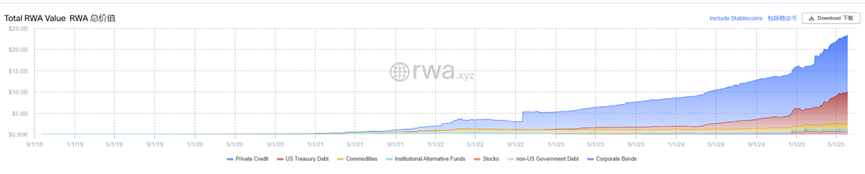

From the data perspective, the growth of the RWA market shows a remarkable state.

Author: Frank, PANews

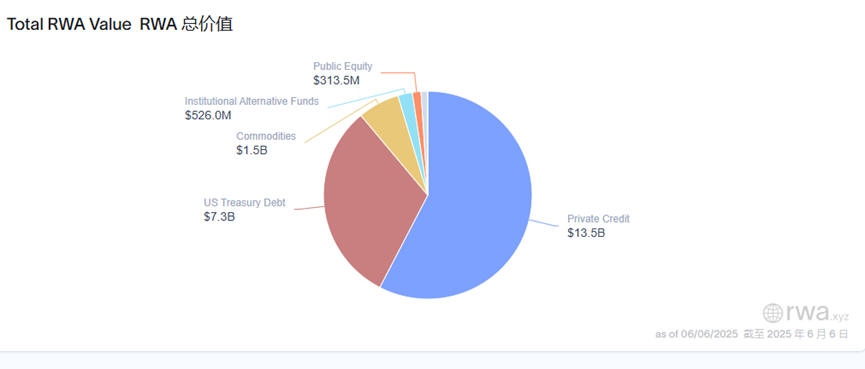

In the first half of 2025, a relatively low-profile track in the cryptocurrency world—real-world asset (RWA) tokenization—has witnessed a remarkable explosive growth. As of June 6, the total market capitalization of the global RWA market has soared to $23.39 billion (excluding stablecoins), a significant leap of 48.9% from $15.7 billion at the beginning of the year. Behind this growth, private credit (accounting for about 58%) and U.S. Treasury bonds (accounting for about 31.2%) form the absolute dual core of the market, together occupying nearly 90% of the share.

However, behind this impressive report card lie deep-seated issues such as high concentration of asset classes, limited liquidity, questionable transparency, and low correlation with the native crypto ecosystem. RWA still has a long way to go before becoming a truly "mainstream track."

Private Credit + U.S. Treasury Bonds Account for 90% of the Market

Private credit has become the most popular asset type in the RWA market, with a total scale reaching $13.5 billion, accounting for about 57.7%.

Among them, Figure ranks first with an active loan amount of $10.19 billion. Figure is a blockchain financial technology service platform, currently focusing on home equity lines of credit (HELOC), allowing users to obtain loans up to 85% of their home's value. According to its official data, HELOC has become the number one non-bank home equity line of credit in the U.S., providing over $15 billion in credit loans.

However, unlike other RWAs that are generally issued on broad public chains, Figure uses the Provenance blockchain, which is a public but permissioned L1 blockchain. This design, similar to a consortium chain, allows Figure's RWA assets to be better managed but also hinders the possibility of these assets circulating widely in the market. Therefore, although Figure's RWA issuance exceeds $10 billion, its actual correlation with the crypto market is not high; these assets are primarily on-chain in the form of collateralized notes, and as of now, this portion of the market does not possess trading liquidity. From the conventional definition of RWA assets, Figure's RWA assets are considered a non-typical RWA.

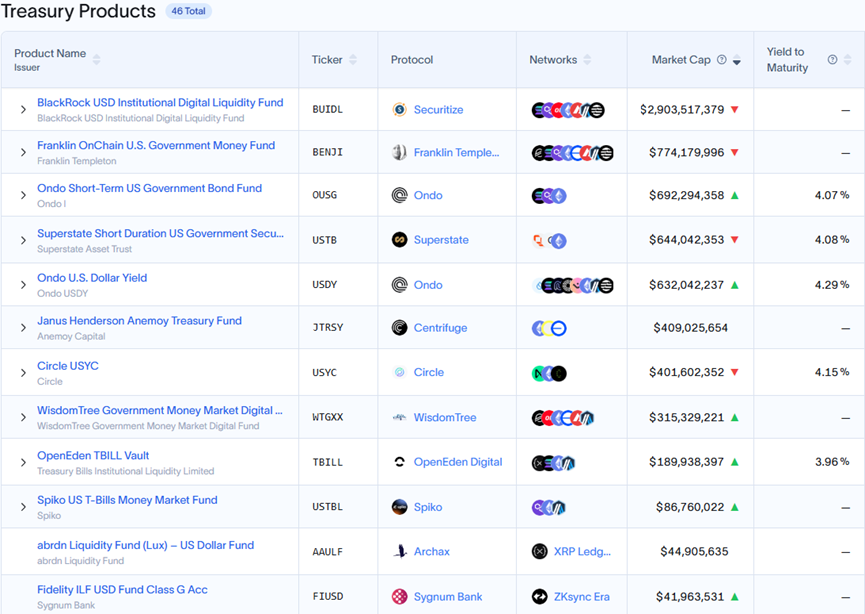

U.S. Treasury bonds are the second highest asset category in the RWA market. The operational logic of this type of RWA is to convert traditional U.S. Treasury bonds, cash, and repurchase agreements, which are dollar-denominated assets, into digital tokens through blockchain technology. In the U.S. Treasury bond sector, the largest issuance is BUIDL, issued by BlackRock, with a current total issuance of about $2.9 billion.

The BUIDL fund was initially launched on the Ethereum blockchain and has now expanded to multiple blockchain networks, including Solana, Aptos, Arbitrum, Avalanche, Optimism, and Polygon. Among them, the vast majority of BUIDL fund assets (about 93%) are still issued on Ethereum.

This type of RWA offers better flexibility compared to the traditional method of directly purchasing U.S. Treasury bonds, providing 24/7 liquidity. Traditional Treasury bond transactions may take several days to complete. However, BUIDL is currently open only to qualified investors, with a minimum investment threshold of $5 million, and the current number of holders is 75. Additionally, BUIDL has launched a DeFi-compatible version, sBUIDL, which is an ERC-20 token representing a 1:1 claim on the BUIDL fund. sBUIDL can interact with DeFi protocols like Euler.

Besides private credit and U.S. Treasury bonds, commodities rank as the third RWA asset category, primarily consisting of tokenized gold issued by institutions like Paxos and Tether, with a current total market capitalization of about $1.51 billion.

ZKsync and Stellar Become Dark Horses in the RWA Public Chain Market

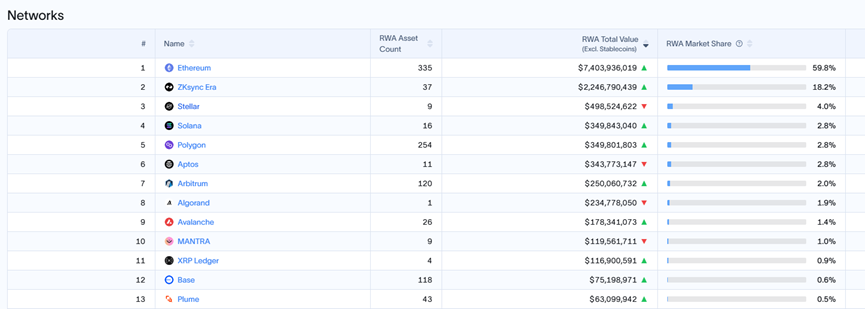

In the comparison of public chains, Ethereum remains the most favored blockchain network for RWA assets. Currently, its market capitalization of $17.4 billion accounts for 55% (it should be noted that this percentage is relative to all assets issued on public chains, which is about $12.55 billion, and assets issued by Figure on its own chain are not included).

Among them, the $2.7 billion assets issued by BUIDL constitute 36.48% of Ethereum, while the rest includes tokenized gold such as PAXG and XAUT.

In the public chain comparison, it is quite surprising that ZKsync, with an asset issuance of $2.25 billion, has become the second largest RWA public chain. The reason ZKsync has achieved such a high issuance of RWA assets is mainly due to Tradable, an asset management company that has introduced web3 technology. Tradable allows institutions to initiate investment opportunities on its application and specify the specific investment purposes and transaction information. Investors can choose to invest in opportunities they are interested in, such as a senior secured loan in fintech, raising $110 million with a return rate of 15%, or a term loan provided to a top law firm with a return rate of 15.5%, raising $57 million. According to official data from Tradable, there are currently 34 assets online, with an average APY of 10%. However, the company clearly lacks motivation in external promotion and operation, having only retweeted 2 news items on Twitter without ever publishing any original content, and its official news page has not been updated since 2023.

Additionally, upon reviewing Tradable's contract information, PANews found that these contracts are all non-open-source and do not interact with crypto assets, with all contracts showing a token value of zero. Therefore, from this perspective, the actual amount of Tradable's RWA assets on-chain is somewhat questionable.

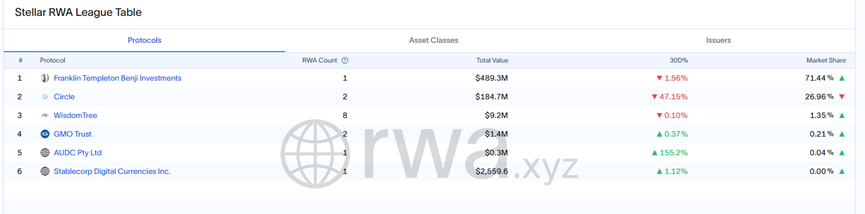

Moreover, Stellar ranks as the third network in the RWA market, which is also somewhat unexpected. Currently, the RWA asset issuance on this network is about $498 million, with Franklin Templeton's BENJI accounting for about $489 million, becoming the absolute main force. BENJI is also a monetized fund based on U.S. Treasury bonds, with a total issuance of about $770 million, of which 63% is issued on the Stellar chain.

Stellar, established in 2014, has gradually faded from the mainstream public chain market in recent years. In 2024, it launched the Soroban smart contract platform and introduced a $100 million adoption fund to promote development and project building. Additionally, it has facilitated cooperation with several contract institutions such as Franklin Templeton, Paxos, and Circle over the past year, allowing Stellar to surpass popular public chains like Solana in the RWA field to become the third largest RWA issuing public chain. However, in terms of composition, Stellar's RWA asset issuance is overly reliant on Franklin's issuance, making it relatively singular.

The RWA issuance on the Solana network ranks fourth, at about $349 million. Although the scale is not large, in terms of growth rate, it has increased by 101% since January 2025, showing rapid growth. In terms of distribution, it is also primarily focused on U.S. Treasury bonds.

Behind the Impressive Data, the RWA Market Hides Challenges

From the data perspective, the growth of the RWA market shows a remarkable state. However, it seems that behind this remarkable growth, there are also some potential challenges.

First, the asset classes are still mainly concentrated in private credit and U.S. Treasury bonds. The data of leading projects in private credit, Figure and Tradable, is not transparent. Moreover, Figure's RWA assets essentially exist only in on-chain form, with most lacking trading attributes. From this perspective, these assets have not truly leveraged the benefits that blockchain technology can provide to traditional assets in terms of liquidity and transparency.

Second, in the Treasury bond sector, many products and stablecoin issuance methods share similarities. In fact, income-generating stablecoins backed by U.S. Treasury bonds essentially provide similar yield effects, and RWA products centered around Treasury bonds face competitive pressure from stablecoins.

Third, the asset classes are overly concentrated. Although RWA has undergone several years of accumulation, the current main force is still concentrated in the issuance methods of Treasury bonds and private credit (accounting for nearly 90%). Asset types such as commodities, stocks, and funds still have a very low proportion. The development of these asset types is limited mainly due to challenges related to physical storage, legal compliance, and costs.

As of now, the total scale of the RWA market is only $23.3 billion, which is far from the scale of the stablecoin market ($236 billion) and even less than the market capitalization of some newly issued public chain tokens. This scale is far from the market's imagination of a so-called trillion-dollar RWA market. From the operational methods of assets, the current RWA market is almost a domain for institutions and major players, and it is quite distant from the traditional crypto market's operational methods. For ordinary investors, participating in the RWA track still seems to have certain difficulties, and RWA becoming a new opportunity for retail investors still has a long way to go.

Overall, the RWA market in the first half of 2025 has indeed delivered a report card with a nearly 50% surge in market capitalization, and the dual-head pattern of private credit and U.S. Treasury bonds is becoming increasingly clear. The potential of RWA is undeniable, but how to break through the current bottlenecks and achieve qualitative changes in transparency, liquidity, and ecological integration will be key to determining whether it is a fleeting moment or the beginning of a new chapter in finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。