A structural cleanup under "administrative norms."

Written by: Portal Labs

You may have heard that the Monetary Authority of Singapore (MAS) recently officially released its final regulatory response regarding the "Digital Token Service Provider" (DTSP) system under the Payment Services Act, clearly announcing that it will be fully implemented by June 30, 2025, with no grace period.

This time, it is no longer a policy probe during the consultation phase, nor is it a symbolic regulatory gesture of "calling out."

The signal released by MAS is very clear: no license, no engagement in any Token-related business. Regardless of whether customers are in Singapore or whether the business is on-chain.

On the surface, this is a new licensing requirement for token services, but in reality, it is a structural reconstruction of the operational logic of Web3 projects.

Last week, there have been many interpretations of the document, and Portal Labs will not repeat a comprehensive interpretation. We will only share some of our views on the implementation of this regulation.

A structural cleanup under "administrative norms"

Some people see DTSP as an extension of VASP, but that is not the case.

The introduction of DTSP marks MAS's attempt to systematically reconstruct the vague but broad concept of "token services" and delineate the boundaries of what is permissible and what is not in the form of legal provisions.

The so-called "token services," from MAS's perspective, are no longer limited to the issuance of Tokens themselves but encompass various activities that project parties may engage in, including issuance, promotion, trading, transfer, custody, OTC matching, and even providing technical or operational assistance.

In other words, as long as you are a part of this Token mechanism, whether actively or passively, you may be regarded as a service provider.

The more critical change is that MAS has abandoned using the place of registration or on-chain deployment as the basis for compliance judgment, returning the core judgment criteria to "where the person is, where the business activity is."

This means that even if your contract is written on-chain, the system is deployed in the cloud, and customers are spread across the globe, as long as you are physically present in Singapore and are advancing Token-related business, you are very likely to be considered "operating in Singapore."

The classic remote architecture model of "people in Singapore, business on-chain" has officially bid farewell to the regulatory vacuum period.

And MAS's attitude towards this has no ambiguous space. In this round of responses, MAS clearly stated that it will hold an "extremely cautious" attitude towards DTSP licensing, applicable only to a very small number of applicants.

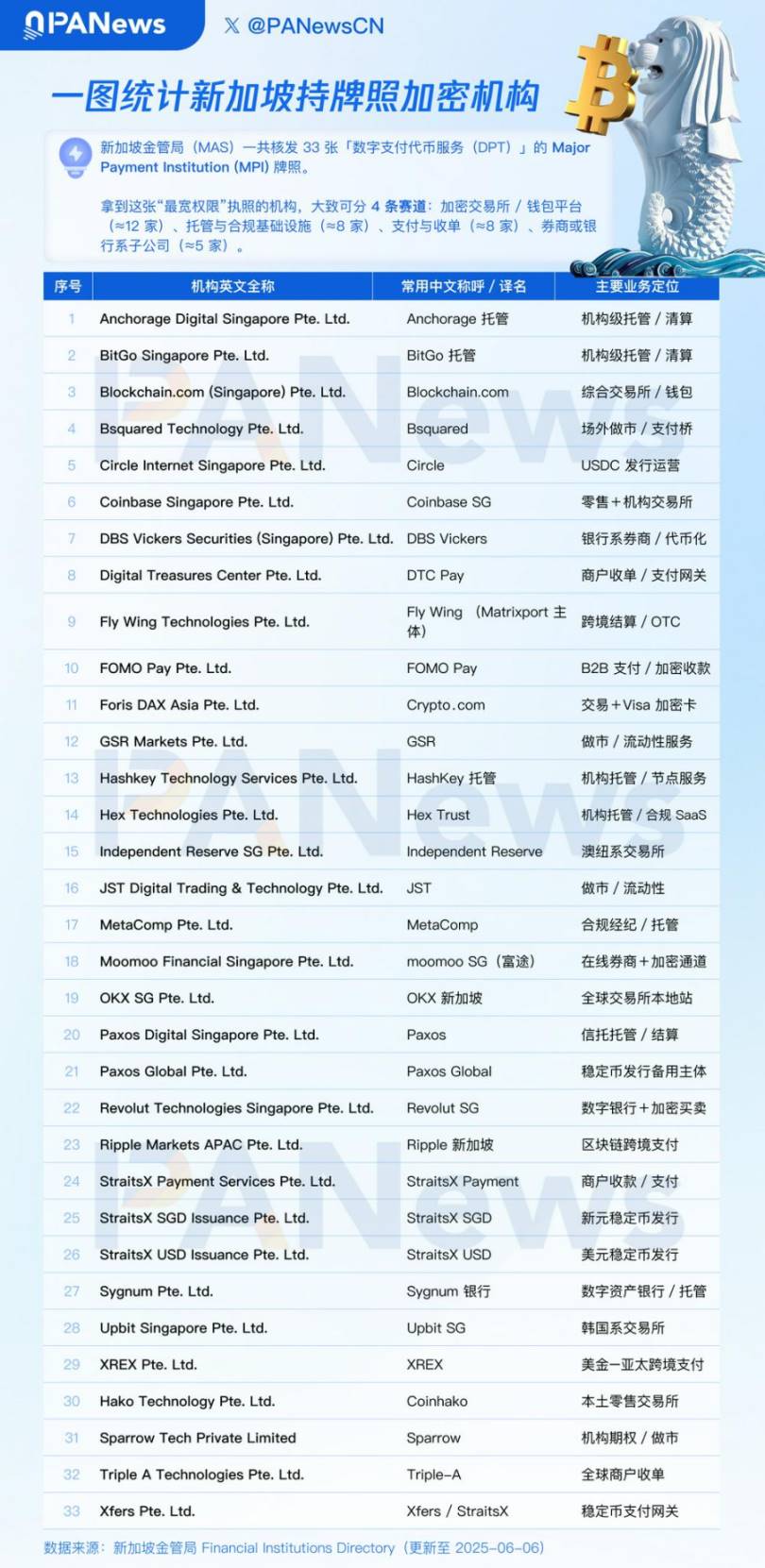

According to data statistics from PANews, there are currently only 33 crypto projects holding MPI licenses, and this license has been open for application for five years. One can imagine the difficulty and approval rate of the upcoming DTSP license.

Therefore, Portal Labs believes that this is not a license bidding process, nor is it a goal that can be achieved solely through the efforts of a technical team. It is more like a proactive screening of project governance structures. Web3 project architectures that lack role separation, unclear funding paths, and ambiguous responsibility divisions will lose their qualification to remain under this round of cleanup.

However, this is not Singapore's regulatory hostility towards Web3, but a more pointed signal that under the mainstream regulatory trend, the logic of regulatory arbitrage is gradually coming to an end.

"Where to go" is no longer the answer

So, where can we go?

Many Chinese-speaking Web3 project parties' first reaction is: move to Hong Kong.

This expectation is not unfounded. Over the past two years, Hong Kong has frequently released welcoming signals: advancing the VASP system, officials publicly expressing their stance, hosting Web3 carnivals… It was once seen as a major candidate for "taking over projects cleared out from Singapore."

Immediately after the announcement of Singapore's DTSP new regulations, Hong Kong Legislative Council member Wu Jiezhuang also quickly expressed his welcome and posted a bilingual statement on social media saying: "If you cannot continue your operations in Singapore and intend to move to Hong Kong, feel free to contact me to learn more. We are willing to provide assistance and welcome you to develop in Hong Kong!"

This statement undoubtedly releases a positive signal from Hong Kong's side to "absorb the momentum." However, from a regulatory reality perspective, the issue is far from simple.

Hong Kong's regulation is not lenient; it is another expression of a structured regulatory system:

At the CEX level, Hong Kong clearly requires trading platforms to operate with a license and be regulated by the SFC under the Securities and Futures Ordinance. Platforms must provide compliance solutions at key points such as user access, currency selection, and custody mechanisms, and must establish independent auditing, anti-money laundering, and risk control systems. Compared to the past "doing while adjusting" gray area approach, Hong Kong's regulatory method emphasizes "pre-emptive structural design," suitable for institutional platforms willing to operate in compliance for the long term.

At the Token issuance level, Hong Kong has not yet introduced specific laws for public Token issuance, but referencing the recent regulatory trends in the U.S., EU, and Singapore, while there is still some space for certain token issuances at this stage, if legislation progresses in the future, there is a possibility that the regulatory framework will tighten further.

In terms of Web3 project implementation, although Hong Kong frequently releases supportive signals, the current regulatory system that has truly landed still focuses on a few areas such as virtual asset trading platforms. For other forms of Web3 projects (such as DeFi, DAO, RWA issuers, etc.), dedicated regulatory channels have not yet been established. In reality, regulation tends to accept project types that have clear structures, sufficient information disclosure, and can be transparently identified under the existing licensing system. To some extent, this is more like "partial openness under financial compliance guidance," rather than a universal acceptance of all innovative forms.

In other words, Hong Kong does welcome the Web3 industry to land, but the premise is that you can match the regulatory pace. If your operational structure in Singapore has already crossed the line, it is likely that you will also be unable to land in Hong Kong shortly thereafter.

As for other alternative locations, such as Dubai, Portugal, Seychelles, or even some regionally urban areas like Shenzhen that seem to have a better atmosphere, they either lack a mature financial regulatory framework or have unclear and unsustainable compliance paths. They may provide temporary shelter but are difficult to build a long-term legal foundation.

The DTSP new regulations are not an isolated case but represent a broader regulatory trend: sovereign jurisdictions are no longer accepting "puzzle-like" Web3 structures based on registration locations, but are beginning to define responsibility based on "where the person is, where the business occurs."

Therefore, the more urgent issue that Web3 projects need to address is no longer "where to move," but whether they can "exist in compliance" after moving.

From this perspective, Singapore is not the endpoint, and Hong Kong is not the solution. The next stop for Web3 is not another "arbitrage gap," but a comprehensive examination of structural capabilities, governance logic, and compliance mindset.

The real question is, how to stay?

The biggest signal released by the DTSP new regulations has never been about suppressing a certain type of project or region, but rather a systematic update of regulatory logic.

In the past, many Web3 projects relied on "puzzle-like structures" to navigate the compliance gray area: registered in Country A, technical team in Country B, market in Country C, customers worldwide, KYC outsourced to Country E, and funds flowing through Country F. This seemingly distributed, but in reality "non-transparent responsibility" operational method was once regarded as the "standard configuration" for Web3 projects.

But today, the regulatory perspective has fundamentally shifted—no longer looking at where your company is registered or where the code is deployed, but directly anchoring:

Who controls the decision-making for Token issuance?

Is the custody path for user assets and the flow of funds clear?

Where is the actual controller of the project located, and what responsibilities do they fulfill?

Is there a mechanism for transparent governance, structural separation, and clear responsibilities?

What is being tested here is no longer the wording skills of a legal opinion but the overall "structural capability" of Web3 project parties, namely whether they can build a truly transparent, accountable, and sustainably operating role system and responsibility framework.

In such a regulatory context, "moving the registration location" has essentially ceased to be a solution. It resembles a risk transfer game, shifting potential issues from one jurisdiction to another area that has not yet reacted to regulation, failing to fundamentally improve risk exposure.

From this perspective, DTSP is not just a notice for Web3 projects but a turning point in the compliance perspective of investors. It makes a key question unavoidable: "Am I investing in a project, or in an unidentified legal risk entity?"

For investors, this regulatory evolution means an upgrade in judgment dimensions. In traditional investment logic, a white paper, a roadmap, and an AMA are sufficient to build confidence expectations. However, in the reality of tightening regulation, the "structural transparency" of Web3 projects will become a mandatory review item:

Does the Token itself have a legal path and basis for issuance?

Is the control structure clear, and are there any internal responsibility overlaps or holding risks?

Has the founder faced excessive legal risks, and should their role be separated?

Does the project have mechanisms for compliant financing, token issuance, and even exit in the future?

These questions are no longer just for lawyers to answer; investors must also learn to ask and scrutinize.

In other words, regulation is forcing the entire Web3 market to enter a new stage of "identity governance." Web3 project parties can no longer rely solely on "narratives" but must deliver answers on structural design; investors can no longer just look at valuations but must ask, "Are you ready to be transparently regulated?"

DTSP is just the beginning; a larger wave of compliance is happening globally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。