Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

RWA Sector Market Performance

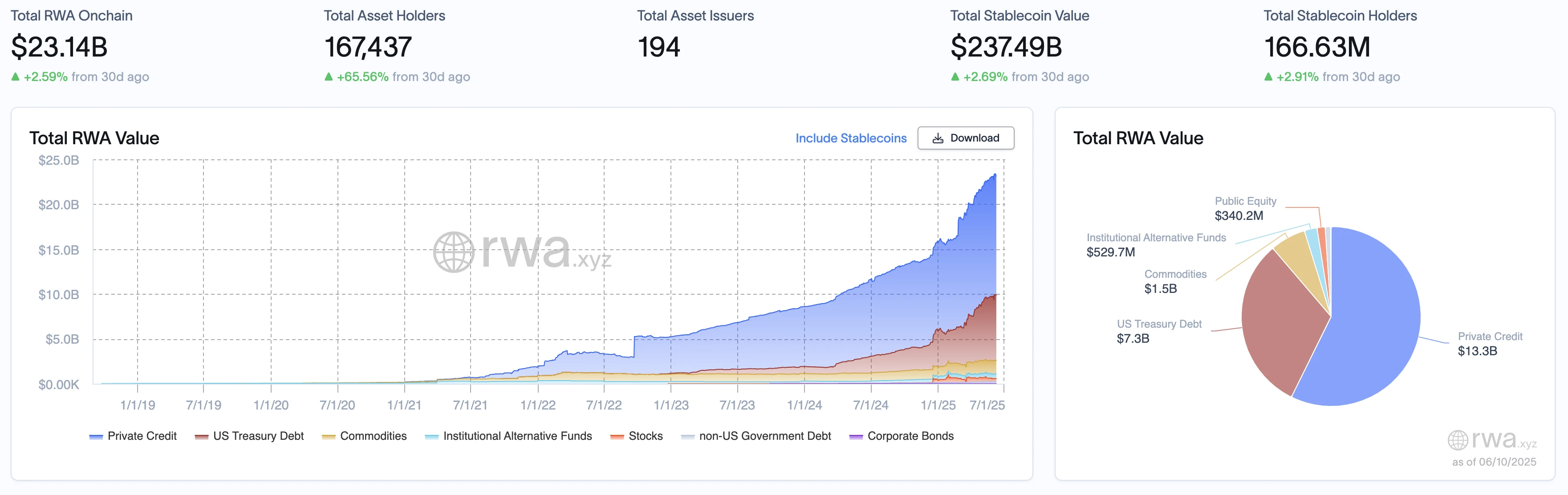

According to the latest data from RWA.xyz, as of June 10, 2025, the total on-chain value of RWA is $23.14 billion, a slight decline of 0.39% from $23.23 billion on June 3. Despite the slight adjustment in market value, on-chain activity has significantly increased, with the number of asset holders jumping from 113,670 to 167,437, a rise of 47.3%. The number of asset issuances increased from 193 to 194, maintaining a steady growth; the total value of stablecoins rose to $237.49 billion, up 0.71% from last week, and the number of holders also increased to 166.63 million, a rise of 0.73%.

In terms of asset categories, private credit slightly decreased to $13.3 billion this week, down $100 million from last week, still accounting for the largest category and maintaining an absolute dominant position in the current RWA structure. U.S. Treasury bonds remained stable at $7.3 billion this week, indicating their continued recognition as a defensive asset.

Commodity assets have maintained at $1.5 billion for the third consecutive week, showing minimal fluctuation, indicating a stabilization in their allocation ratio. Institutional alternative funds grew from $527.8 million last week to $529.7 million, although the increase is modest, it continues a gentle upward trend. Notably, equity assets continued to grow this week to $340.2 million, up 7.2% from last week, indicating a gradual increase in market attention and confidence in on-chain securities.

What are the Trends (Compared to Last Week)

Asset structure remains stable, user participation significantly increases: The biggest change this week is not the market value itself, but the significant growth in the number of asset holders, indicating a rapid expansion of the platform's user base, possibly related to the launch of new assets, user incentives, or a warming market sentiment; private credit assets slightly adjusted, growth momentum has slowed: Although still in the lead, the amount has decreased, which may indicate a short-term diversion of funds or a phase of risk preference adjustment; U.S. Treasury assets continue to rise steadily: In the current market environment, their stable performance acts as a ballast for the asset structure; commodities, alternative funds, and other allocations maintain slight growth, overall remaining as "conservative base" assets. Investors' attention to these low-volatility assets continues, reflecting an enhanced awareness of diversified allocation.

In summary, unlike the previous stable growth, this week RWA on-chain assets maintain a "steady yet adjusted" structural pattern: total market value slightly decreased but participation surged, the structural axis remains unchanged but asset rotation has begun to appear. Private credit, as a high-yield asset, remains strong, but short-term volatility may present potential diversion; U.S. Treasury bonds, alternative funds, and other stable assets continue to rise steadily, providing a safety cushion for investment portfolios.

Key Events Review

U.S. Stablecoin GENIUS Act Triggers Intense Bipartisan Struggle

The stablecoin GENIUS Act, which is about to be voted on in the U.S. Senate, has sparked intense bipartisan contention. Legislative disputes disclosed on June 6 indicate that the act could reshape the $250 billion stablecoin market, but has faced strong opposition from Republican Senator Josh Hawley of Missouri and others, who argue that it would grant tech giants excessive financial control. Hawley accused the act of effectively greenlighting stablecoin issuance by tech companies like Meta, and his proposed amendment requires non-financial public companies to be approved by a newly established "Stablecoin Certification Review Committee." Although some provisions were adopted, he criticized the final version for weakening key regulatory constraints. Democrats are concerned that the act may provide regulatory arbitrage opportunities for private companies like Musk's X Money and plan to propose an amendment to prohibit tech companies from issuing stablecoins.

Circle Opens with 186% Surge, Triggers Circuit Breaker Again

Stablecoin issuer Circle Internet Group and its selling shareholders raised nearly $1.1 billion in their initial public offering (IPO), after which the company's stock price surged 186% at opening, triggering circuit breakers twice. Circle has become one of the few pure cryptocurrency companies listed in the U.S., alongside Coinbase, Mara Holdings, and Riot Platforms. This is the company's second attempt to go public. Previously, its merger plan with a special purpose acquisition company failed at the end of 2022 due to regulatory challenges. With a friendly attitude from the U.S. government, the cryptocurrency industry is gaining new political support. Particularly in the stablecoin sector, as Congress is expected to pass stablecoin-related legislation this summer, the sector has been accelerating its development. Wall Street analysts suggest that the stablecoin market could grow tenfold in the next five years, creating a trillion-dollar market opportunity.

Hong Kong Government: "Stablecoin Regulation" Will Take Effect on August 1, 2025

On June 6, the Hong Kong Special Administrative Region government published the "Stablecoin Regulation (Effective Date) Announcement" in the Gazette, designating August 1, 2025, as the date for the implementation of the "Stablecoin Regulation" (Chapter 656) (the "Regulation"). The Secretary for Financial Services and the Treasury, Christopher Hui, stated: "After the Regulation takes effect, the licensing system will provide appropriate regulations for relevant stablecoin activities, marking a milestone in promoting the sustainable development of Hong Kong's stablecoin and digital asset ecosystem."

U.S. Digital Asset Market Clarifies the "CLARITY Act" Substitute Amendment Has Been Released

According to crypto journalist Eleanor Terrett, the substitute amendment for the U.S. digital asset market's "CLARITY Act" has been released. This substitute amendment is an updated version of the submitted bill, containing recent amendments and new content. The text will serve as the basis for the Republican review and revision in the U.S. House Financial Services Committee this Tuesday (June 10).

According to official news, Plume Network announced the launch of its public mainnet Plume Genesis on June 5. Plume Genesis has brought on-chain RWA from entities including Superstate, Blackstone, and Invesco, with over $150 million in RWA capital already utilized across various use cases; it has ample liquidity across multiple asset categories; and over 200 projects have been announced within its ecosystem. The ecosystem includes a large number of RWA-native and blue-chip DeFi applications, such as Morpho, Curve, Orderly, Matrixdock, Lorenzo, Rooster, Solera, and Mystic.

Plume focuses on bringing RWA on-chain, with a commitment to hosting over $4 billion in assets.

In the future, Plume will introduce various asset categories and RWAfi use cases to its ecosystem, including tokenized artworks, precious metals, motorcycles, uranium, and trading cards, thereby broadening the application scope of RWA on-chain utility.

Hot Project Updates

Bedrock (BR)

Official Website: https://www.bedrock.technology/

One-Sentence Introduction:

Bedrock is a multi-asset liquidity re-staking protocol supported by a non-custodial solution designed in collaboration with RockX. Bedrock utilizes its universal standard to unlock liquidity and maximize value for PoS tokens (such as ETH and IOTX), as well as existing liquid staking tokens (referred to as uniETH and uniIOTX).

Latest Updates:

On June 4, Bedrock announced its BR/BNB PancakeSwap V3 liquidity pool has been included in OKX Wallet's Binance Alpha Earn Hub, offering yield opportunities of up to 134% APR. Users can earn rewards and Alpha Points (OKX incentive program) by participating in this pool.

On June 9, Bedrock partnered with WLFI to launch a USD1/BR liquidity pool on PancakeSwap, providing users with the opportunity to earn farming rewards in stablecoin USD1 and BR.

Usual (USUAL)

Official Website: https://usual.money/

One-Sentence Introduction:

Usual is a decentralized stablecoin protocol aimed at creating a fair, community-driven financial ecosystem through the tokenization of real-world assets (RWA). Its core goal is to transform the centralized profit model of traditional stablecoins (such as USDT) into a user-owned and governed model, redistributing value and control back to the community through its stablecoin products USD0 and USD0++, as well as the governance token USUAL. The project combines the stability of physical assets with the composability of DeFi, dedicated to providing users with secure, transparent, and high-yield financial tools.

Recent Updates:

On June 5, Usual released its roadmap for 2025-2026, announcing a transformation from a single yield stablecoin protocol (USD0) to a "yield-sharing, composable financial layer."

On June 9, Usual submitted the UIP-8 governance proposal, suggesting the use of Lido's wstETH as the first collateral for ETH0, which the community evaluated as a key step for Usual's expansion into synthetic assets.

Recommended Related Articles

RWA Weekly Report from last week: Summarizing the latest insights and market data in the industry.

《Ethereum RWA Explosion: Regulatory Changes and New Growth Engines》

Analyzing the data aspects of RWA on Ethereum, combined with the new policies in the U.S., discussing the ongoing optimism for Ethereum and whether RWA can organically connect traditional finance and DeFi.

《Comprehensive Interpretation of RWA Ecological Projects》

A comprehensive deep report written by DePINOne Labs, reviewing the main categories and representative projects of the RWA ecosystem in 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。