The premium frenzy of top tokens and the value trap of tail assets.

Written by: kushagra

Translated by: Luffy, Foresight News

Every day we see new cryptocurrency treasury strategy tools being born. This article will analyze Bitcoin's performance as a corporate treasury strategy and the key trends in crypto strategies based on Private Investment in Public Equity (PIPE).

Every region will launch its own "Bitcoin" strategy, but what concerns me are the tail assets (Right Tail Assets) that may adopt similar strategies. Bitcoin is a good reserve asset, but what about your favorite L1 or L2? It makes no sense. After all, who will be the marginal buyer of the 50th zkEVM L2? Not to mention, tail assets have low liquidity issues, and the paper gains that market participants see may not be realizable. So, friends, please be cautious.

Operating Mechanism

There are mainly three paths to build such treasury tools:

- Business Transformation: Struggling companies turn to crypto financial services firms and implement crypto strategies (such as Solana staking);

- Mergers and Acquisitions: Merging private companies into small and medium-sized companies listed on NASDAQ / NYSE;

- SPAC Mergers: Merging through Special Purpose Acquisition Companies (SPACs) to redefine business and treasury strategies.

Regardless of the path taken, all strategies need to be financed through Private Investment in Public Equity (PIPE) and convertible bonds. Here is a typical operation of PIPE:

- Targeting shell companies: Usually SPAC tools or failed small and medium-sized companies publicly traded on NASDAQ or the New York Stock Exchange.

- Collaborating with the company to create reserves for Bitcoin or any other crypto asset.

- Requesting investment banks to issue/build two types of tools: i) traditional PIPE and ii) convertible bonds.

- Traditional PIPE: Selling common or preferred stock directly to qualified investors at a fixed price (usually at a discount).

- Convertible Bonds: Issuing convertible bonds or convertible preferred stock, which investors can convert into common stock of the issuing company under certain conditions or within a specified period. These typically provide downside protection and partially reduce upside gains.

For example, Trump Media & Technology Group (DJT) adopted the following structure:

- Raised $1.44 billion by selling nearly 56 million shares (at $25.72 per share);

- Issued $1 billion of 0% convertible senior secured bonds maturing in 2028 (conversion price of $34.72 per share).

- This is a hybrid structure of stock dilution and senior convertible debt, combining features of PIPE and convertible bonds.

Note: Compared to other issuance methods, PIPE is less regulated by the SEC but may lead to dilution of existing shareholders' equity. These shares come with registration rights, meaning the company must file a registration statement with the SEC, allowing PIPE investors to resell shares to the public after the lock-up period.

Investor Framework

You may ask why investors are willing to participate in such issuances. The reasons can be summarized in three points:

- Team Intellectual Property: The industry influence of the chairman or core team is crucial. For example, the ETH strategy launched by Joe Lubin (co-founder of Ethereum) can easily be likened to "the Ethereum version of Microstrategy." After witnessing the success of MSTR (Microstrategy), investors eagerly participated in the ETH strategy due to Joe's industry status, as ConsenSys has always been vital to the development of the Ethereum ecosystem.

- Asset Quality: The choice of reserve assets is critical. A wave of tail assets (such as tokens in the top 50 by market cap) is expected to be incorporated into small business treasuries. However, these tail asset strategies carry higher risks, as their volatility is usually greater than that of Bitcoin.

- Crypto Premium: The reason such PIPE tools can raise funds on a large scale is not because the value of Bitcoin or Ethereum in corporate strategies "skyrockets 3-4 times overnight," but because traditional hedge funds and crypto-native institutions flood in due to fear of missing out (FOMO) on current first/second market arbitrage opportunities. Indeed, these strategies may achieve returns or leverage through staking and lending, but can this support a premium of 3 times the net asset value? Probably not.

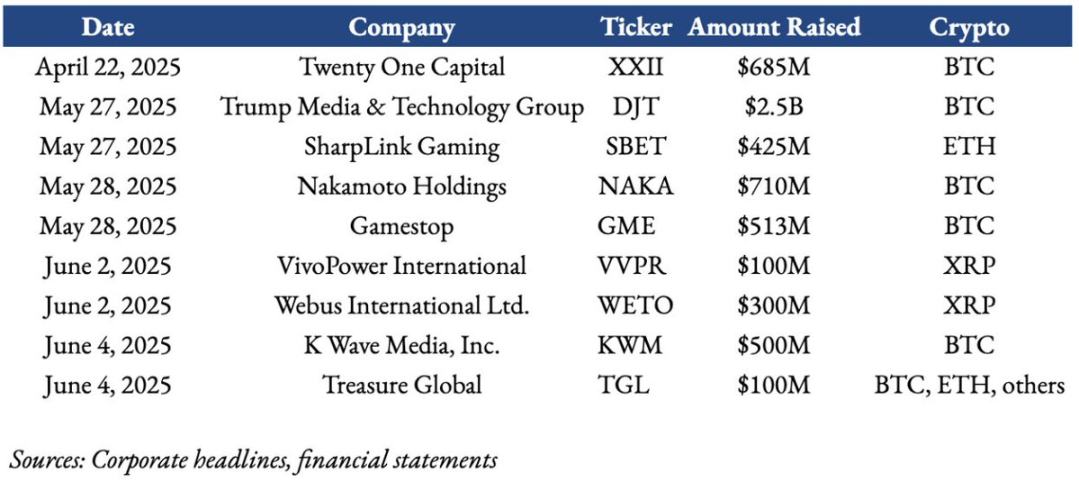

Overview of corporate crypto treasury transactions in the past two months

So far, the most controversial treasury transaction is the case of Trump Media Company. This has also raised questions about "strategic Bitcoin (or digital asset) reserves"—how to handle potential conflicts of interest? At least in the short term, inspired by Microstrategy (MSTR) and Metaplanet (3350.T), both private and public investors expect such financing to bring high returns in the medium to short term.

MSTR initially viewed Bitcoin as a store of value and an anti-inflation tool; today's crypto PIPEs achieve more active management and yield generation through staking and lending. Private investors' demand for crypto PIPEs is almost frenzied, as once such transactions are announced, stock prices often rise 2-10 times at launch.

Performance of Corporate Crypto Treasury Strategies

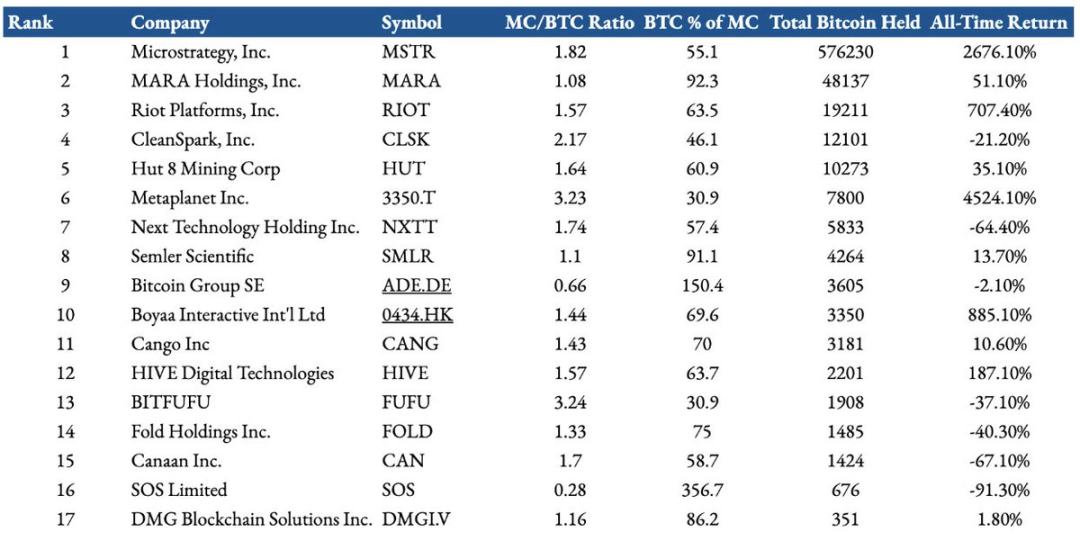

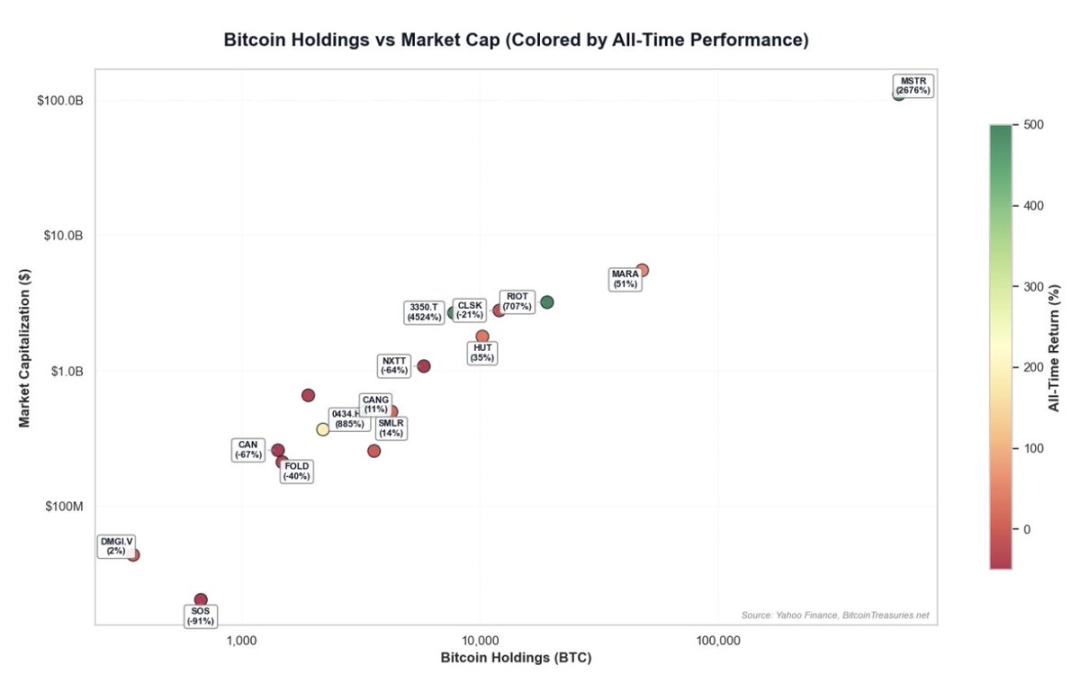

Although history cannot predict the future, there is a wealth of data available to analyze Bitcoin strategies. Below is a study of the performance of corporate pure Bitcoin treasury strategies, where I examined 17 publicly listed companies:

The list includes 17 publicly listed companies with Bitcoin holdings accounting for over 30% of the company's market value and holding more than 300 BTC.

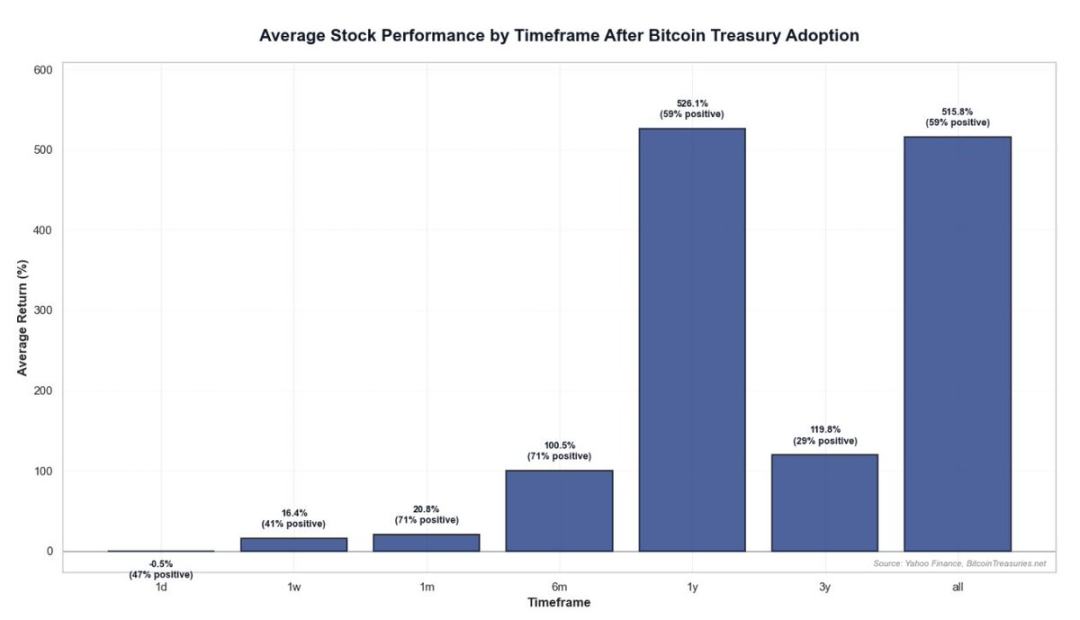

So far, the most successful company adopting this strategy is Microstrategy, which was one of the first to engage in corporate Bitcoin strategies. However, with the introduction of Bitcoin ETFs and new treasury strategies, its "Bitcoin/Market Cap" premium may gradually fade. In the short term, announcements of Bitcoin funding strategies often increase the likelihood of short-term or even long-term returns. The return rates vary widely, even across different time frames. However, over time, performance tends to decline:

- 1-year average return: 526% (59% of companies profitable);

- 3-year average return: 119% (only 13.64% of companies profitable);

- Historical average return: 515% (59% of companies profitable).

Note: The median return is significantly lower than the mean, indicating that extreme values have inflated the overall average. From 2020 to 2025, Bitcoin outperformed most asset classes, which is a core driver of these companies' high returns.

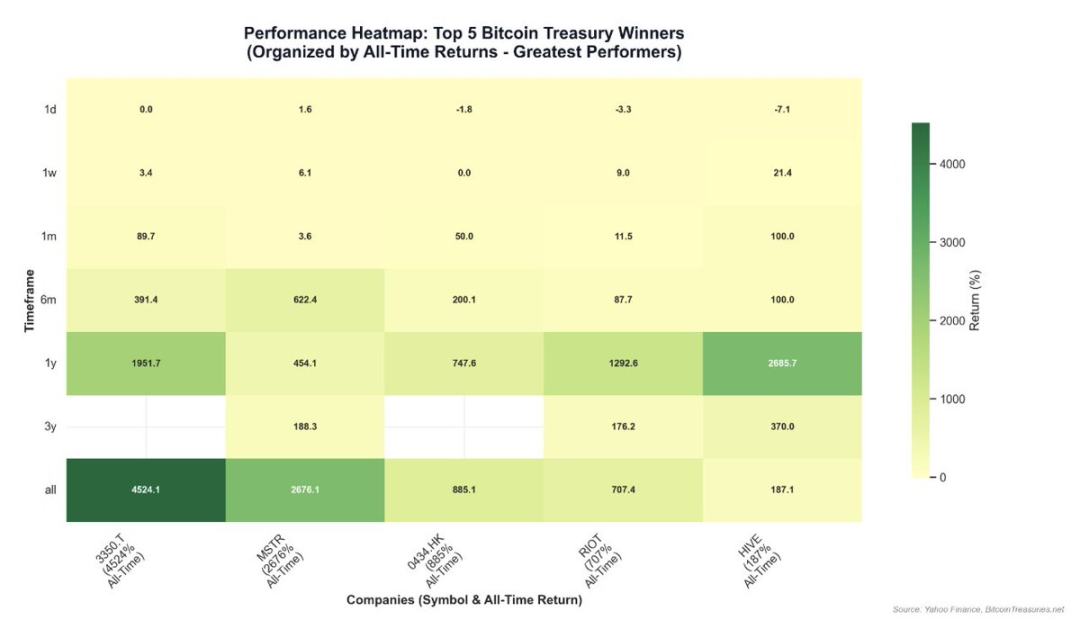

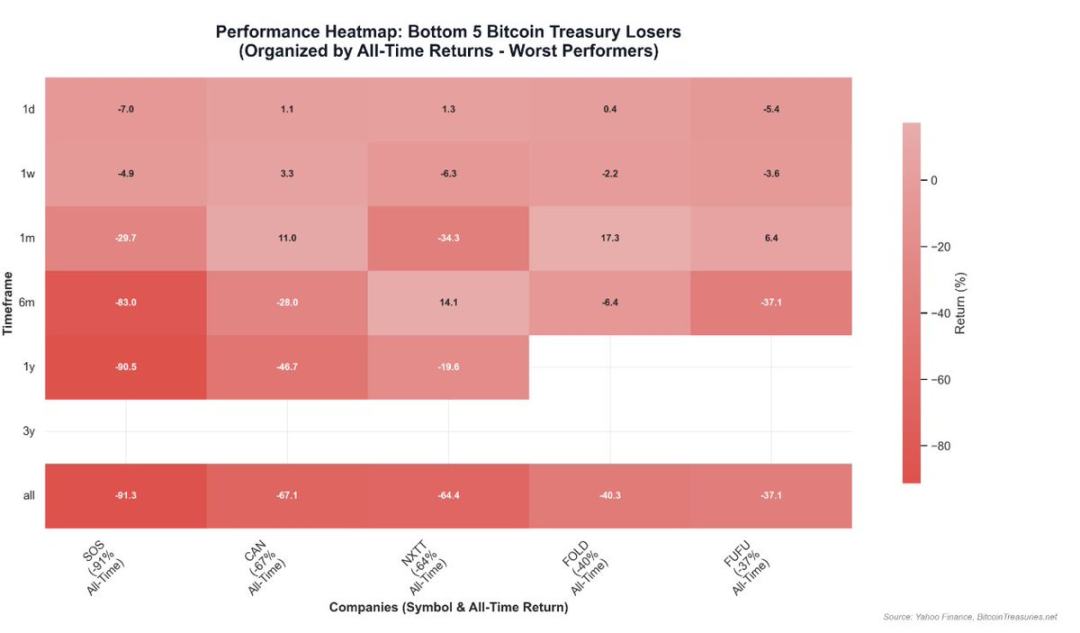

Heatmap of Bitcoin strategy performance

- Success Cases: Companies with strong community consensus that can enhance "Bitcoin holdings per share" and create financial engineering opportunities perform well.

- Failure Cases: For example, SOS Limited (originally a crypto mining company that transformed into a commodity trading firm) underperformed due to difficulties in its main business and ineffective execution of Bitcoin strategies. It is evident that "pure Bitcoin strategy" companies are more recognized by the market than "small allocations" companies.

- Risk Warning: Bitcoin-related companies may face extreme volatility and drawdowns, but when a company's net asset value (NAV) exceeds its market value, there may be opportunities for a turnaround. Note: For companies on the brink of bankruptcy, merely holding a small amount of Bitcoin on the balance sheet cannot reverse the decline.

Conclusion

With the successful IPO of Circle as a pure stablecoin company, the stock market and crypto market are accelerating their convergence. More high-quality crypto companies are expected to go public in the future, along with the emergence of more crypto strategy tools. Given the recent market enthusiasm for crypto strategies, investors can capture opportunities through the following framework: team influence, asset quality, and sustainability of crypto premiums, while conducting in-depth analysis of specific projects.

However, when strategies involve tokens outside the top 20 by market cap, extreme caution is essential. These tokens not only lack the hard asset properties of Bitcoin but often also lack sustained net buying demand. Structurally, investors must clarify: 1) What is the underlying business strategy the company is implementing; 2) What is the capital structure of the transaction (debt, convertible bonds, PIPE); and 3) What is the net asset value per share.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。