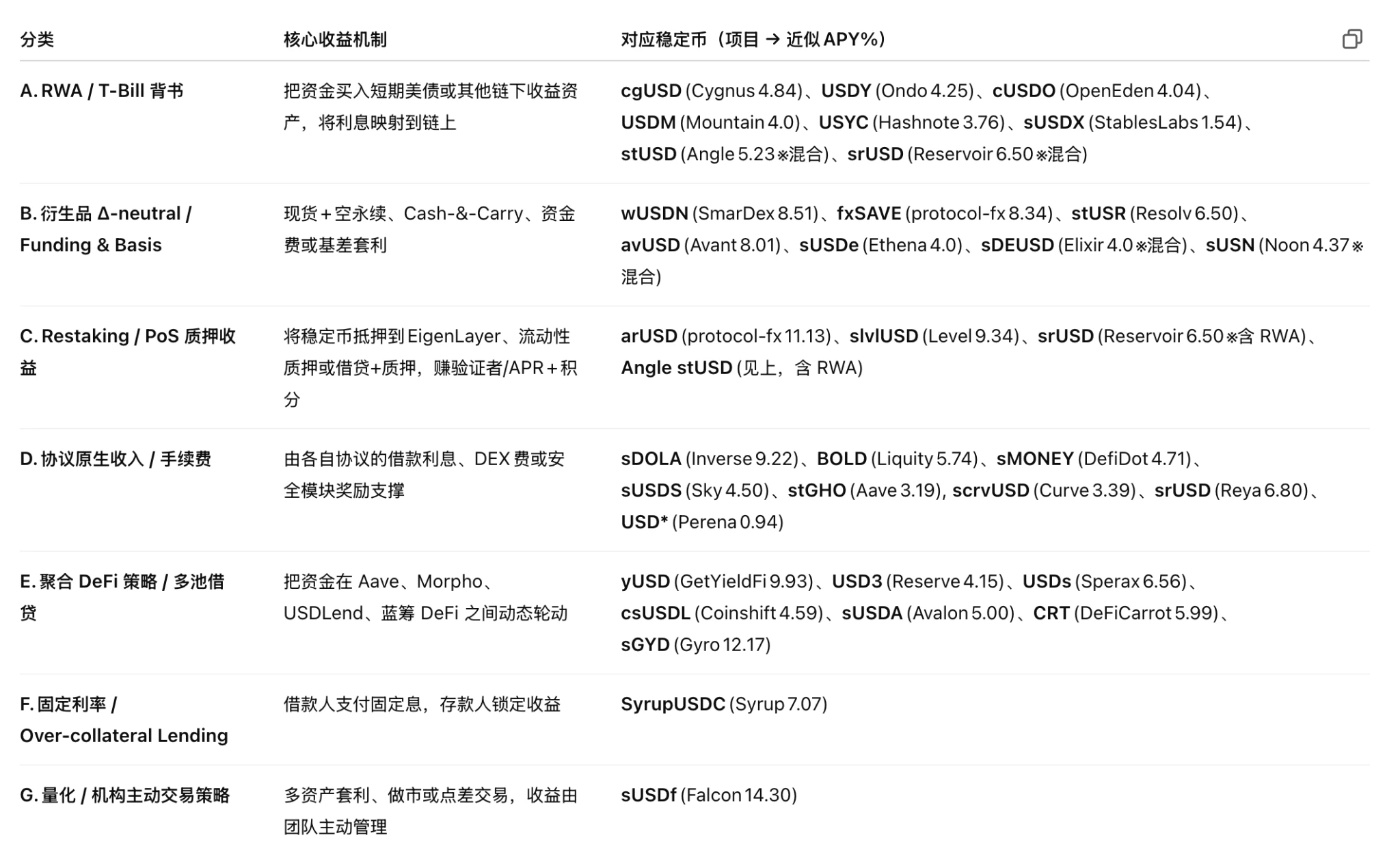

Yield-bearing stablecoins have various yield channels, including lending protocols, liquidity mining, market-neutral arbitrage, RWA U.S. Treasury yields, structured products, a basket of stablecoin yields, and stablecoin staking yields. Below is a summary of some yield strategies:

We will delve into the current status and catalysts of some major innovative interest rate channels to assess future development prospects.

On-Chain Lending Market

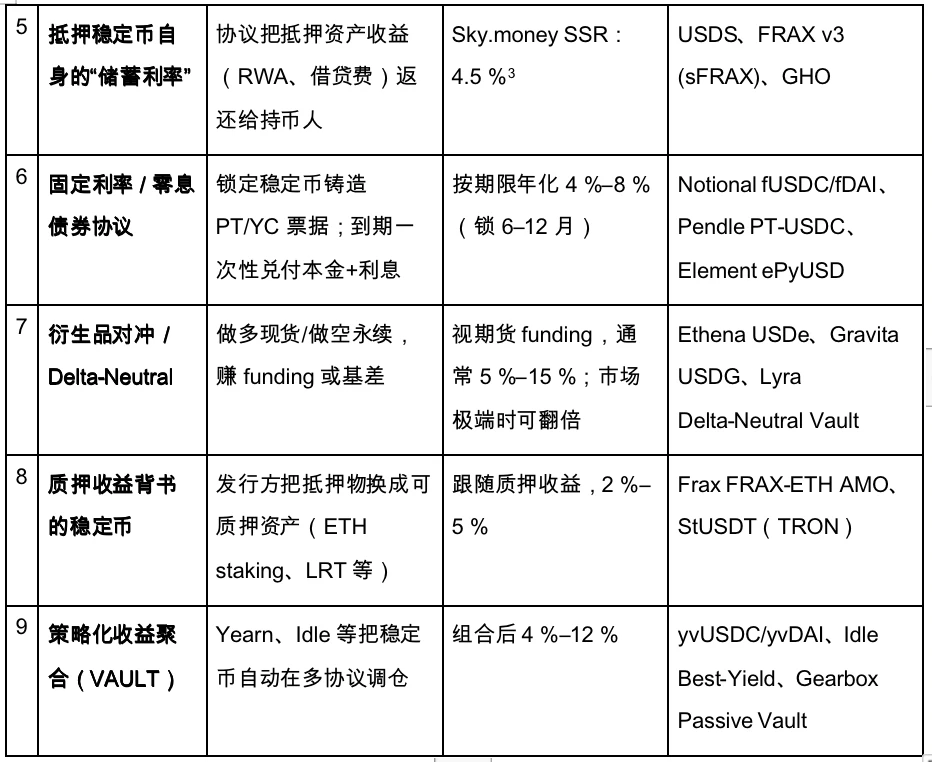

AAVE V3 USDC, source: AAVE

The above chart shows the lending rates for USDC on the AAVE V3 Ethereum mainnet, which is typically regarded as the "benchmark rate" for on-chain lending. In the current market environment of low sentiment and insufficient capital demand, lending activity has significantly declined, resulting in rates remaining around 2% since the beginning of the year.

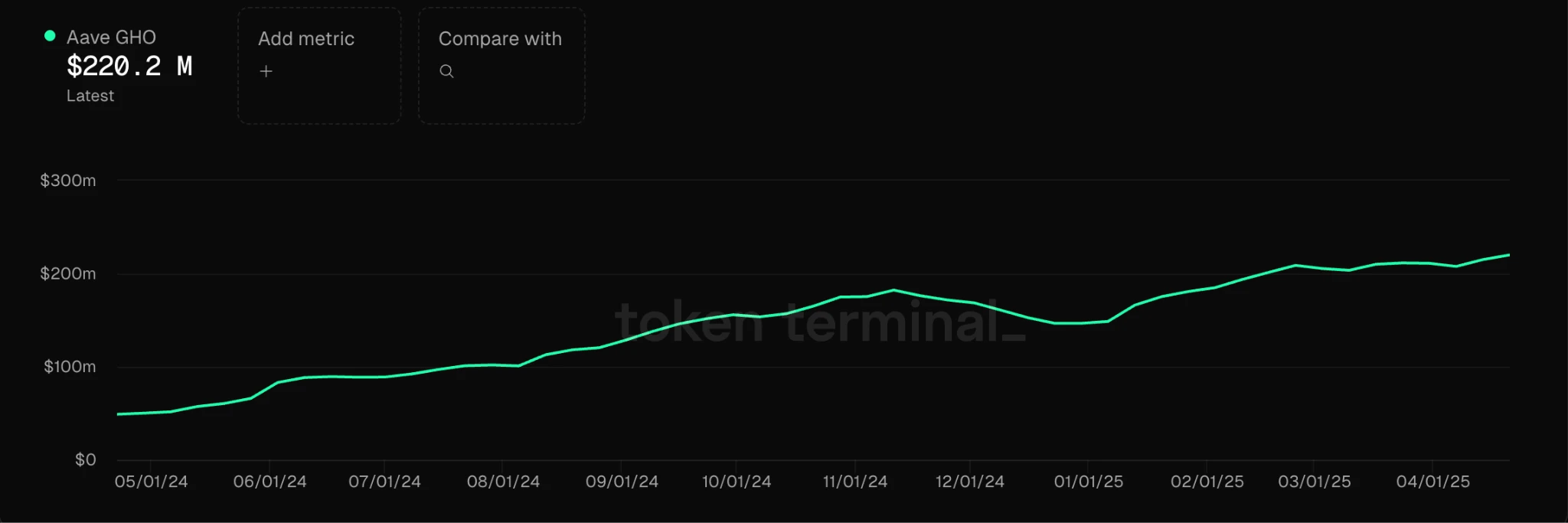

At the same time, AAVE has launched its native stablecoin GHO, supported by an over-collateralization mechanism, with its rates also derived from market lending demand. Although most mainstream stablecoins can earn interest on this platform, it must be done through borrowing, which limits capital efficiency. Currently, GHO's borrowing rate fluctuates between 2-4%, heavily influenced by market cycles. During bull market phases, such borrowing rates can soar to 10%-20%, but overall volatility is high, leading to insufficient stability. In such high-volatility rate scenarios, Pendle can serve as a tool to redeem this interest in advance. At this point, it may be worth considering using Pendle to cash out this interest early.

RWA Market (Primarily U.S. Treasuries)

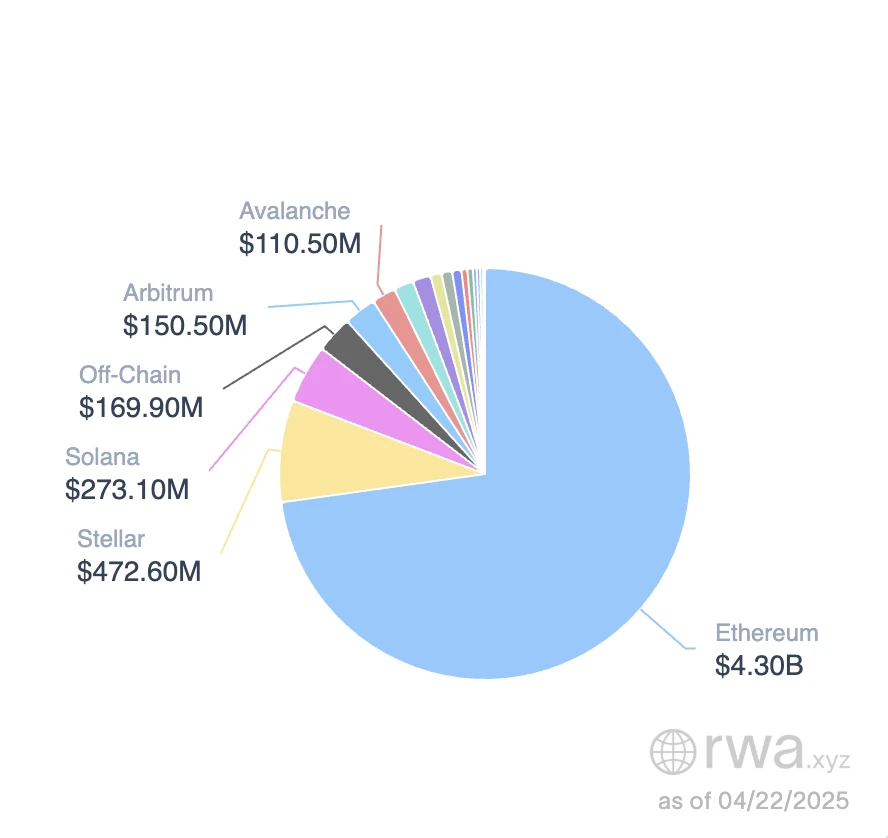

Opportunities in the RWA market for stablecoins, source: RWA.xyz

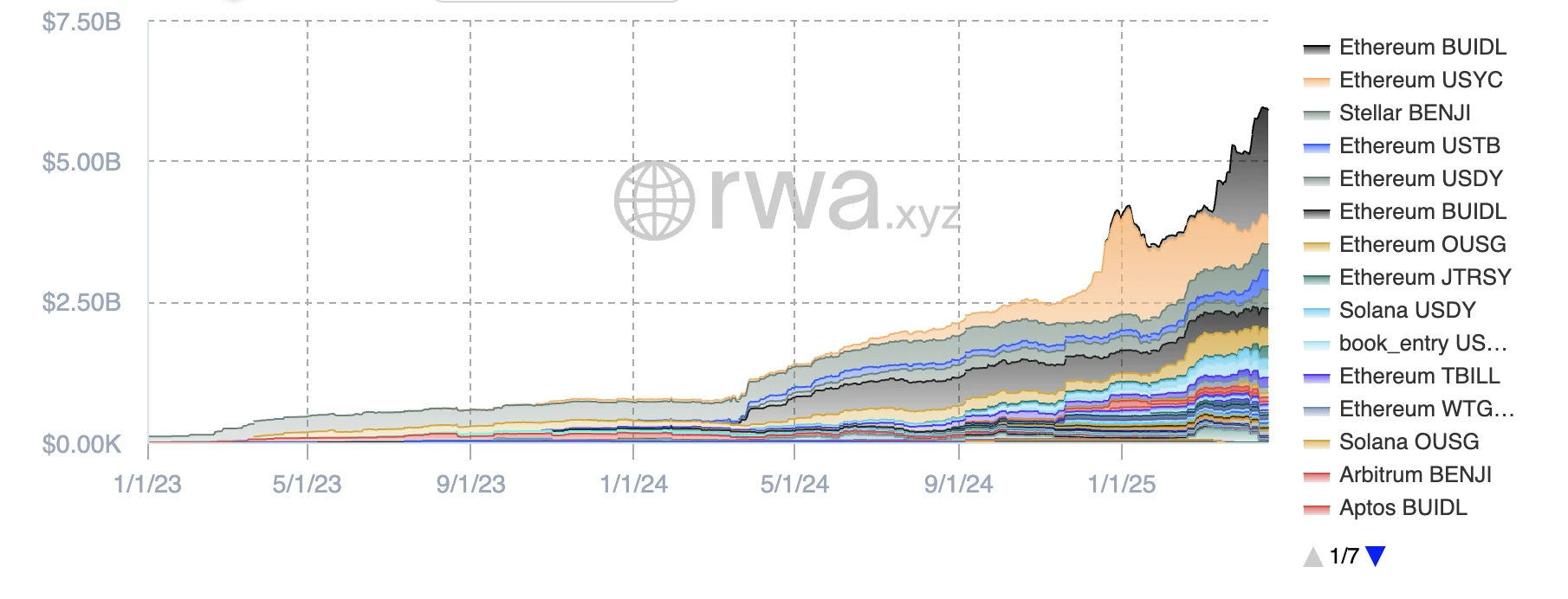

Currently, stablecoins based on U.S. Treasuries are showing a gradual growth trend, with the current total market size at $5.9 billion. The Ethereum ecosystem dominates, covering over 80% of the market share. In terms of stablecoin categories, BlackRock's BUILD holds the majority share of the U.S. Treasury-based stablecoin market (32%), approximately $1.9 billion; followed by Circle's USYC ($490 million) and Franklin Templeton's BENJI.

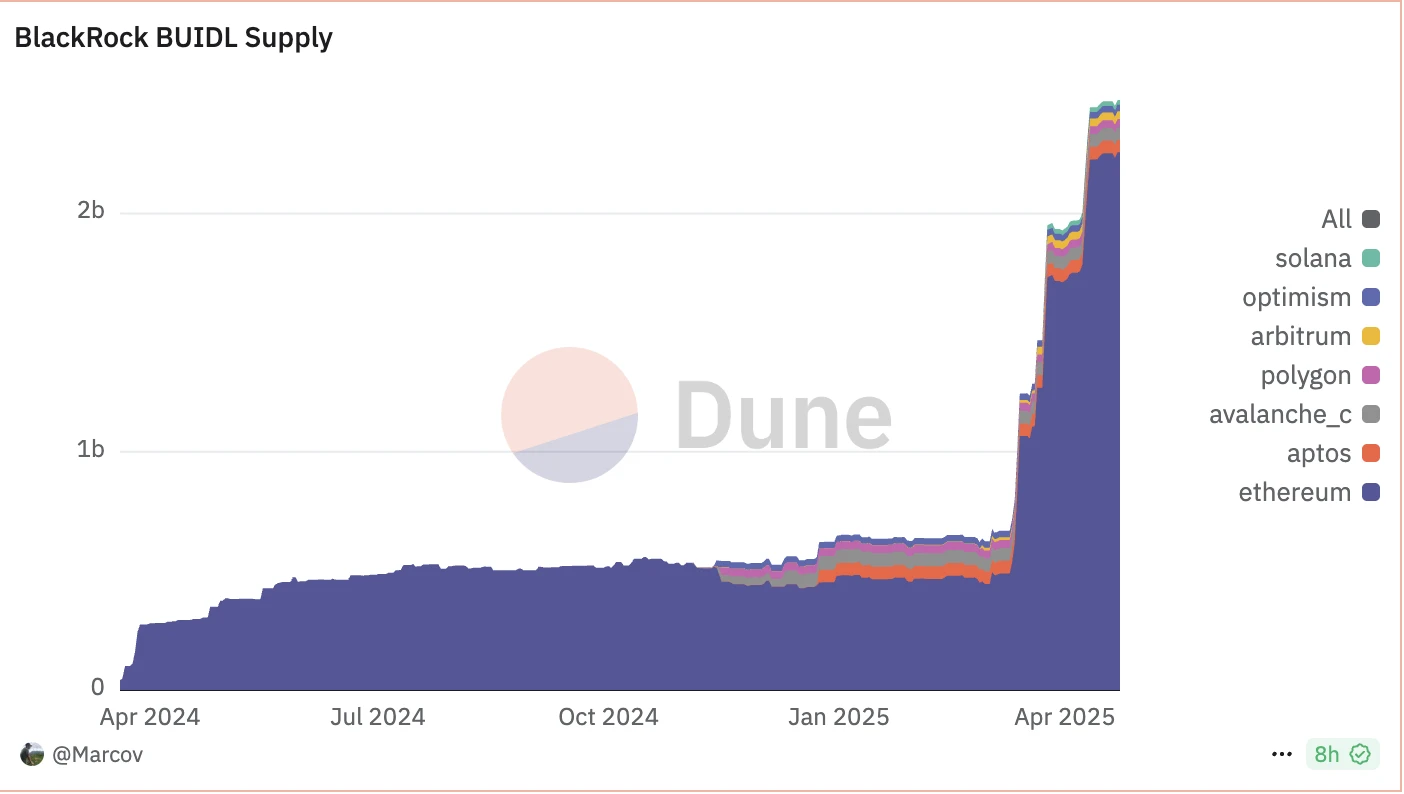

BUIDL Supply, source: Dune

Taking BUIDL as an example, although it is pegged to $1, it is essentially not a stablecoin for everyday payments but a fund share benchmarked against short-term U.S. Treasuries, cash, and overnight repurchase agreements. Users can subscribe through USDC/USD, with each BUIDL corresponding to $1 principal, and returns distributed through a monthly Rebase mechanism. Early participants include Anchorage Digital Bank NA, BitGo, Coinbase, and Fireblocks.

The supply scale of BUIDL is rapidly increasing, with a minimum subscription threshold of $5 million. As of May 1, 2025, 48 clients have participated, with total assets under management (AUM) reaching $2.47 billion. According to Ondo Finance, the product's annualized yield (APY) is approximately 4%, corresponding to the current yield levels of U.S. Treasuries with 3 to 6-month maturities.

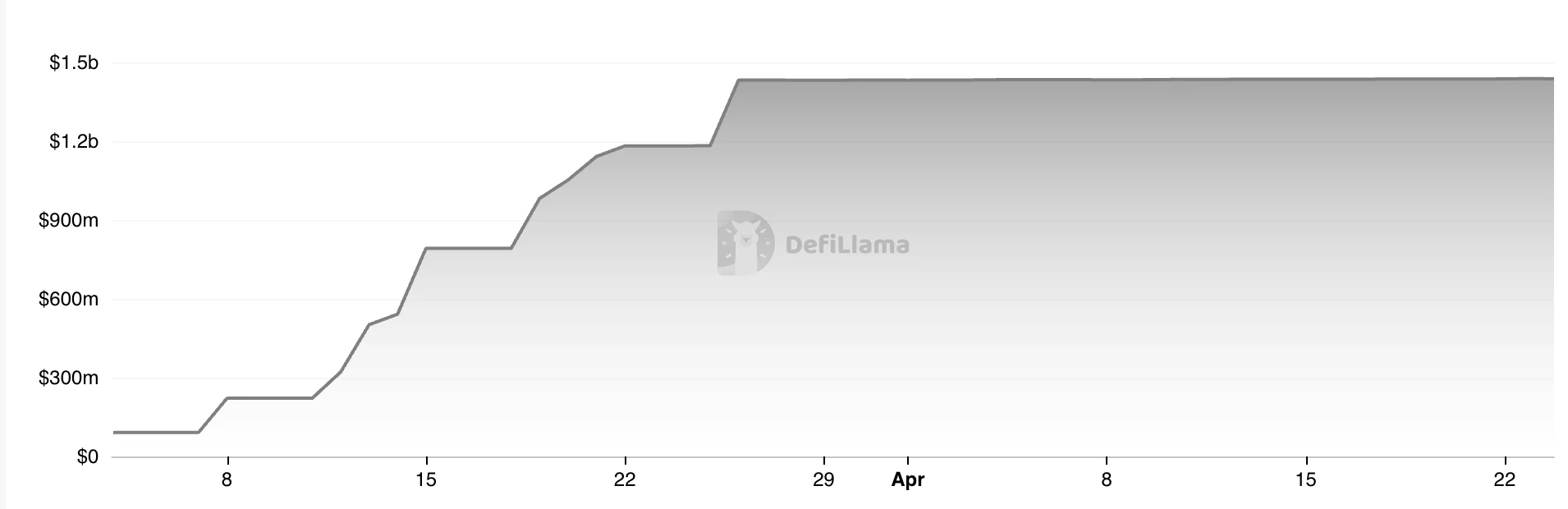

USDtb TVL, source: Defillama

Building on existing money market fund-type stablecoins, Ethena's USDtb is an innovative attempt. This product constructs a freely tradable asset based on the BUIDL tokenized fund, differing from Ondo's OUSG and BlackRock's BUIDL. Currently, its assets under management are approximately $1.43 billion, and it has established deep cooperation with Bybit, showing good overall market liquidity.

Overall, the RWA-based stablecoin market is rapidly expanding, with a total size reaching approximately $5.9 billion. Ethena's USDtb provides a new directional reference: if U.S. regulators allow the "yield-bearing stablecoin" model in the future, the market cap of such products could theoretically match that of U.S. money market funds, reaching $6 trillion.

However, in the short to medium term, there is downward pressure on U.S. Treasury yields. In the current context where stablecoins are primarily driven by interest rates rather than actual payment demand, stablecoin strategies based on money market funds may face a contraction in returns in the short term. Nevertheless, from a long-term perspective, this sector still possesses strong growth potential.

The "Savings Rate" of Collateralized Stablecoins

The DSR (Dai Savings Rate) was initially launched by MakerDAO and has now evolved into the SSR (Stablecoin Savings Rate) module in Sky.money. This module allows USDS holders to earn a share of protocol yields at an annualized rate, with interest calculated in real-time per block, no lock-up, and no fees, allowing users to deposit and withdraw at any time.

The yield comes from the profits generated by MakerDAO/Sky.money. To promote the broader use of USDS in DeFi, Sky.money has established an incentive mechanism that allocates a portion of the protocol's revenue to the USDS savings rate. Currently, this rate is approximately 4.5% annually.

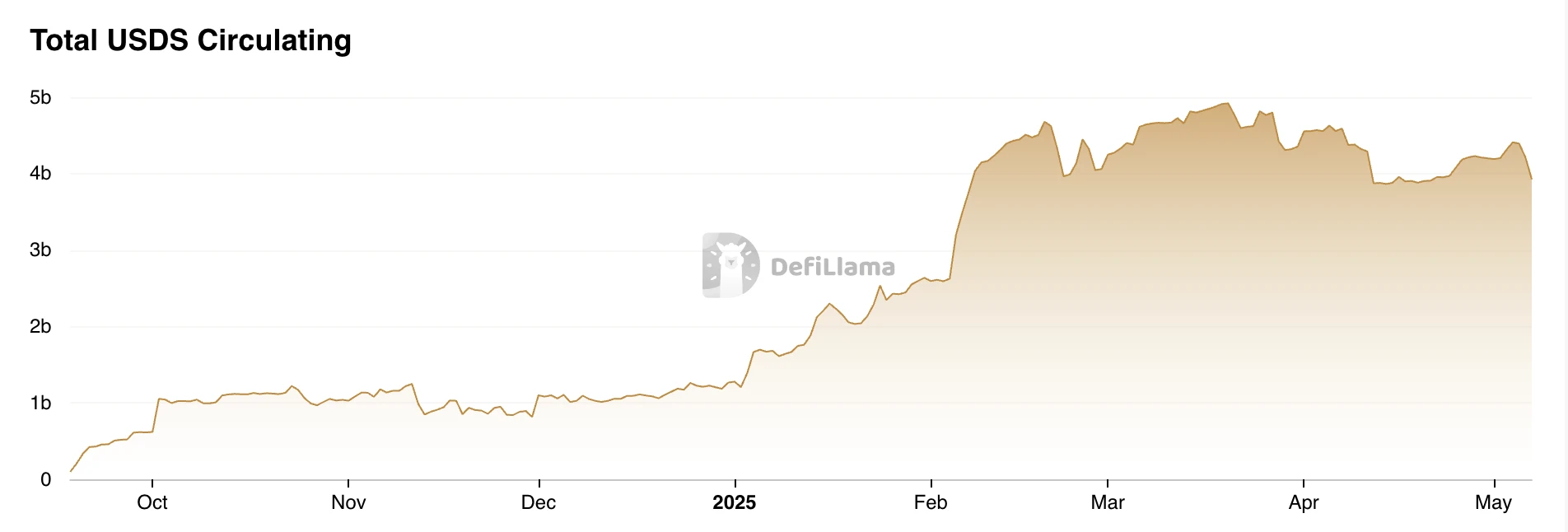

USDS Growth, source: Defillama

Essentially, this is a protocol dividend-type stablecoin model. During market downturns, Sky.money will redirect profits originally intended to empower the native token towards USDS to encourage its use, which may weaken the price support for the native token. Conversely, during favorable market conditions, moderately transferring token yields in exchange for overall protocol growth can help boost the token price, which is a reasonable strategy. Given that this model is deeply tied to the protocol, Sky.money needs to have sufficient influence to truly promote USDS as a widely used unit of account, which is inherently challenging and demonstrates great ambition.

Derivatives Hedging + Staking Yields

Derivatives hedging rates (also known as delta-neutral rates) are a source of yield based on the derivatives market. They lock in price direction risk (Delta) by simultaneously holding long and short positions while earning from funding rates or the price difference between futures and spot prices. In the derivatives market, perpetual contracts are the primary focus. There are several types of yields:

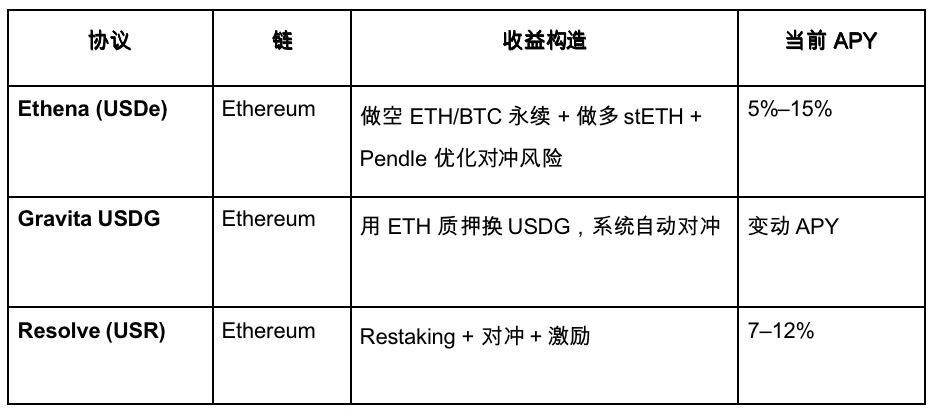

Some representative projects are shown below:

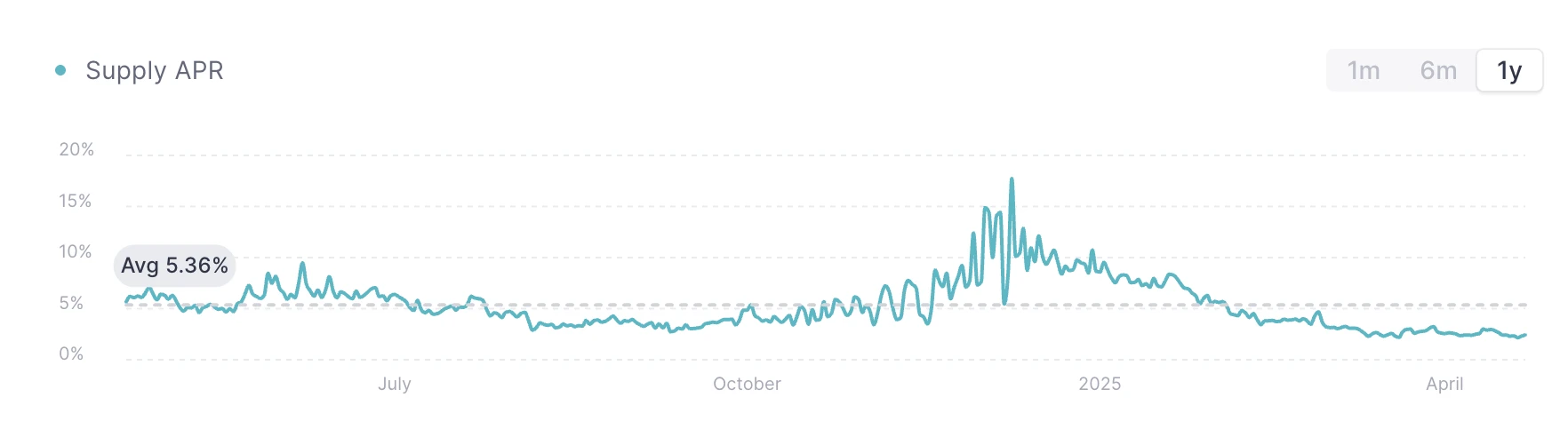

USDe APY, Source: Exponential.FI

USR APR, source: Resolve

The above shows the changes in stablecoin rates for USDe and USR. Overall, USDe, as the first neutral rate stablecoin, and USR as a follower, currently promote their strategy by offering higher rates to attract user deposits, but there is not much essential difference from Ethena.

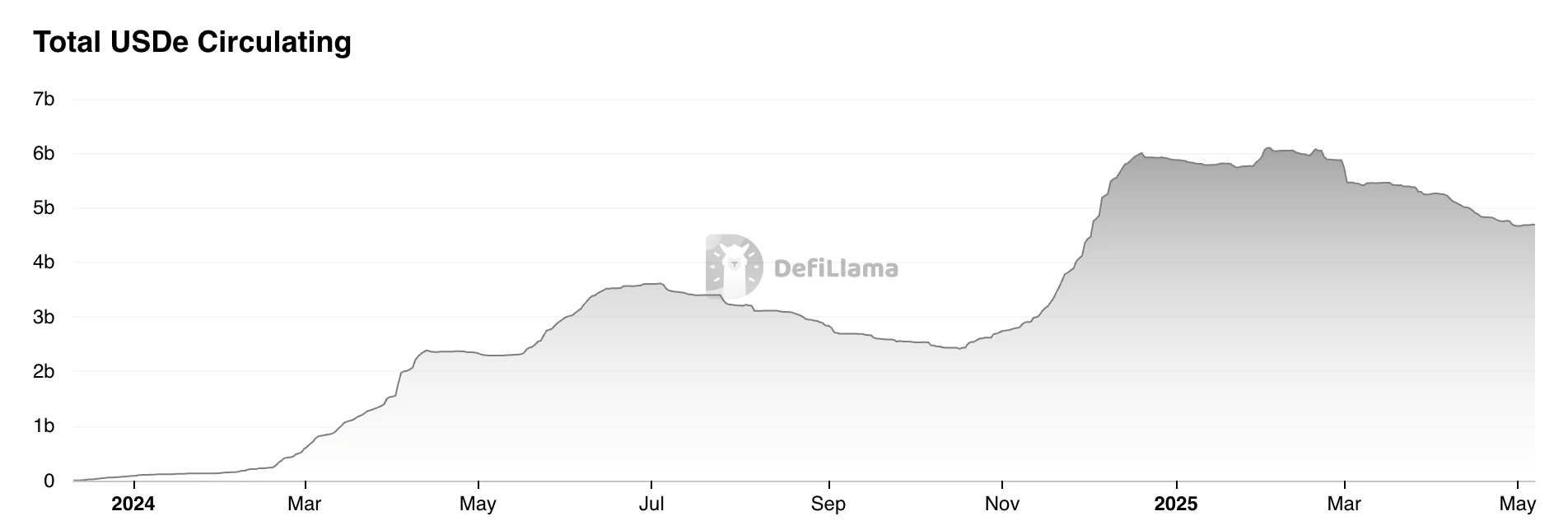

USDe TVL, source: Defillama

According to data from Defillama, after completing its airdrop, the market value of Ethena's stablecoin has significantly declined, falling about 20% from its peak. This is mainly influenced by the downward trend in USDe yields; additionally, current stablecoins generally face the "financial legos" dilemma—lacking rigid demand from the real world, they essentially resemble funds constructed for capital fee arbitrage.

The minting method for funding-rate type stablecoins (Δ-neutral stablecoin) is:

- Purchase an equivalent amount of spot (or LST)

- Open a short position of the same face value in the perpetual market

Thus, for every $1 of stablecoin minted, it corresponds to approximately $1 in spot + $1 in nominal short position, meaning its minting scale is theoretically limited by the existing open interest (OI) in the perpetual market.

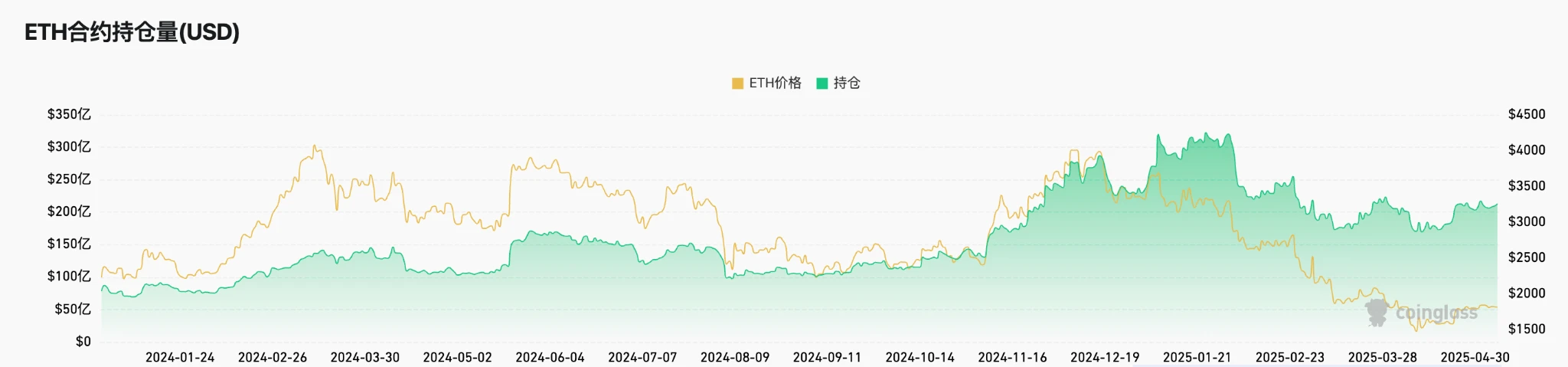

Ethereum OI, source: Coinglass

According to Coinglass statistics, the total open interest (OI) for ETH across major exchanges is approximately $20 billion. Conservatively estimated, the market cap for USDe is about $4 billion.

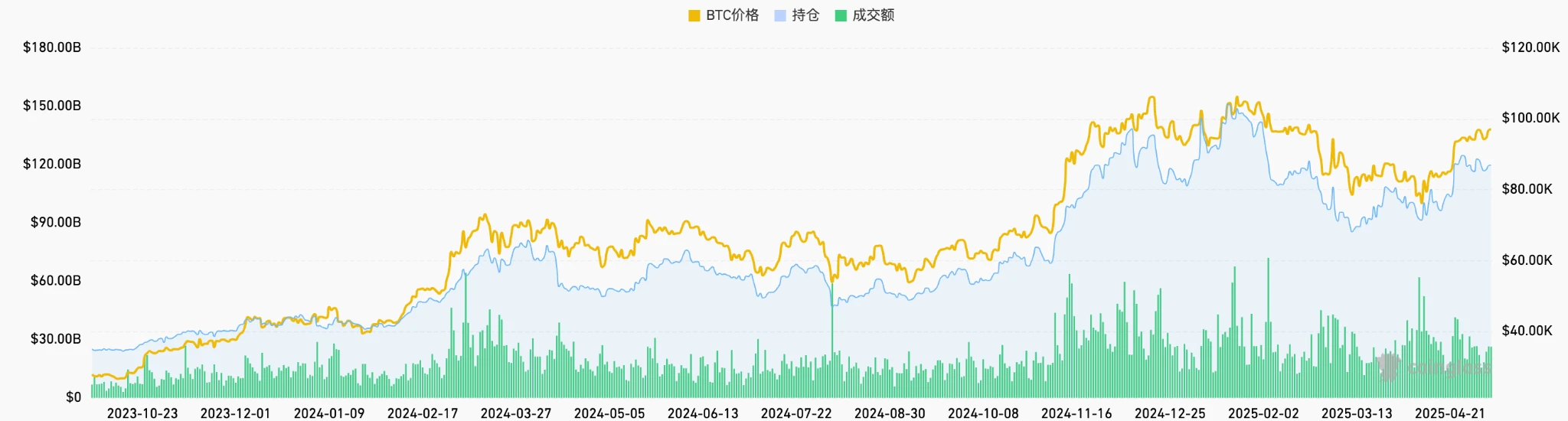

All tokens’ OI, source: Coinglass

If we include the total OI across the network, the market size for hedging strategies based on contract rates is approximately $120 billion. Conservatively estimated, this type of strategy could capture about 20% of the market share, or approximately $24 billion.

In other words, the entire market share available for the contract rate hedging strategy is conservatively estimated at $24 billion. Based on this, the potential market size that USDe, focused on the ETH market, could capture is roughly between $4 billion and $8 billion. Currently, the minting scale of USDe is about $4.6 billion and is showing a downward trend, indicating that its growth is gradually approaching its ceiling, with a noticeable cap.

Strategy Aggregation Vault

For example, Idle Best-Yield has deployed an automated strategy system on Ethereum and Polygon that dynamically adjusts positions based on on-chain arbitrage opportunities to maximize stablecoin yields. Similarly, Hyperliquid's HLP can also be seen as a yield pool for strategy-based stablecoins, with its yield primarily sourced from counterparty strategies that oppose retail direction. While these multi-strategy models offer higher yields, they also come with higher risk exposure.

Binance Launches LDUSDT

We must always maintain a very cautious attitude towards this type of stablecoin, as it essentially represents a hedge fund subscription share. As Binance describes LDUSDT, it is not a stablecoin but a new type of margin asset designed specifically for users subscribing to the Simple Earn USDT flexible investment product. It is a wrapper for USDT, serving as a valuation asset for contract margins and also earning annual interest from Binance's Simple Earn. Therefore, its underlying interest depends on the lending market of Binance's Simple Earn module.

Simple earn APR, source: Binance

The strategy-based stablecoin represented by Ethena's USDe may be an innovative form. Overall, the rise of strategy stablecoins reflects a certain conservatism in the crypto market, but it can also be seen as progress. Unlike the previous round of stablecoins that relied on subsidy-driven growth, current stablecoins depend more on diversified, organic strategies that yield actual returns, demonstrating stronger sustainability. However, when excluding points or token airdrop subsidies, their annualized yields do not show a significant advantage compared to U.S. Treasuries.

At the same time, the synergistic effects of the DeFi world have yet to be fully realized, leading to stablecoins still being primarily used for "financial legos" internal plays rather than driving real large-scale applications. Promoting exchanges to list such synthetic stablecoins is an important step towards large-scale adoption in the Web3 world. Currently, Ethena is advancing rapidly in this field, with Bybit and Bitget already listing its trading pairs, and Gate has also reached a strategic partnership with Ethena. However, the results are still not ideal, with the 24-hour trading volume of USDE/USDT across the network being less than $100 million.

Overview of Stablecoin Projects

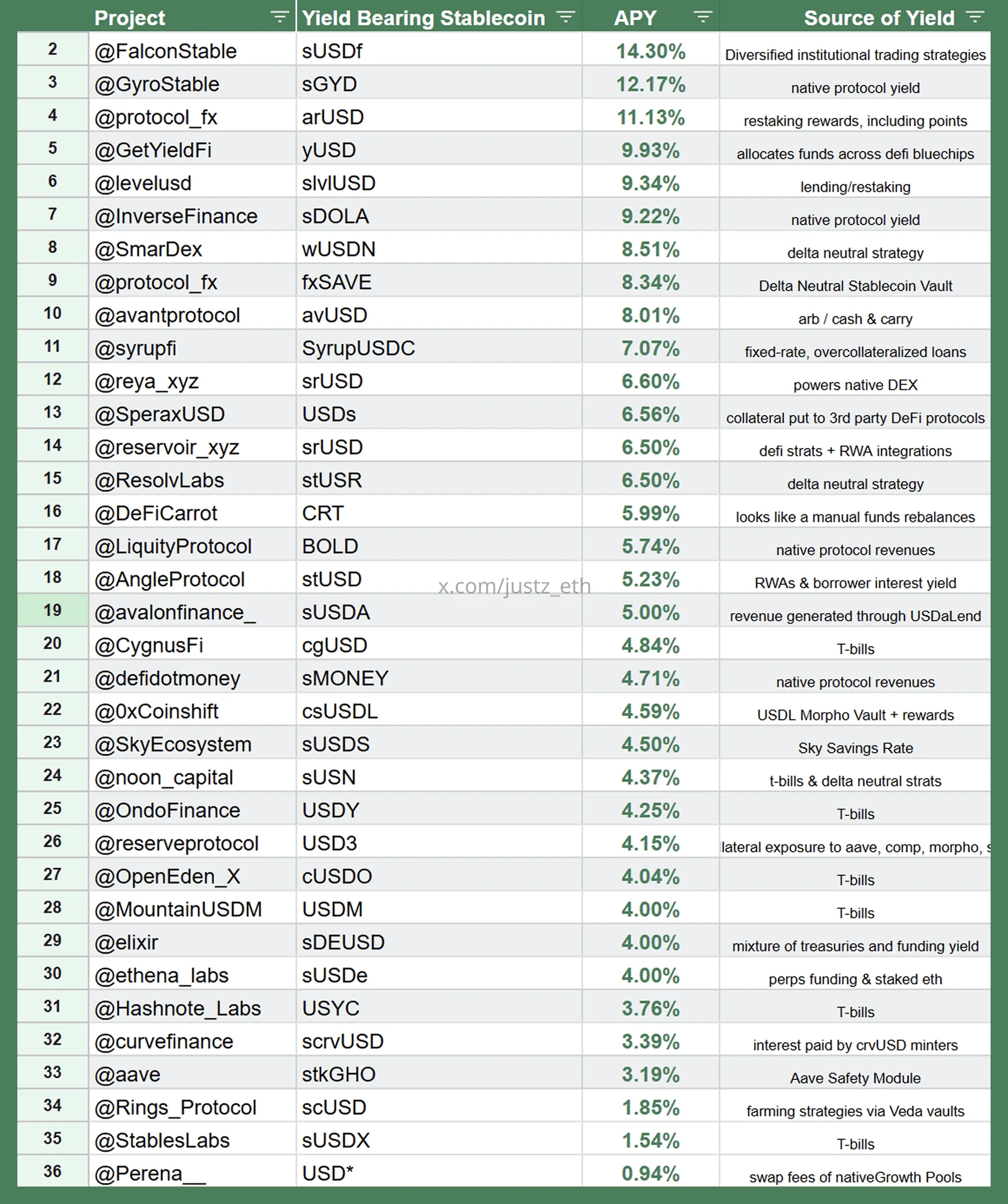

Strategy-backed Synthetic Stablecoins Landscape, source: justz_eth

The above shows more strategy-based synthetic stablecoins, with each stablecoin's interest source corresponding to the strategies listed in the chart.

Strategy Classification, source: justz_eth

Some popular stablecoin projects in the current market have their underlying synthetic asset interest sources mostly categorized into the several strategies mentioned earlier. However, it should be noted that many projects' TVL data may be inflated, and some projects even have special agreements with large holders, so readers should approach this information with caution. Ultimately, these stablecoins are closer to hedge fund subscription shares, and thus carry legal risks of being classified as securities.

In terms of market share, the stablecoin sector based on U.S. Treasuries has a larger scale, and the large-scale application of these projects heavily relies on strong support from legal regulations and the banking system. Therefore, we are relatively more optimistic about such projects. Other strategies, such as lending rates, restaking rates, risk-free contract rates, and protocol revenues, all have significant ceilings, and we recommend moderate participation.

New Ways of Interest Rates

Here are some of our ideas for entrepreneurs' reference:

First is the new play with assets. BTC, as a key asset connecting TradFi and Web3, has a market value of trillions of dollars. If BTC-Fi can introduce a base interest rate into stablecoins and build a stablecoin system based on the BTC ecosystem, its promotion difficulty may be lower than that of other public chain ecosystems. However, the challenge lies in the lack of infrastructure within the BTC ecosystem itself. One could consider starting from off-chain, such as initiating the first step around BTC's contract rate arbitrage, but the overall logic still falls within the realm of strategy-based hedge funds.

Secondly, there are new applications for strategies. All arbitrage strategies can theoretically become sources of "stablecoin" interest. For example, on-chain MEV, IV-RV deviations, cross-term volatility arbitrage, GameFi yields, and even security fees provided by EigenLayer AVS or some income generated by DePIN devices could potentially be incorporated into the interest mechanism of stablecoins, thus deriving new stablecoin interest rate models.

Ultimately, these still belong to strategy-based synthetic stablecoins, rather than traditional stablecoins anchored to real assets. Their market capacity is limited by the feasible space of the strategies themselves, which depends on the scale of the underlying markets. Currently, most related markets are still relatively small. In the long term, as DeFi expands overall, this sector has growth potential, especially since many strategies themselves possess highly Crypto Native characteristics, allowing them to more sensitively reflect changes in the on-chain market.

Beneficiaries Under the Stablecoin War: Pendle

Fixed interest rates are an innovative yield mechanism designed to provide users with predictable fixed returns, similar to zero-coupon bonds in traditional finance. In traditional finance, zero-coupon bonds are issued at a price below par value and repay the principal at par upon maturity, with no interest paid during the period. Investors' returns come from the difference between the purchase price and the amount repaid at maturity. In DeFi, a similar mechanism has been introduced by Pendle, which tokenizes the future yields of yield-bearing assets, allowing users to:

Lock in fixed returns: By purchasing tokens representing the principal, users can hold them until maturity to receive fixed returns.

Speculate on yields: By purchasing tokens representing future yields, users can bet on changes in yield rates.

Improve capital efficiency: By selling future yields for immediate liquidity while retaining ownership of the principal.

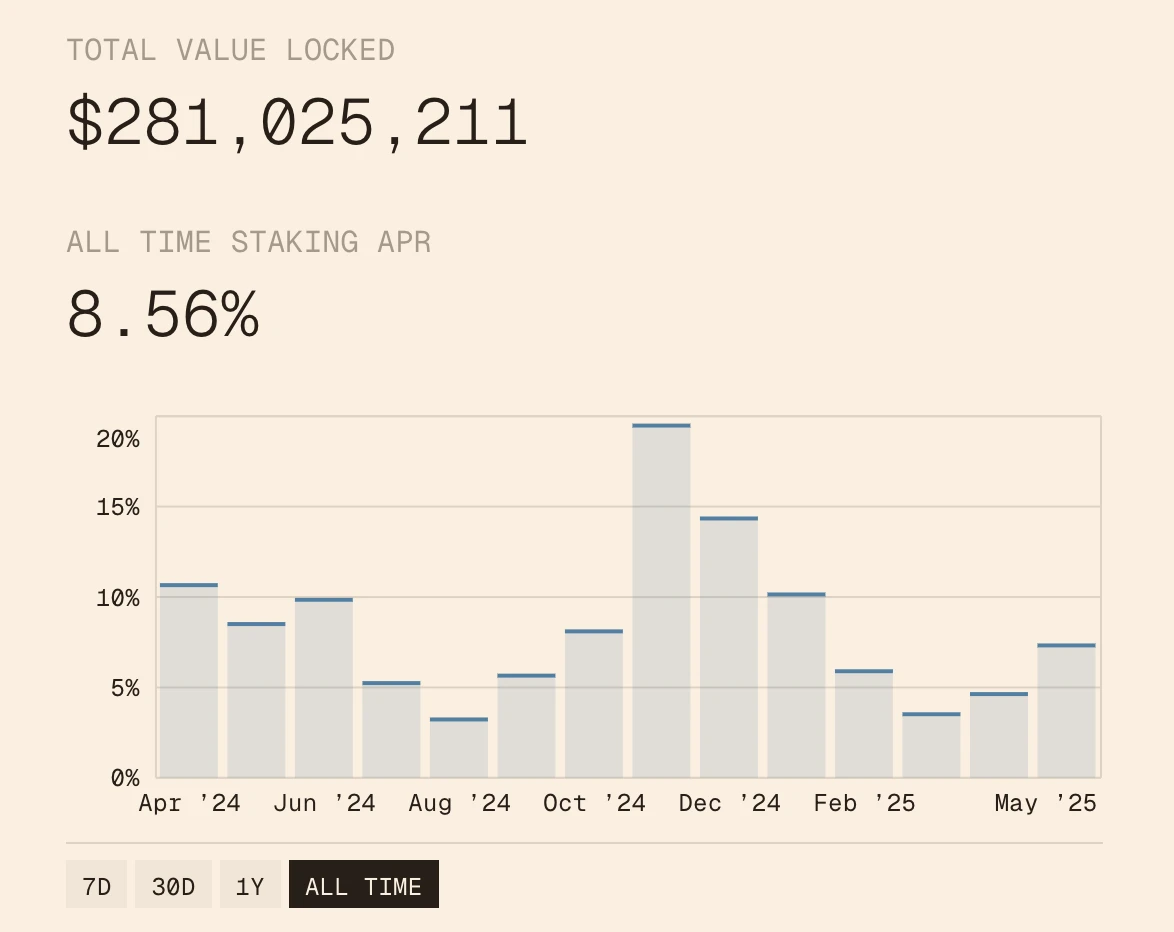

Pendle Snapshot, source: pendle

Pendle is a DeFi protocol focused on yield tokenization, allowing users to split yield-bearing assets into two types of tokens: PT and YT, and trade them on its platform. Essentially, Pendle has built a trading market for these interest rates, providing a means to hedge the yield strategies behind stablecoins, thus forming fixed interest rates.

During the last LRT craze, Pendle's token price experienced a significant drop following the issuance of EigenLayer tokens. However, with the rise of "strategy-based stablecoins," Pendle's TVL has seen explosive growth. It is gradually establishing itself as the core "interest swap layer" for such assets: stablecoin issuers can sell future yields in one go through Pendle to hedge risks, while speculators and asset managers can buy or provide liquidity for these yield streams. With the launch of more Δ-neutral and RWA mixed yield coins, Pendle's TVL, trading volume, fee income, and vePENDLE ecosystem are all rising in tandem. Currently, it has formed an almost monopolistic leading advantage in this sector.

Disclaimer:

This content does not constitute any offer, solicitation, or advice. You should always seek independent professional advice before making any investment decisions. Please note that Gate and/or Gate Ventures may restrict or prohibit all or part of the services from restricted areas. Please read their applicable user agreements for more information.

About Gate Ventures

Gate Ventures is the venture capital arm of Gate, focusing on investments in decentralized infrastructure, ecosystems, and applications that will reshape the world in the Web 3.0 era. Gate Ventures collaborates with global industry leaders to empower teams and startups with innovative thinking and capabilities to redefine the interaction patterns of society and finance.

Official website: https://ventures.gate.io/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/gate_ventures

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。