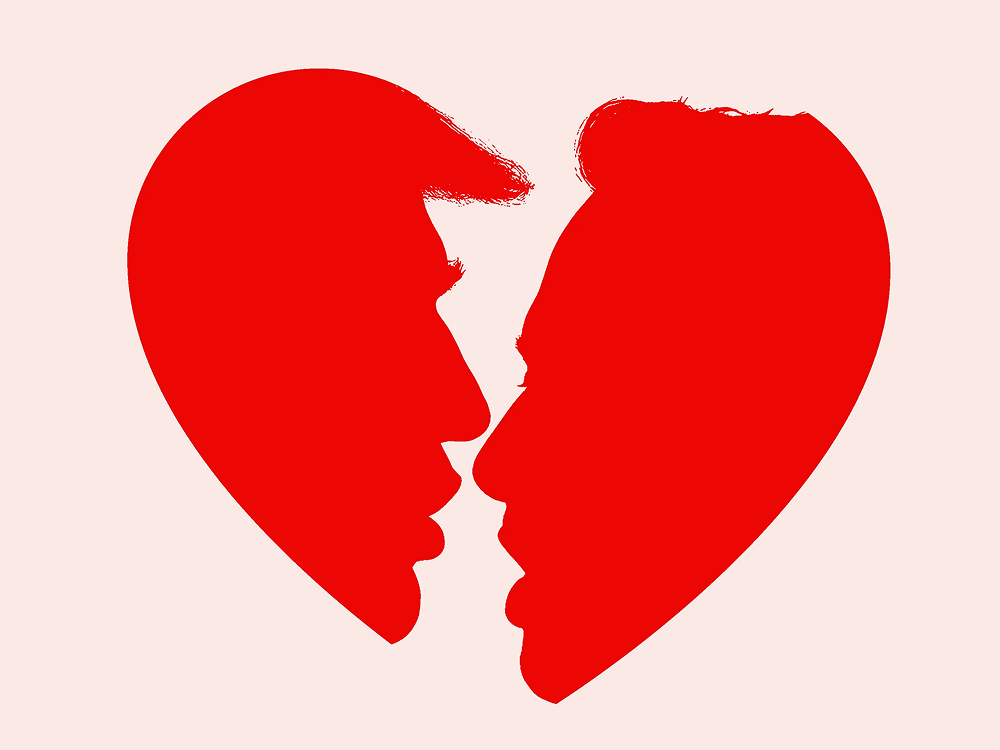

Since June 2025, the American political scene has been shaken by a major upheaval, with Trump and Musk, once allies, completely tearing apart their relationship and publicly confronting each other, causing global market turbulence. At the same time, Trump is accelerating the appointment of the Federal Reserve Chairman while facing regulatory pressure from the Democrats regarding his cryptocurrency investments.

Trump Warns Musk: Funding Democrats Will Have "Consequences"

On June 7, U.S. President Donald Trump stated in an interview that there is no possibility of repairing his relationship with Musk. According to Jinshi Data, Trump warned that if Musk funds Democratic candidates opposing the Republican budget proposal, he will face "very serious consequences." He bluntly said, "If he does this, he will pay the price." Trump further stated, "I think this relationship is over."

The catalyst for this public break stems from Musk's fierce criticism of Trump's promoted "Big Beautiful Bill." The bill passed the House in May by a narrow vote and includes a $4 trillion tax cut plan, increased defense spending, and immigration enforcement funding, but is expected to increase the federal deficit by $2.4 trillion over the next decade.

Musk posted multiple messages on social media platform X, calling the bill "absurd and ridiculous, filled with political manipulation," pushing the U.S. towards an "unsustainable debt abyss." He even initiated a poll asking whether a new political party should be formed, attracting 120 million participants within 24 hours, with 81% in favor.

Musk's intense reaction is not without reason. The "Big Beautiful Bill" eliminates the electric vehicle tax credit, which directly impacts Tesla. On June 5, Tesla's stock price plummeted by 14%, wiping out over $150 billion in market value. Trump retaliated, stating that Musk was already aware of the bill's details but "suddenly turned against" it after the electric vehicle subsidies were canceled, threatening to terminate SpaceX's government contracts, claiming this could "save billions of dollars." Musk announced that if the contracts were canceled, SpaceX would retire the "Dragon spacecraft," which would severely damage the U.S. manned space program, forcing NASA to rely on Russian spacecraft and pay a $2.3 billion penalty.

This war of words not only exposes the stark personality differences between the two—"Trump demands absolute loyalty, while Musk sees himself as a 'disruptor'"—but also reflects the divisions within the Republican Party. Analysts point out that Musk's tech empire relies on global supply chains and federal contracts, while Trump needs to maintain the interests of traditional energy and military-industrial groups, making their structural contradictions difficult to reconcile.

The Uncertainty of the Federal Reserve Chairman Appointment: Rising Expectations for Rate Cuts

On June 6, Trump revealed at a press conference that the results of the new Federal Reserve Chairman appointment would be announced "soon," and he indicated that he already had a candidate in mind. He added that a good Federal Reserve Chairman would lower interest rates.

It is noteworthy that Trump's monetary policy inclination sharply contrasts with Musk's fiscal conservatism. During Musk's tenure at the Department of Government Efficiency (DOGE), he pushed for cuts in federal spending but only achieved a reduction of $170 billion, far below his $1 trillion target. Trump's advocacy for rate cuts could further exacerbate deficit pressures.

Market speculation about the new Federal Reserve Chairman is focused on pro-business figures. Kevin Warsh, who was nearly selected as the Federal Reserve Chairman, has drawn attention due to his investment in the blockchain project Basis.

Democrats Target Trump's "Crypto Crimes"

According to crypto journalist Eleanor Terrett, the House Financial Services Committee will hold a hearing next week (June 16) to discuss the "Stop Trump from Participating in Cryptocurrency Act" (HR 3573) and the "CLARITY Act" (HR 3633). Led by Democratic Congresswoman Maxine Waters, the hearing aims to examine the potential risks of Trump and his family profiting from meme coins like "Trump Coin" ($Trump), labeling it as "crypto crime."

Trump launched "Trump Coin" on January 18, managed by his CIC Digital LLC, and within hours of its issuance, its market value soared to $5.5 billion, with 80% of the tokens held by Trump-related entities. Democratic lawmakers Elizabeth Warren and Jake Auchincloss wrote to the government ethics office, warning that the transaction could violate constitutional compensation clauses and "open the door" for foreign influence on U.S. policy.

The hearing will also focus on the "CLARITY Act," which aims to establish a regulatory framework for digital assets, but Democrats believe it could loosen regulations on Trump's crypto investments. Previously, Senate Democrats rejected a stablecoin bill supported by the crypto industry on May 8, refusing to include provisions that would prohibit Trump and other high-ranking officials from profiting from crypto investments.

Extended Analysis: The Triangular Game of Power, Capital, and Policy

The rift between Trump and Musk is not just a personal feud but a microcosm of the collision between capital and political power. Musk, as Trump's largest donor for the 2024 campaign (contributing nearly $300 million), was once seen as a core ally. However, his reform efforts at the Department of Government Efficiency faced obstacles, compounded by the impact of the "Big Beautiful Bill" on his business interests, prompting him to adopt a confrontational stance.

In the cryptocurrency realm, Trump's "pro-crypto" policy is highly tied to his personal investments. He has promised to make the U.S. the "crypto capital" and appointed pro-crypto Paul Atkins as SEC Chairman and David Sacks as crypto envoy, attempting to promote industry development through legislative and administrative means, but Democratic regulatory pressure may limit his policy space, especially with the advancement of the "Stop Trump from Participating in Cryptocurrency Act."

The appointment of the Federal Reserve Chairman will be a key juncture in Trump's second term. A rate cut policy could stimulate short-term economic growth but may also exacerbate inflation and deficit risks, standing in opposition to Musk's fiscal conservatism. Behind this game is Trump's attempt to balance economic stimulus, party interests, and personal wealth in a complex consideration.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。