$87 Million Inflow Pushes Bitcoin ETFs Higher With Ether ETFs Seeing Continued Momentum

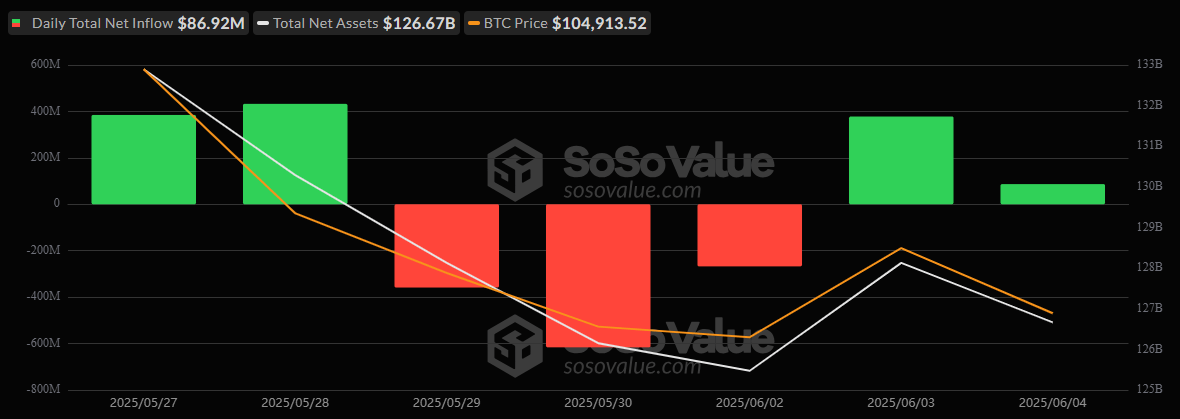

Momentum hasn’t slowed for digital asset ETFs. Bitcoin ETFs registered a net inflow of $86.92 million, marking another recovery day as markets continue to find their bullish rhythm.

There were two major players in the trading session: Blackrock’s IBIT and Fidelity’s FBTC. Blackrock took the spotlight with a massive $283.96 million inflow, reinforcing its role as the market’s institutional favorite. Meanwhile, Fidelity’s FBTC posted a significant $197.04 million outflow, but it wasn’t enough to tip the scales red. The day still ended with net gains for bitcoin ETFs.

Source: Sosovalue

The total value traded came in at $2.38 billion, and the total net assets for the bitcoin ETF market settled at $126.67 billion.

Ether ETFs kept their hot streak alive with a 13th consecutive day of net inflows, raking in $56.98 million. Blackrock’s ETHA once again led the charge, contributing $73.18 million, while Grayscale’s Ether Mini Trust added $7.42 million. The lone drag came from Fidelity’s FETH, which saw a $23.62 million outflow.

Despite the pull from Fidelity, ether ETFs remained in the green, trading $386.06 million across the board and pushing total net assets up to $9.88 billion. The trend, for now, remains decisively bullish.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。