On Monday, June 9, 2025, bitcoin (BTC) is floating above the $108,000 mark, which has led to $155.57 million in short liquidations over the past day, with $81 million being BTC short plays. James Toledano, the chief operating officer at Unity Wallet, shared with our news desk that “Bitcoin’s rebound from $100K on June 5 speaks to its resilience. This robustness is being powered by sustained institutional inflows into spot ETFs and easing concerns around U.S. regulations.”

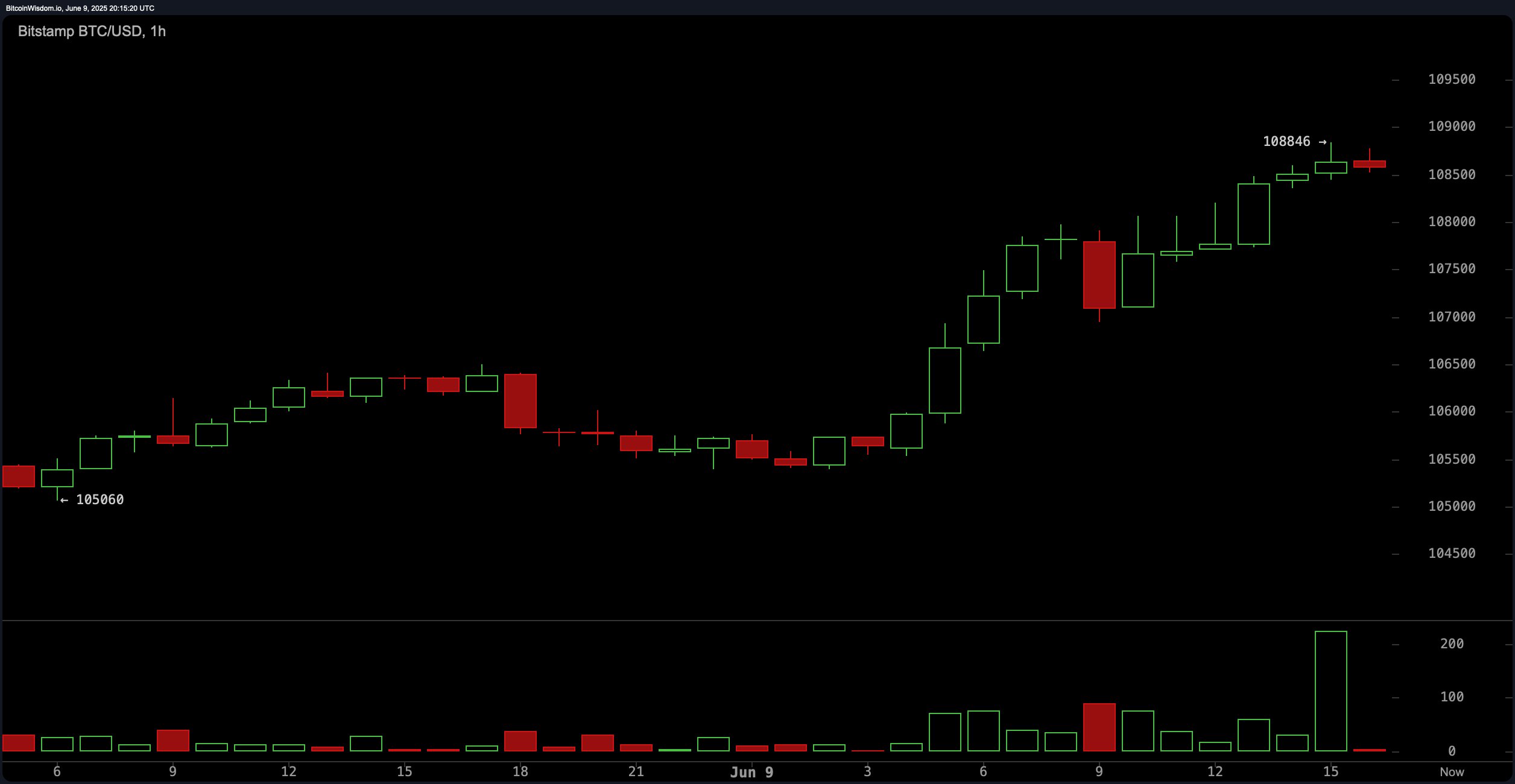

BTC/USD 1-hour chart at 4:15 p.m. Eastern time on Monday, June 9, 2025.

“The fact that the markets did not react to major macro factors like the U.S. losing its AAA credit rating also demonstrates growing investor confidence,” Toledano explained. The Unity Wallet executive continued:

Additionally, the expectations of a Federal Reserve rate cut — possibly as early as July — have reignited bullish positioning. Together, these elements have restored momentum after Friday’s dip, suggesting continued institutional appetite and improved investor confidence are the primary forces driving today’s recovery.

Bitcoin’s upbeat climb precedes the coming FOMC meeting, and while July remains an option, it is certainly a consideration. Data from the CME Fedwatch Tool along with forecasts from Polymarket and Kalshi point to the likelihood of any rate change in June being very low. The CME Fedwatch tool indicates a 99.9% chance the Fed will keep rates the same this month. Nevertheless, for July, there is a 14.9% probability a quarter-point reduction could occur, as stated by CME’s futures.

“Looking forward, a dovish shift by the Federal Reserve, particularly a summer rate cut of between 25-50 basis points, would likely accelerate bitcoin’s climb by making risk assets more attractive,” Toledano concluded. “Persistent ETF inflows and continuing regulatory progress would also bolster upward momentum. However, BTC must also overcome strong resistance around $112K–$125K, where profit-taking could trigger temporary pullbacks before any new highs are tested.”

Sergei Gorev, the risk head at Youhodler, pointed out that both bitcoin and gold have responded to changes within the U.S. monetary markets. “[Bitcoin] quotes are currently in a state of uncertainty,” Gorev said in a note shared with our newsdesk. “On the one hand, many global traders are gradually withdrawing from the U.S. currency and shifting to more risky assets, including cryptocurrencies.”

Gorev added:

This has a positive effect on the BTC exchange rate. On the other hand, the price on the BTC chart is behaving extremely erratically, and there is currently a possibility of a local price hike. There is a ‘Head and Shoulders’ picture, which, when implemented in its scenario, can lead to a correction in the price of BTC to the level of $92,000 per 1 BTC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。