Original Author | Nathan (@proofofnathan)

Compilation | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

Editor's Note: Since Circle announced its IPO, an invisible boundary in the stablecoin market has been officially drawn: USDC and USDT are beginning to follow two different development paths. USDC is centered on compliance and transparency, gradually embedding itself into the U.S. financial system, becoming a "permissioned dollar" for institutional users and fintech scenarios; while USDT relies on its extensive on-chain liquidity and deep market foundation, continuing to play a key role in global trading, payments, and asset hedging scenarios.

This difference essentially reflects the varying priorities of "value realization" for stablecoins in different markets. For some users, compliance and programmability are crucial; for others, liquidity, accessibility, and a permissionless user experience take precedence. Therefore, we need a new cognitive model to understand how different types of users realize value through stablecoins. This is precisely what the "Hierarchy of Value Realization for Stablecoins" aims to explore.

Although everyone derives benefits from stablecoins in different ways, ultimately, these benefits stem from four core value propositions: low cost, high speed, permissionless, and programmability.

The original author Nathan explained in another article titled "The What and Why of Programmable Money": Programmable money is money that can have its behavioral logic set like code. It is stablecoins and also the fuel for smart contracts. It can determine: when, for what reason, and in what manner to transfer funds. And all of this no longer relies on banks, no longer relies on trust, but solely on the code itself.

These four value propositions correspond to four core use cases: store of value, payment, transfer, and yield.

The "Hierarchy of Value Realization for Stablecoins" is a new cognitive model designed to explain the value points that different types of users prioritize when using stablecoins.

This article will focus on two user groups: "those who need stablecoins" and "those who do not need stablecoins as much," namely: users in emerging markets and users in Western markets.

Two Major User Groups of Stablecoins

In simple terms, in emerging markets, stablecoins are building a new financial infrastructure; while in Western markets, stablecoins are more of a supplement, integrated into existing fintech and traditional financial systems.

This pattern applies broadly to both emerging stablecoin projects and established players.

Based on this, we can outline different "value realization hierarchies" for the two user groups.

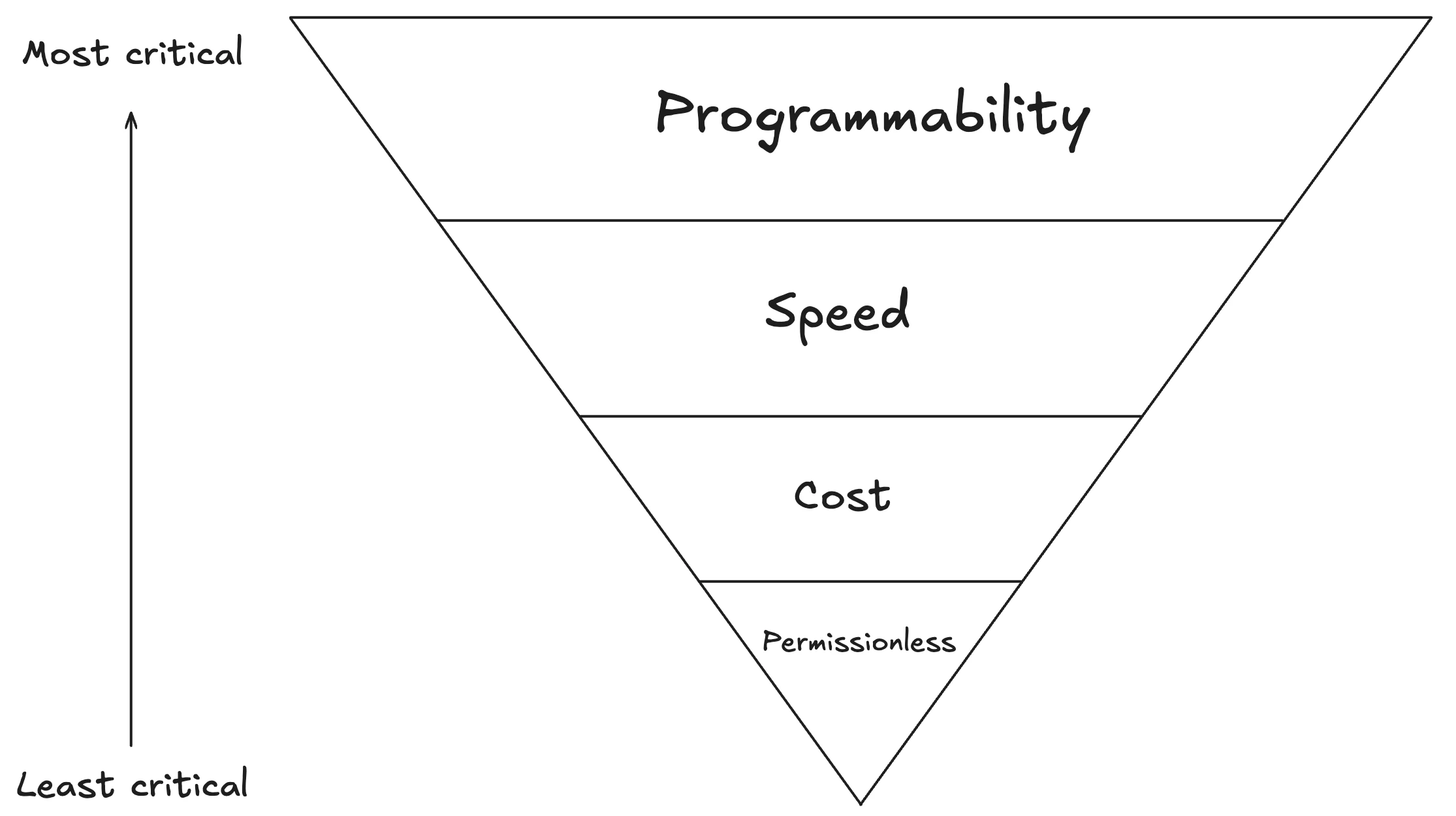

I. Value Realization Hierarchy for Western Market Users

The Western market primarily corresponds to "Global North" countries: politically stable, with developed financial systems, where most people have bank accounts and can earn interest on savings.

In these markets, "programmability" is the core driving force behind stablecoin innovation. This is similar to the explosive development of the internet, iPhone, or smart contracts: programmability brings new financial innovations, which are the passion and advantage of the Western world.

Next is "speed." The settlement speed of cross-border or local payments has long been a significant challenge in the fintech field; settlement delays can consume liquidity and create opportunity costs, thus ranking second in the Western market.

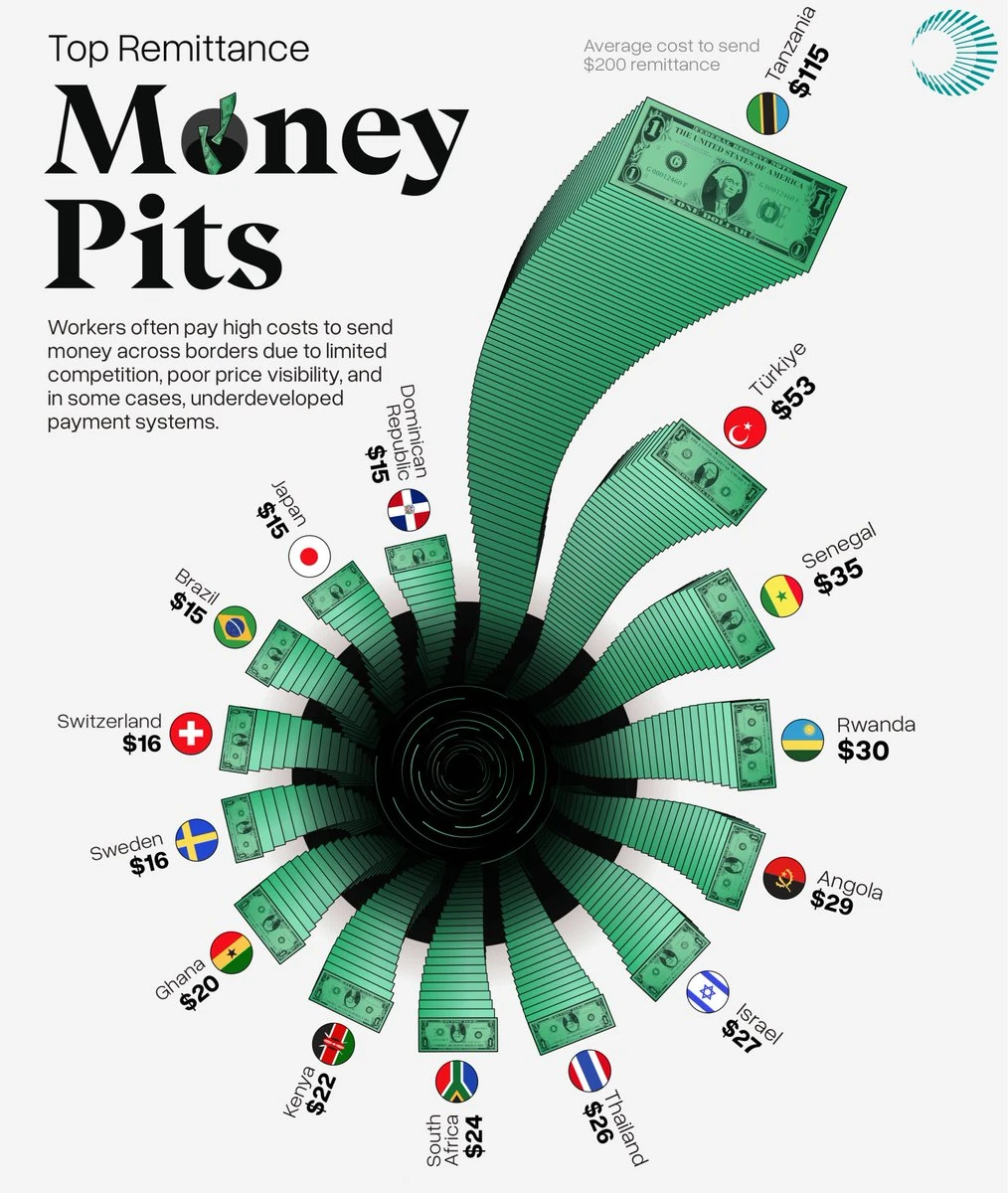

"Cost" ranks third. Although reducing transfer costs is a major highlight of stablecoins, transaction fees in the Western market are already low, far from the outrageous $115 fee for a $200 remittance in emerging markets.

The importance of "permissionless" in the Western market is the lowest. Since the vast majority of people already have bank accounts and can easily use cash or transfer payments, there is naturally no need to rely on stablecoins for financial services.

Therefore, Circle and USDC have a competitive advantage in the Western market. As a company that is essentially fintech-oriented, Circle emphasizes programmability, low cost, and efficiency, all of which align with the preferences of Western users. Increasingly, more Western companies are choosing to develop stablecoin solutions based on USDC.

Additionally, "yield" is gradually becoming an extra point of concern for Western users. Since they are accustomed to earning interest from bank deposits, they may question why holding stablecoins does not yield similar returns.

This is completely different in emerging markets, where users are more concerned about the value stability that stablecoins provide, especially the ability to access dollars, rather than yield.

According to the author's perspective: In fact, yield has never been the decisive factor for stablecoins' success in these markets. As industry analysis points out, the reason USDT has become the most liquid stablecoin globally is that it does not need to allocate treasury yields to users, yet it can dominate the market with strong accessibility and deep liquidity. For many users in high-inflation or capital-restricted areas, avoiding the risk of local currency depreciation is far more meaningful than an annual interest rate of 3%. They are more concerned about: Can I safely convert my assets into dollars, can I withdraw at any time, and can I use it locally?

Therefore, in these regions where there is a true "product-market fit," the liquidity of stablecoins is far more important than their yield capabilities. Liquidity tends to concentrate, ultimately forming the network effect of leading stablecoins. This is why stablecoins like USDT can still achieve widespread adoption globally, even without a yield mechanism.

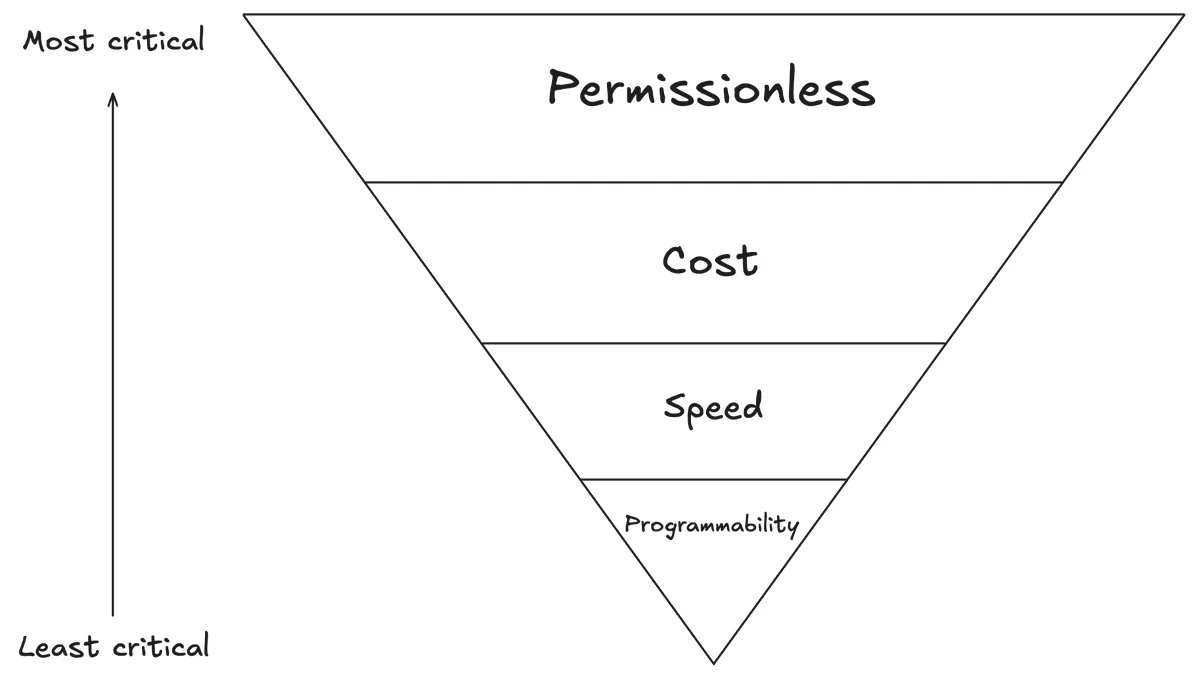

II. Value Realization Hierarchy for Emerging Market Users

Compared to the West, emerging markets (i.e., "Global South") have relatively weak financial infrastructure, with severe inflation of local currencies and low penetration of banking services.

The emergence of stablecoins has allowed users in these regions to freely access, transfer, and use stable currencies like the dollar for the first time, which was previously unimaginable.

Therefore, for emerging market users, "permissionless" is the most core and transformative value proposition. Regardless of whether they have a bank account, users can directly access the dollar system, unlocking financial freedom.

Next is "low cost." In emerging markets, cross-border remittance fees remain high. For example, when a father sends money home to support his family, the fees can consume a significant portion of the remittance amount. Stablecoins greatly reduce this remittance cost.

Third is "speed." Current cross-border transfer systems are inefficient, often taking days or even weeks for funds to arrive. Stablecoins can enable near-instant transfers, alleviating the life and economic difficulties caused by delays.

Finally, there is "programmability." Although this value proposition also has profound impacts in emerging markets (such as unlocking insurance, lending, contract payments, etc.), its perceived value in the short term is slightly lower compared to the first three.

Overall, Tether's USDT shines in emerging markets. Tether provides critical financial services to millions of unbanked individuals through the freely usable, widely accepted, and highly liquid USDT. Its success is precisely based on the realization of these fundamental value points.

Summary Thoughts

Circle is suited for the Western market, as it aligns more with the needs of fintech companies;

Tether serves a broader user base, especially those who truly rely on stablecoins.

In other words, Circle wins on "tool attributes," while Tether wins on "survival necessity."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。