In the past 24 hours, the global business and cryptocurrency markets have been ignited by a high-profile "century showdown." Elon Musk, the head of Tesla and SpaceX, and former U.S. President Donald Trump have gone from allies to openly tearing each other apart, with their dispute quickly escalating from differences over a budget bill to mutual threats, affecting Tesla's stock price, SpaceX's government contracts, and the cryptocurrency market, marking a "Mars colliding with Earth" level of business-political confrontation.

The Trigger: A Budget Bill Sparks a War of Words

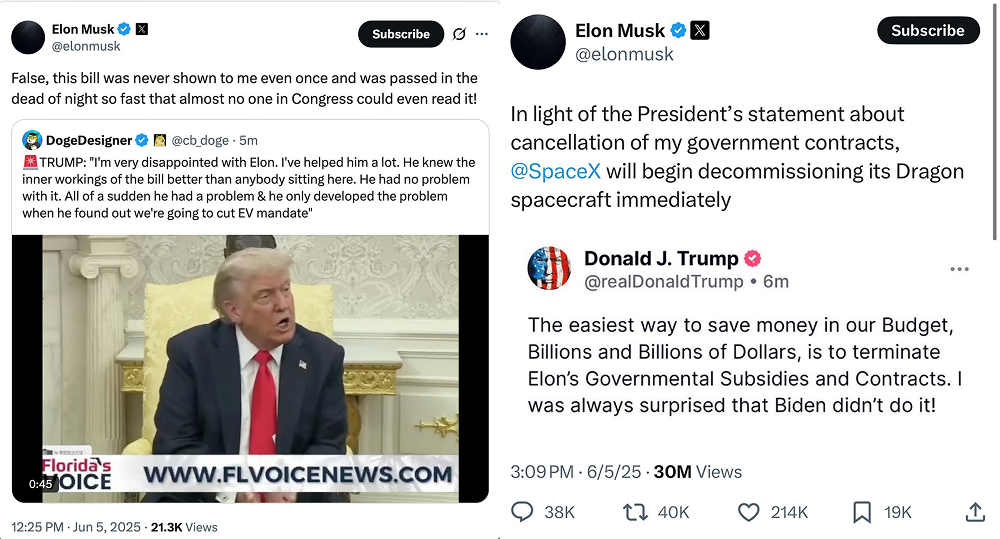

On June 5, Musk took the initiative on the X platform, sharply criticizing the "budget-busting Megabill" promoted by the Trump administration, calling it a "fiscal disaster," and urging the Republican Party to reassess its spending plans. Musk's remarks were pointed, implicitly accusing Trump of shortsightedness in fiscal policy, quickly sparking heated discussions. Within two hours, Trump retaliated on Truth Social, accusing Musk of being "ungrateful" and threatening to cancel over $38 billion in government contracts for Tesla and SpaceX, including the NASA-SpaceX Dragon spacecraft project. Trump even bluntly stated that Musk was "disloyal to the Republican Party" and suggested that his influence was overestimated.

The confrontation did not stop at verbal exchanges. In the early hours of June 6, Musk dropped a "bombshell" on X, implying that Trump was connected to the undisclosed Epstein files, stating, "This is the real reason the files have not been released." He also announced that SpaceX would "immediately retire" the Dragon spacecraft project in response to Trump's contract threats. Following this statement, market sentiment quickly deteriorated, with Tesla's stock price plummeting 14% in after-hours trading, resulting in a market value loss of approximately $150 billion.

Market Turmoil: Pressure on Both Crypto and Stock Markets

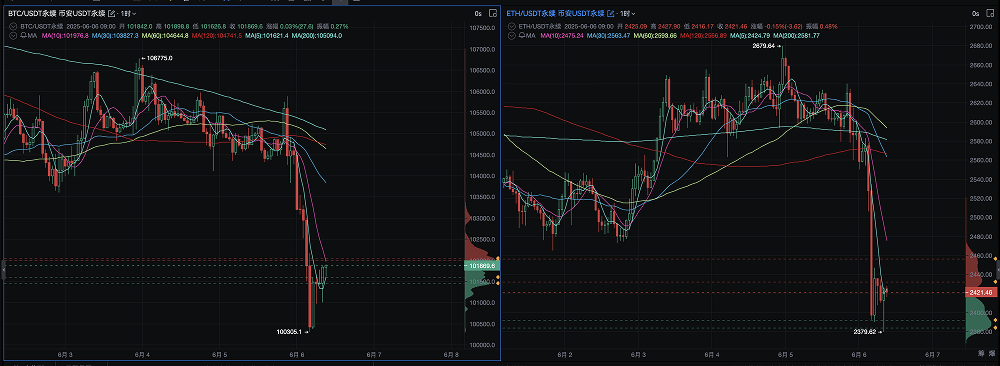

The aftermath of this dispute quickly swept through the cryptocurrency and stock markets. Bitcoin (BTC) dipped to $100,305 within 24 hours, a drop of 4%, hitting a one-week low, before rebounding above $101,500 with support from institutional buying, with trading volume increasing by 38%, indicating heightened market panic. Ethereum (ETH) fell by over 5%.

Dogecoin (DOGE), which Musk has long supported, was not spared; influenced by "Musk-related" sentiment, DOGE plunged 9% within three hours, reaching a two-week low of $0.195. The $TRUMP token suffered an even heavier blow due to Trump's controversial remarks, plummeting 12% within 24 hours, with a market value loss of nearly $1 billion. Crypto-related stocks also did not fare well, with Coinbase (COIN) down 5.7% and Riot Platforms (RIOT) down 8.3%.

Underlying Logic: Power Struggles and Market Sentiment

The essence of this dispute goes far beyond personal grievances, reflecting a structural conflict between Musk and Trump over political and business influence. Musk, as the head of the U.S. Government Efficiency Department (DOGE), has recently promoted a plan to optimize federal spending through blockchain technology, which directly contradicts Trump's fiscal expansion policies. Bloomberg reported that Musk has met with representatives from several blockchain projects to explore tracking government spending through distributed ledger technology, a plan seen as a challenge to the traditional fiscal system. Trump views Musk's criticism as a provocation to his authority, exposing their differences in ideology and interest distribution.

The sharp decline in Tesla's stock price is not only due to Musk's personal controversies but also related to expectations of potential contract cancellations. The SpaceX Dragon spacecraft project is a core component of NASA's moon landing plan, and if the contract is terminated, it would pose a threat to SpaceX's valuation and long-term development. The volatility in the crypto market is closely tied to Musk's "on-chain influence," as his long-term endorsement of DOGE makes the currency highly sensitive to his words and actions.

Public Opinion: Polarized Discussions on the X Platform

Discussions on the X platform are polarized. @Crypto_Cat888 posted: "Musk wants absolute control, and Trump can't stand being challenged; it's not surprising that they finally tore off the mask after pretending for so long."

@BTW0205 analyzed: "This is not just a clash of emotions but a structural fracture; Musk might even create a 'new party'." Trump's supporters on Truth Social rallied behind the president, believing Musk to be "ungrateful" and that he should not challenge Trump's authority.

It is worth noting that the Epstein files mentioned by Musk have not been officially confirmed, and discussions related to this on the X platform have been rapidly amplified, but lack substantial evidence.

Future Trends: Reconciliation or Continued Confrontation?

The future developments of this dispute remain unclear. In the short term, Tesla and SpaceX's stock prices may continue to be under pressure, and the crypto market will seek direction amid uncertainty. CoinVoice reported that Musk's Government Efficiency Department plans to audit the SEC to investigate potential issues in crypto regulation, which could inject new variables into the market.

In the long run, the game between Musk and Trump may reshape the interaction between technology and politics in the U.S. If Musk's blockchain reform plan progresses smoothly, it could bring policy benefits to the crypto industry; however, if the conflict with Trump continues to deepen, the prospects for government cooperation involving Tesla and SpaceX will be overshadowed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。