SUI is a public chain with a relatively high allocation ratio in our asset allocation. With the stablecoin legislation and the listing of #Circle, payments and RWA have become the core focus for the future, and #SUI will be one of the biggest beneficiaries.

SUI, as the fastest-growing new battlefield for payments, is closely related to the background of its predecessor team and their technical research direction. We know that #SUI is developed by the Mysten Labs team, whose core members were once the backbone of the Facebook Libra/Diem project. After leaving Meta, they are reconstructing the original core concept of Diem (high speed, security, global payment service) in #Web3.

Therefore, the core moat of #SUI is not only high performance but also the comprehensive layout of "on-chain payment scenarios." You will find that many public chains are still entangled in the #DeFi ecosystem, but #SUI's core strategy is not "DeFi competition," but rather starting anew—creating a true closed-loop scenario aimed at real-world payments.

🎯 #SUI's core moat:

✅ Good technical experience:

• Fast (sub-second confirmation)

• Cheap (extremely low transaction fees)

• Integratable (seamless integration with Web2 Apps)

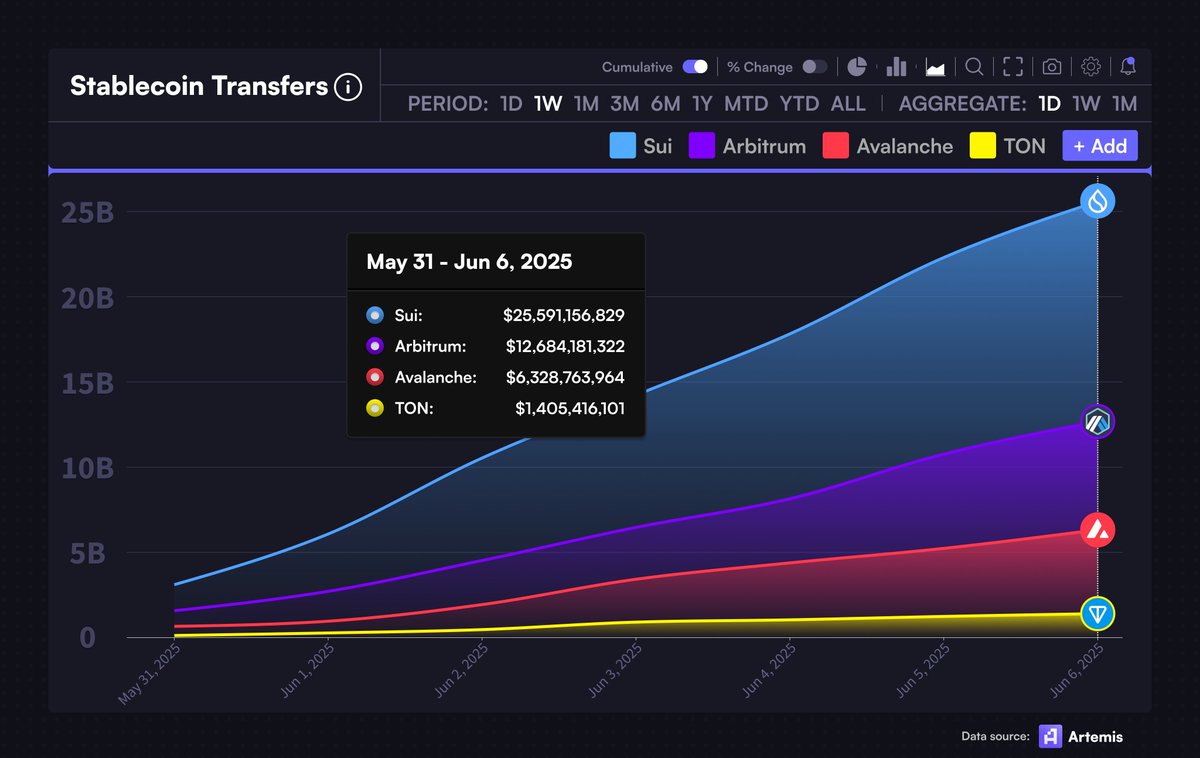

• High transfer frequency (#SUI's stablecoin transfer volume exceeds the total of Arbitrum, Avalanche, and TON, as shown in Figure 2)

✅ Strong cooperation and implementation:

• Collaborating with xMoney and xPortal to launch a crypto version of the Mastercard

• Can be added to Apple Pay / Google Pay

• Supports 20,000 merchants for offline card payments in Europe

• Users can directly spend with cryptocurrencies

✅ New gameplay launched:

• Sui is testing the launch of Game Dollar (a stablecoin for in-game use)

• In the future, it can enter high-frequency scenarios such as social payments, tipping, in-game purchases, and metaverse settlements

📝 As a steady player, #SUI's stablecoin ecosystem + #Circle investment will achieve flywheel-driven growth.

SUI is not fighting alone; it has the strong backing of major investor Circle:

✅ #Circle is an investor in #SUI, and the most held crypto asset is $SUI ($9.48 million)

• Circle is the issuer of USDC, and its deep binding with #SUI allows #SUI to take off in stablecoin issuance.

• In the composition of #SUI's stablecoin, #USDC accounts for as much as 75%, which fully demonstrates the close relationship between Circle and #SUI, ensuring priority support in the future.

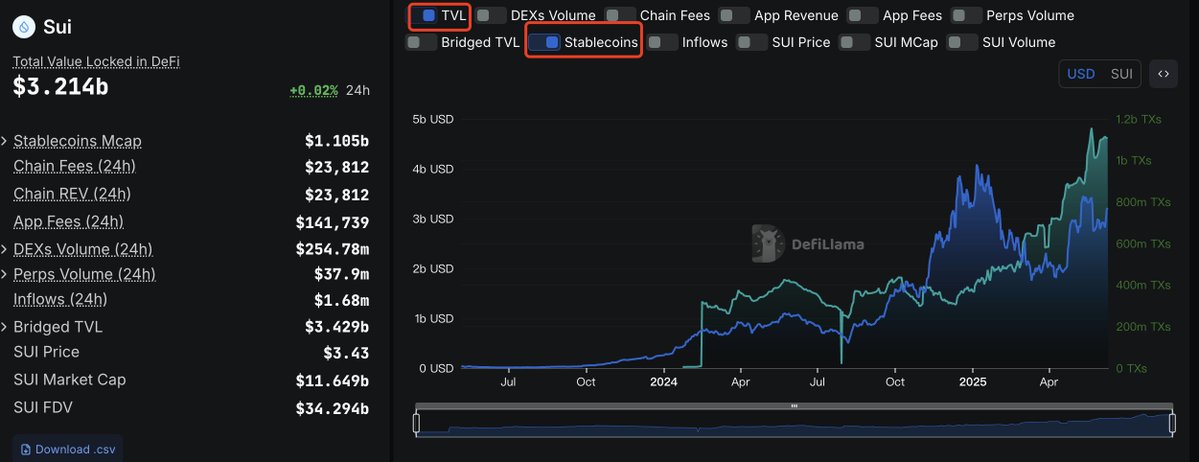

✅ #SUI's stablecoin is growing rapidly: from $5 million ➜ to $1.1 billion. At the beginning of 2024, the market value of #SUI's on-chain stablecoin was only $5 million, but by June 2025, in just over a year, it skyrocketed to $1.1 billion, growing over 220 times, making it the fastest-growing among the new generation of public chains (as shown in the figure below).

✅ #SUI ETF is applying for listing

• The SEC has officially accepted the application for the listing of the SUI ETF by Nasdaq 21Shares. Once approved, it will bring a large influx of compliant funds, enhancing liquidity and mainstream recognition.

Overall, you will find that #SUI's strategic layout and thinking are very clear. It aims to create a synthetic platform for the stablecoin network + #Web3 payment layer + high-frequency application ecosystem. It does not engage in DeFi competition or staking arbitrage; instead, it is precisely focused on deeply cultivating the "US dollar stablecoin payment" revolution. If #Web3 is truly to enter daily life, projects like #SUI may be the key to unlocking new opportunities, warranting close attention. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。